More sales, prices rise as activity builds in the market - REINZ stats February 2024

Friday, 15 March 2024

February has seen a significant increase in listings and an expansion in stock levels, providing more options for buyers.

REINZ Chief Executive Jen Baird says "Overall, the data paints a picture of a more active housing market in New Zealand, characterised by increasing listings, robust sales activity, expanding stock levels, and growth in property prices. With the combination of high listing numbers, elevated stock and shifts in the median sale price we are seeing increased activity".

“There was a substantial rise in listings nationally, indicating heightened activity in the housing market. New Zealand’s stock levels saw a year-on-year increase, resulting in a growing inventory of available properties for sale. Coupled with median sale price growth in some regions, agents are seeing more investors and first-home buyers out there at open homes.

In the regions, there is an increase in property investment and certain sales volume numbers are reflecting that. Although still below the average February sales count of 60 (2015-2022), Gisborne particularly stands out with remarkable increases in this month’s data. This surge in sales activity suggests strong demand from buyers post the devastating effects of Cyclone Hale and Gabrielle this time in early 2023.”The total number of properties sold increased in February (+81.8%) compared to January 2024 for New Zealand from 3,132 to 5,693 and from 4,129 to 5,693 (+37.9%). Gisborne has seen a large increase in the properties sold up 264% year on year and up year on year by +82.1%," she says.

All regions except for the West Coast saw an increase in activity this month. In 14 of 16 regions, the sales count year-on-year has increased by more than 20%. The exceptions were West Coast (-22.0%) and Taranaki (+7.5%). The Marlborough sales count more than doubled compared to February 2023 (from 37 to 77 sales).

New Zealand’s inventory levels have increased by 8.1% from 29,083 to 31,424 properties year on year. The national median sale price has increased by 3.1% from $766,000 to $790,000 year-on-year. There was also an increase of +3.9% from January 2024 $760,000 to $790,000. New Zealand, excluding Auckland, also increased month-on-month, +3.6% from $685,000 to $710,000 and up year-on-year by 2.6% from $692,000 to $710,000.

The median days to sell increased by 1 day month-on-month from 50 up to 51 days and reduced 9 days year-on-year, down from 60 to 51. Northland down 10 days and Wellington down 8 days showed the biggest decreases since February 2023.

“We are looking at the back of the government’s 100-day plan and the changes to the bright line test back to two years and the latest reintroduction of interest deductibility on investment properties for landlords. With a significant increase in property listings, the rise in the total number of properties sold, and an increase in the median sale price, some buyers are holding out for the ‘right’ property while others are getting ‘into the market’ before competition rises as investors return. This buoyancy is a positive sign that we haven’t seen for a while,” adds Baird.

For the first time in a long time, there was a new record high set in the regional HPI this month. Otago saw a sizeable monthly increase in HPI pushing over the prior peak set in December 2021. Otago also ranked first in the HPI movements for 1 month (3.0%), 3 months (3.0%) and 12 months (+8.2%).

The HPI for New Zealand, stood at 3,700 in February 2024, a 1.1% increase compared to the previous month and a 3.2% increase for the same period last year. The average annual growth in the New Zealand HPI over the past five years has been 5.9% per annum, and it is currently 13.5% below the peak of the market reached in 2021.

Regional highlights

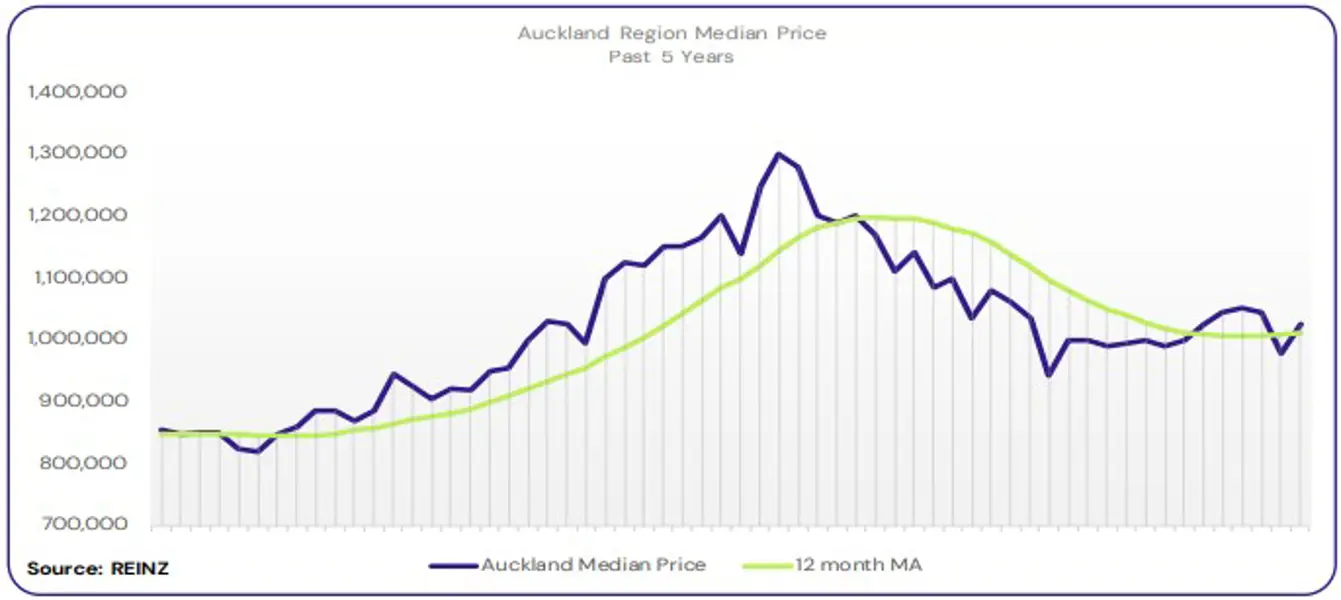

- Auckland’s median sales price increased above the $1 million mark, up to $1,025,000.

- North Island regions also saw large month-on-month increases with Northland up 247 listings (+94.6%), Wellington up 402 listings (+76.6%), Hawke’s Bay up 141 listings (+75.4%).

- Otago also ranked first in the HPI movements for 1 month (3.0%), 3 months (3.0%) and 12 months (8.2%).

Regional Analysis - Northland

Median prices in Northland increased by 5.6% year-on-year to $750,000.

“First-home buyers and owner-occupiers continued to be the most active buyer groups across the region.

Most vendors are adjusting their price expectations according to the market, although some are waiting for conditions to improve in their favour. Open home and auction room activity has picked up since January. Listings have increased significantly, creating more choices for buyers, some of whom are taking more time before making a decision. Factors such as interest rates, current economic conditions, and challenges for some buyers in securing finance, are continuing to affect market sentiment. Local agents predict a slow market for the time being.” (REINZ)

The current median Days to Sell of 70 days is more than the 10-year average for February which is 61 days. There were 46 weeks of inventory in February 2024 which is the same as the same time last year.

Regional Analysis - Auckland

In Auckland, median prices increased by 2.6% year-on-year to $1,026,000.

“First-home buyers and owner-occupiers were the most active buyer groups. Most vendors are adjusting their prices according to the market. Sales were up by 52.9% year-on-year. The region was affected by the floods in late January 2023, and Cyclone Gabrielle in February 2023; these have been factors in the substantial year-on-year increase in sales.

Local agents report that open-home activity and auction room activity varied, with some areas seeing reasonable levels of sales and attendance. Factors such as interest rate uncertainty and a lack of borrowing power are influencing the market. The increased number of listings is giving more choices to buyers. Local salespeople predict the market will remain steady until interest rates ease.” (REINZ)

The current median Days to Sell of 50 days is more than the 10-year average for February which is 45 days. There were 30 weeks of inventory in February 2024 which is 4 weeks more than the same time last year.

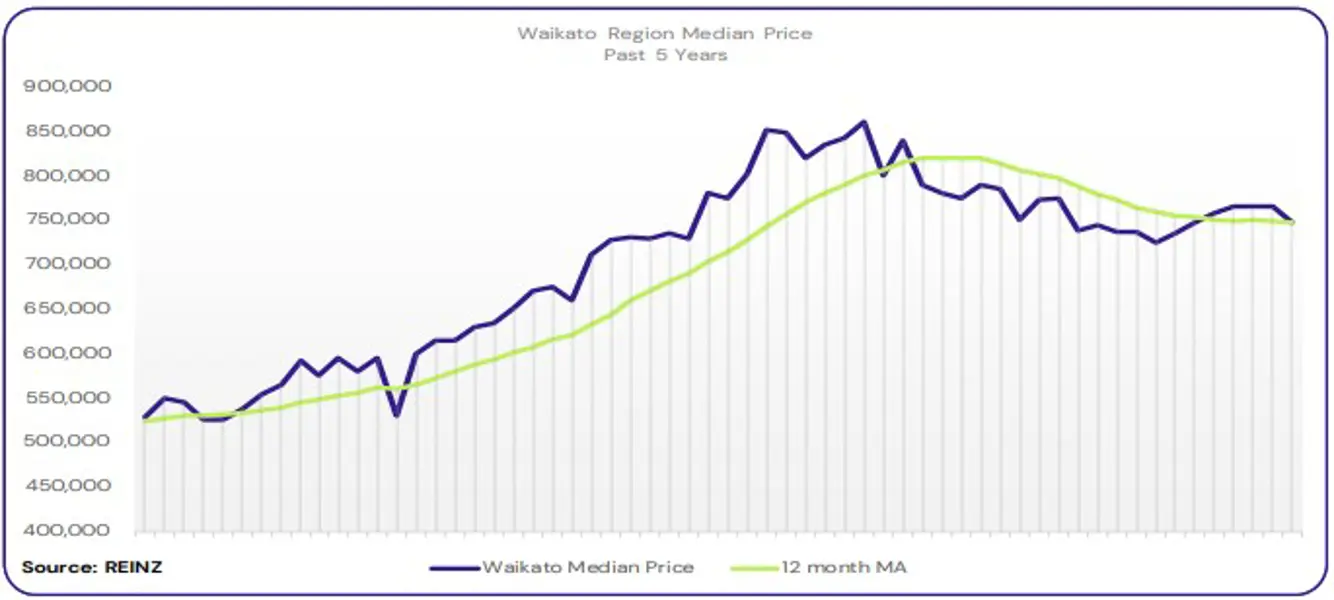

Regional Analysis - Waikato

Median prices in Waikato decreased by 3.5% year-on-year to $747,500.

“Owner-occupiers remained the most active buyer group across the region. Hamilton and Taupo also saw activity from first home buyers, while there was activity among holiday home buyers in Thames-Coromandel. While most vendors are meeting the market, some are holding firm on their original price expectations. Open home attendance levels and auction room activity were good, with more properties selling under the hammer compared with late 2023.

Factors such as interest rates, uncertainty regarding government policy changes, difficulty securing finance for some buyers, and a ‘wait-and-see’ approach by some buyers, are having the most significant impact on the market. Despite this, local agents observe that overall market confidence is building.” (REINZ)

The current median Days to Sell of 56 days is much more than the 10-year average for February which is 44 days. There were 27 weeks of inventory in February 2024 which is 5 weeks less than the same time last year.

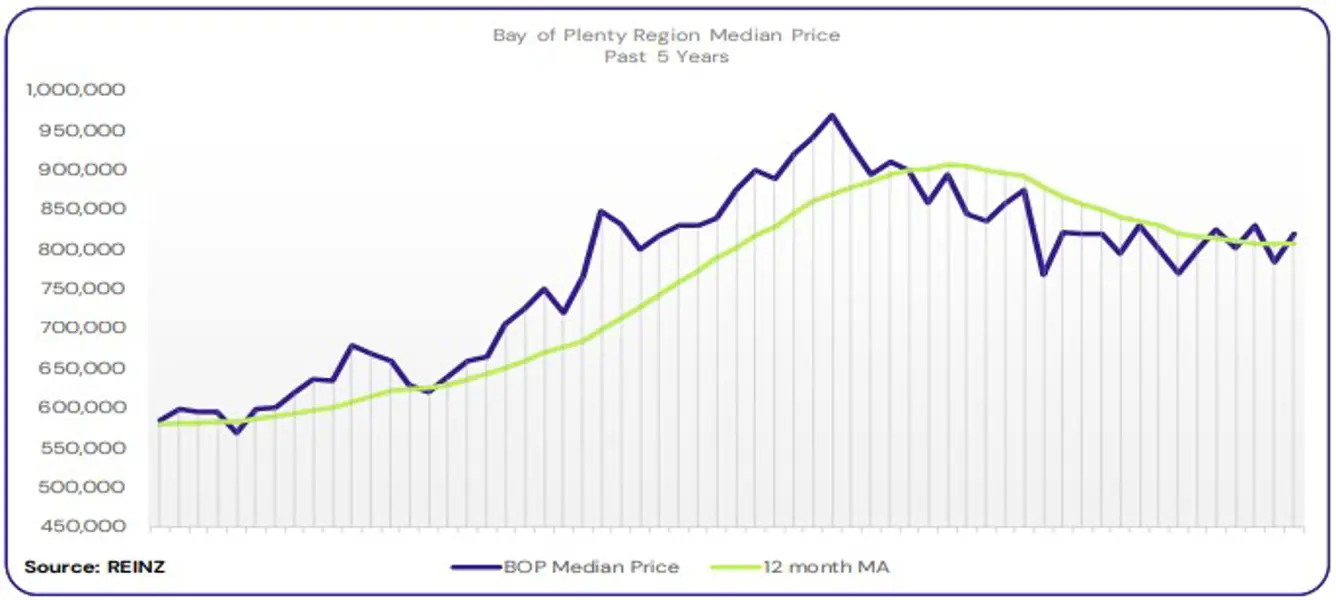

Regional Analysis - Bay of Plenty

Bay of Plenty’s median prices decreased slightly by 0.2% year-on-year to $820,000.

“February saw first-home buyers continue to be the most active buyer groups across the region, with some activity from investors in Rotorua as well. Most vendors are listening to the market and are willing to negotiate, although some continue to stick with their original price. Open-home attendance was steady, with new listings and the more popular locations attracting good numbers. Auction activity and clearance rates were good in Tauranga.

Factors such as interest rates, the cost of living, and caution among some buyers are having the most significant effect on the market. Some areas in the region have seen a rise in listings, while others are seeing more sales. Local agents are cautiously optimistic that they will see more buyer activity in the next few months if interest rates ease and factors such as the cost of living and global events don’t have too much of an impact.” (REINZ)

The current median Days to Sell of 59 days is more than the 10-year average for February which is 52 days. There were 25 weeks of inventory in February 2024 which is 8 weeks less than the same time last year.

Regional Analysis - Gisborne

In Gisborne, median prices increased by 7.7% year-on-year to $619,000.

“The region recorded one of the highest year-on-year increases in sales count, by 82.1% year-on-year (from 28 sales to 51 sales). The Gisborne region was severely impacted by Cyclone Gabrielle in February 2023, and the significant year-on-year increase in sales reflects how different the real estate market was in February last year.

Gisborne’s average inventory was 84 in February 2024, a 32.4% decrease year-on-year. These are encouraging signs for the Gisborne property market.” (REINZ)

The current median Days to Sell of 63 days is much more than the 10-year average for February which is 49 days. There are 11 weeks of inventory in February 2024 which is 4 weeks less than last year.

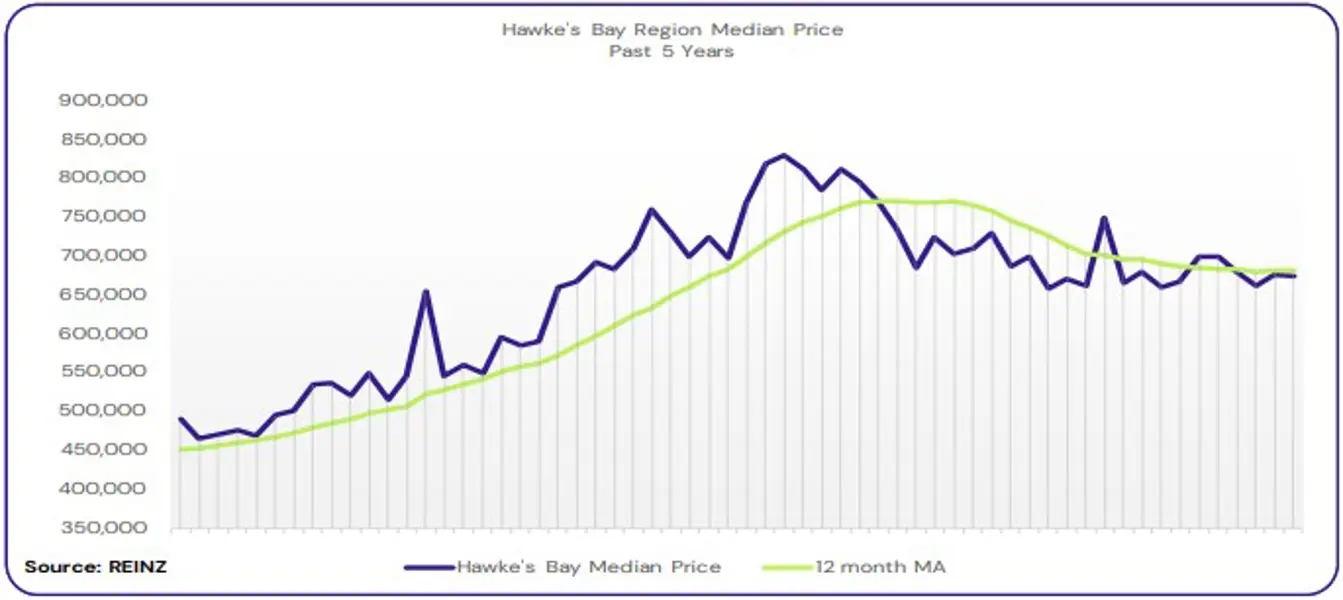

Regional Analysis - Hawke's Bay

Hawke’s Bay’s median price increased by 0.6% year-on-year to $675,000.

“Owner-occupiers and first-home buyers were once again the most active buyer groups in the region. Some vendors are more optimistic about their price expectations, in light of recent increases in values in some regions. Open home activity was steady as more stock entered the market. Sales were up by 73.7% year-on-year. The severe impact of Cyclone Gabrielle in the region in February 2023 has been a factor in the substantial year-on-year increase in sales.

Market sentiment is cautiously optimistic, but factors such as interest rates continue to have a significant impact. Local agents report that some buyers are keen to get into the market before any potential increase in values.

Local salespeople predict the market will continue to strengthen over 2024, but unemployment and interest rates will continue to influence the direction the market takes.” (REINZ)

The current median Days to Sell of 53 days is much more than the 10-year average for February which is 41 days. There were 20 weeks of inventory in February 2024 which is 1 week more than the same time last year.

Regional Analysis - Taranaki

Taranaki’s median price increased by 4.5% year-on-year to $606,000.

“Owner-occupiers were the most active group in the region, with first-home buyer and investor activity increasing as well. Most vendors are keeping their price expectations realistic. The number of high-end properties means buyers in this price range have a lot of options to choose from, and some vendors are adjusting their prices to meet the market.

Open home attendance was steady and the region saw strong sales activity in the second half of February.

Interest rates continue to affect market sentiment and some buyers are delaying making a buying decision. However, some properties in the lower price brackets are generating interest. Local salespeople predict buyer confidence will rise in the coming months, leading to an increase in sales. Government policy changes for landlords are likely to see more investor activity as well.” (REINZ)

The current median Days to Sell of 55 days is much more than the 10-year average for February which is 42 days. There were 21 weeks of inventory in February 2024 which is 3 weeks less than the same time last year.

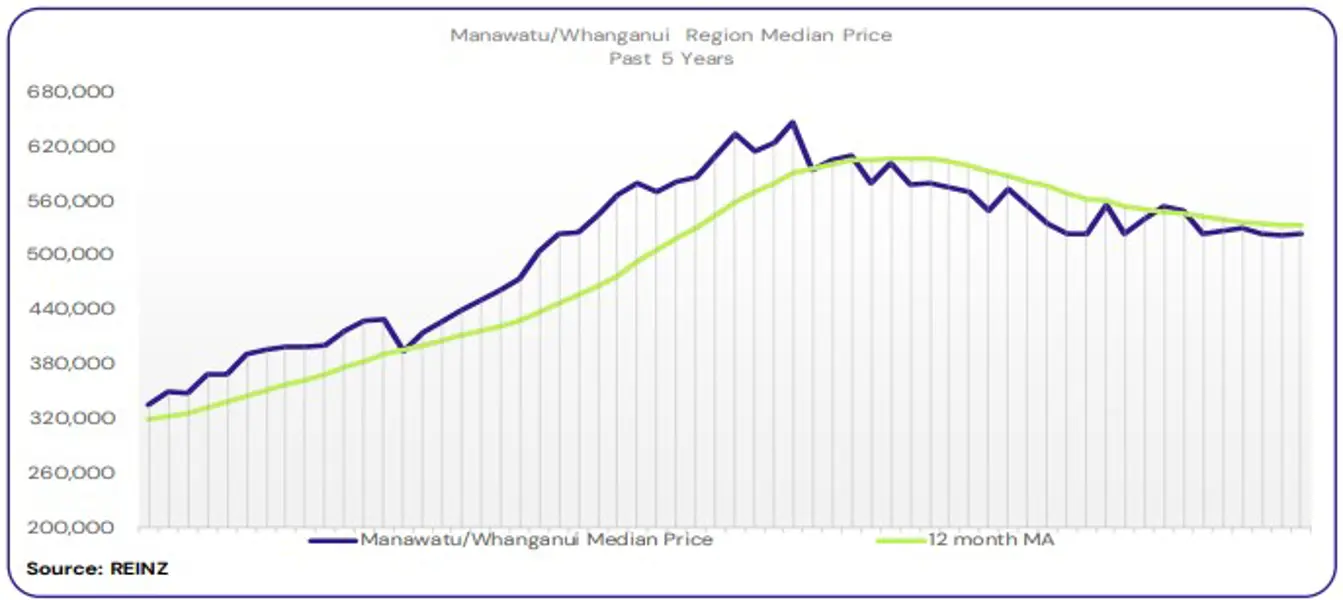

Regional Analysis - Manawatu/Whanganui

The median price for Manawatu/Whanganui was $525,000, which was the same as the median price for February 2023.

“Owner-occupiers continue to be the most active buyer group in the region. Some vendors are meeting the market and adjusting their price expectations, while others are holding on to their original price expectations. Open homes saw steady levels of attendance, especially new listings.

Local agents report that interest rates, economic uncertainty, and challenges securing finance are having the most significant impact. Some vendors and buyers are taking a ‘wait and see’ approach and continuing to monitor the market before deciding.” (REINZ)

The current median Days to Sell of 54 days is much more than the 10-year average for February which is 43 days. There were 22 weeks of inventory in February 2024 which is 4 weeks less than the same time last year.

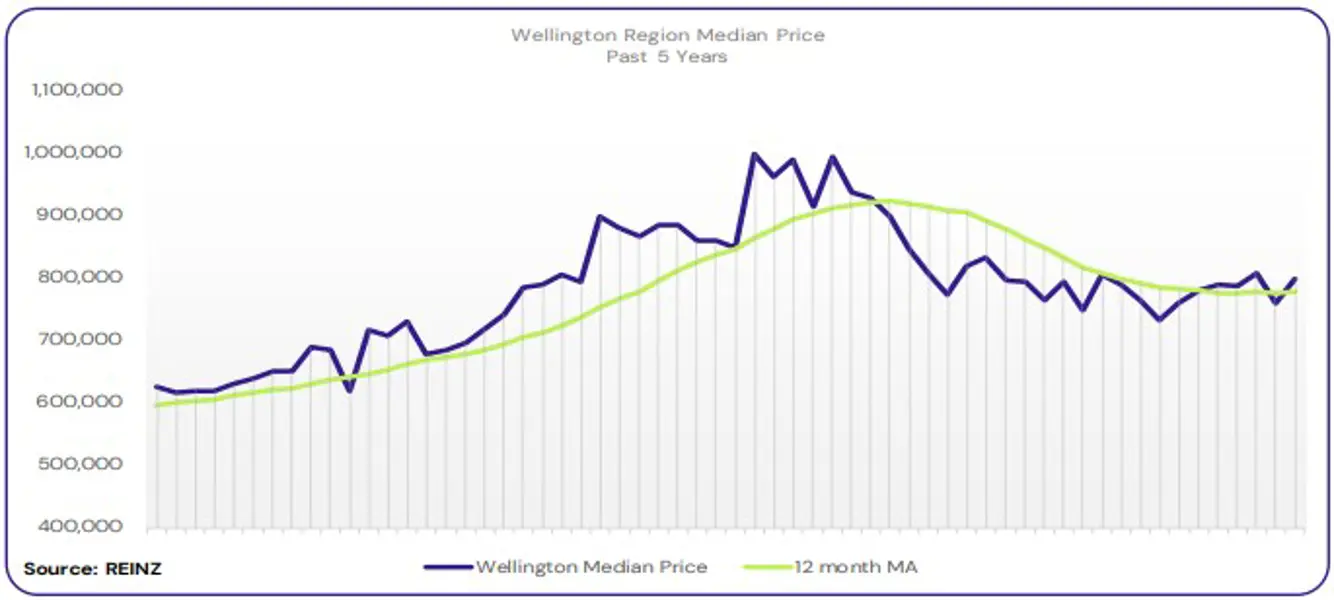

Regional Analysis - Wellington

Wellington’s median price increased by 0.6% year-on-year to $800,000.

“Local agents report that first-home buyers remained the most active buyer group in the region, alongside owner-occupiers looking to upsize. Vendors are keeping their price expectations reasonable.

Open home attendance varied, with good attendance in the suburbs and quieter activity in the inner city. Activity in auction rooms was relatively quiet. Interest rates and the cost of living are having the most significant impact on the Wellington property market.” (REINZ)

The current median Days to Sell of 40 days is more than the 10-year average for February of 39 days. There were 13 weeks of inventory in February 2024 which is 2 weeks less than the same time last year.

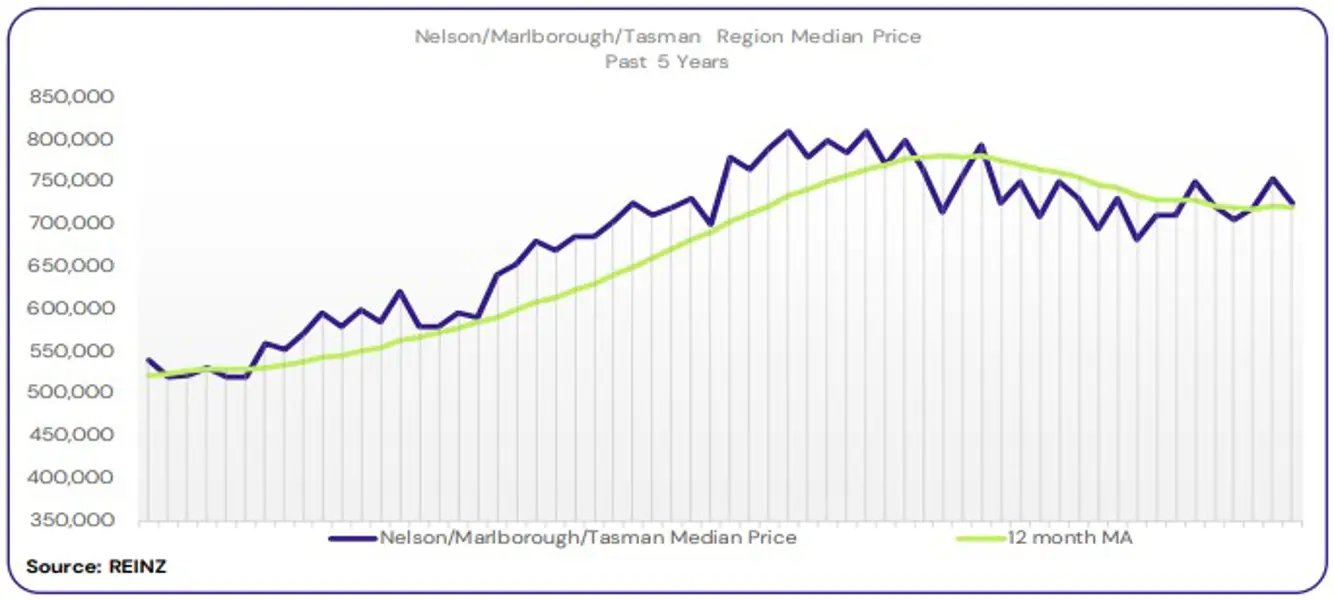

Regional Analysis - Nelson/Marlborough

In Nelson, the median price increased by 6.9% year-on-year to $732,500. The median price in Marlborough decreased by 0.7% year-on-year to $680,000. Tasman’s median price decreased by 10.6% year-on-year to $760,000.

“There was activity from all buyer groups across the region. Most vendors are adjusting their prices to meet the market, although vendors in some areas are seeing multiple offers being made and have kept their price expectations reasonably high. Open home attendance was fairly low.

Interest rates continue to impact market sentiment. Local agents report a return in market confidence with buyer activity picking up, however, some buyers remain cautious and are taking time before buying as they have more properties to choose from. Most agents predict that the market will continue to pick up in the next few months, with visitors and tourists potentially helping lift activity.” (REINZ)

The current median Days to Sell of 51 days is more than the 10-year average for February which is 42 days. There were 27 weeks of inventory in February 2024 which is 4 weeks more than the same time last year.

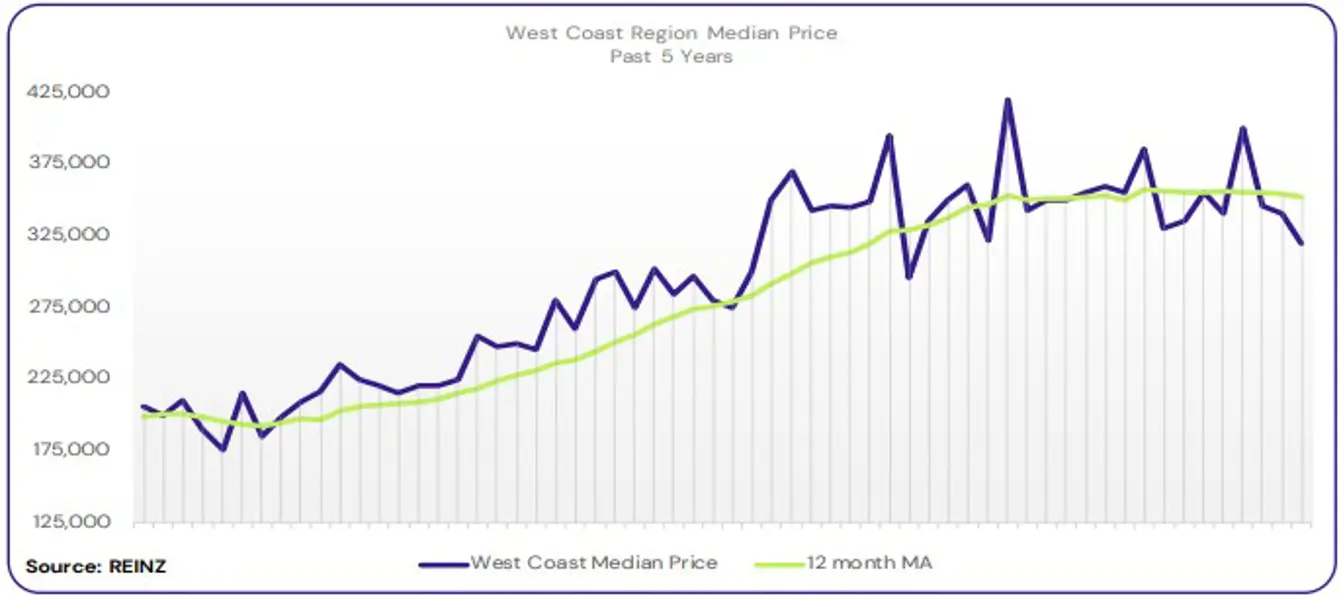

Regional Analysis - West Coast

In the West Coast, median prices decreased by 8.6% year-on-year to $320,000.

“First-home buyers remained the most active buyer group across the region. More vendors are modifying their price expectations and meeting the market, yet some are still sticking to their original price expectations. Open home activity has remained steady.

Interest rates and the cost of living continue to have the most significant impact on the market, and buyers are cautious about how interest rates may change. Despite this, the market has remained positive, with activity picking up from outside buyers, locals, and investors. Local agents expect the market will remain strong over the next few months.” (REINZ)

The current median Days to Sell of 43 days is much less than the 10-year average for February which is 83 days. There were 53 weeks of inventory in February 2024 which is 14 weeks more than the same time last year.

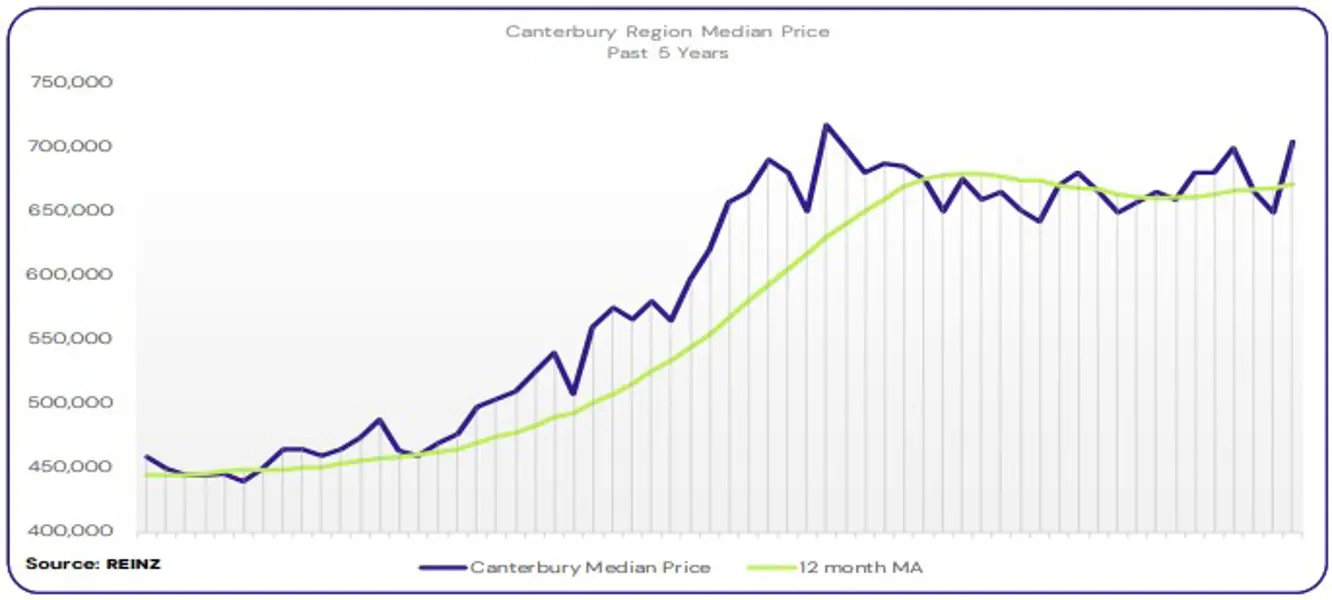

Regional Analysis - Canterbury

Canterbury’s median price increased by 5.2% year-on-year to $705,000.

“First-home buyers and owner-occupiers were the most active buyer groups across the region. More buyers from the North Island are showing interest in this region. Most vendors are willing to meet the market and adjust their asking price, although some have begun to raise their price expectations.

Open home attendance ranged from steady to very good. Auction activity was varied, with steady bidding for some properties. Interest rates and the cost of living are the main factors affecting the market, and local salespeople have noted that some buyers are cautious, while others want to buy soon before demand or prices lift further.

Local agents report positivity is growing and confidence is returning, and predict the market will remain stable for the next few months.” (REINZ)

The current median Days to Sell of 42 days is more than the 10-year average for February which is 42 days. There were 17 weeks of inventory in February 2024 which is 4 weeks less than the same time last year.

Regional Analysis - Otago

Dunedin City - ”Dunedin’s median price increased by 3.5% year-on-year to $590,000.

First-home buyers and owner-occupiers continued to be the most active buyer groups in the region. Many vendors have kept their price expectations high, but are willing to meet the market. Local agents report good levels of activity for open homes, especially new listings.

The cost of living and interest rates continue to have the most significant impact on the market, alongside challenges for buyers to secure financing.

Local salespeople report good numbers of buyers looking to purchase properties, and listings are matching buyer numbers. They predict that the migration of people to Dunedin – including Aucklanders moving to Dunedin and people coming to work on the new hospital – will significantly impact the market over the coming months, as will interest rates and the cost of living.”

Queenstown Lakes

“First-home buyers remain the most active group, with some activity from investors as well. Vendors continue to be stay with their original price expectations, however, the lift in the number of listings means more options for buyers.

Activity in open homes remained steady, and clearance rates in auction rooms saw a steady increase. Interest rates, the cost of living, and inflation continue to impact the market. Despite this, sales numbers are rising, especially in Queenstown. Local agents report that buyers are showing more confidence and there is more market positivity in general.” (REINZ)

The current median Days to Sell of 52 days is much more than the 10-year average for February which is 40 days. There were 16 weeks of inventory in February 2024 which is 4 weeks less than the same time last year.

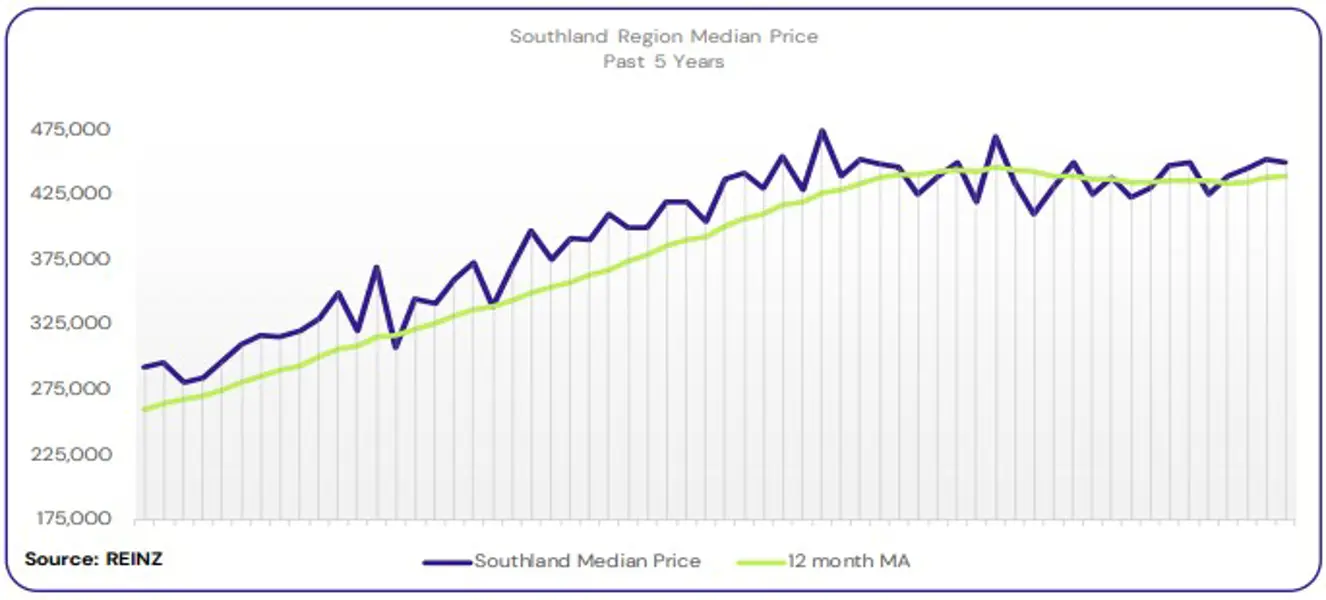

Regional Analysis - Southland

The median price in Southland increased by 4.7% year-on-year to $450,000.

The region continued to see increased activity from all buyer groups. Most vendors are meeting the market, while others are sticking to their original price expectations. Open homes attendance has varied, depending on the asking price and how long a property has been on the market.

Factors such as interest rates and the cost of living continue to have the largest impact on the market and local agents report that buyers remain cautious about how much they offer. Agents remain cautiously optimistic that the current steady market will improve later Din the year, if interest rates ease and more favourable legislation is introduced for business owners or investors.” (REINZ)

The current median Days to Sell of 45 days is more than the 10-year average for February which is 39 days. There were 17 weeks of inventory in February 2024 which is 4 weeks less than the same time last year.

Browse

Topic

Related news

Read more

Find us

Find a Salesperson

From the top of the North through to the deep South, our salespeople are renowned for providing exceptional service because our clients deserve nothing less.

Find a Property Manager

Managing thousands of rental properties throughout provincial New Zealand, our award-winning team saves you time and money, so you can make the most of yours.

Find a branch

With a team of over 850 strong in more than 88 locations throughout provincial New Zealand, a friendly Property Brokers branch is likely to never be too far from where you are.