Autumn Chill Hits Property Market - REINZ stats April 2025

Thursday, 15 May 2025

Autumn Chill Hits Property Market

The Real Estate Institute of New Zealand (REINZ) has released figures for April, revealing a slightly slower and more subdued market as the cooler months arrive. Although sales have increased compared to April 2024, the national median price has declined. Additionally, new listings entering the market have also reported a drop. “ This April, there were many factors that influenced the property market, such as school holidays, ANZAC Day, and Easter. Some salespeople mentioned that there were fewer attendees at open homes and fewer successful auctions, ” says Acting Chief Executive Rowan Dixon.

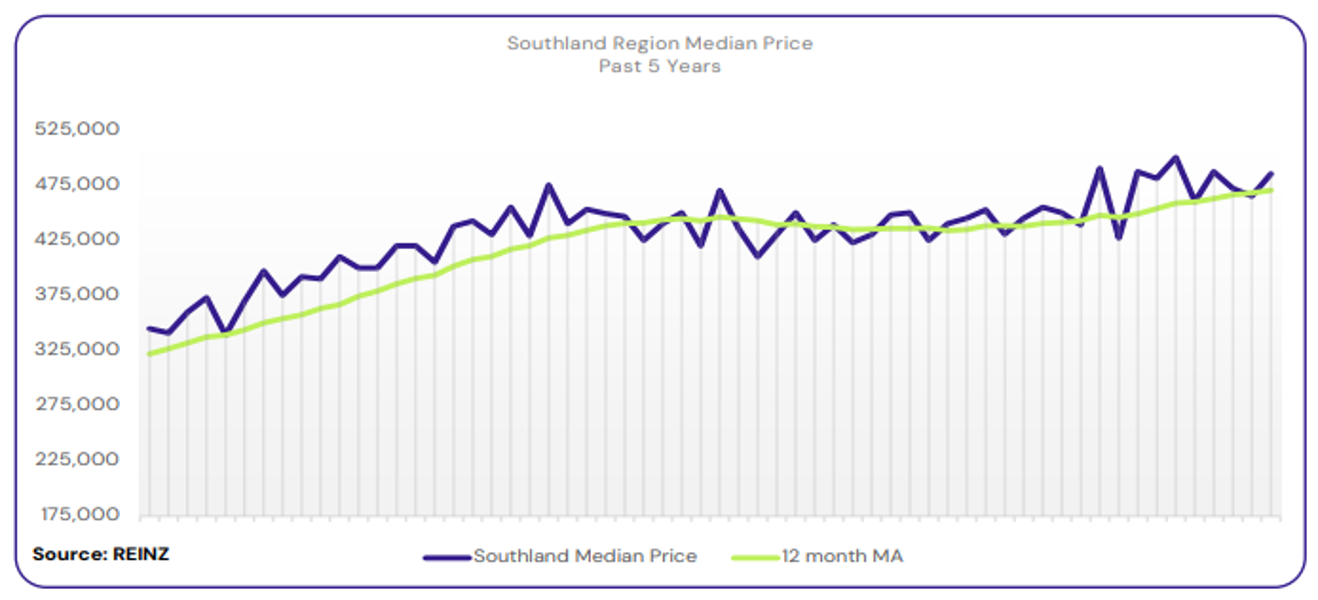

New Zealand’s median price declined by 1.1% year-on-year to $781,000. In New Zealand, excluding Auckland, the median price remained unchanged year-on-year, at $700,000. Auckland’s median price declined by 4.0% year-on-year, at $1,000,000. Seven out of the sixteen regions reported an increase in median prices compared to April 2024. Tasman recorded the highest yearly increase of 8.4%, to $875,000 from $807,550. Southland followed with an increase of 6.6% compared to April 2024, reaching $485,000, up from $455,000.

The number of properties sold in New Zealand in April 2025 increased by 9.5% compared to April 2024, rising from 5,871 to 6,427 sales. Excluding Auckland, sales increased 11.1% year-on-year from 4,023 to 4,470. At a regional level, the highest year-on-year increase was achieved by Southland, up 28.7% from 115 to 148 sales. Other regions that experienced notable increases were Manawatu/Whanganui (+19.0%), Waikato (+17.3 %), and Gisborne (+15.9%).

“There has been a notable increase in sales across the country. However, despite this upward trend, property prices continue to decline due to a significant number of properties still available on the market. Real estate professionals report that buyers are seeking properties at lower price points, and they are willing to explore alternative options if they view prices as being excessively high,” says Dixon.

Fewer properties were listed for sale this April compared to both the previous month and the same period last year. New Zealand experienced an 11.6% decline in listings from April 2024, totalling 8,518 listings. Excluding Auckland, a 5.7% decline was reported in listings, bringing the total to 5,739. Inventory levels for New Zealand increased by 6.2% year-on-year to 35,924 properties for sale. Nationally, there were 912 auction sales reported. Excluding Auckland, there were 424 auction sales. There was no change year-on-year for the average days to sell in New Zealand, sitting at 42 days. Sales often decline in winter or over the holidays, so month-to-month changes may reflect seasonal behaviour rather than true market shifts. Seasonally adjusted (SA) data eliminates these seasonal effects and shows the actual trend.

“Looking at sales activity across New Zealand, the raw data shows a 17.6% drop in activity from March to April 2025,” notes Dixon. “However, when seasonally adjusted, this substantial decline becomes just a 0.5% decrease. This reveals that while transaction numbers have fallen as expected for this time of year, the actual market activity remains stable when seasonal patterns are taken into account.”

This month, market sentiment is largely influenced by easing interest rates and concerns about job security. As interest rates decrease, we can expect an increase in market activity. However, vendors should be aware that prices haven’t yet aligned with these changes and should be ready to adapt to evolving market dynamics, Dixon advises.

The House Price Index (HPI) for New Zealand is currently at 3,621, showing a year-on-year and month-on-month decrease of 0.3%. Over the past five years, the average annual growth rate of New Zealand’s HPI has been 4.0%. Southland remains the highest-ranked region for HPI movement, taking the top place for 10 consecutive months. (REINZ).

Regional highlights:

- Southland had the highest increase in sales count, up 28.7% year-on-year. Manawatu/Whanganui followed with a 19.0% increase compared to April 2024.

- Only three regions reported an increase in listings compared to last year. Those were Gisborne, up 60.6% (33 to 53 listings), West Coast, up 17.3% (52 to 61 listings) and Northland, up 10.7% (290 to 321 listings).

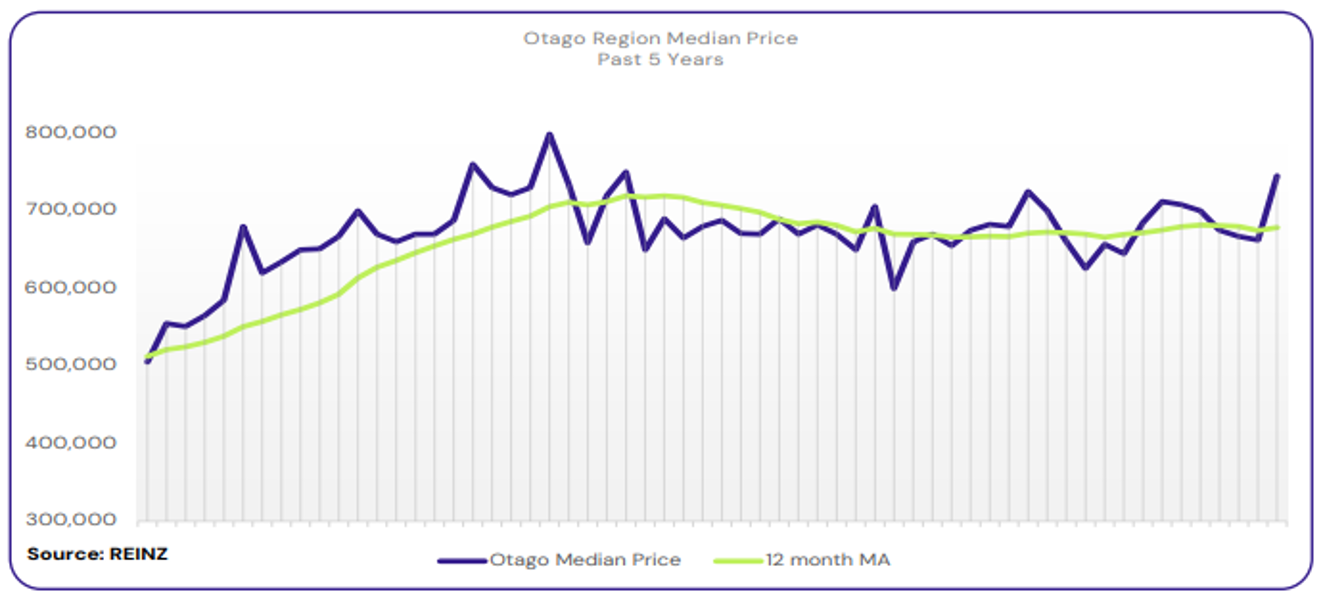

- Seven regions had year-on-year median price increases. The three largest increases compared to April 2024 were Tasman (+8.4%), Southland (+6.6%) and Otago (+6.4%).

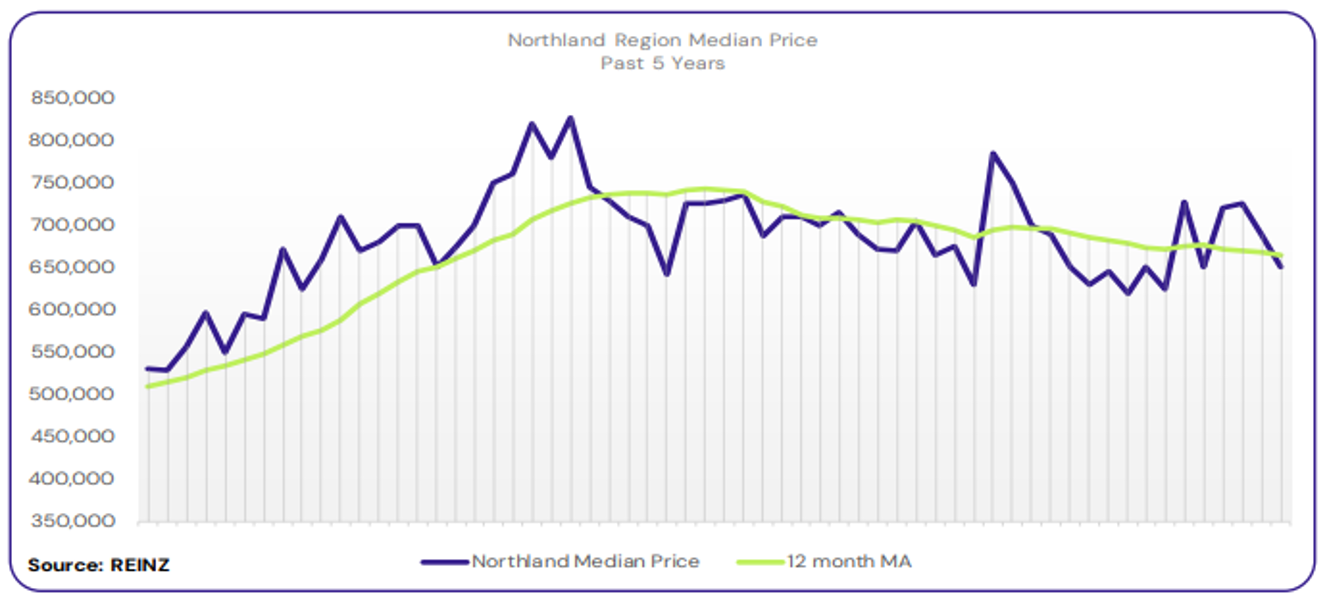

Regional Analysis - Northland

The median price for Northland decreased by 5.8% year-on-year to $650,000

“Owner-occupiers and first-home buyers were the most active participants in the market. Investor enquiries increased in Whangarei. Some vendors had high expectations and clung to prices seen at the height of the market; however, as the campaign progressed and they were motivated by the desire to sell, they became willing to adjust to meet market expectations. Attendance at open homes for new listings and well-priced properties drew good numbers.

The auction room clearance rate in Whangarei was reasonable. Bidder numbers rose, and buyers preferred to purchase at auction rather than risk missing out due to multiple offers. Local agents describe their market sentiment as relatively flat, with first-home buyers expressing concerns about their KiwiSaver funds. They predict a slight dip in sales in the coming months as the stock coming to market continues to increase which could lead to a decrease in buyer activity.” (REINZ)

The current median Days to Sell of 59 days is more than the 10-year average for April which is 51 days. There were 45 weeks of inventory in April 2025 which is 8 weeks less than the same time last year.

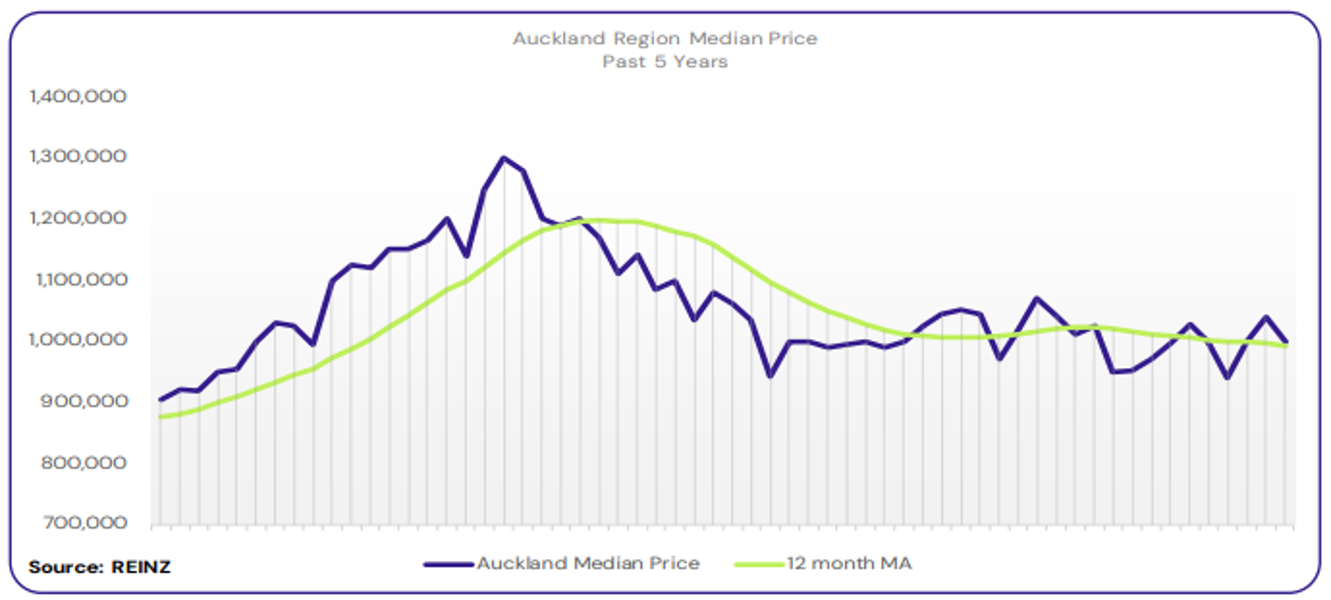

Regional Analysis - Auckland

The median price for Auckland decreased by 4.0% year-on-year to $1,000,000

“First home buyers and owner-occupiers looking to upsize were the most active buyer groups in the region, with developers active in South Auckland, too. Some vendors were realistic regarding price, while others opted for a “wait and see” approach. Attendance at open homes varied across the region. Auction activity also varied – some had good attendance and average clearance rates, while others had low attendance and a lack of bidding.

Interest rates, concerns around employment, and current economic conditions influenced market sentiment. Additionally, there were reports of caution and a lack of motivation shown by buyers. Local salespeople suspect the Auckland market will continue to improve slowly over the coming months.” (REINZ)

The current median Days to Sell of 40 days is more than the 10-year average for April which is 38 days. There were 27 weeks of inventory in April 2025 which is 6 weeks less than the same time last year.

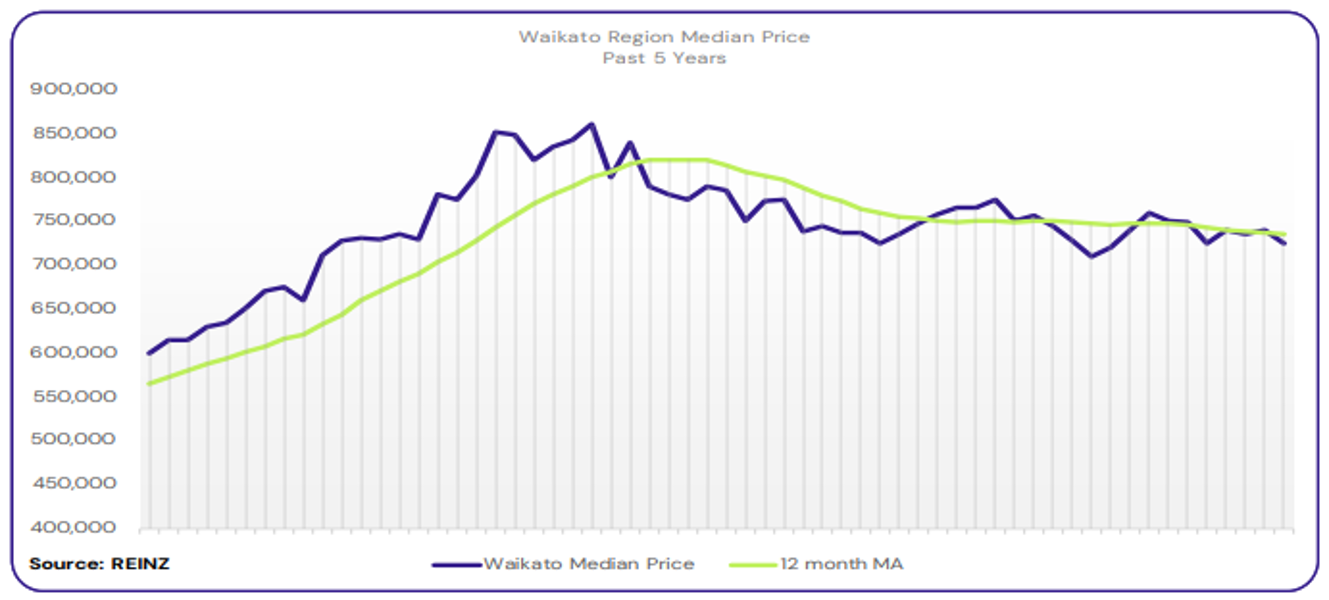

Regional Analysis - Waikato

Waikato’s median price decreased by 2.7% year-on-year to $725,000

“Owner-occupiers, first home buyers, investors and holiday home buyers were the most active in April. Most vendors met market expectations regarding price and were motivated to make a sale. Attendance at open homes varied across the region, with steady numbers in most areas; however, due to the long weekends, attendance was poor in others. Clearance rates in Taupo were on the rise, with sales either happening under the hammer or post-auction.

Global economic concerns influenced market sentiment. Although in the local market, vendors appear to have realistic expectations, and buyers are looking to purchase properties for lower prices. Local salespeople are cautiously hopeful that confidence will return to the market in the coming months and is predicted to remain consistent throughout winter, with further improvements later in the year.” (REINZ)

The current median Days to Sell of 46 days is more than the 10-year average for April which is 39 days. There were 22 weeks of inventory in April 2025 which is 5 weeks less than the same time last year.

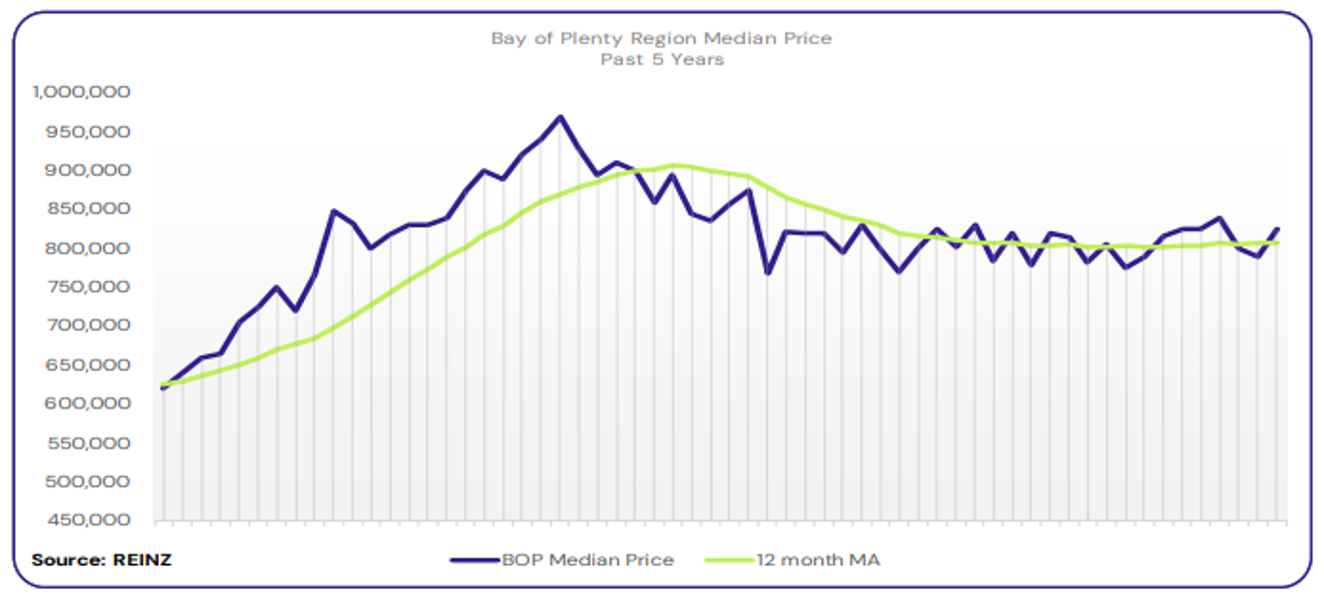

Regional Analysis - Bay of Plenty

The median price for the Bay of Plenty increased by 0.6% year-on-year to $825,000

“First home buyers were the most active in the region. Vendor expectations were steady, with some aligning with market expectations, and enquiries remained consistent across most price points. Others have been holding on to prices for several years. Attendance at open homes was steady, with newer listings receiving the highest attendance numbers. Many buyers were viewing multiple properties, as there was no pressure to secure one immediately.

Auction activity varied depending on the properties available; bidders were active, but not always at the vendor’s level. Factors such as economic conditions, lower interest rates, obtaining finance, a lack of commitment from buyers, and general uncertainty influenced market sentiment. Local salespeople predict the next few months will be much the same as what happened over the last six months.” (REINZ)

The current median Days to Sell of 45 days is more than the 10-year average for April which is 41 days. There were 24 weeks of inventory in April 2025 which is the same as the same time last year.

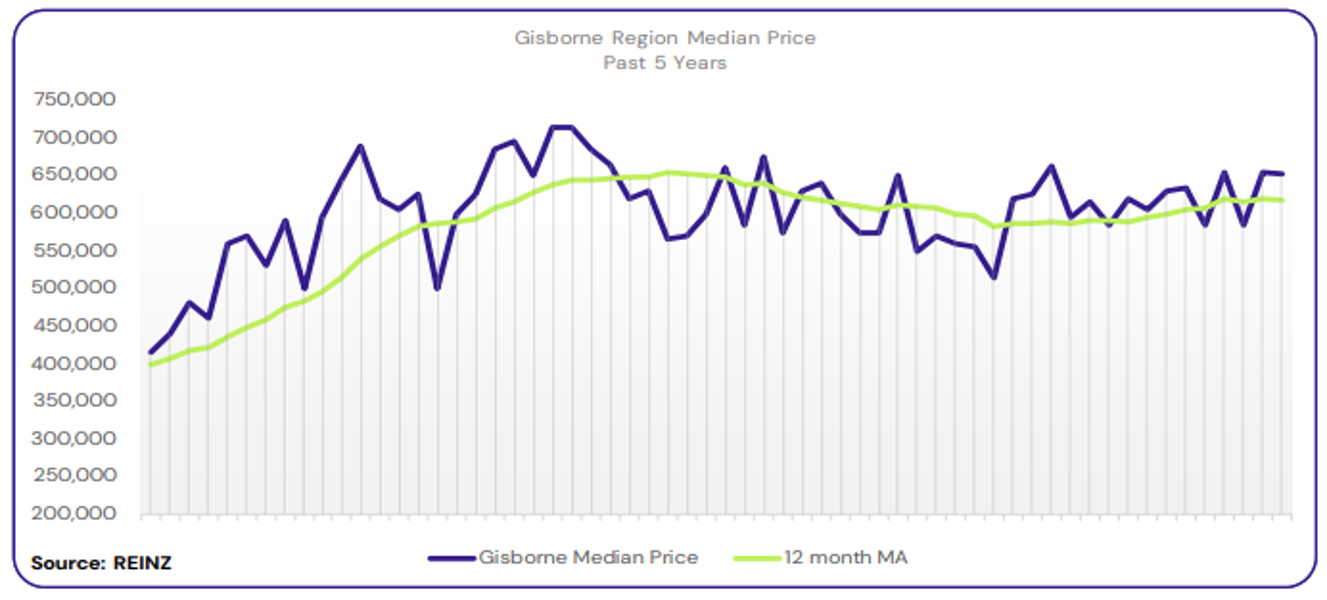

Regional Analysis - Gisborne

Gisborne’s median price decreased year-on-year by 1.6% to $652,000

“Owner-occupiers were the most active buyers, making up most of the purchasers over April. There were no reports of buyer declines. Vendor expectations regarding price were realistic due to the amount of stock available. Attendance at open homes was lower due to multiple long weekends and school holidays. Activity in the auction room was reported as stable, both in attendance and sales. There were no reports of easing sales counts.

Market sentiment has shifted, influenced by lower interest rates and renewed confidence in vendors achieving a sale. Local salespeople predict a slight seasonal slowdown during winter, but are quite optimistic for what spring might bring.” (REINZ)

The current median Days to Sell of 50 days is much more than the 10-year average for April which is 39 days. There are 16 weeks of inventory in April 2025 which is 8 weeks more than last year.

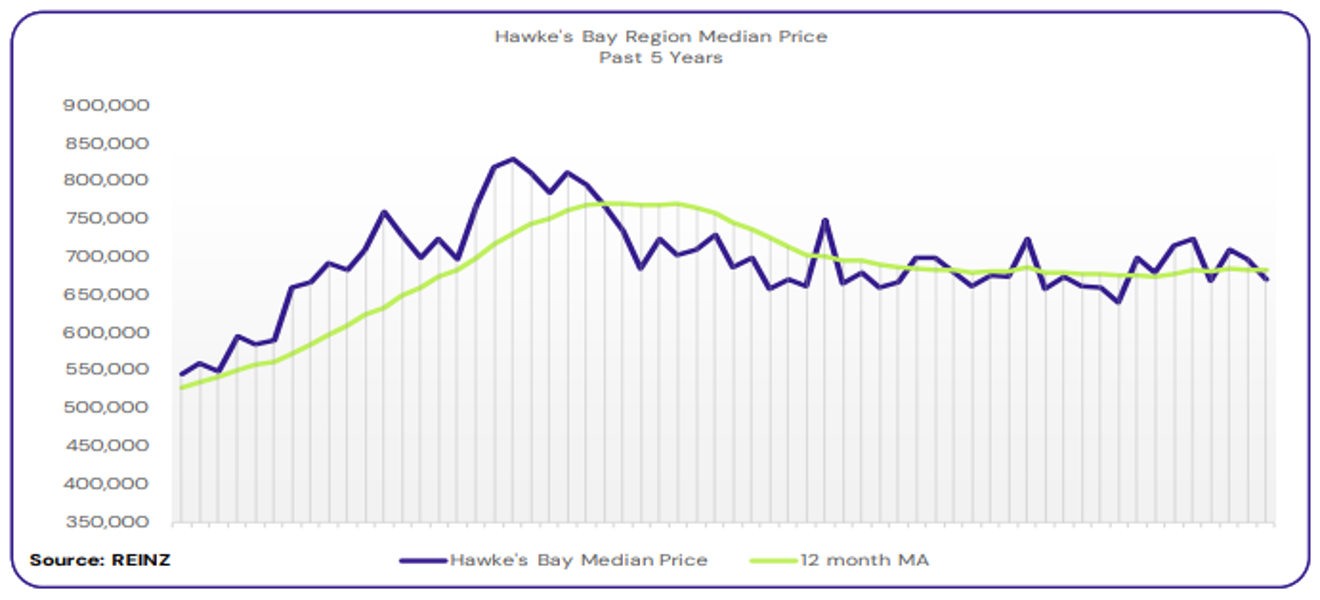

Regional Analysis - Hawke's Bay

Hawke’s Bay’s median price increased by 1.8% year-on-year to $671,000

“First home buyers and owner-occupiers were the most active buyer groups. Vendor expectations regarding price were reported as situational. Some sectors and areas have many choices for buyers, and some vendors weren’t adjusting their prices accordingly. Attendance at open homes varied depending on the property type and price. Auctions were not a preferred method of sale for the region.

Market sentiment shifted to more positivity, with confidence to buy strengthening. However, some buyers remain concerned about job security. Salespeople described their local market as patchy, as some sectors outperformed others. Local agents predict that the months may improve, due to interest rates continuing to ease.” (REINZ)

The current median Days to Sell of 40 days is more than the 10-year average for April which is 37 days. There were 16 weeks of inventory in April 2025 which is the same as the same time last year.

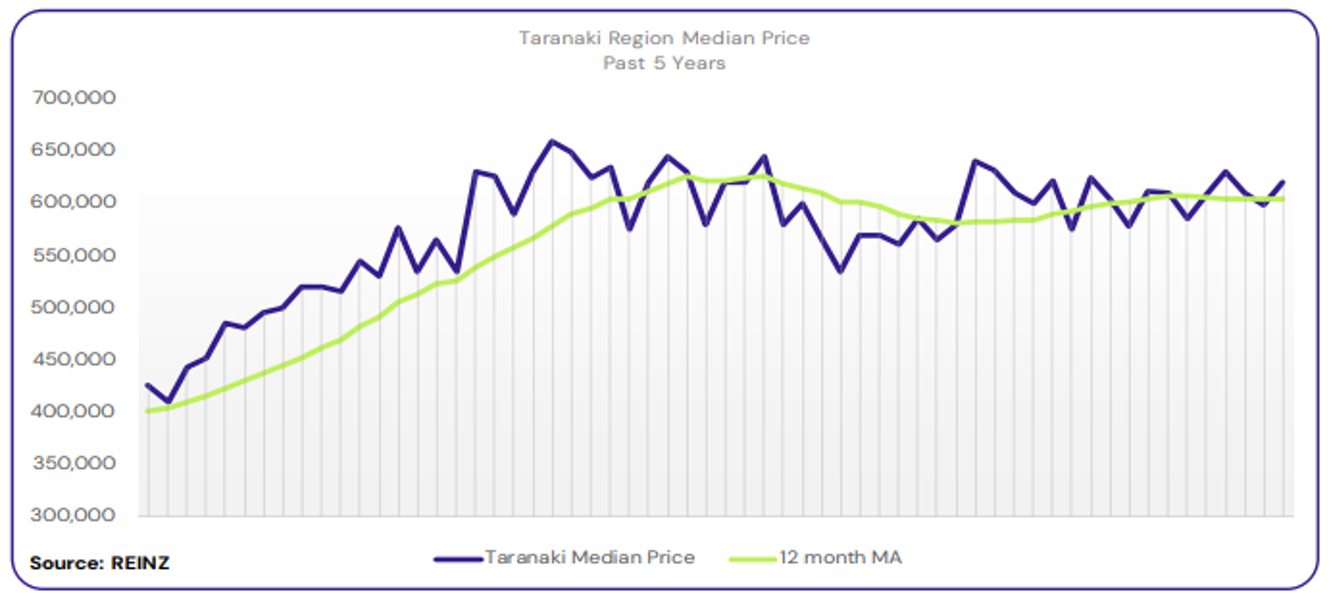

Regional Analysis - Taranaki

Taranaki’s median price decreased year-onyear by 0.3% to $620,000

“Owner-occupiers continue to be the most active buyer group, with growing interest from buyers outside the Taranaki region reported. While some vendors have increased price expectations, many understand that achieving a premium price will take longer. Due to a few long weekends, attendance at open homes saw mixed numbers in April. New listings continue to attract good numbers.

Factors like increased listings providing lots of choice for buyers and an increase in new buyers each week have influenced market sentiment. However, most buyers remain cautious. Local salespeople cautiously predict an increase in sales over the next few months, as buyers enjoy an ample supply of listings.” (REINZ)

The current median Days to Sell of 44 days is more than the 10-year average for April which is 36 days. There were 17 weeks of inventory in April 2025 which is 3 weeks less than the same time last year.

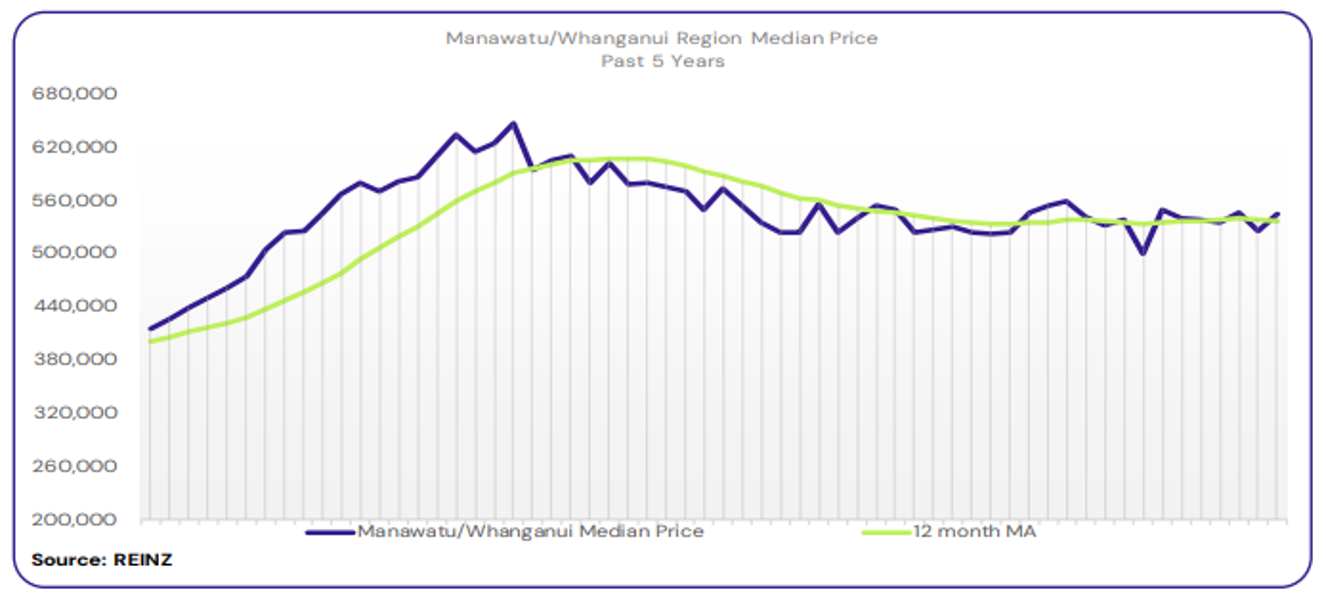

Regional Analysis - Manawatu/Whanganui

The median price for Manawatu/Whanganui decreased year-on-year by 1.8% to $545,000

“Owner-occupiers were the most active buyer group, with reports of an increased number of first home buyers viewing properties as interest rates ease. Investor enquiries have increased, too. Most vendors were unrealistic regarding price and were encouraged to meet market value if they wished to sell over other listings. Buyers in the region were reported to understand prices and property value well. Attendance at the open was varied. Newer listings were well-attended, but attendance dropped with time on the market and no price adjustments.

Auction room activity was low, with reports of low cash buyers and many properties passed in. Few were sold post-auction to conditional buyers. Local market sentiment was reported as transitioning between a buyer’s and seller’s market. Although enthusiasm has been rekindled with easing interest rates, this is surpassed by concerns over job security, the cost of listing, and the general economy. Local salespeople predict there won’t be too much change over the next few months.” (REINZ)

The current median Days to Sell of 37 days is more than the 10-year average for April which is 34 days. There were 19 weeks of inventory in April 2025 which is 3 weeks less than the same time last year.

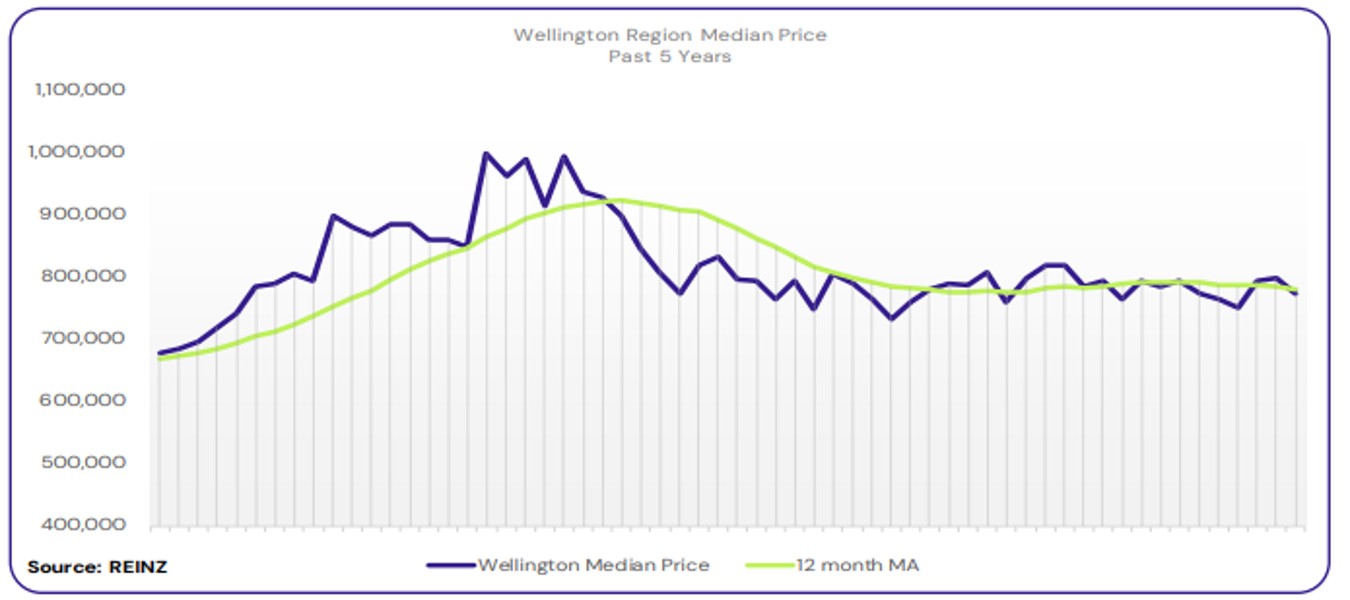

Regional Analysis - Wellington

Wellington’s median price decreased by 5.5% year-on-year to $775,000

“Buyers looking for properties suitable for inter-generational families, as well as families putting money together in a pool, were the most active in the market. Vendor expectations were generally too high, which could be due to the media’s coverage of property values. Attendance at open homes varied depending on the property’s price range. There were more attendees at properties listed below $1 million.

Factors like interest rates decreasing, increased rental properties on the market, job uncertainty, and concerns around market increases influenced market sentiment. Local salespeople suggest that their local market will be subdued over the winter period and are hopeful there will be increased activity towards the end of the year.” (REINZ)

The current median Days to Sell of 42 days is more than the 10-year average for April of 36 days. There were 14 weeks of inventory in April 2025 which is 1 week more than the same time last year.

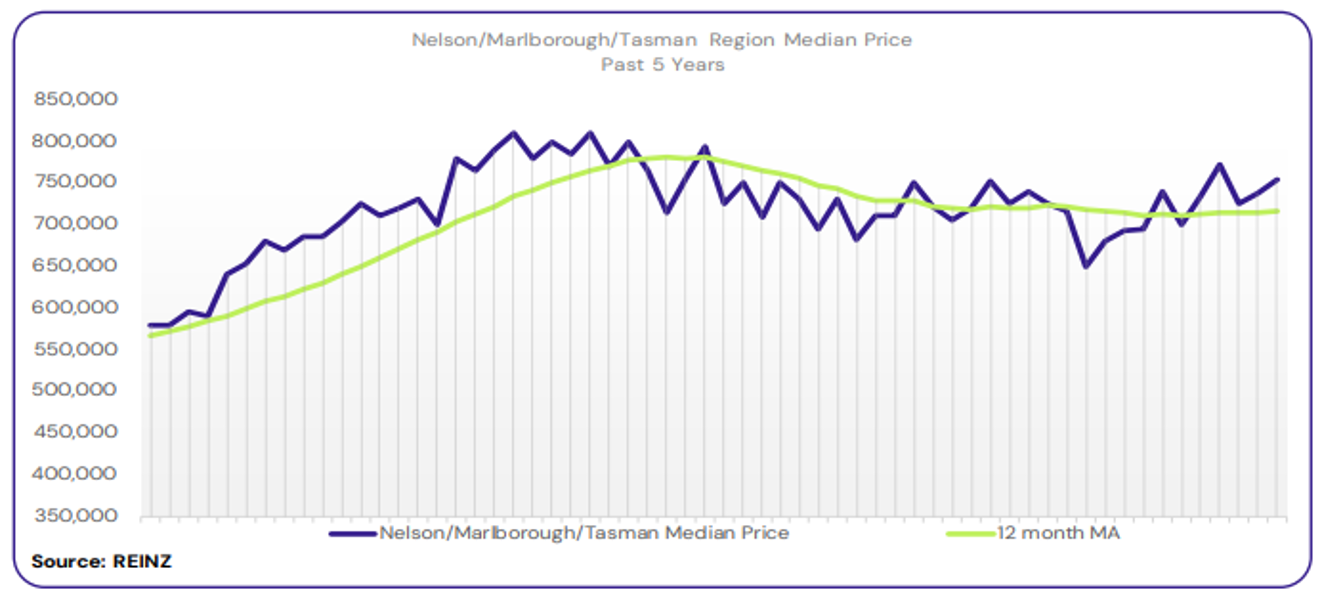

Regional Analysis - Nelson/Tasman/Marlborough

The median price for Nelson increased by 5.7% year-on-year to $745,000. The median price for Marlborough decreased year-on-year by 7.1% to $650,000. The median price for Tasman increased by 8.4% year-on-year to $875,000

“Owner-occupiers, first home buyers and investors were active across the regions, with a mix of out-of-town and local buyers. Most vendors were aware of high stock levels and how they influence prices, while for others, it depended on when they purchased their property, especially if it was at the height of the market. Attendance at open homes improved over the month, except during school holidays, especially for newer listings.

Auctions were becoming increasingly prominent as a marketing strategy, with some auctions brought forward due to pre-auction offers. Market sentiment was reported as positive and balanced, and the market remains active in this region. Local salespeople say that stock is moving at a steady pace, and the current market trends suggest continued interest over the coming months.” (REINZ)

The current median Days to Sell of 39 days is more than the 10-year average for April which is 36 days. There were 19 weeks of inventory in April 2025 which is 4 weeks less than the same time last year.

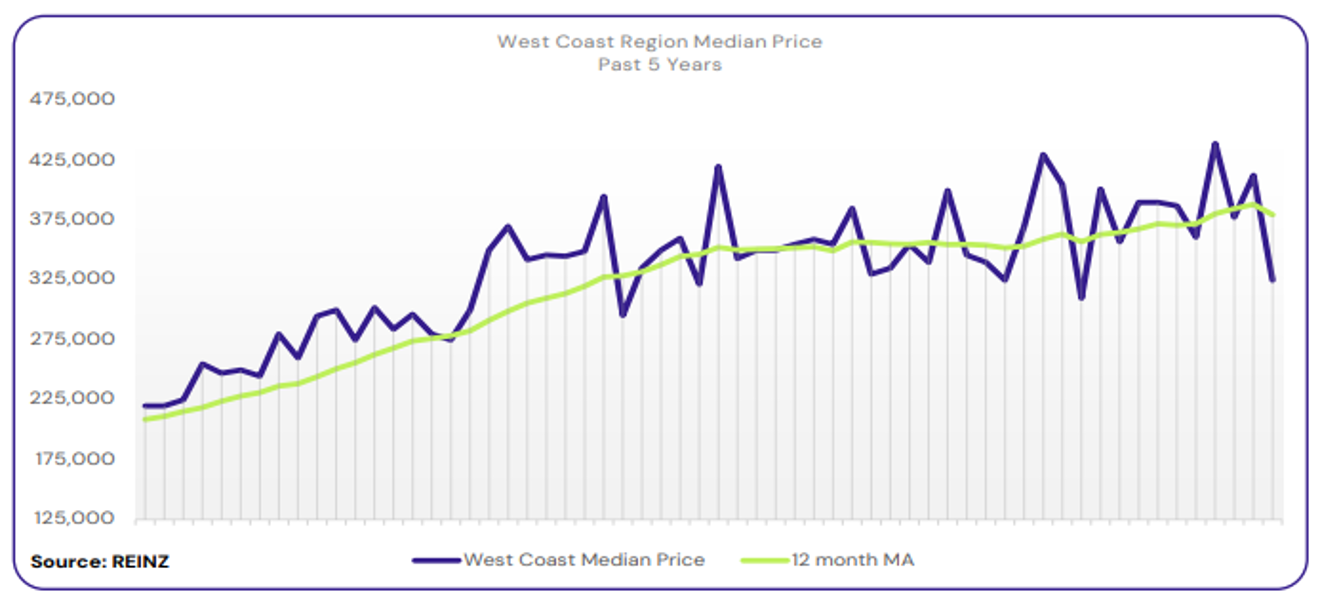

Regional Analysis - West Coast

West Coast’s median price decreased by 24.4% year-on-year to $325,000

“Owner-occupiers were the most active buyers. However, there was an overall decline in all buyers due to a slower market. Vendors were meeting market expectations regarding price. Attendance at open homes was steady – buyers looking around and taking advantage of everything available. Reports of a slowdown in the market as buyers lack the urgency to buy.

This influenced market sentiment, with a lack of buyer urgency, fewer buyers, and more properties coming to the market. Local agents cautiously predict that upcoming mining activity will positively impact the market.” (REINZ)

The current median Days to Sell of 62 days is less than the 10-year average for April which is 67 days. There were 40 weeks of inventory in April 2025 which is 11 weeks more than the same time last year.

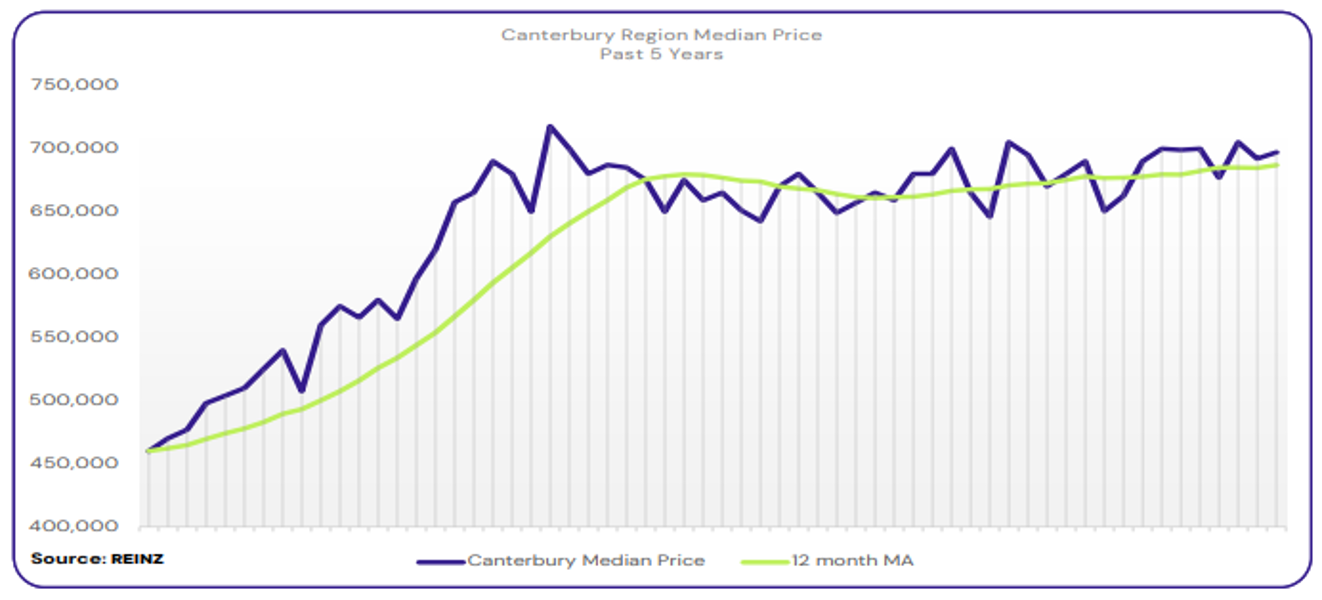

Regional Analysis - Canterbury

The median price for Canterbury increased by 4.0% year-on-year to $697,000

“Owner-occupiers and first home buyers were the most active buyer groups. There were reports of a decline in investor enquiries in Timaru. Most vendors were meeting market expectations regarding price. Attendance at open homes varied around the region, highly dependent on the property. Auction attendance and clearance rates under the hammer also varied, with mixed clearance rates reported in Christchurch.

Market sentiment remained largely unchanged from previous months, with high levels of buyers meeting strong listing numbers, indicating a happy medium at the moment. However, local agents state it might not take much to tip the scales either way. Local salespeople suggest that over the coming months it will be much the same, but are anticipating the usual seasonal dip over winter.” (REINZ)

The current median Days to Sell of 37 days is more than the 10-year average for April which is 34 days. There were 14 weeks of inventory in April 2025 which is 2 weeks less than the same time last year.

Regional Analysis - Otago

“Dunedin’s median price decreased by 3.2% year-on-year to $600,000

First home buyers remained the most active group in April. Owner-occupiers also showed increased activity, while investor activity remained subdued. Vendor expectations were generally realistic, although some still anticipated higher prices. Open home attendance was good, especially for newer listings, but auction activity was limited, with most sales occurring post-auction.

Market sentiment was influenced by factors such as job security, the cost of living, and current economic conditions. Local agents predict a more balanced market over the coming months, with steady activity expected.”

Queenstown Lakes

“First home buyers were the most active buyers. However, there were reports of strong investor enquiries due to lower interest rates. Vendor price expectations remained high, as they believed that improved market conditions, easing interest rates, and rising stock prices would lead to higher prices. Attendance at open homes was steady around the region. Activity in the auction room saw motivated vendors achieve sales.

A lack of buyer urgency and engagement, along with mortgage rates, has influenced market sentiment, as has the decline in mortgage applications and pre-approval. Local salespeople predict that their market will hopefully increase over the next few months as interest rates ease further, encouraging more sales and a rise in confidence.” (REINZ)

The current median Days to Sell of 47 days is much more than the 10-year average for April which is 36 days. There were 17 weeks of inventory in April 2025 which is 3 weeks less than the same time last year.

Regional Analysis - Southland

The median price for Southland increased by 6.6% year-on-year to $485,000

“Owner-occupiers and first home buyers were the most active, taking advantage of the levels of stock available and lower interest rates. Vendor expectations at the higher end of the market remained firm, with a commitment to high prices, and they adopted the “wait and see” approach. Attendance at open homes was good for properties at the lower end of the market.

Auction activity was good for properties on the lower end of the market. Market sentiment remains steady compared to other months as the Southland market has been relatively buoyant and consistent. However, local salespeople expect a seasonal slowdown as we head into winter.” (REINZ)

The current median Days to Sell of 36 days is more than the 10-year average for April which is 34 days. There were 15 weeks of inventory in April 2025 which is the same as the same time last year.

Browse

Topic

Related news

Find us

Find a Salesperson

From the top of the North through to the deep South, our salespeople are renowned for providing exceptional service because our clients deserve nothing less.

Find a Property Manager

Managing thousands of rental properties throughout provincial New Zealand, our award-winning team saves you time and money, so you can make the most of yours.

Find a branch

With a team of over 850 strong in more than 88 locations throughout provincial New Zealand, a friendly Property Brokers branch is likely to never be too far from where you are.