Momentum in multiple market measures - REINZ stats March 2024

Wednesday, 17 April 2024

March has shown a significant increase in listings, stock levels and median sale prices, creating even more options for buyers.

REINZ Chief Executive Jen Baird says the market is clearly more active compared to a year ago, with high listing numbers, increased stock levels, higher sales counts, and higher median sale prices.

“Listings increased substantially, up by 23.9% nationally compared with March 2023, reinforcing a trend we have seen since the beginning of 2024 with more property coming to market. New Zealand’s stock levels also saw a year-on-year increase, which means more available properties for sale and more choices for buyers. Agents are seeing activity among a range of buyer groups, with first-home buyers and owner occupiers being the most active." says Baird.

Listings nationally increased by 23.9% year-on-year from 9,242 to 11,455; compared with February 2024, national listings decreased 2.8% from 11,788 to 11,455. Five regions, all in the North Island, saw large year-on-year increases, with Wellington up 215 listings (+32.4%), Auckland up 986 listings (+31.4%), Manawatu-Whanganui up 112 (+30.4%), Bay of Plenty up 172 listings (+28.8%), and Hawke’s Bay up 72 listings (+26.8%). Only Nelson (-2.7%) and West Coast (-1.4%) recorded decreases in listings compared with March 2023. This is the second consecutive month where North Island regions have recorded the highest year-on-year increases in listings

New Zealand’s inventory levels have increased by 13.5% from 29,284 to 33,245 properties year-on-year – the highest level since 2015.

“Sales activity was higher in 13 of 16 regions compared to March 2023. Seven of those regions’ sales counts increased by over 10%; Gisborne led the way with the highest year-on-year increase in sales (+27.8%), reflecting a more usual level of demand, bouncing back from the low levels post the devastation of cyclones Hale and Gabrielle in early 2023.”

The national median sale price has increased by 2.7% from $779,000 to $800,000 year-on-year; it also increased by 1.1% from February 2024, from $791,500 to $800,000. For New Zealand, excluding Auckland, the median price also increased – it was up by 2.3% year-on-year from $695,000 to $711,000, and up by 0.1% month-on-month from $710,000 to $711,000.

“This is the second consecutive month recording a year-on-year increase in the median sale price nationally. This, along with the increased year-on-year levels of sales and listings, suggests that we are past the lowest point of this market cycle.”

Median days to sell decreased by 6 days compared to a year ago, from 44 to 38 days, both nationally and for NZ excluding Auckland. In 12 of 16 regions, median days to sell were lower compared with March 2023, with the biggest decreases in Marlborough (down 26 days), Hawke’s Bay (down 25 days), and Tasman (down 20 days).

Overall, the data paints a picture of the New Zealand housing market being more active, characterised by increasing listings, solid sales activity, expanding stock levels, and lifts in property prices.

“This summer has seen a return to a more normal level of real estate market activity after a relatively slow and subdued 2023. Reasons for this will vary, for example some vendors may prefer not to wait any longer and are willing to ‘meet the market’ with their price expectations. Some buyers may want to act now ahead of potential further lifts in sale prices or potential increased competition for properties, as upcoming changes to bring the bright line test back to two years, and the reintroduction of interest deductibility on investment properties, are expected to draw some investors back to the market in the next few months.

“The current economic environment with higher interest rates and some uncertainty in the jobs market will mean some buyers remain cautious, with prices still off their peaks from a couple of years ago, however growing numbers of buyers are acting now. Most agents are cautiously optimistic that market activity will continue to pick up as we move into the cooler months,” adds Baird.

Regional highlights

- In 13 of 16 regions, the year-on-year sales count was higher, and seven of those increased by over 10%. Gisborne recorded the highest year-on-year sales count, up by 27.8%.

- Nine of 16 regions had year-on-year price increases. Wellington had the highest increase, up by 9.3% compared with March 2023.

- Five regions, all in the North Island, saw large year-on-year increases in new listings, with Wellington up 215 listings (+32.4%), Auckland up 986 listings (+31.4%), Manawatu Whanganui up 112% (+30.4%), Bay of Plenty up 172 listings (+28.8%), and Hawke’s Bay up 72 listings (+26.8%).

- Otago is the top-ranked HPI year-on-year movement this month, a position it has held for four consecutive months.

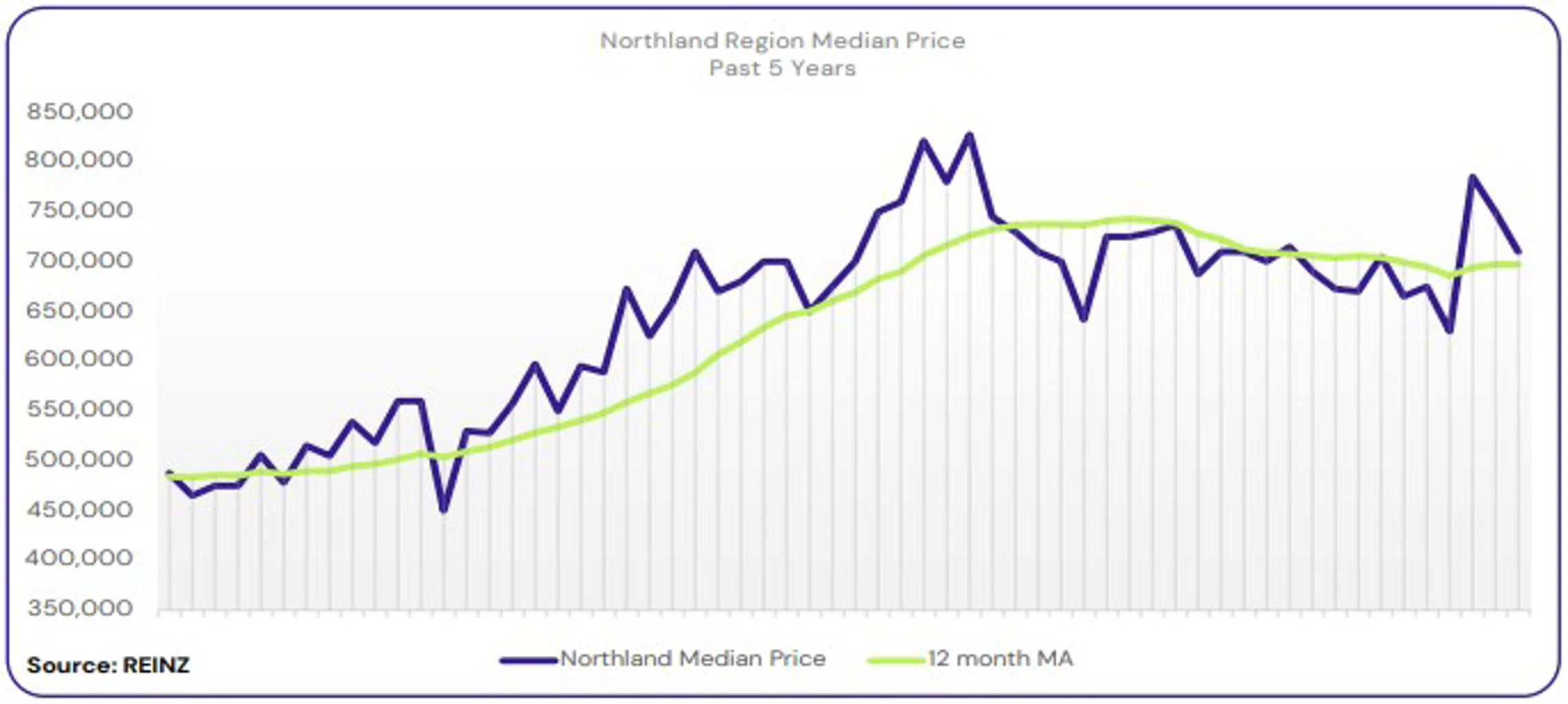

Regional Analysis - Northland

The median price for Northland was $710,000, which is the same median price for March 2023.

“Local agents report that first-home buyers continue to be the most active buyer group across the region, with strong levels of enquiry from owner-occupiers as well.

Most vendors are setting realistic price expectations, while some are reluctant to adjust their prices to meet the market. With plenty of stock available, open home attendance has increased significantly for newer listings. Auction attendance has picked up in some areas, but sales through this method remain light. The number of listings is giving buyers more confidence and means that some buyers are taking their time before making decisions. Local agents are predicting that activity may slowly pick up, as investors return.” (REINZ)

The current median Days to Sell of 59 days is more than the 10-year average for March which is 50 days. There were 45 weeks of inventory in March 2024 which is 1 week more than the same time last year.

Regional Analysis - Auckland

In Auckland, median prices increased by 5.0% year-on-year to $1,050,000.

“First-home buyers and owner-occupiers who are looking to upsize remain the most prominent buyer groups across Auckland, with developer activity also reported in South Auckland.

While some vendors are hopeful of achieving a higher price, most vendors who have been in the market for longer are adjusting their expectations. Open home attendance increased in some areas, and auction activity remains steady, with some properties selling after the auction.

Interest rates, market uncertainty, and vendor expectations are the main factors influencing market sentiment. Local agents are cautiously optimistic that activity may lift, depending on what happens with tax incentives, and interest rates.” (REINZ)

The current median Days to Sell of 39 days is more than the 10-year average for March which is 36 days. There were 25 weeks of inventory in March 2024 which is 5 weeks less than the same time last year.

Regional Analysis - Waikato

Median prices in Waikato increased by 2.8% year-on-year to $760,000.

“Owner-occupiers remain the most active buyer group across the region. Holiday home buyers were also active in Thames-Coromandel and Taupo, and Taupo saw good levels of first home buyer activity as well. Local agents report that most vendors are ready to meet the market with their price expectations. Open home attendance levels varied, with high numbers in Taupo but quieter activity elsewhere. Auction room activity has increased, with local agents seeing a lift in performance under the hammer and more bidders in attendance.

Local salespeople report that overall market sentiment is becoming slightly more positive, with growing confidence among some buyers. While high levels of listings are contributing to a lack of urgency among some buyers, agents are cautiously optimistic that once economic conditions improve, the market will improve also.” (REINZ)

The current median Days to Sell of 45 days is more than the 10-year average for March which is 35 days. There were 30 weeks of inventory in March 2024 which is 2 weeks less than the same time last year.

Regional Analysis - Bay of Plenty

Bay of Plenty’s median prices decreased by 4.3% year-on-year to $785,000.

“First-home buyers and owner-occupiers continue to be the most active buyer group in the region. Local agents are reporting that most vendors are holding firm on their original price expectations.

Open home attendance has been steady, with newer listings attracting the highest numbers. Auction activity in Tauranga continues to be good, with it being one of the preferred sales methods in the area. Factors such as challenges with borrowing, the cost of living, and job uncertainty have a significant impact on market sentiment, and some buyers are taking their time before making decisions.

Local agents are hopeful for a positive change in the coming months as they await the impact of the proposed brightline changes and a possible lowering of interest rates later in the year.” (REINZ)

The current median Days to Sell of 42 days is more than the 10-year average for March which is 40 days. There were 25 weeks of inventory in March 2024 which is 6 weeks less than the same time last year.

Regional Analysis - Gisborne

In Gisborne, median prices decreased slightly by 0.8% year-on-year to $625,000.

“The region recorded the highest year-on-year increases in sales count nationally, by 27.8% (from 36 sales to 46 sales). Gisborne also recorded an increase in average listings month-on-month by 23.5% (from 34 to 42) and year-on-year by 13.5% (from 37 to 42).

The region’s average inventory was 84 in March 2024, a 26.1% decrease year-on-year. These are encouraging signs for the Gisborne property market.” (REINZ)

The current median Days to Sell of 52 days is much more than the 10-year average for March which is 41 days. There are 7 weeks of inventory in March 2024 which is 10 weeks less than last year.

Regional Analysis - Hawke's Bay

Hawke’s Bay’s median price increased by 8.2% year-on-year to $715,000.

“Owner-occupiers and first-home buyers continue to be the most active buyer groups across the region. Open home attendance was relatively quiet in some areas, while auction room activity was fairly positive.

Factors such as interest rates and mortgage serviceability continue to impact market sentiment. Local agents are predicting that the market will remain steady over the coming months, with more listings becoming available.” (REINZ)

The current median Days to Sell of 39 days is more than the 10-year average for March which is 36 days. There were 19 weeks of inventory in March 2024 which is 3 weeks less than the same time last year.

Regional Analysis - Taranaki

Taranaki’s median price was $600,000, the same median price as March 2023.

“Owner-occupiers were the most active buyer group, with a lot of activity among buyers from outside the region as well. Open homes attracted a steady number of attendees throughout March, but with the increase in listing numbers creating more choices for buyers, average attendance numbers per property were down.

Interest rates, and uncertainty around when these will ease, remain a concern for most buyers, with some opting to delay making a purchase.

Despite this, local agents are seeing clear signs of positivity in the region, with an increase in buyer activity particularly in the lower price brackets. They’re cautiously optimistic that proposed legislative changes will lead to an increase in investor activity in the coming months.” (REINZ)

The current median Days to Sell of 43 days is more than the 10-year average for March which is 33 days. There were 23 weeks of inventory in March 2024 which is the same as the same time last year.

Regional Analysis - Manawatu/Whanganui

The median price for Manawatu/Whanganui increased by 3.8% year-on-year to $545,000.

“Owner-occupiers continue to be the most active buyer group in the region.

Most vendors are open to adjusting their price expectations to meet the market. Open home attendance rates vary, with encouraging numbers visiting newly listed properties.

Factors such as interest rates, difficulties with finance approvals, the cost of living, and a large number of listings are continuing to influence the market. Local salespeople report that some buyers are adopting a ‘wait and see’ approach.” (REINZ)

The current median Days to Sell of 41 days is more than the 10-year average for March which is 34 days. There were 23 weeks of inventory in March 2024 which is 3 weeks less than the same time last year.

Regional Analysis - Wellington

Wellington’s median price increased by 9.3% year-on-year to $820,000.

“The region recorded an increase in sales count, by 17.2% year-on-year (from 609 sales to 714 sales). Wellington also recorded an increase in average listings year-on-year by 32.4% (from 663 to 878), but a decrease month-on-month by 5.3% (from 927 to 878).

The region’s average inventory was 1,819 in March 2024, a slight increase of 3.5% year-on-year. These are encouraging signs for the Wellington property market.” (REINZ)

The current median Days to Sell of 36 days is more than the 10-year average for March of 33 days. There were 13 weeks of inventory in March 2024 which is 3 weeks less than the same time last year.

Regional Analysis - Nelson/Tasman/Marlborough

In Nelson, the median price increased by 7.5% year-on-year to $715,000. In Marlborough, the median price decreased by 1.8% year-on-year to $648,000. In Tasman, the median price stayed the same as in March 2023 ($840,000).D

“Owner-occupiers remain the most active buyer group in Marlborough, with all buyer groups being active across the region more broadly.

Vendor price expectations vary, with some adjusting their expectations to meet the market, while others holding firm on their original price. Local agents report that open home attendance in Marlborough is declining and in Nelson, newer listings are attracting higher numbers.

An increase in stock levels, interest rates, uncertainty around the market, and lack of buyer urgency are impacting market sentiment. Local agents predict that activity levels will remain the same until confidence grows.” (REINZ)

The current median Days to Sell of 39 days is more than the 10-year average for March which is 33 days. There were 21 weeks of inventory in March 2024 which is 6 weeks less than the same time last year.

Regional Analysis - West Coast

In the West Coast, median prices have increased by 4.2% year-on-year to $370,000.

“Owner-occupiers were the most active buyer group in the region in March. Local agents report that first-home buyer activity has reduced, largely due to high interest rates. Some vendors have adjusted their expectations to meet the market, particularly where their property has been listed for some time.

Open home attendance has been steady, with buyers having more choices and options to compare properties. Factors such as interest rates and the cost of living continue to have the most significant influence on market sentiment. Local agents predict that the market will continue to be steady over the coming months. The fact that West Coast prices are lower than in other parts of the country adds to the appeal of the region, particularly with investors.” (REINZ)

The current median Days to Sell of 56 days is more than the 10-year average for March which is 53 days. There were 42 weeks of inventory in March 2024 which is 8 weeks more than the same time last year.

Regional Analysis - Canterbury

Canterbury’s median price has increased by 1.9% year-on-year to $693,000.

“Owner-occupiers and first-home buyers remain the active group across the region. Some vendors are adjusting their price expectations. Open home attendance remains steady. Auction activity is seeing strong numbers, with usually more than one buyer in attendance.

Factors such as the economy are having the most significant impact on market sentiment. Local agents have reported that buyers are taking their time as the listing numbers increase. Local agents are cautiously optimistic that the market will remain steady throughout the region, as we enter the cooler months.” (REINZ)

The current median Days to Sell of 31 days is the same as the 10-year average for March which is 31 days. There were 16 weeks of inventory in March 2024 which is 4 weeks less than the same time last year.

Regional Analysis - Otago

Dunedin City - “Dunedin’s median price has increased by 4.4% year-on-year to $595,000.

Owner-occupiers are the main active buyer group in the region.

Many vendors have kept their original price expectations and are willing to adjust their prices to meet the market. Local agents report open home attendance has increased, due to the greater selection of properties.

Factors such as interest rates, inflation, and the cost of living continue to have the most significant impact on market sentiment. Local agents are predicting that the market will remain steady and that if the economy improves over the year, investors will return.”

Queenstown Lakes

“Owner-occupiers and first-home buyers are still the most active in the market, with enquiry from investors picking up as well. Vendors continue to stay with their original price expectations. Auction activity has increased and there have been more negotiations with buyers. Local salespeople report strong open home numbers across most listings.

Local agents report that overall market sentiment is positive, with buyers and vendors having renewed confidence, although factors such as interest rates and the cost of living continue to influence market sentiment.” (REINZ)

The current median Days to Sell of 40 days is more than the 10-year average for March which is 32 days. There were 14 weeks of inventory in March 2024 which is 8 weeks less than the same time last year.

Regional Analysis - Southland

The median price in Southland has decreased by 1.1% year-on-year to $445,000.

“The region continues to see all buyer groups active over March, although some buyers remain cautious about making a decision. Many vendors are beginning to decrease their prices to meet buyer expectations. Open home attendance has been relatively quiet. Factors such as the cost of living and challenges for buyers with getting finance approved are having the most impact on the market.

Local agents remain cautiously optimistic that activity will improve later in the year.” (REINZ)

The current median Days to Sell of 36 days is more than the 10-year average for March which is 32 days. There were 18 weeks of inventory in March 2024 which is 3 weeks less than the same time last year.

Browse

Topic

Related news

Find us

Find a Salesperson

From the top of the North through to the deep South, our salespeople are renowned for providing exceptional service because our clients deserve nothing less.

Find a Property Manager

Managing thousands of rental properties throughout provincial New Zealand, our award-winning team saves you time and money, so you can make the most of yours.

Find a branch

With a team of over 850 strong in more than 88 locations throughout provincial New Zealand, a friendly Property Brokers branch is likely to never be too far from where you are.