Regional Market Activity Gains Pace - REINZ stats June 2025

Tuesday, 15 July 2025

Property Market Steady Overall As Regional Activity Gains Pace

The Real Estate Institute of New Zealand (REINZ) published figures for June, which showed a relatively stable market. Although there had been increases in the number of sales compared to June 2024, the median price for New Zealand remained unchanged, and listings across the country also declined.

The median price for New Zealand was steady year-on-year at $770,000. Excluding Auckland, the median price increased by 1.7% year-on-year to reach $691,500. Auckland experienced a further decline year-on-year, decreasing by 3.4% to $990,000. Ten out of the sixteen regions reported an increase in median prices compared to June 2024. The most significant increase was seen on the West Coast, up 35.5% from $310,000 to $420,000. Southland reached a record high in its median price, reaching $502,500, the first record median price in any region since January.

“We’re seeing a market that is steady on the surface but with some movement underneath at a regional level. The unchanged national median price suggests stability, yet this reflects contrasting regional dynamics, with some areas experiencing renewed growth year-on-year,” REINZ Chief Executive Lizzy Ryley says.

The number of properties sold across the country increased by 20.3% year-on-year, increasing from 4,877 to 5,865. When excluding Auckland, sales increased by 21.4%, from 3,371 to 4,091. Looking to the regions, the highest year-on-year increase was recorded in Gisborne, which saw a 70.0% increase (from 20 to 34 sales). Other regions with notable sales increases included Southland (+34.9%), Bay of Plenty (+33.3%) and Marlborough (+32.7%).

“June is typically a quieter month for real estate, and while the seasonal slowdown was expected, sales came in slightly below typical early winter levels. Nationally, seasonally adjusted sales fell by around five per cent, suggesting some caution in the market, but compared to this time last year, sales remain significantly stronger overall,” says Ryley. Looking at properties coming to market, New Zealand saw a 2.5% decline in listings compared to June 2024, totaling 7,612 listings. Excluding Auckland, there was also a decrease in listings, down 3.3% to 4,700. Inventory levels across the country, however, continue to rise, increasing by 2.0% year-on year to 32,384 properties available for sale.

Nationally, there were 676 auction sales reported in June 2025, representing 11.5% of all sales. For New Zealand, excluding Auckland, there were 315 auction sales, which were 7.7% of all sales. The median number of days to sell for New Zealand increased by three days to 50 days. Excluding Auckland, it rose by four days to reach a median of 50 days as well.

“While properties are still selling, the increase in median days to sell indicates that buyers are taking a more considered approach. This shift probably reflects a broader sense of caution, with many buyers feeling they have the time to explore their options, especially with the amount of choice they have,” adds Ryley. “Most vendors are entering the market with realistic price expectations and a willingness to adapt to current conditions, especially those motivated to sell. However, many are receiving offers below their anticipated value, prompting some to delay listing, or relisting, until spring or summer, when market activity may show signs of improvement.”

The House Price Index (HPI) for New Zealand is currently at 3,580, showing a year-on-year increase of 0.3% and a decrease of 0.8% compared to May 2025. Over the past five years, the average annual growth rate of New Zealand’s HPI has been 3.9%. (REINZ)

Regional highlights:

- Gisborne had the highest percentage increase in sales count, up 70.0% year-on-year, from 20 to 34 sales. Southland followed with a 34.9% year-on-year increase, from 109 to 147 sales.

- Ten regions recorded increases in median prices – West Coast led the way with a 35.5% increase year on-year, from $310,000 to $420,000. Marlborough followed behind with a rise of 21.0% compared to June 2024, up from $620,000 to $750,000.

Five regions reported an increase in listings compared to last year. The highest were:

- Gisborne, up 25.8% (31 to 39 listings).

- Marlborough, up 12.0% (75 to 84 listings).

- Northland, up 7.7% (222 to 239 listings).

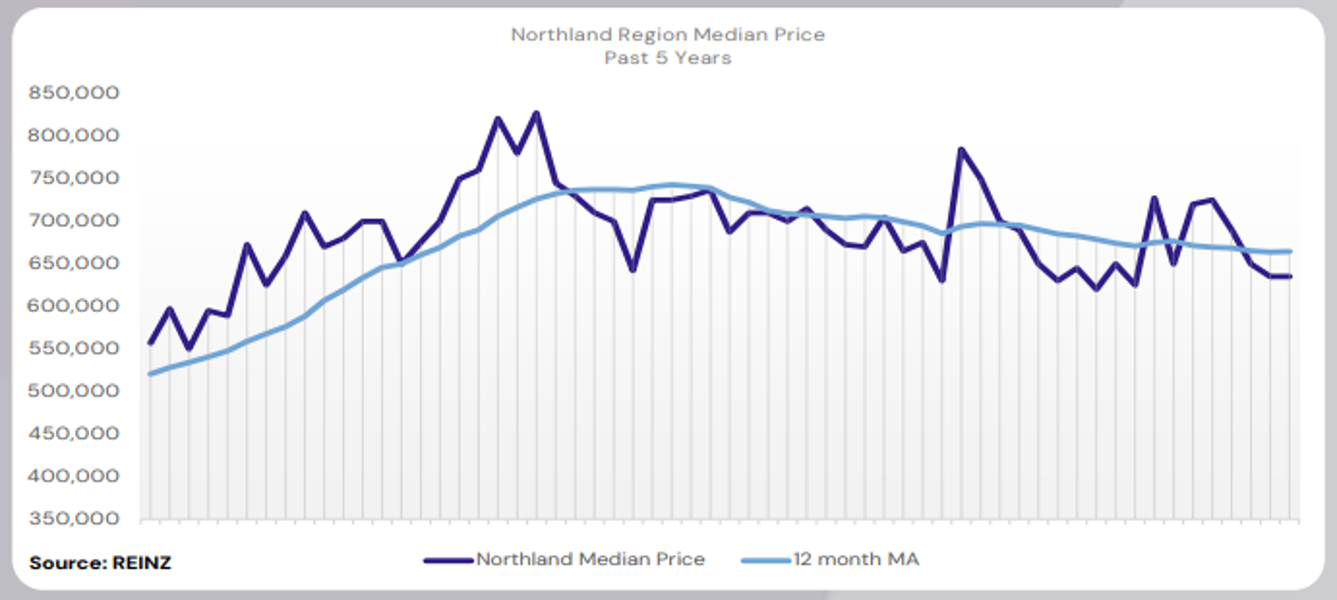

Regional Analysis - Northland

The median price for Northland increased by 0.8% year-on-year to $635,000

“Owner-occupiers, first home buyers and investors were the most active buyers across the region, with reports of reduced middle to high-end buyers in Kerikeri. Most vendor expectations regarding the asking price started high but tend to adjust to meet market expectations throughout the campaign, as well as the low offers that come in. Attendance at open homes was low and slow – the newly listed properties achieved higher attendance.

Auction room attendance and clearance rates varied across the region. Some saw good numbers in attendance and active bidders, while others had the opposite. Market sentiment was influenced by lending criteria and finance approvals, as well as the fear of overpaying – buyers remained confident that they would achieve a lower price if they persisted. Local agents predict that once the Auckland market picks up, their market will follow suit; in the meantime, it will remain steady and patchy.” (REINZ)

The current median Days to Sell of 60 days is more than the 10-year average for June which is 55 days. There were 33 weeks of inventory in June 2025 which is 13 weeks less than the same time last year.

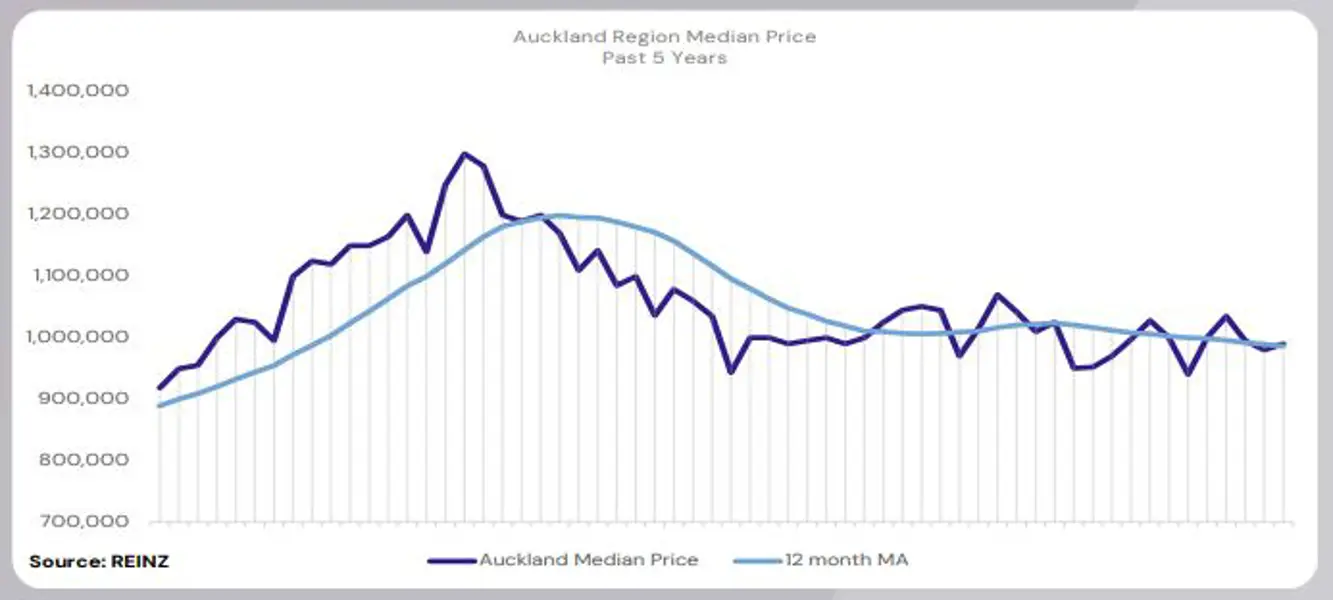

Regional Analysis - Auckland

The median price for Auckland decreased by 3.4% year-on-year to $990,000

All buyer types were active across the Auckland region in June. Vendor expectations were mainly realistic and have come to terms with the new Council Valuations (CVs), with very motivated vendors trying to match market expectations right away. Attendance at open homes was steady, and the new properties to market achieved higher attendance. Auction room attendance levels slowly increased, with some properties receiving multiple active bidders.

Factors such as high stock, decreased interest rates, and the buyers’ lack of urgency all contributed to a relatively stagnant market sentiment. Local agents predict much of the same over the coming months – slow and steady.” (REINZ)

The current median Days to Sell of 49 days is more than the 10-year average for June which is 43 days. There were 29 weeks of inventory in June 2025 which is 4 weeks less than the same time last year.

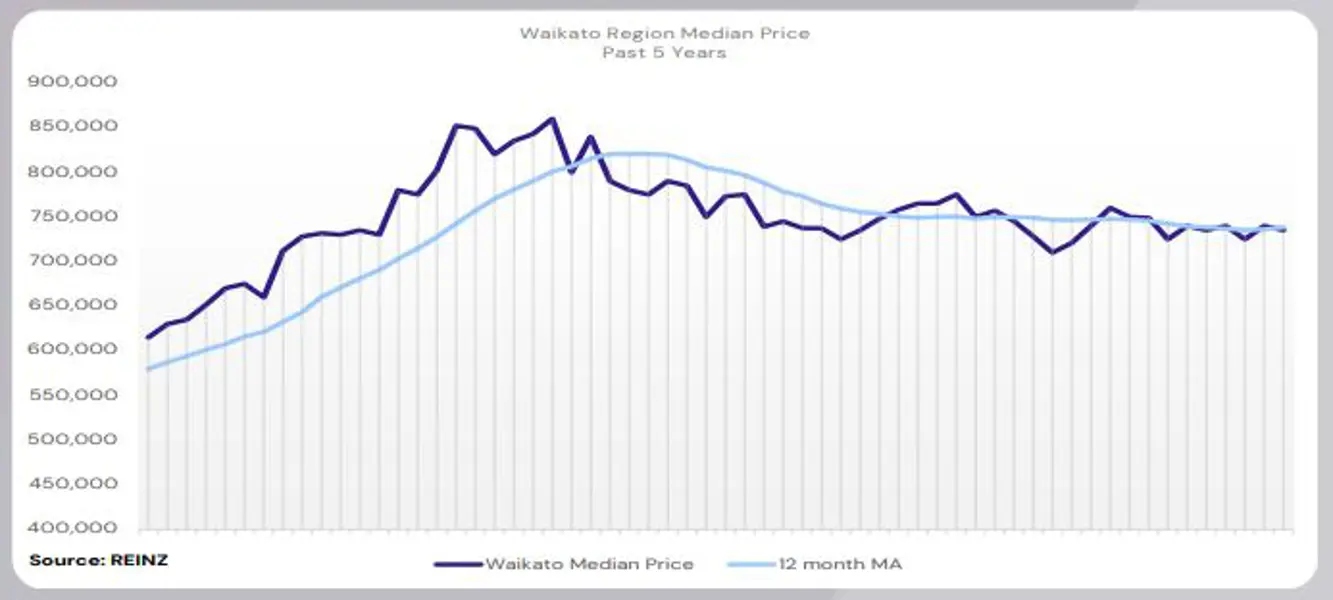

Regional Analysis - Waikato

Waikato’s median price increased by 3.5% year on-year to $735,000

“All buyer types were active across Waikato in June, with no reports of any declines. Most vendor expectations were realistic regarding asking price. When the new Council Valuations (CVs) were released, buyers anticipated that properties would be cheaper, while vendors preferred to ignore the change if it was lower than before. Attendance at open homes varied around the region, with some receiving good numbers, while others had lower numbers.

Auction room activity and attendance were also mixed, but encouraging. Auctions were a preferred method of sale for some areas, and if not sold under the hammer, most post auction offers were accepted. Market sentiment remained steady compared to previous months; however, optimism and the willingness to participate between buyers and sellers have increased. Local salespeople cautiously predict incremental improvements as demand improves and stock numbers decrease. There have been reports that there is a renewed interest in sections and buyers willing to commit to building, which shows growing confidence in the market.” (REINZ)

The current median Days to Sell of 57 days is much more than the 10-year average for June which is 45 days. There were 22 weeks of inventory in June 2025 which is 5 weeks less than the same time last year.

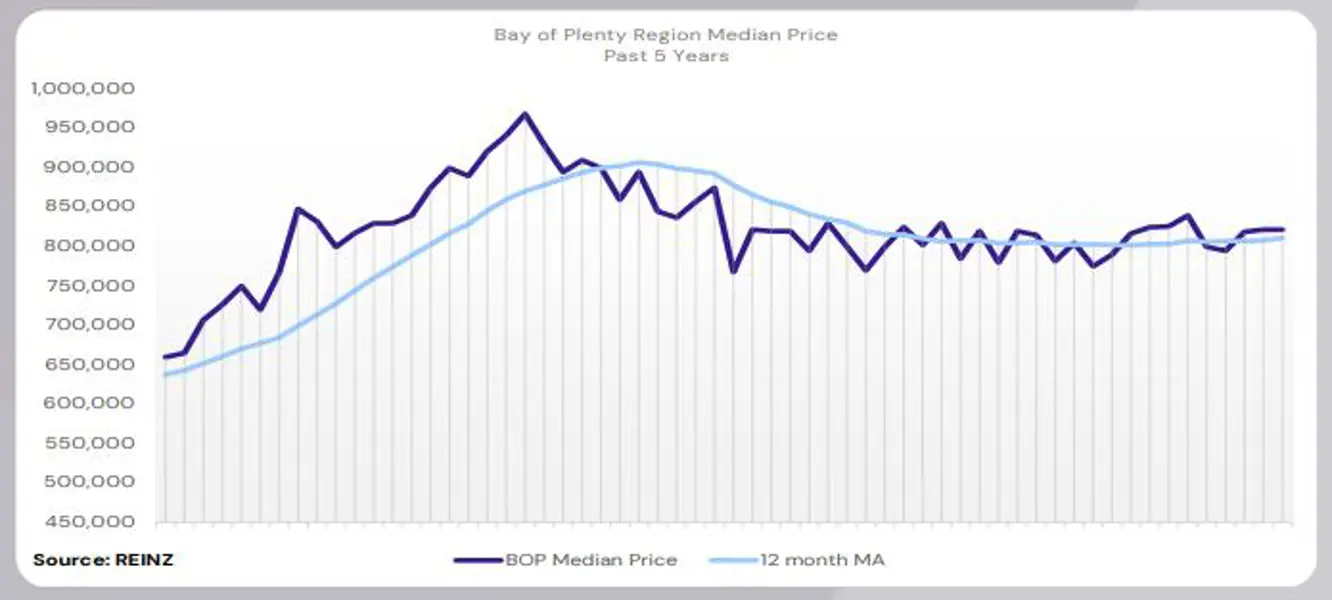

Regional Analysis - Bay of Plenty

The median price for the Bay of Plenty increased by 5.1% year-on-year to $822,000

“First home buyers and owner-occupiers continue to be the most active buyers in the Bay of Plenty, with reports of developer enquiries declining in Rotorua. Most vendor expectations regarding asking price were realistic and accepted current market conditions, which is further motivated if they are buying again in the same market. Attendance at open homes was high in desirable areas, but that noticeably dropped after the second week.

Auction clearance rates were steady, with the mix of properties on offer on auction day influencing attendance levels. Market sentiment remained steady, although some sellers are postponing listing their properties over winter, and those with properties on the market are receiving offers but are perceived to be at a lower level. Local agents cautiously predict that the easing interest rates that are anticipated could help give the market the boost it needs towards spring.” (REINZ)

The current median Days to Sell of 57 days is more than the 10-year average for June which is 49 days. There were 21 weeks of inventory in June 2025 which is 7 weeks less than the same time last year.

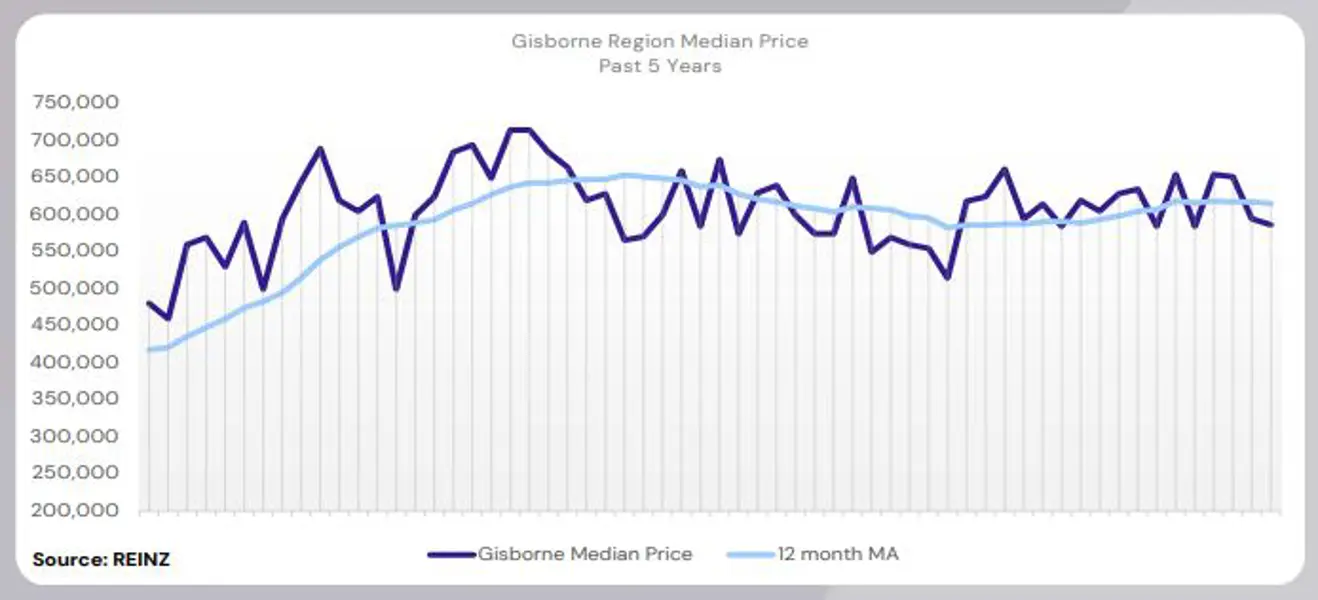

Regional Analysis - Gisborne

Gisborne’s median price decreased by 4.6% year-on-year to $587,000

“Owner-occupiers taking the opportunity to upgrade in properties, and first home buyers, were the most active in the market. Local agents reported fewer buyers in the $800K to $1 million range, due to higher living costs. Vendor expectations were relatively realistic as they don’t want their property on the market in six months’ time. Attendance was good at the beginning of June, but tapered off towards the end due to multiple factors, mostly winter setting in.

Attendance in the auction rooms was reportedly quieter this month, but clearance rates lifted. Factors like global events, the OCR announcement, the amount of stock on the market and the lack of urgency influenced market sentiment. Local agents predict the market will stay tracking as it is currently, and once the weather warms up, so should the market.” (REINZ)

The current median Days to Sell of 51 days is much more than the 10-year average for June which is 40 days. There are 14 weeks of inventory in June 2025 which is 7 weeks more than last year.

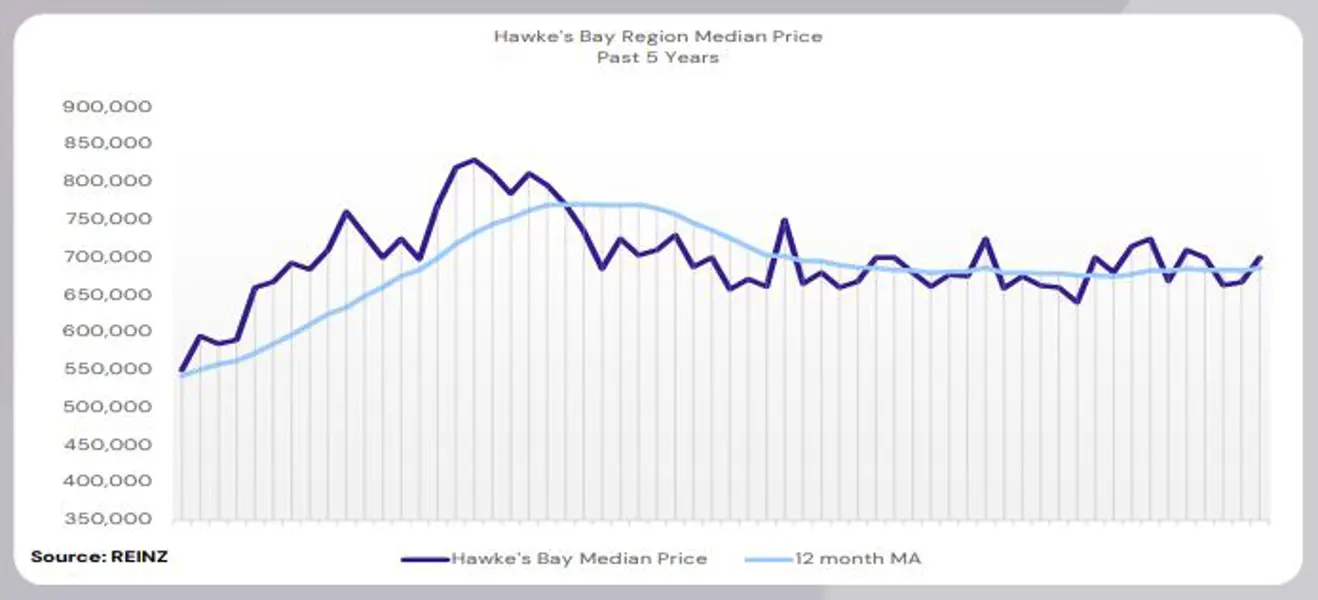

Regional Analysis - Hawke's Bay

Hawke’s Bay’s median price increased by 5.7% year-on-year to $700,000

“First home buyers and owner-occupiers were the most active in the market for June, with fewer investors reported. Most vendor expectations in terms of asking price were improving to be more realistic and meeting the market, which was mainly influenced by their next purchase. Attendance at open homes was lower than in previous months, but those who did attend were serious buyers who were focused on making well-informed decisions.

Market sentiment was influenced by buyers waiting for further interest rate reductions and the onset of the winter season. Local agents cautiously predict the market to improve over the next few months, however slowly that might be.” (REINZ)

The current median Days to Sell of 57 days is much more than the 10-year average for June which is 42 days. There were 17 weeks of inventory in June 2025 which is 5 weeks less than the same time last year.

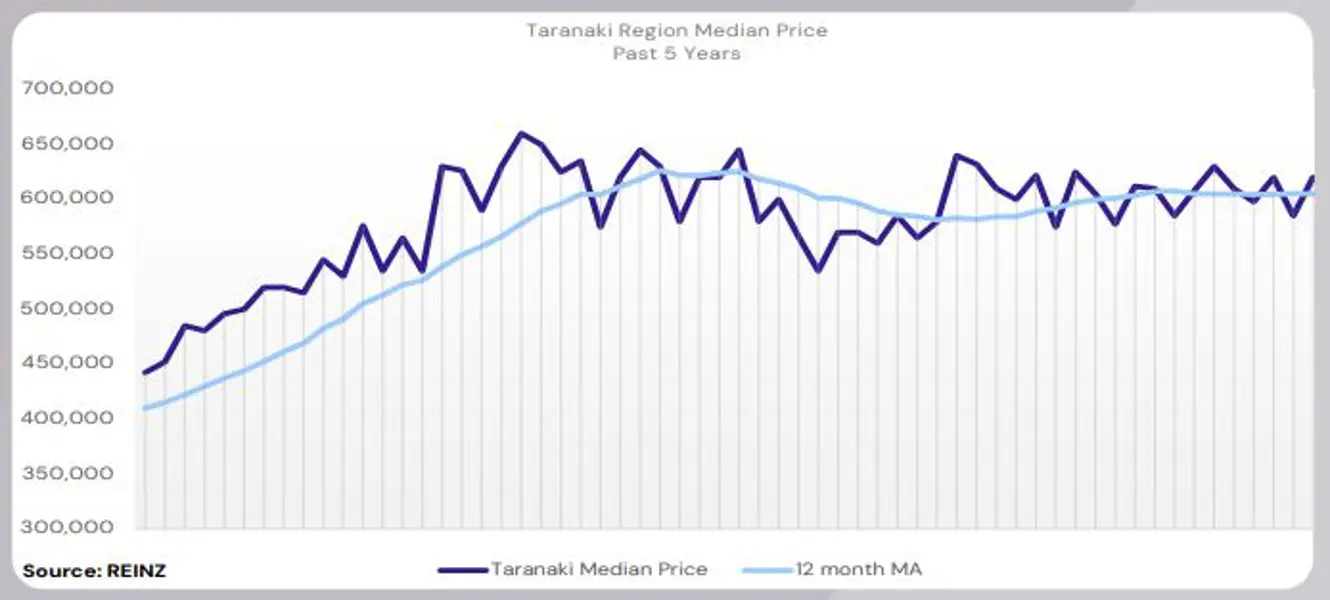

Regional Analysis - Taranaki

Taranaki’s median price decreased by 0.8% year-on-year to $620,000

“Owner-occupiers continue to be the most active buyers in Taranaki, but investors and first home buyers were visible, too. While there was no noticeable decline in the buyer pool, buyers at the higher end of the market ($1 million and above) continued to tread carefully. Vendor expectations regarding the asking price were mainly realistic, especially when a property has been on the market for an extended time. Attendance at open homes was varied; the newly listed open homes continued to attract firm numbers, but then they fell sharply in the weeks that followed.

Market sentiment was influenced by the fact that it remains a buyer’s market, a lack of buyer urgency, increased new listings, and buyers’ cautiousness. Local agents predict that they will have high listing numbers and low average sales through winter, which is what they are expecting.” (REINZ)

The current median Days to Sell of 41 days is more than the 10-year average for June which is 39 days. There were 17 weeks of inventory in June 2025 which is 7 weeks less than the same time last year.

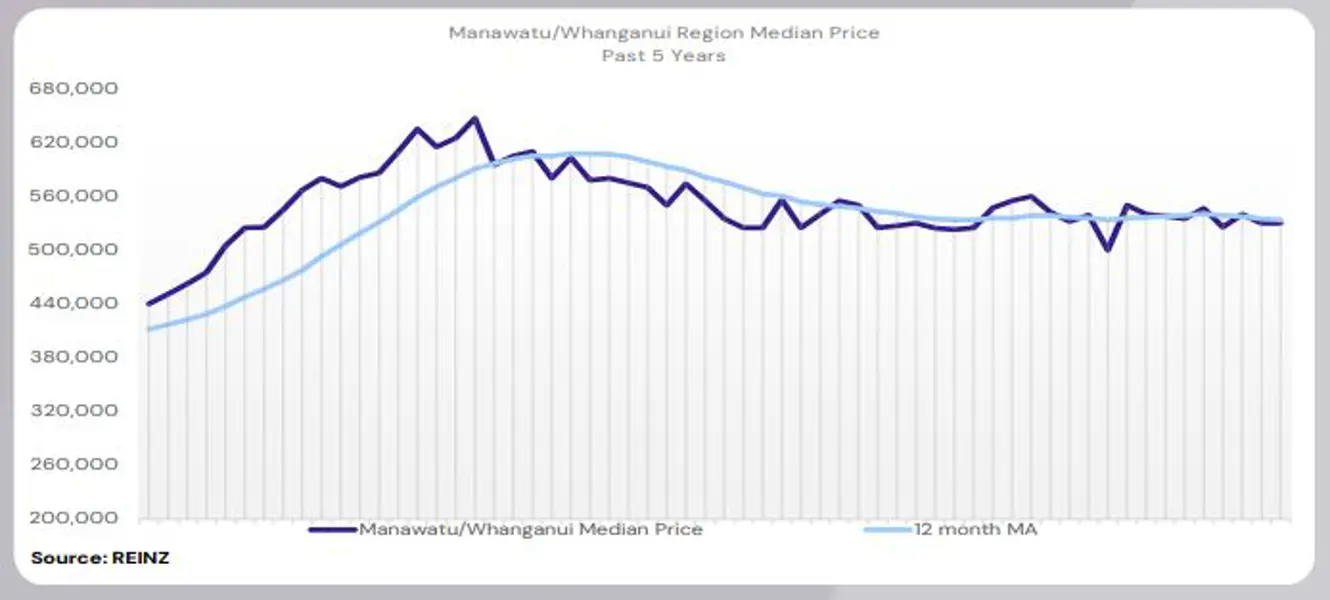

Regional Analysis - Manawatu/Whanganui

The median price for Manawatu/Whanganui decreased by 2.3% year-on-year to $530,000

“First home buyers and owner-occupiers were the most active, either upsizing, downsizing, or due to job transfers or moving overseas. Local agents report very few investors in the market at the moment. Some vendor expectations regarding the asking price were above market conditions. Open homes attracted good levels of interest for new listings and the longer the property sits on the market, the fewer numbers attend. Auction rooms saw few positive results; some properties sold post-auction by negotiation.

Market sentiment was influenced by a decrease in the number of listings available, paired with May’s increase in sales volumes. Only time will tell if this will be sustainable. Local salespeople predict that the next few months will confirm where the market is heading.” (REINZ)

The current median Days to Sell of 55 days is more than the 10-year average for June which is 41 days. There were 18 weeks of inventory in June 2025 which is 6 weeks less than the same time last year.

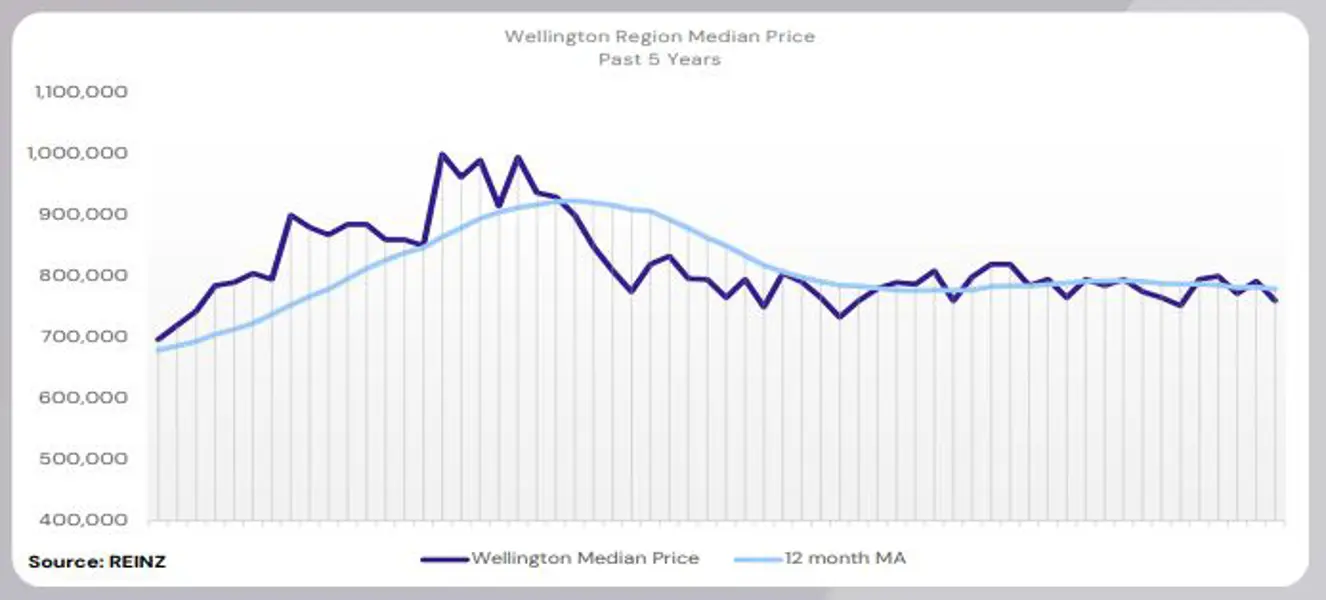

Regional Analysis - Wellington

Wellington’s median price decreased by 4.4% year-on-year to $760,000

“First home buyers and intergenerational buyers were the most active, with reports of fewer investors due to legislation changes and high demand for rentals. Most vendors were realistic regarding asking price because they are motivated to sell. Attendance at open homes was quiet due to the winter setting in; however, there was an increase in private viewings. Auction room attendance was limited as this method of sale isn’t popular in Wellington.

Market sentiment was influenced by reduced interest rates, and buyers feared missing out on the lower prices in case the market increased over the next few months. Local agents predict that more listings will become available in the market over the next few months.” (REINZ)

The current median Days to Sell of 54 days is much more than the 10-year average for June of 39 days. There were 14 weeks of inventory in June 2025 which is 1 week less than the same time last year.

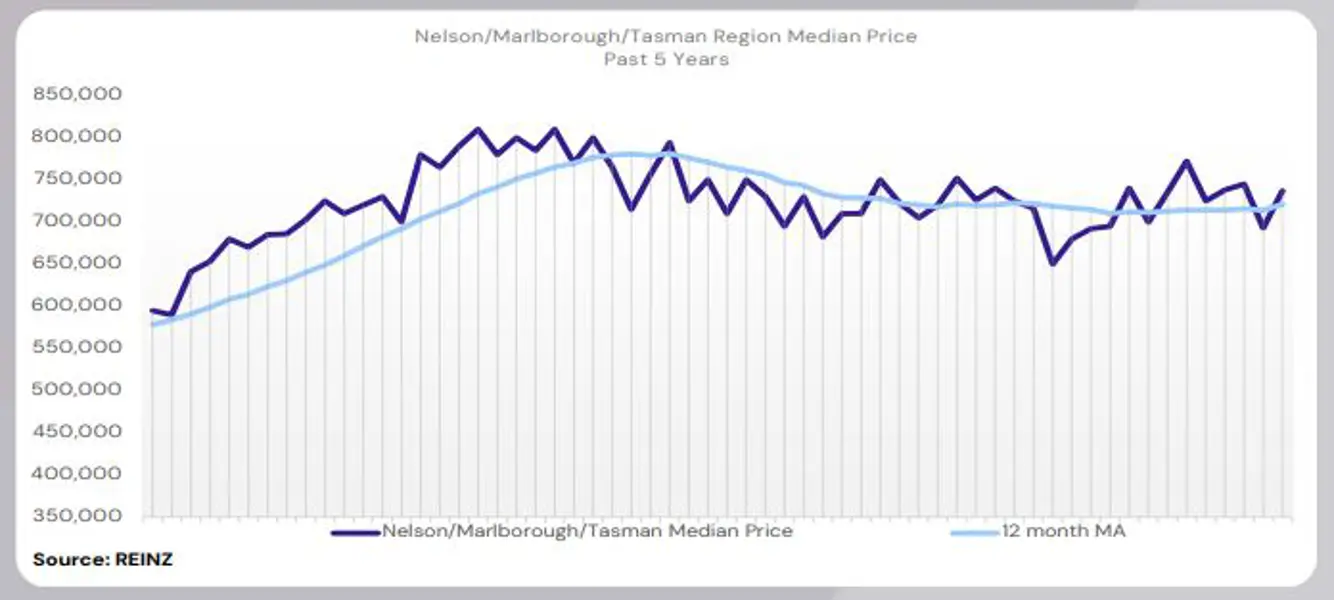

Regional Analysis - Nelson/Tasman/Marlborough

The median price for Nelson increased by 8.0% year-on-year to $700,000. The median price for Marlborough increased by 21.0% year-on-year to $750,000. The median price for Tasman increased by 2.3% year-on-year to $739,000

“First home buyers and owner-occupiers were the most active in the market. Vendor expectations were realistic in terms of asking price, as most properties have been priced, which suggests vendors know they have to be competitive to create interest. Attendance at open homes was mostly quiet, with new listings having the highest attendance at first. Auctions in Blenheim achieved good clearance rates under the hammer, paired with moderate attendance.

The local market is considered to be a buyers’ market with no evident shift in market sentiment. Reduced interest rates had a positive impact on buyer confidence and willingness to commit to a purchase. Local agents are cautious that the weather may impact housing available for rentals and sales.” (REINZ)

The current median Days to Sell of 44 days is more than the 10-year average for May which is 40 days. There were 20 weeks of inventory in May 2025 which is 1 week less than the same time last year.

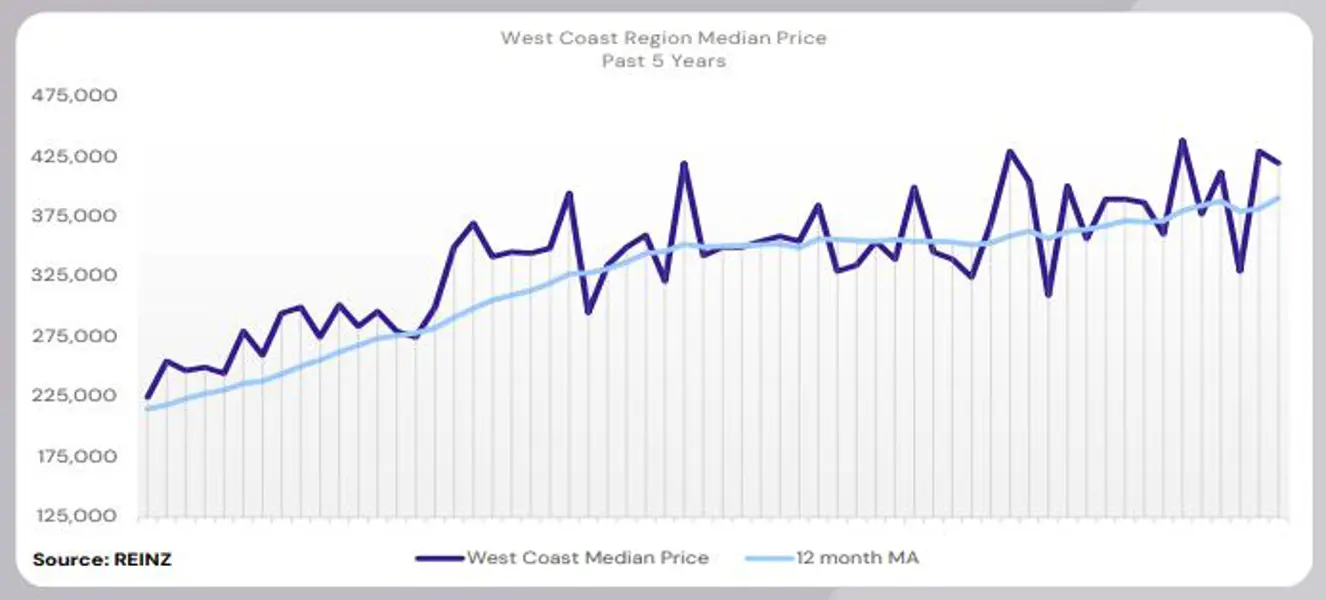

Regional Analysis - West Coast

West Coast’s median price increased by 35.5% year-on-year to $420,000

“Owner-occupiers were the most active in the market, mainly due to relocation. Local agents reported declines across most buyer pools because of increased caution among buyers.

Most vendors were meeting market expectations regarding property prices. Attendance at open homes was low, as there were not many active buyers in the region. Market sentiment was influenced by buyers adopting a wait-and-see approach to see if prices would bounce back, as well as the winter season being a factor. Local salespeople predict little change in the market over winter; however, they mention that mining remains a focus in the job market.” (REINZ)

The current median Days to Sell of 73 days is more than the 10-year average for June which is 64 days. There were 28 weeks of inventory in June 2025 which is 3 weeks more than the same time last year.

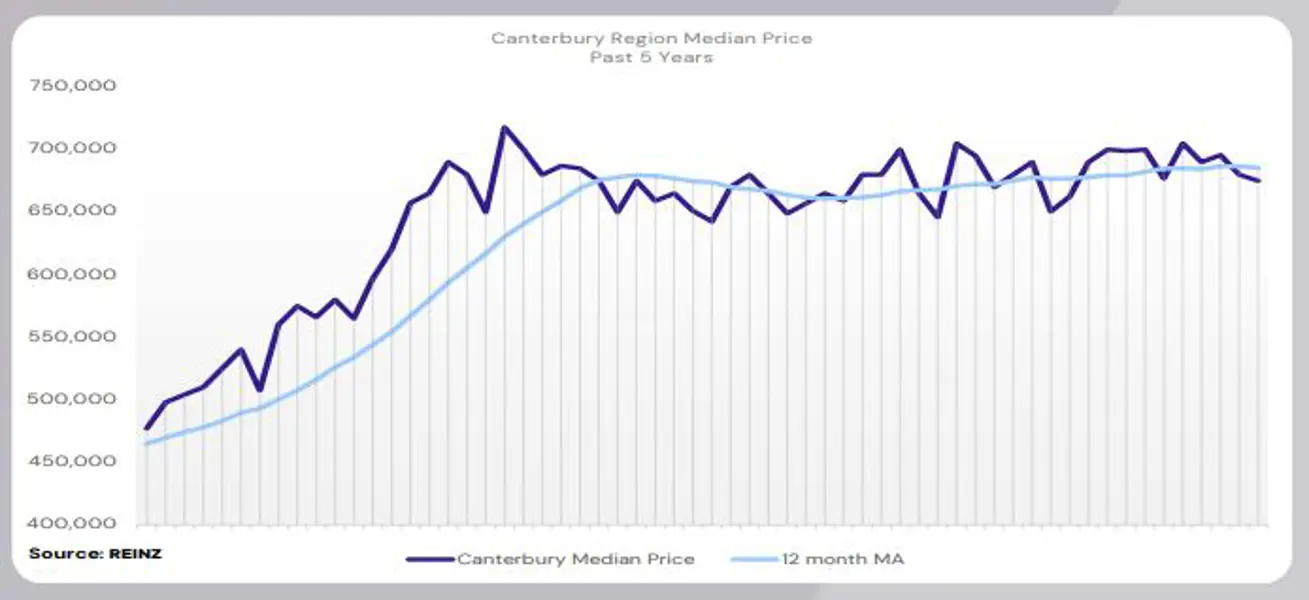

Regional Analysis - Canterbury

The median price for Canterbury decreased by 2.2% year-on-year to $675,000

“First home buyers and owner-occupiers were the most active buyers, with fewer investor enquiries reported and fewer purchases from that buyer type. Most vendors were realistic and willing to meet market expectations; however, vendors at the higher end of the market tended to hold firm on their original price expectations. Attendance at open homes was dependent on the weather, but overall, it was steady across the board. Auction room activity was steady, with a mix of multiple bidders and no bidders, but conditional offers were accepted immediately post-auction.

Factors like vendors’ reluctance to sell in winter, lower stock levels, and a lack of buyer urgency despite lower interest rates influenced market sentiment. Local salespeople are cautiously optimistic that spring will bring more activity, as there will be the usual winter slump for the next couple of months.” (REINZ)

The current median Days to Sell of 40 days is more than the 10-year average for June which is 38 days. There were 15 weeks of inventory in June 2025 which is the same as the same time last year.

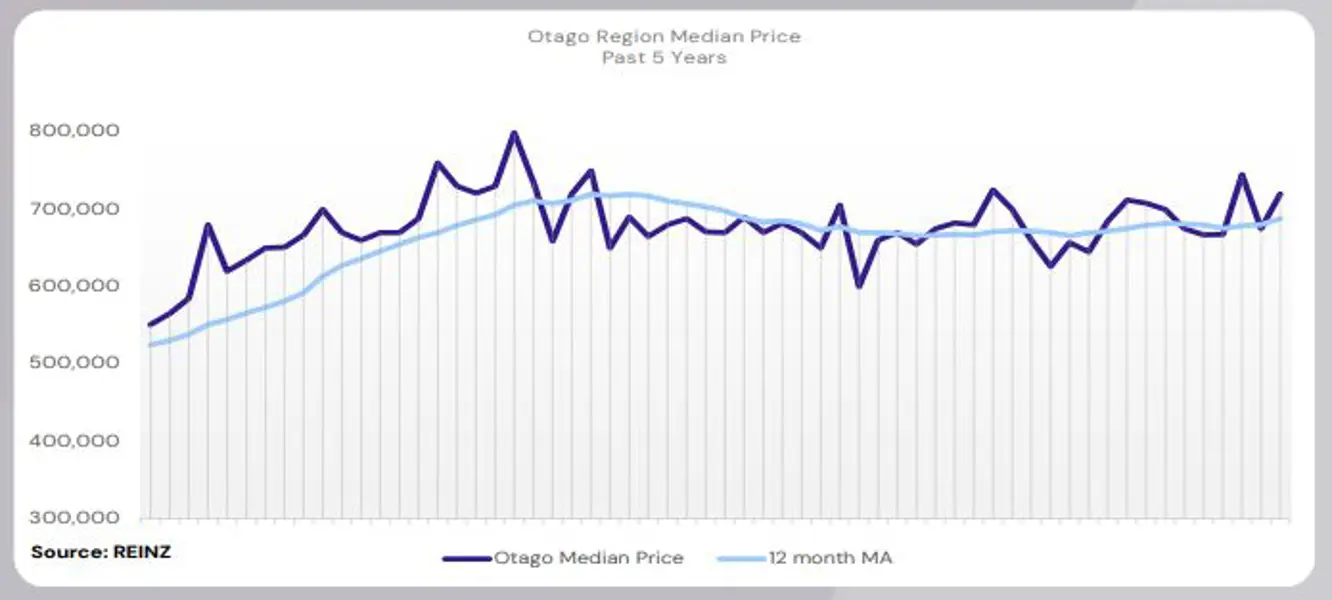

Regional Analysis - Otago

“Dunedin’s median price increased by 2.6% year-on-year to $595,000"

Owner-occupiers were the most active buyers in June, with a decline in first-home buyer enquiries. Vendor expectations were mainly in line with current conditions, unchanged from the previous months. Open home attendance was good in the first week, but then it tapers off from the second week. Auction activity was steady.

Market sentiment was influenced by the high cost of living and the arrival of winter, which has led to fewer listings and a lack of enthusiasm. Local agents forecast reduced stock levels and, hopefully, easing interest rates in the coming months, with conditions improving around spring.” (REINZ)

Queenstown Lakes

“Owner-occupiers and first home buyers continued to be the most active, with increased investor activity reported. Driven by lower interest rates and increased sales, most vendors believe they can secure a higher price, while other vendors prefer to wait until spring. Strong numbers were reported at open homes across the Central Lakes. Properties with a point of interest attracted higher numbers, with plenty of first home buyers looking at what’s available. Auction room clearance rates and attendance levels proved challenging, with the key being to work closely with the buyer and the vendor.

Local agents report that the local market held up well during the early winter months despite challenges in some sectors. Stock levels were high earlier in the year but dropped as sales outpaced new listings, a typical occurrence for winter. The perception that interest rates seemed close to their lowest point is expected to boost buyer activity later in the year.” (REINZ)

The current median Days to Sell of 60 days is much more than the 10-year average for June which is 41 days. There were 17 weeks of inventory in June 2025 which is 5 weeks less than the same time last year.

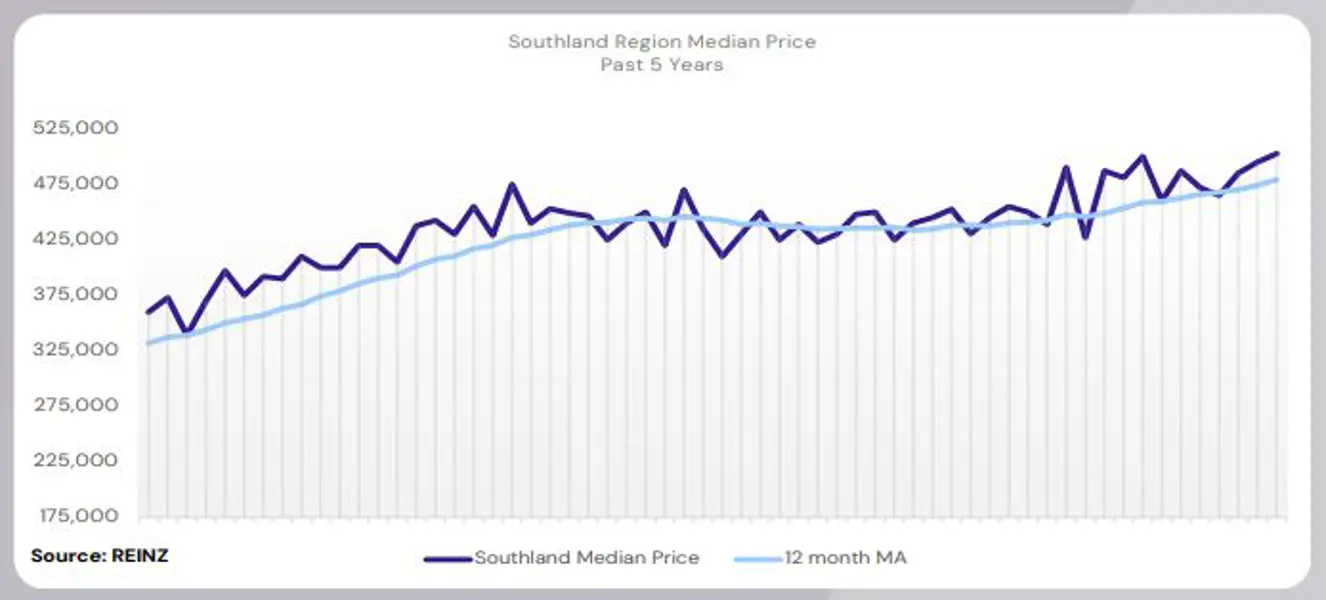

Regional Analysis - Southland

The median price for Southland increased by 14.5% year-on-year to $502,500 – a record high for the region

“Owner-occupiers, first home buyers and investors were the most active buyer groups in Southland. Most vendors held firm on their asking prices, and, subject to motivation, they were not willing to drop. Attendance at open homes was good for new listings, which attracted the most activity. Auction room attendance was also strong for properties at the lower end of the market, achieving the desired results.

Market sentiment was influenced by the fact that vendors had less competition on the market, older stock was selling, and there was a slowdown in new stock coming to the market. Over the next couple of months, local agents predict a seasonal slowdown as fewer properties come to market over winter.” (REINZ)

The current median Days to Sell of 41 days is more than the 10-year average for May which is 39 days. There were 14 weeks of inventory in May 2025 which is 3 weeks less than the same time last year.

Browse

Topic

Related news

Find us

Find a Salesperson

From the top of the North through to the deep South, our salespeople are renowned for providing exceptional service because our clients deserve nothing less.

Find a Property Manager

Managing thousands of rental properties throughout provincial New Zealand, our award-winning team saves you time and money, so you can make the most of yours.

Find a branch

With a team of over 850 strong in more than 88 locations throughout provincial New Zealand, a friendly Property Brokers branch is likely to never be too far from where you are.