Taking advantage of bank cashbacks to handle higher mortgage interest rates

Thursday, 14 September 2023

By continuing, you agree to our terms of use and privacy policy

Instructions on how to reset your password will be sent to the email below.

Your password reset link has been sent. Please check your inbox and follow the instructions provided.

Thursday, 14 September 2023

It’s evident that property investors are becoming more optimistic. This optimism is partly tied to the belief that we’re nearing the peak of the mortgage interest cycle. Personally, I also think a significant part of this optimism stems from the growing probability of a more investor friendly government after October 14th.

While we are seeing an increase in the first home buyers coming into the market since lending rules were relaxed at the start of June, new mortgage borrowing by property investors has stayed at very low levels, which will be connected to stringent loan affordability requirements which the banks have imposed and also investors feeling the pinch of higher interest rates as their existing debt comes off historically low-interest rates onto something much higher.

While the Reserve Bank has put cash rate increases on hold since their review in May, households are still set to feel the pressure for some time. Recent Corelogic analysis of Reserve Bank numbers suggests that over 50% of all mortgages are due to be refixed at higher rates than what they are currently on at some stage over the next 12 months.

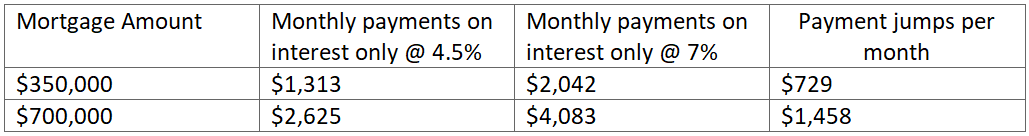

It is worth understanding how these increases will look to you if you are a borrower. As an example, let’s use a couple of examples of a $350,000 mortgage and a $700,000 mortgage.

If you’ve remained loyal to one lender for an extended period, you may not be aware that many banks have been providing cash incentives when you transfer your mortgage (and property) to them. To be frank, it’s a bit of an inducement to win your business, but it can genuinely provide tangible benefits since you receive the cash directly.

At present, these cash contributions tend to be in the region of between 0.7% and 0.9% of the loan amount (so potentially $9k to you for a $1m loan taken out with the new bank).

It is important to note that if you need to use a solicitor, then the costs of that service need to be taken away from any benefit you will get, so you’ll want to understand what the net benefit is (the cash contribution received minus any costs incurred) before making your mind up.

The great news is that in many cases a solicitor is not needed as some lenders offer a quick refinance option which avoids this cost.

You can use this cash however you want. If you are tight for cashflow it can assist to bridge this period where interest rates are at or near their highest or for any other reason you choose.

This also gives you the chance to review your mortgage to see if there are any other ways to improve your existing mortgage structure.

If you want to see if refinancing is the right option for you, we suggest a review of your current position. Please contact us HERE to arrange a discussion. Note that in most situations there are no costs for our services.

About the author: Kris Pedersen is a leading figure in mortgage advising and property investment, consistently ranked among the country's top six mortgage advisers for the past four years. With over a decade of experience, Kris is the preferred choice for investors seeking expert guidance to expand their portfolios. He shares his insights as a respected speaker at Property Investor Association groups, and his expertise extends to New Zealand and overseas property and finance markets, with regular features in NZ Property Investor Magazine. Kris Pedersen and Kris Pedersen Mortgages Limited are registered financial service providers, ensuring transparency and reliability in all financial dealings. Their credentials on the Financial Service Providers Register can be viewed here: https://fsp-register.companiesoffice.govt.nz/

Read more

From the top of the North through to the deep South, our salespeople are renowned for providing exceptional service because our clients deserve nothing less.

Managing thousands of rental properties throughout provincial New Zealand, our award-winning team saves you time and money, so you can make the most of yours.

With a team of over 850 strong in more than 88 locations throughout provincial New Zealand, a friendly Property Brokers branch is likely to never be too far from where you are.