Property prices remain firm as supply now outweighs demand - REINZ stats February 2022

Tuesday, 15 March 2022

February shows property prices continuing to climb but now at a more moderate pace. While sales activity is down, demand remains and stock on the market is up.

Median prices for residential property across New Zealand increased 13.5% annually, from $780,000 in February 2021 to $885,000 in February 2022.

Jen Baird, Chief Executive of REINZ, says: “Market sentiment has shifted over the past couple of months which is evident throughout our February data. While prices remain strong — increasing annually in all regions — the number of sales continue to trend downwards and an influx of stock across New Zealand is easing demand side pressure, which may in turn further ease price growth in the coming months.

“In February, the median price increased 13.5% nationwide to $885,000. While down from the November 2021 peak ($925,000), following decreases in December and January, prices in February saw a moderate positive change of 0.6%, with six regions reaching record medians.

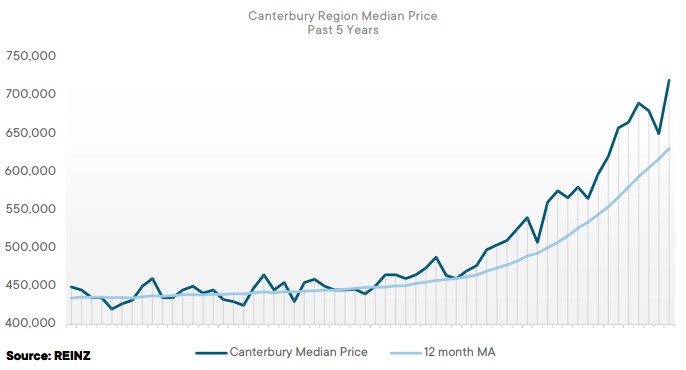

“Canterbury continues to see healthy increase in its median price, reaching a record high in February. This continued growth is driven by districts such as Selwyn and Waimakariri, which have both reached record medians in eight of the past 12 months. Since its peak in November 2021, Auckland has seen a significant drop in the annual percentage increase at a level not seen since LVRs started to effectively curtail rapid property price rises in late 2015.

“While prices are holding despite the change in market dynamics, there is now a fear of over paying (FOOP) amongst buyers, some of whom will be under additional pressure from legislative and fiscal changes impacting their ability to borrow. As a shift in sentiment sets in and buyers are less willing, or unable, to pay the prices we saw towards the end of 2021, pressure will come on vendors to adjust their expectations to meet the market.

“For those selling, conversations with their real estate professional will help provide a better understanding of what is happening in the market right now, get a feel for market values and the most effective approach to achieve the best outcomes,” Baird says.

In February, six regions achieved record medians, making this an above average February month, and there were 23 territorial authority (TA) median records. Regional records were achieved in:

Canterbury: increased 28.6% annually from $560,000 to $720,000

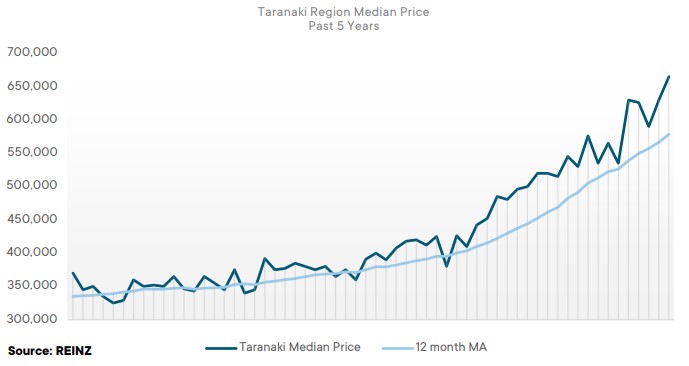

Taranaki: increased 27.9% annually from $520,000 to $665,000

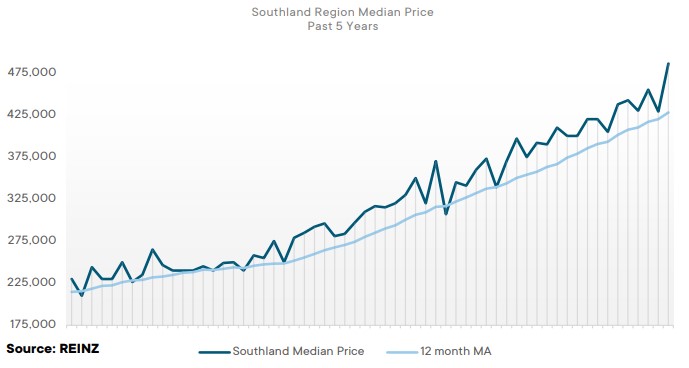

Southland: increased 24.6% annually from $390,000 to $486,000

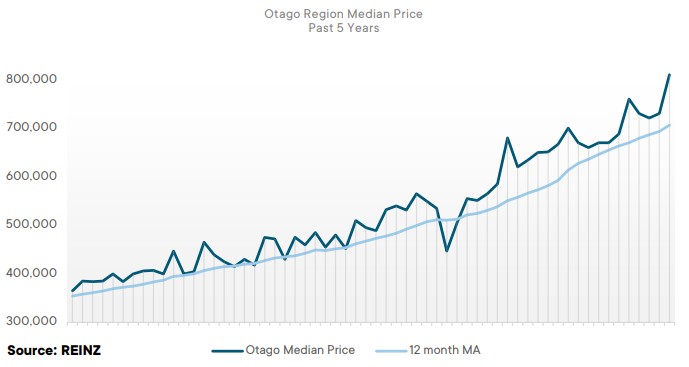

Otago: increased 24.4% annually from $651,000 to $810,000

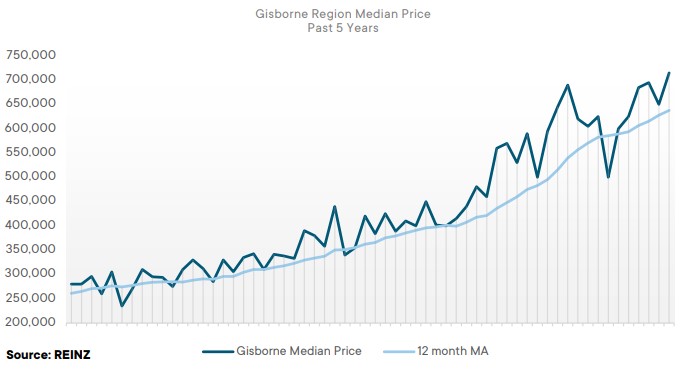

Gisborne: increased 20.2% annually from $595,000 to $715,000

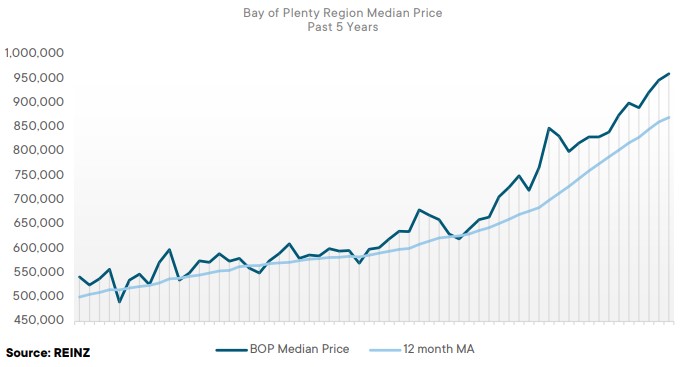

Bay of Plenty: 13.2% annually from $848,250 to $960,000, a new record median high for the third month running

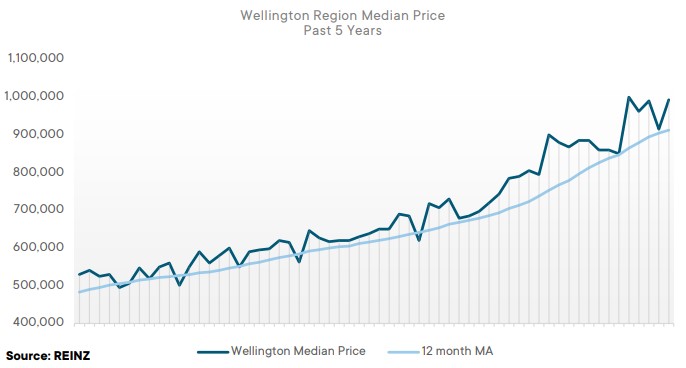

Regional Analysis - Wellington

Prices remain strong in Wellington and continue to increase annually. In February 2022, the median property price in the Wellington region increased 10.3% year-on-year — from $899,900 in 2021 to $993,000 in 2022. Two regions reached record median prices: Lower Hutt City ($940,000) and Masterton District ($740,000).

Buyers now have more choice in the market. February 2022 saw a substantial increase in listings across Wellington — up 27.1% on the same period last year. People have used lockdown to evaluate their lifestyle and financial goals and there has been an increase in Wellington residents looking to move to the outer suburbs for a lifestyle change. Hutt Valley and Levin have been a popular choice for those wanting to leave the city, with demand in Levin particularly price driven. (REINZ)

The current Days to Sell of 48 days is much more than the 10-year average for February of 36 days. There were 13 weeks of inventory in February 2022 which is 6 weeks more than the same time last year

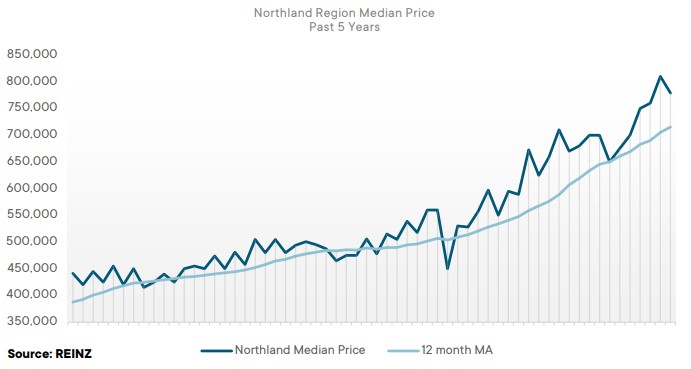

Regional Analysis - Northland

“This February, Northland’s median house price increased by 18.2% year-on-year to $779,000. February saw fewer first home buyers in the market; those who were active moved with some caution around finances. Investor numbers also declined despite high demand for rental properties as median property price growth outpaced rent price growth.

“Concern around COVID-19 has impacted the numbers attending open homes and auctions — however, genuine buyers have still turned up or bid over the phone. Vendors are maintaining positive expectations for sale prices, and agents have reported more negotiation at auctions with reserves reduced to make the sale. Properties spent an additional five days on the market in February 2022 compared to February 2021, and sales decreased by 26.6%. Uncertainty is the general feeling in the market — vendors are wary of possible price drops and buyers are concerned about over-paying.” (REINZ)

The current Days to Sell of 50 days is much less than the 10-year average for February which is 62 days. There were 20 weeks of inventory in February 2022 which is 1 week more than the same time last year.

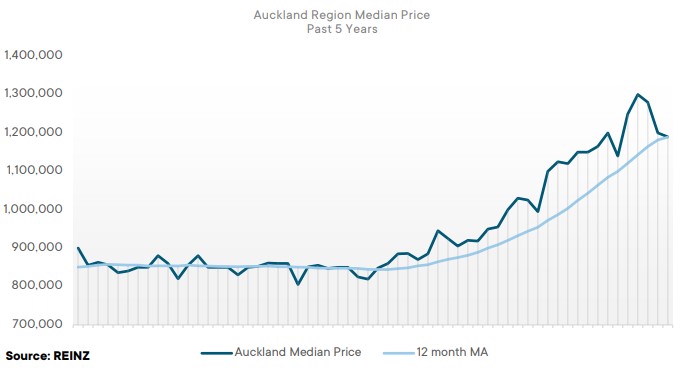

Regional Analysis - Auckland

“The Auckland region had a median house price of $1,190,000 in February — an 8.2% increase year-on-year. Agents noted a decline in buyers across all segments. Tighter lending criteria are affecting first home buyers and, with international borders open, some younger people are re-evaluating their financial goals. The number of investors has declined due to the complexity of compliance and maintenance issues with rental investments. A high level of stock has given buyers more choice, and as increasing supply dilutes demand, attendance at open homes and auctions decreased; in February 2022, 31.8% of properties were sold by auction in Auckland, compared to 45.6% last year. Properties are spending longer on the market — the median days to sell up 14 days from 34 in February 2021 to 48 in February 2022.

“Vendor expectations remain firm. Many are aiming for the prices obtained towards the end of 2021. An important role of your agent right now is having conversations to ensure you understand the change in market sentiment and how to adjust the approach to selling accordingly. As COVID-19 cases peak, market activity is expected to stay low until people are less cautious about going out.” (REINZ)

The current Days to Sell of 48 days is more than the 10-year average for February which is 41 days. There were 19 weeks of inventory in February 2022 which is 8 weeks more than the same time last year.

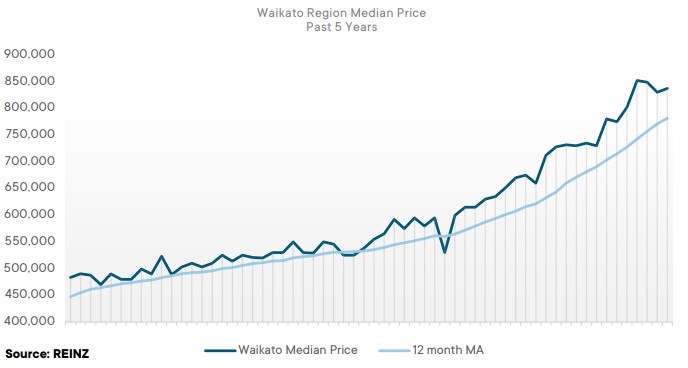

Regional Analysis - Waikato

“The Waikato region had a median house price of $837,500 in February this year — a 17.6% increase on February 2021. Four districts in Waikato reached record medians: Hauraki District ($725,000), Taupo District ($850,000), Thames-Coromandel District ($1,150,000), and Waipa District ($915,000). Inventory levels in Waikato are high — a 74.9% increase year-on-year. More choice in the market has seen fewer people at open homes and auctions as supply rises to satisfy demand. Clearance rates have been satisfactory, but with fewer bidders. Fear of missing out and the sense of urgency in the market has simmered down, and buyers are not having to invest as much as previously in being unconditional for auction.

“Vendors are beginning to understand that the high prices achieved towards the end of 2021 have eased. The number of sales decreased by 31.1% in February 2022 compared to February 2021, but agents expect sales counts will increase over the year, but with softer prices.” (REINZ)

The current Days to Sell of 38 days is less than the 10-year average for February which is 44 days. There were 16 weeks of inventory in February 2022 which is 8 weeks more than the same time last year.

Regional Analysis - Bay of Plenty

“Median house prices in the Bay of Plenty reached a record median of $960,000 — an increase of 13.2% year-on year. Four districts in Bay of Plenty also reached record medians: Kawerau District ($493,000), Rotorua District ($720,000), Tauranga City ($1,100,000), and Western Bay of Plenty District ($1,050,000). Bay of Plenty saw an increase in out-of-town buyers through February, many of them looking to secure an investment property. First home buyers are finding it difficult to enter the market as changes to the CCCFA impacted their ability to secure finance.

“Stock levels in the Bay of Plenty have increased by 85.5% year-on-year from 759 in February 2021 to 1,408 in February this year. Buyers can now take their time to look for a property. Time frames for conditions have extended — sales are not as quick and straight-forward as previously.” (REINZ)

The current Days to Sell of 44 days is less than the 10-year average for February which is 53 days. There were 17 weeks of inventory in February 2022 which is 9 weeks more than the same time last year.

Regional Analysis - Gisborne

“Gisborne reached a new record median house price of $715,000 — a 20.2% increase year-on-year. Unlike most other regions across the country, Gisborne saw a slight decrease in inventory levels in February. There’s been a steady increase in out-of-town buyers as Gisborne becomes more of an attractive option to families and those looking for a lifestyle change. “Auction rooms have been quieter than usual due to banks making it difficult for bidders to be ready in time.

The changes to the CCCFA have significantly impacted buyers in the lower to mid-price range with some leaving the market altogether.” (REINZ)

The current Days to Sell of 42 days is less than the 10-year average for January which is 44 days. There were 11 weeks of inventory in January 2022 which is 5 weeks more than the same time last year.

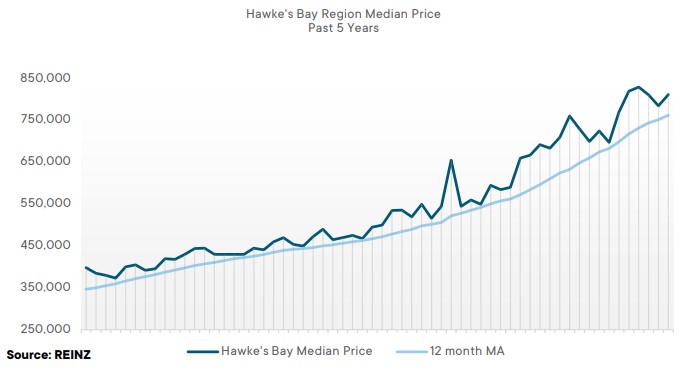

Regional Analysis - Hawke's Bay

“The Hawke’s Bay region had a median house price of $812,000 in February 2022 — an 18.7% increase on February 2021. Hawke’s Bay saw its inventory levels increase by 98.4% compared to the same time last year and listings increase 28.3%. More choice in the market has eased the sense of urgency among buyers, and properties are spending longer on the market. The median days to sell increased 19 days, from 31 in February 2021 to 50 in February 2022.

“For the first time in a while, the market is not performing to vendors’ expectations who now must adapt to changes in market sentiment. The main concern for buyers is their ability to secure finance, and fear of overpaying.” (REINZ)

The current Days to Sell of 50 days is more than the 10-year average for February which is 40 days. There were 13 weeks of inventory in February 2022 which is 5 weeks more than the same time last year.

Regional Analysis - Taranaki

“Price increases in Taranaki remain strong with the median house price reaching a new record high of $665,000 in February 2022 — a 27.9% increase yearon-year. The New Plymouth District also reached a record high of $730,000. Taranaki saw a 9.5% increase in new listings in February and a steady rise in inventory levels. The sales count declined by 41.3% year-on-year as buyers became increasingly concerned about rises in interest rates and stricter lending criteria.

“February saw fewer people attend open homes and auctions due to financial and market uncertainty, and the preferred method of sale was by private treaty.” (REINZ)

The current Days to Sell of 31 days is less than the 10-year average for February which is 40 days. There were 11 weeks of inventory in February 2022 which is 2 weeks more than the same time last year.

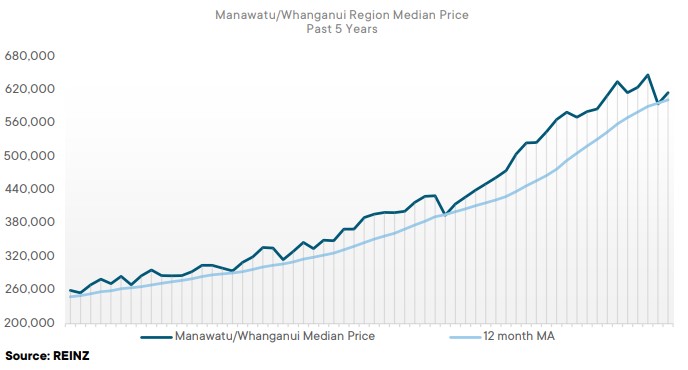

Regional Analysis - Manawatu/Whanganui

“The median house price in Manawatu/Whanganui was $615,000 in February 2022 — a 12.8% increase year-on-year. Rangitikei District reached a record median price of $595,000. Stock levels in Manawatu/Whanganui were high in February, increasing 161.7% compared to this time last year. New property listings increased 30.5%.

“The high level of inventory has provided more choice for buyers allowing them to take their time searching for the right property. The tightening of lending criteria has also slowed the sales process for many buyers, and properties are now spending a significantly longer time on the market. The median days to sell doubled, from 24 in February 2021 to 48 in February 2022.” (REINZ)

The current Days to Sell of 48 days is less than the 10-year average for February which is 43 days. There were 16 weeks of inventory in February 2022 which is 10 weeks more than the same time last year.

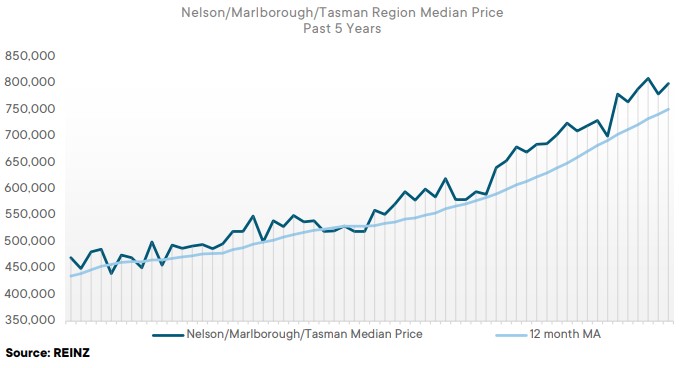

Regional Analysis - Nelson/Marlborough

“The Nelson/Marlborough/Tasman regions all saw increases in median house prices in February. Nelson increased 17.0% annually to $807,500, Marlborough increased 6.5% annually to $655,500, and Tasman increased 21.1% annually to $908,500. Nelson and Marlborough saw properties spend longer on the market in February, but Tasman’s median days to sell decreased four days from 28 in February 2021 to 24 in February 2022.

“In all three regions owner-occupiers have been most active in the market as securing finance is less of an issue for this buyer segment. However, first home buyers are still present, albeit limited by deposit and finance requirements.

“Out of town buyers continue to find Marlborough and Nelson attractive options for a lifestyle change or an investment opportunity. Vendors still expect high prices, but buyers are taking their time to purchase and are often offering below vendor expectations. There has been an increase in transactions subject to sale or subject to funding.” (REINZ)

The current Days to Sell of 37 days is less than the 10-year average for February which is 39 days. There were 12 weeks of inventory in February 2022 which is 3 weeks more than the same time last year.

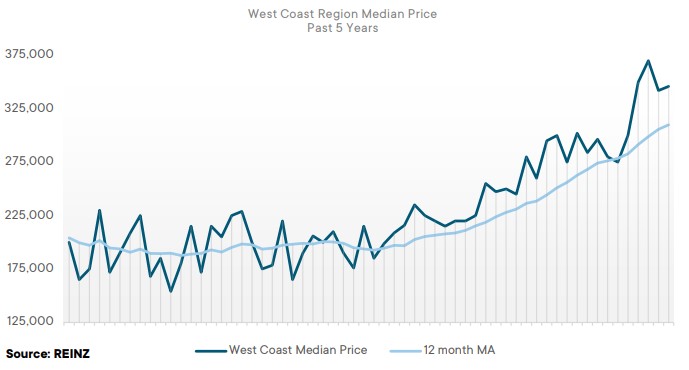

Regional Analysis - West Coast

“The West Coast region’s median house price was $346,000 in February — a 17.3% increase year-on-year. Sales count saw a significant decrease in the West Coast, down 55.6% year-on-year. Unlike most other regions around the country, the West Coast saw inventory and new listings drop slightly compared to the same period last year.

“Following flooding in Westport last July, the Buller District experienced more severe weather events in February, which caused concern amongst residents and stalled activity in the market. The Council is planning ways to protect the town, which should alleviate concerns once implemented. The preferred method of sale in February was sale by negotiation — normally on the back of an advertised price.” (REINZ)

The current Days to Sell of 41 days is much less than the 10-year average for February which is 87 days. There were 19 weeks of inventory in February 2022 which is 10 weeks less than the same time last year.

Regional Analysis - Canterbury

“Median house prices in the Canterbury region reached a new record high of $720,000 — a 28.6% increase year-on-year. Four districts in Canterbury reached record medians: Christchurch City ($731,000), Selwyn District ($890,000), Timaru District ($508,000), and Waimakariri District ($757,000). Owner-occupiers were the most active buyers in the market. First home buyers are cautious given tightening lending criteria. An increase in out-of-town buyer enquiry was evident due to the region’s employment opportunities.

“Auctions were a popular method sale in the region with 34.8% of properties selling by auction this February compared to 25.8% in February 2021. Agents note that the Canterbury market has become more comfortable with auctions over the past 12 to 18 months and has become a preferred method of sale. Clearance rates dropped slightly due to a combination of access to finance slowing the sales process down, concern the market is easing and vendor expectations remaining at the upper end. Agents say that informing vendors of the shift in market sentiment is important.” (REINZ)

The current Days to Sell of 33 days is less than the 10-year average for February which is 39 days. There were 11 weeks of inventory in February 2022 which is 2 weeks more than the same time last year.

Regional Analysis - Otago

Dunedin City -“The median price in Dunedin City increased 10.3% year-on-year to $685,000 in February. More properties have entered the Dunedin market, providing buyers with more choice. Market headwinds gathered over the past couple of months, including changes to the CCCFA, reintroduction of loan-to-value ratios and rising interest rates have impacted many buyers’ abilities to purchase property. As a result, properties spent an extra 20 days on the market — up from 23 days in February 2021 to 43 days in February this year.” (REINZ)

Queenstown Lakes - “The Queenstown-Lakes District saw its median house rise to $1,385,000 in February 2022 — a 38.5% increase year-on-year. The Wanaka Ward’s median price was $1,275,000 — up 41.5% on last February. The median price in the region combined with tighter lending criteria makes it difficult for first home buyers to enter the market.

“Despite this, properties sold four days faster, with the median days to sell down from 49 days in February 2021 to45 days in February 2022. Demand for property across the Queenstown-Lakes District remains strong from buyers who want to upgrade and North Island buyers who have no issues securing finance. Arrowtown in particular is of interest to this buyer pool.” (REINZ)

The current Days to Sell of 41 days is more than the 10-year average for February which is 38 days. There were 14 weeks of inventory in February 2022 which is 1 week more than the same time last year.

Regional Analysis - Southland

“Southland reached a new record median house price of $486,000 this February — an annual increase of 24.6%. All three districts in Southland reached record medians: Gore District ($435,000), Invercargill City ($484,500) and Southland District ($525,000).

“The most active buyers in the market were owner-occupiers backed by equity. There is strong demand from upper-end buyers moving from other areas of New Zealand as people reassess their goals and look for a lifestyle change. With an increase of stock in the region, attendance at open homes was lower across most of the market, and auctions saw fewer bidders and cash buyers. Vendors are starting to understand the shifting market and adjusting their expectations and approach to selling. Changes to the CCCFA have meant finance is taking longer to secure or is pulled altogether which is further impacting the time properties take to sell.”(REINZ)

The current Days to Sell of 37 days is less than the 10-year average for February which is 39 days. There were11 weeks of inventory in February 2022 which is 1 week more than the same time last year.

Browse

Topic

Related news

Find us

Find a Salesperson

From the top of the North through to the deep South, our salespeople are renowned for providing exceptional service because our clients deserve nothing less.

Find a Property Manager

Managing thousands of rental properties throughout provincial New Zealand, our award-winning team saves you time and money, so you can make the most of yours.

Find a branch

With a team of over 850 strong in more than 88 locations throughout provincial New Zealand, a friendly Property Brokers branch is likely to never be too far from where you are.