Golden weather sees confidence lift - REINZ stats January 2024

Thursday, 15 February 2024

January has seen slower sales and a significant increase in the number of property listings available. This shows confidence from sellers while warming up buyers with a greater choice of property to choose from.

REINZ Chief Executive Jen Baird says "January is usually a slower month for the completion of sales in New Zealand and this year is no exception with 2,995 properties being sold. While this is 4.9% more than January 2023, the increase in listings is a stronger indicator that the market continues to pick up. Listings increased by 10.4% nationally and 5.4% for New Zealand, excluding Auckland, year-on-year. The biggest increases in listings compared with the previous month were seen in Wellington at 148%, followed by Gisborne at 84%, Canterbury at 81%, and Auckland at 76.8%.

The total number of properties sold increased in January, rising by 16.0% year-on-year for New Zealand, excluding Auckland. Ten regions, including the bigger markets of Bay of Plenty, Waikato, and Northland, had higher sales counts this January compared to January 2023.

The national median sale price has slightly decreased from December 2023, down 2.5% from $779,830 to $760,000. Year-on-year, there is a slight decrease in the national median price by 0.7% from $765,000 to $760,000, while New Zealand, excluding Auckland, is down by 2.1% month-on-month (from $700,000 to $685,000) and up year-on-year by 0.8% (from $680,000 to $685,000).

The data shows regional variation in median sale prices, with Northland topping the scale with a 21% increase month-on-month from $630,000 to $762,000, and a 10.8% increase year-on-year from $687,500 to $762,000. Meanwhile, Auckland’s median sale price has fallen under the $1 million mark again this month, for the fifth time in a year, to $975,000 – however this is still 3.4% more than a year ago.

Despite the wave of listings favouring buyers, the challenges of last year, including the cost of living, inflation, interest rate changes, and government reforms, mean some buyers remain cautious. However, most regions are reporting more buyer activity across the board, with some seeing a particular surge in first-home buyer interest. Vendors are also being confident but realistic with prices as activity increases over the summer months. This is likely to resolve in inventory moving over the coming more active months in the year, “adds Baird.

"2024 is shaping up to deliver a series of changes and shifts in dynamics for the market. The property sector is expecting the new government to make good on its promises to reduce the bright line back to two years and reintroduce interest deductibility on investment properties, changing the dynamics of the property market again.” she says.

Regional highlights

- Auckland’s median sales price has dropped below the $1 million mark, shifting for the 5th time over the last year.

- Northland’s median sale price increased 21% month-on-month from $630,000 to $762,000, and increased by 10.8% year-on-year from $687,500 to $762,000.

- The biggest increases in listings were seen in Wellington at 148%, followed by Gisborne at 84%, Canterbury at 81%, and Auckland at 76.8% compared to December 2023.

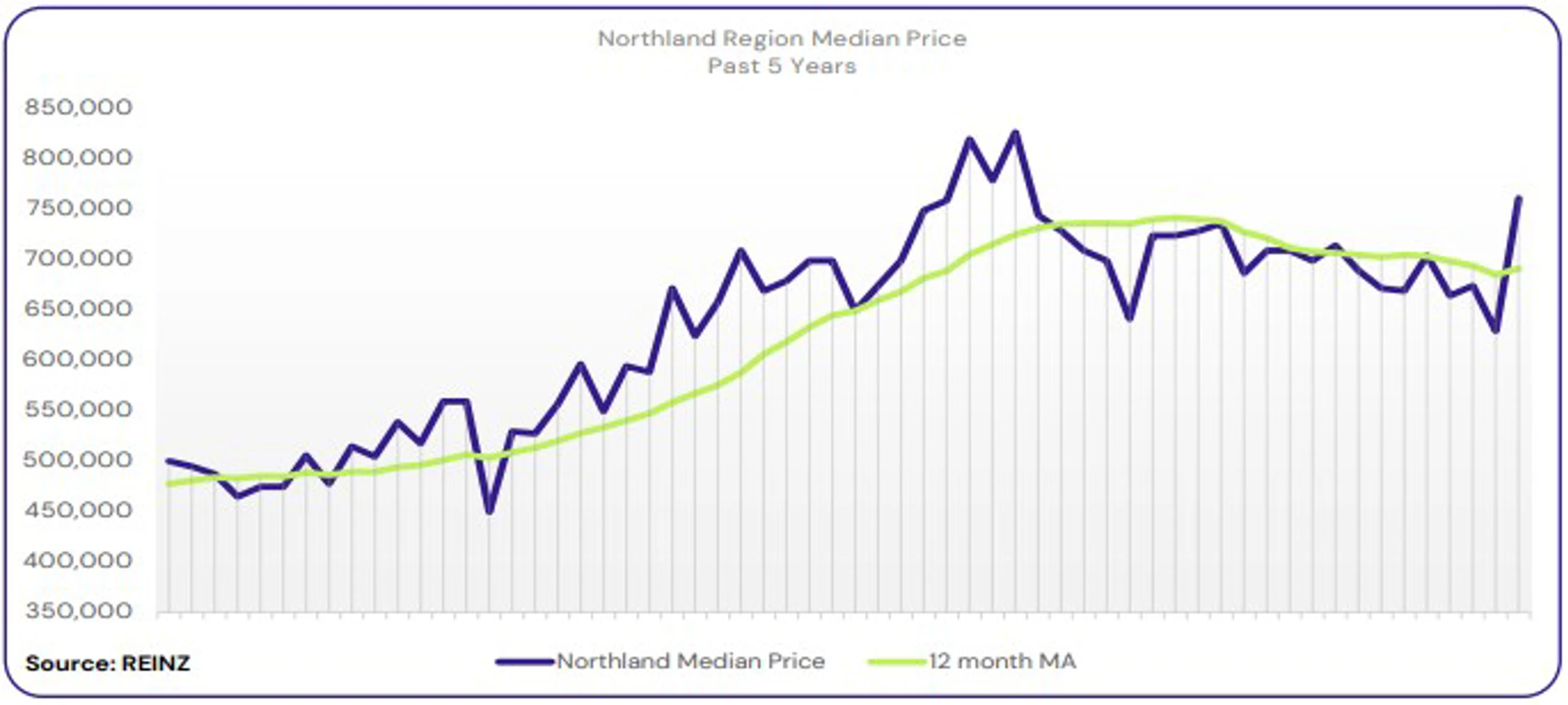

Regional Analysis - Northland

Median prices in Northland increased by 10.8% year-on-year to $762,000.

“First-home buyers and owner-occupiers remained the most active buyers in the region.

Vendors are hopeful that the market will improve, and prices will rise, which reflected in the price expectations of several vendors in the region. Open homes and auction rooms were relatively quiet in January. Local agents report a rise in listings. Buyers have no sense of urgency right now, fearing that they may overpay. Most people are waiting to see how the new government’s policies may affect the economy.

Buyers and sellers are cautiously optimistic about the market. Local agents anticipate a slow market for the time being but are hopeful that activity will pick up in the coming months." (REINZ)

The current median Days to Sell of 80 days is much more than the 10-year average for January which is 55 days. There were 42 weeks of inventory in January 2024 which is 9 weeks less than the same time last year.

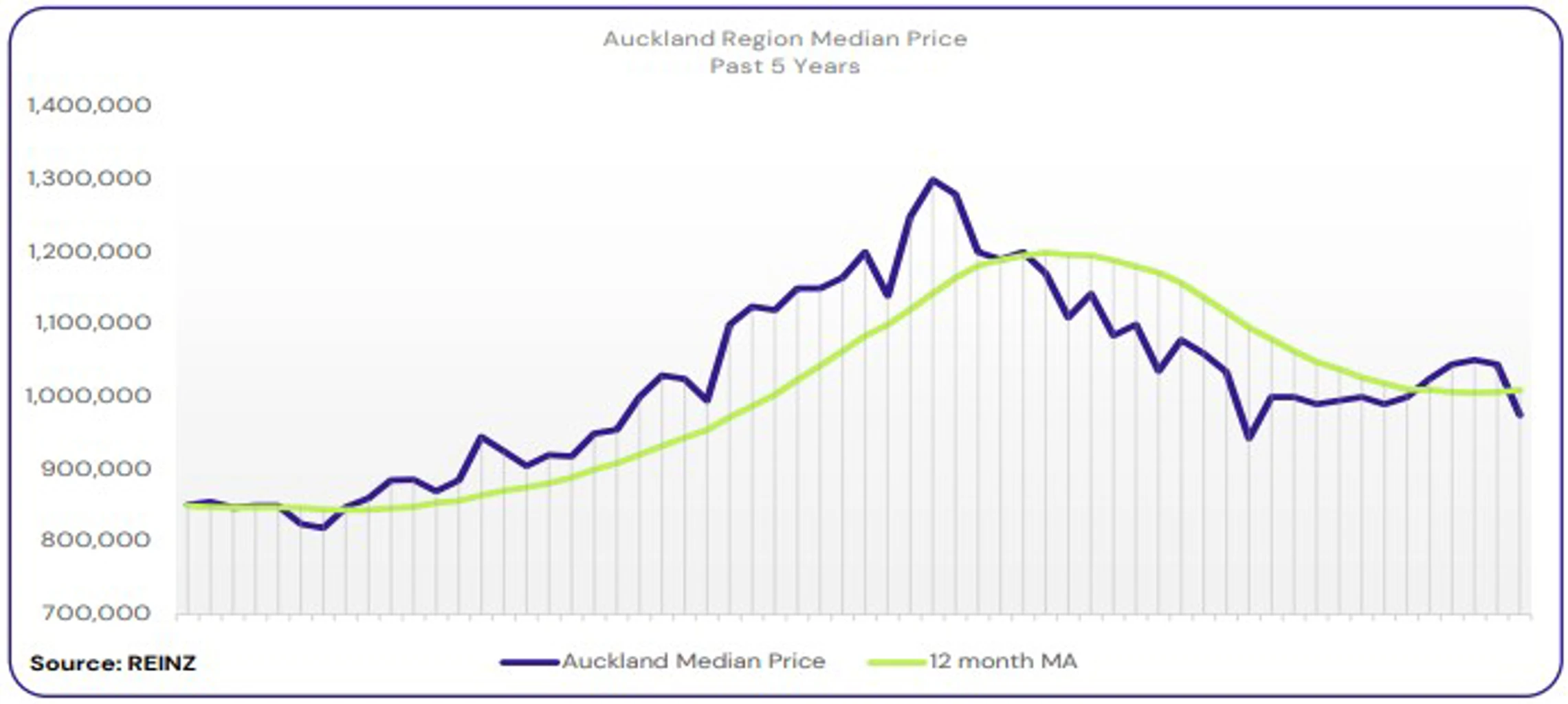

Regional Analysis - Auckland

In Auckland median prices increased by 3.4% year-on-year to $975,000.

“Owner-occupiers remain the most active buyer group in Central Auckland. South Auckland saw the most activity from first-home buyers and investors. First-home buyers were also the most active in West Auckland. Most vendors continue to set realistic price expectations. However, as market activity increases, some vendors have begun to raise their asking prices. Agents report seeing more activity at open homes and auctions.

Local salespeople report a boost in market confidence, but some buyers are still cautious. The change in government, interest rates, weather, and banks’ current lending criteria had significant impact on the market. Agents remain cautiously optimistic that market activity will increase in the coming months.” (REINZ)

The current median Days to Sell of 54 days is much more than the 10-year average for January which is 43 days. There were 26 weeks of inventory in January 2024 which is 6 weeks less than the same time last year.

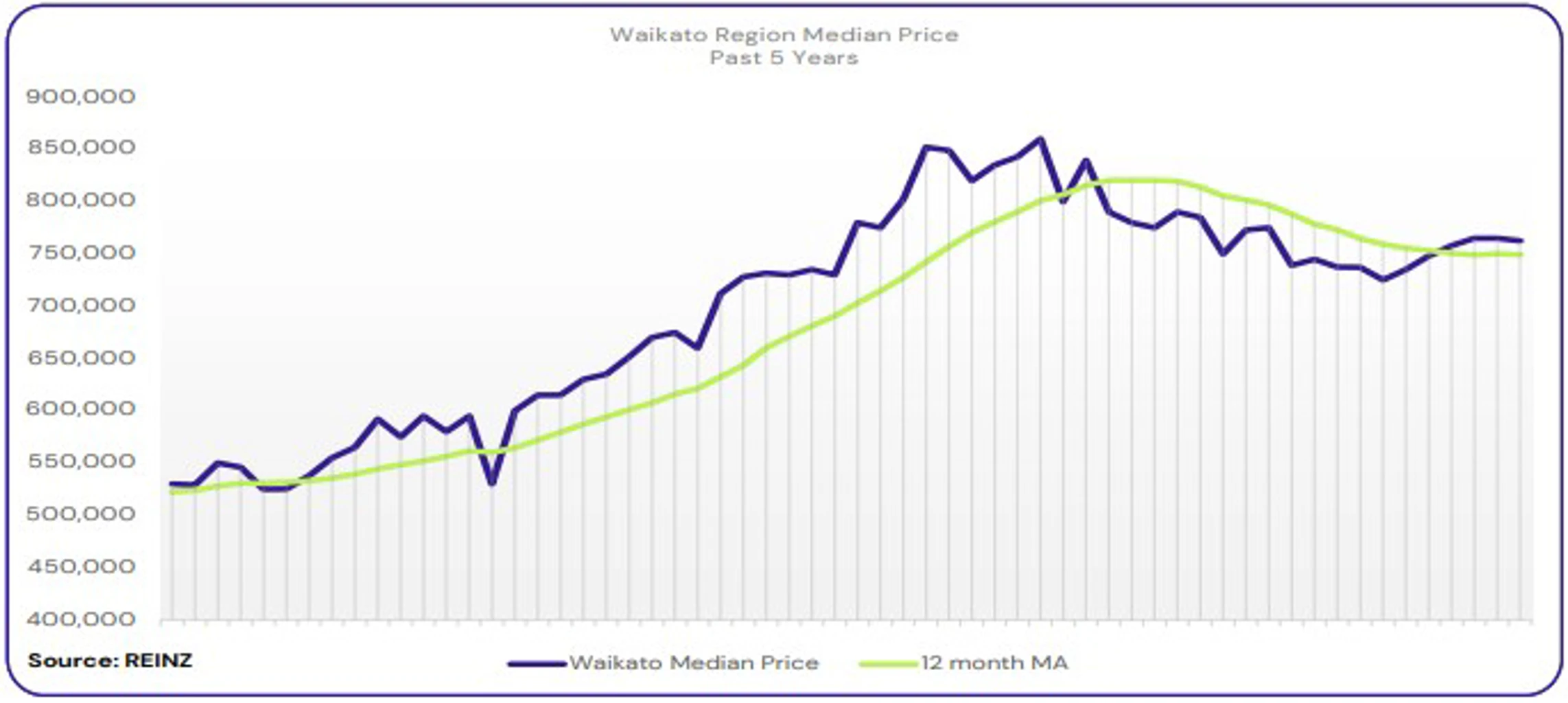

Regional Analysis - Waikato

Median prices in Waikato decreased by 1.4% year-on-year to $762,000.

“Owner-occupiers remained the most active buyer group across the region. First-home buyers were also active in Hamilton and Taupo, while holiday home buyers expressed interest in Taupo properties. Most vendors across the region have set realistic price expectations; however, vendors hope to raise their prices as the market develops.

Open homes were well attended throughout the region. Hamilton and Taupo also had a good amount of activity in the auction rooms. Sales counts have been good throughout the region. Market sentiments remain positive, and local agents report a return to market confidence. Taupo experienced an increase in listing numbers, giving buyers more negotiating power. Local agents are cautiously optimistic and anticipate an increase in market activity over the next few months.” (REINZ)

The current median Days to Sell of 52 days is more than the 10-year average for January which is 46 days. There were 24 weeks of inventory in January 2024 which is 14 weeks less than the same time last year.

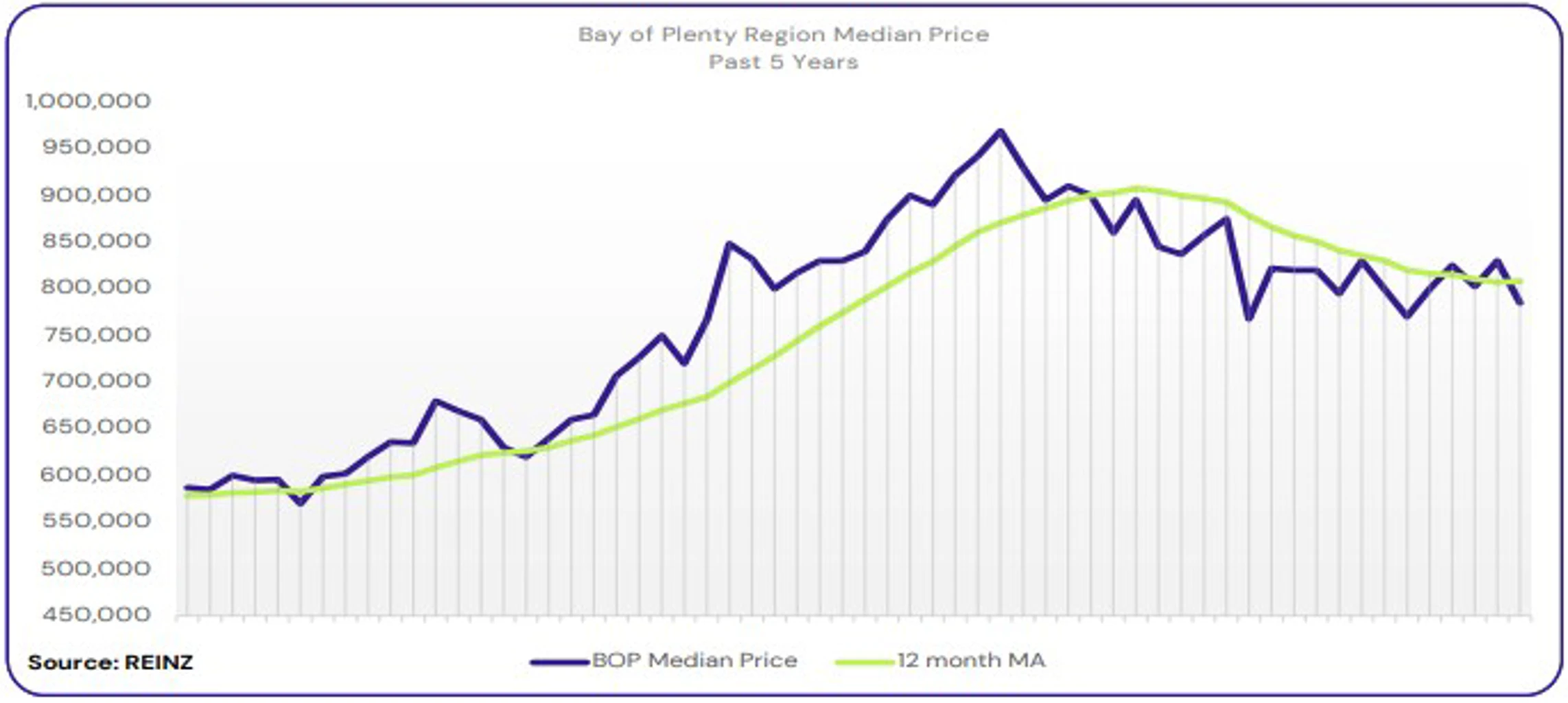

Regional Analysis - Bay of Plenty

Bay of Plenty’s median prices increased by 2.2% year-on-year to $785,000.

“January was a quiet month for all Tauranga buyer groups. First-home buyers and investors remained the most active buyer groups in Rotorua.

While some vendors in the region are more willing to negotiate pricing, others remain strong on their original price expectations. In Tauranga, attendance in open homes and auction rooms was low, as expected, given that most people were still on holiday. Open homes in Rotorua were well attended. Sales counts were low across the region.

Interest rates, the new government, and economic uncertainty had the greatest impact on the market. However, agents report a feeling of the market picking up amongst buyers and sellers, making them cautiously optimistic.” (REINZ)

The current median Days to Sell of 51 days is the same as the 10-year average for January which is 51 days. There were 22 weeks of inventory in January 2024 which is 11 weeks less than the same time last year.

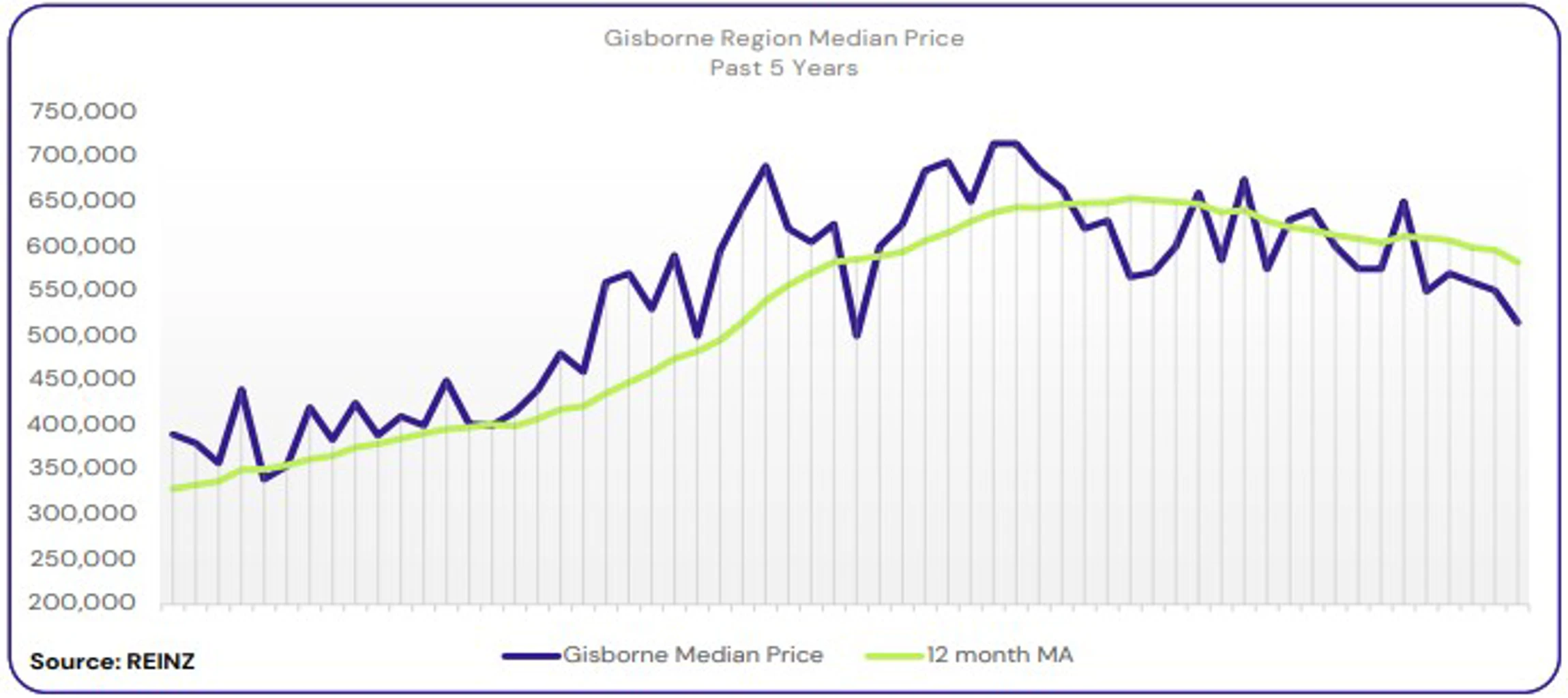

Regional Analysis - Gisborne

In Gisborne median prices decreased by 23.7% year-on-year to $515,000.

“Gisborne had the lowest days-to-sell year-on-year at 37 days; this was 26 days less compared to January 2023. Gisborne’s median inventory was 93 in January 2024; while this was a 25.4% decrease year-on-year, it was a 25% increase month-on-month. The average listings for the region also saw a month-on-month rise, from 19 in December 2023 to 35 in January 2024.

These are encouraging signs for the Gisborne property market.” (REINZ)

The current median Days to Sell of 37 days is less than the 10-year average for January which is 42 days. There are 10 weeks of inventory in January 2024 which is 13 weeks less than last year.

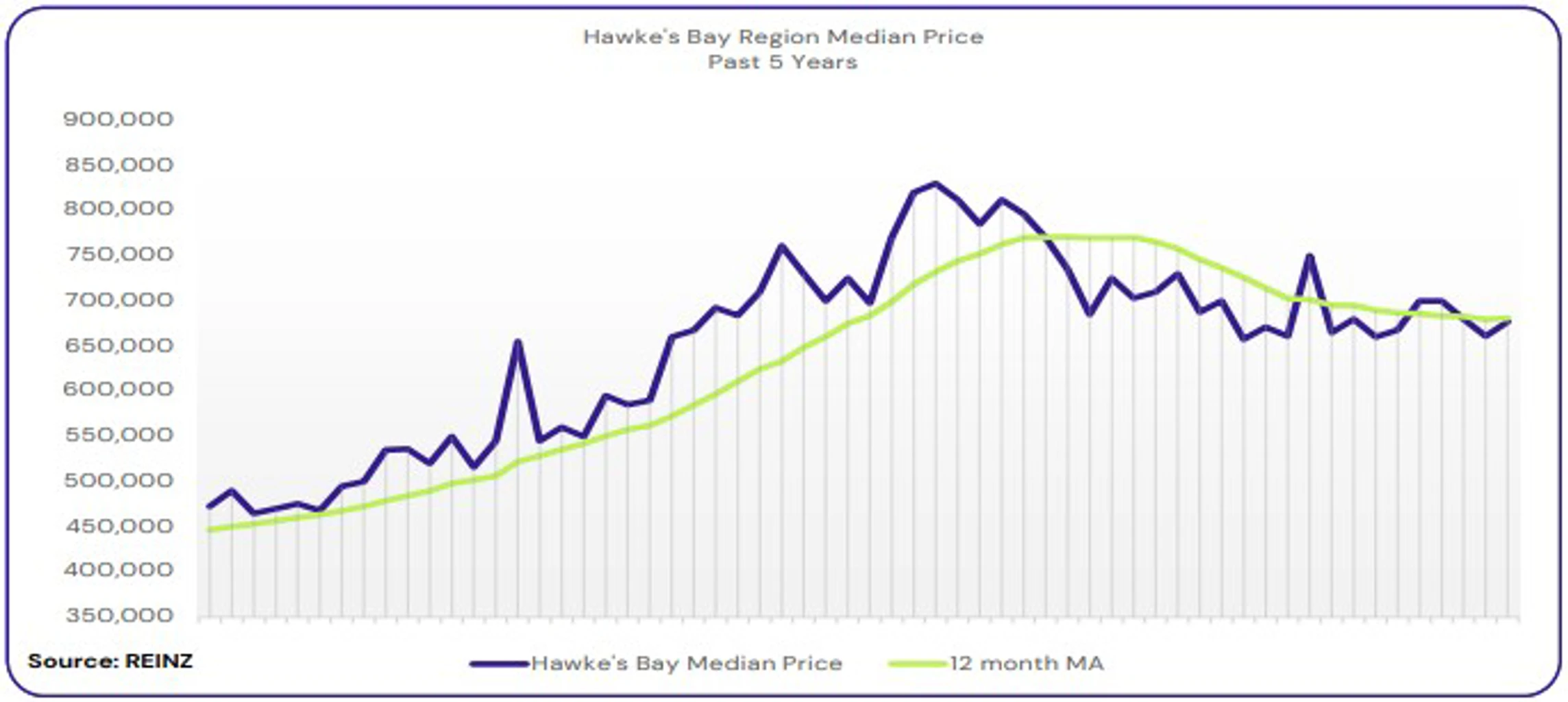

Regional Analysis - Hawke's Bay

Hawke’s Bay’s median price increased by 3.0% year-on-year to $677,000.

“First-home buyers and owner-occupiers remained the most active buyer groups in the region. Vendors continue to set realistic price expectations. Open homes saw a drop in attendance, but sales counts increased in January. The new government, bank legislation, and expectations for lower interest rates have all had a significant impact on the market. However, buyers are beginning to worry that prices will rise.

Local agents report that overall, they have seen steady improvement in the market.” (REINZ)

The current median Days to Sell of 45 days is more than the 10-year average for January which is 42 days. There were 16 weeks of inventory in January 2024 which is 8 weeks less than the same time last year.

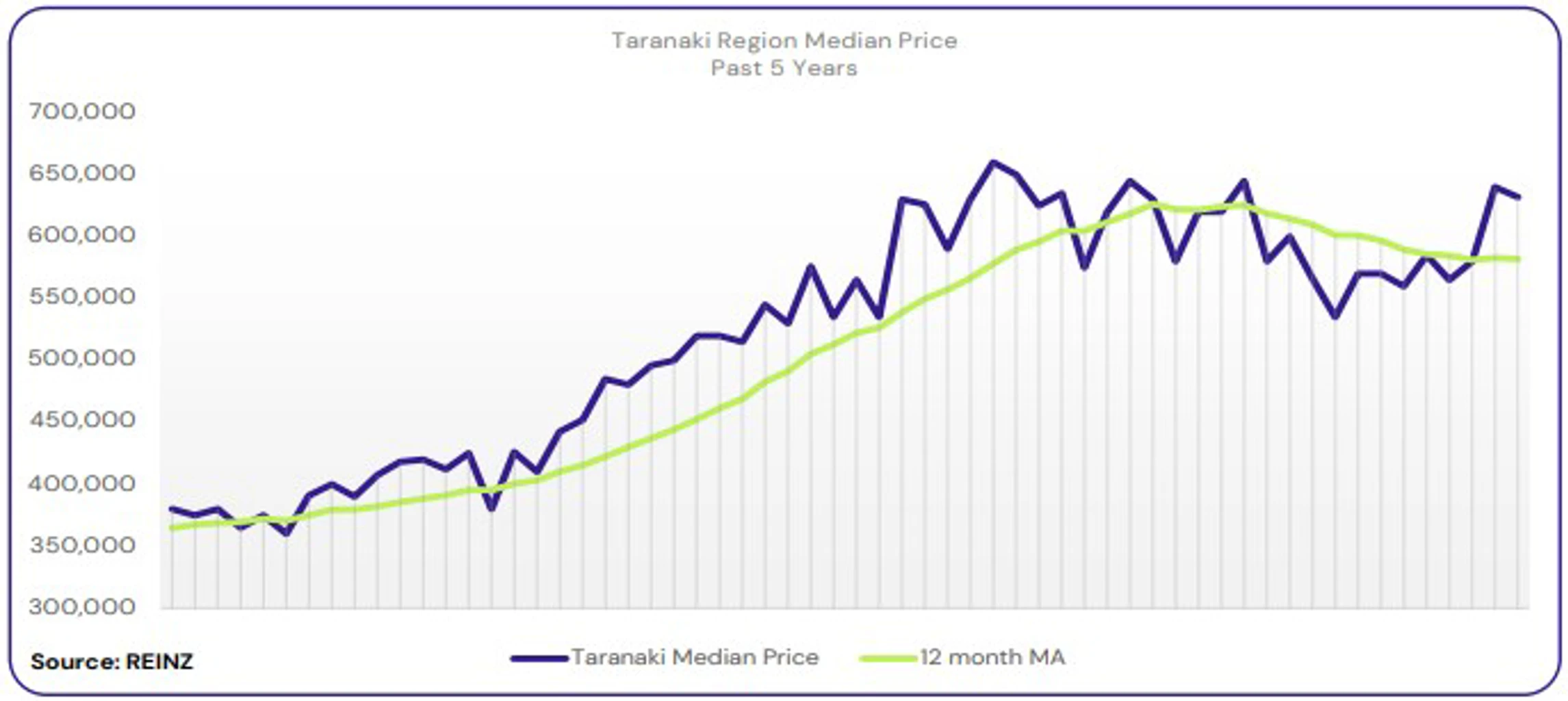

Regional Analysis - Taranaki

Taranaki’s median price decreased by 2.0% year-on-year to $632,000.

“The region saw an increase in activity from all buyer groups. Most vendors continue to set realistic price expectations. Although open homes were only held in the second half of January, agents report fair to good attendance, particularly at new listings. While sales numbers were low in early January, they increased at the end of the month, resulting in a strong finish.

Confidence is gradually returning to the region, but interest rates continue to have a significant impact on the market. Overall, it remains a buyers’ market. Agents are encouraged by the level of activity they witnessed in January and expect sales volumes to rise in the coming months.” (REINZ)

The current median Days to Sell of 54 days is more than the 10-year average for January which is 44 days. There were 22 weeks of inventory in January 2024 which is 2 weeks less than the same time last year.

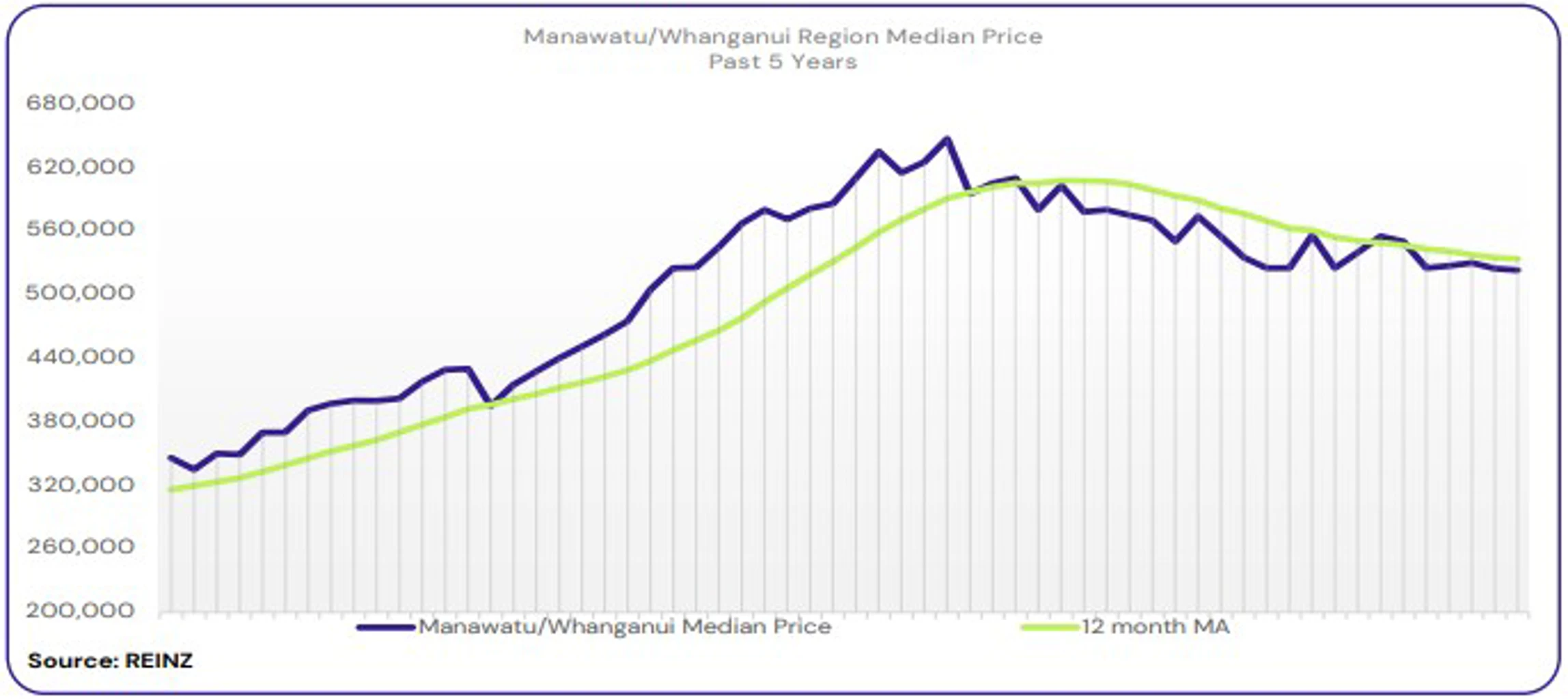

Regional Analysis - Manawatu/Whanganui

The median price for Manawatu/Whanganui decreased by 2.2% year-on-year to $523,000.

“Once again, owner-occupiers were the most active buyer group. The region also saw an increase in activity from first home buyers. Most vendors continue to set realistic price expectations. Local agents reported low attendance at open homes and auction rooms in January. Sales counts were similar, as people were preoccupied with other activities during the holiday season.

Lending criteria, LVR’s, changes to the Brightline test, laws governing investment, and difficulty securing finance have all had an impact on current market sentiments. According to local salespeople, most people have adopted a ‘wait and see’ approach while keeping a close eye on the market.” (REINZ)

The current median Days to Sell of 48 days is more than the 10-year average for January which is 43 days. There were 20 weeks of inventory in January 2024 which is 5 weeks less than the same time last year.

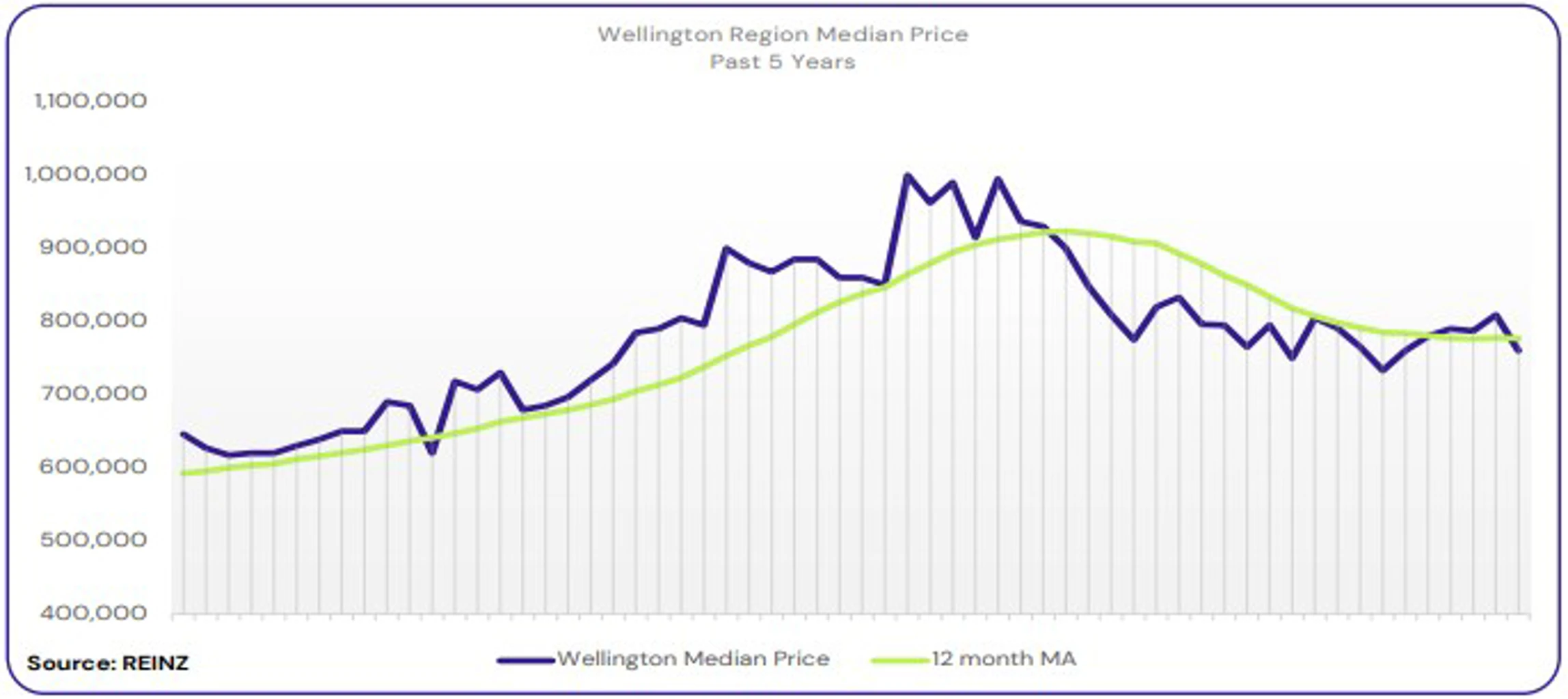

Regional Analysis - Wellington

Wellington’s median price decreased by 0.7% year-on-year to $760,000.

“First-home buyers were once again the most active buyer group in the region. Vendors continue to set reasonable price expectations. The number of people attending open homes varied greatly depending on the location of the property in Wellington. Open homes in the suburbs had the highest attendance.

The most significant impact on the Wellington market came from interest rates and the possibility of further price increases. Buyers are looking to enter the market before this occurs. Depending on whether interest rates rise, local agents predict that mortgage sales will increase this year.” (REINZ)

The current median Days to Sell of 46 days is more than the 10-year average for January of 45 days. There were 12 weeks of inventory in January 2024 which is 6 weeks less than the same time last year.

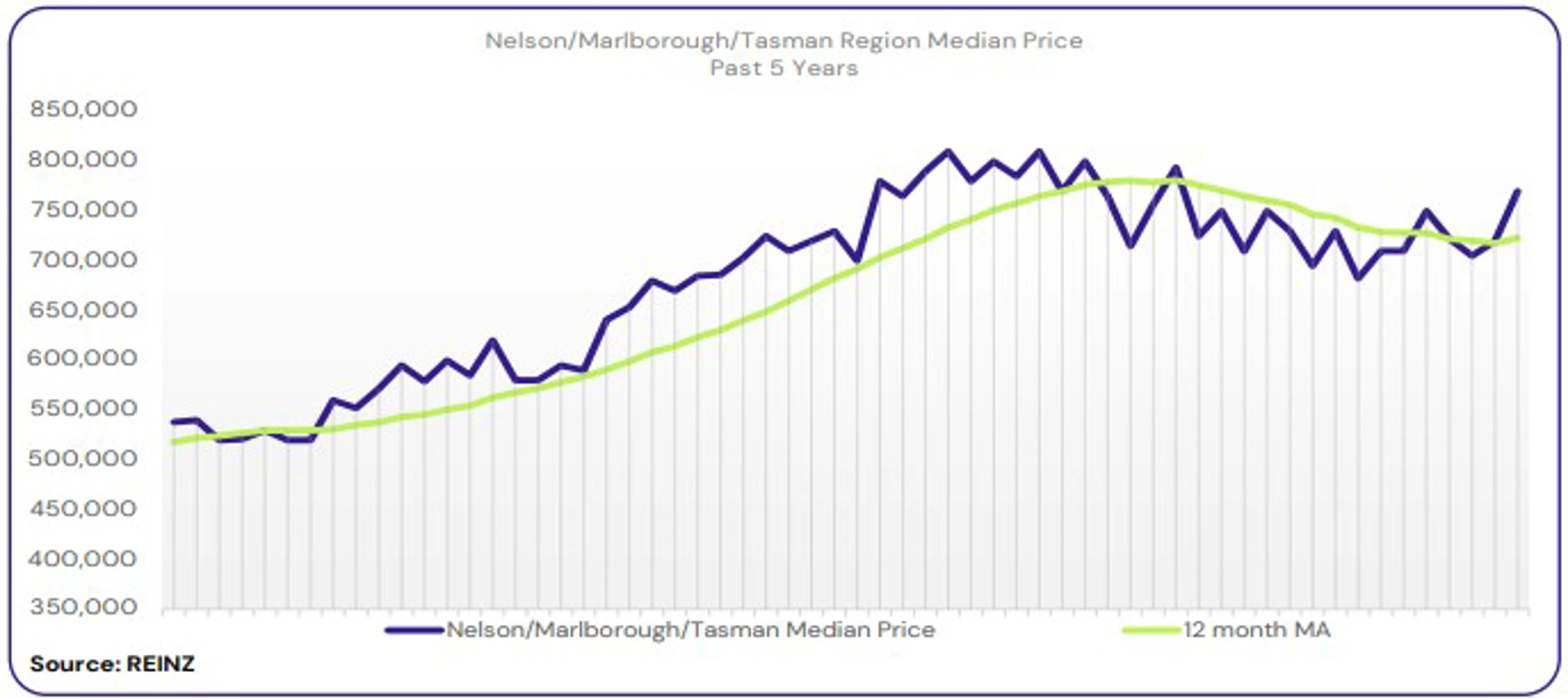

Regional Analysis - Nelson/Marlborough

In Nelson, the median price increased by 0.7% year-on-year to $675,000. The median price in Marlborough increased by 2.5% year-on-year to $666,250. Tasman’s median price increased by 11.2% year-on-year to $870,000.

“In Nelson, activity levels were consistent across all buying groups. Meanwhile, Blenheim saw an increasing in activity from first-home buyers and investors. While some vendors continue to temper their price expectations, others maintain their original price expectations. Open house and auction activity was low in Nelson but increasing in Blenheim.

Interest rates, current economic conditions, and global events have had the most impact on the market. Local agents have noted a rise in market activity, which has led in more positive market sentiments, though buyers and sellers remain cautious. Agents hope to see more action in the coming months.” (REINZ)

The current median Days to Sell of 53 days is much more than the 10-year average for January which is 42 days. There were 22 weeks of inventory in January 2024 which is 4 weeks less than the same time last year.

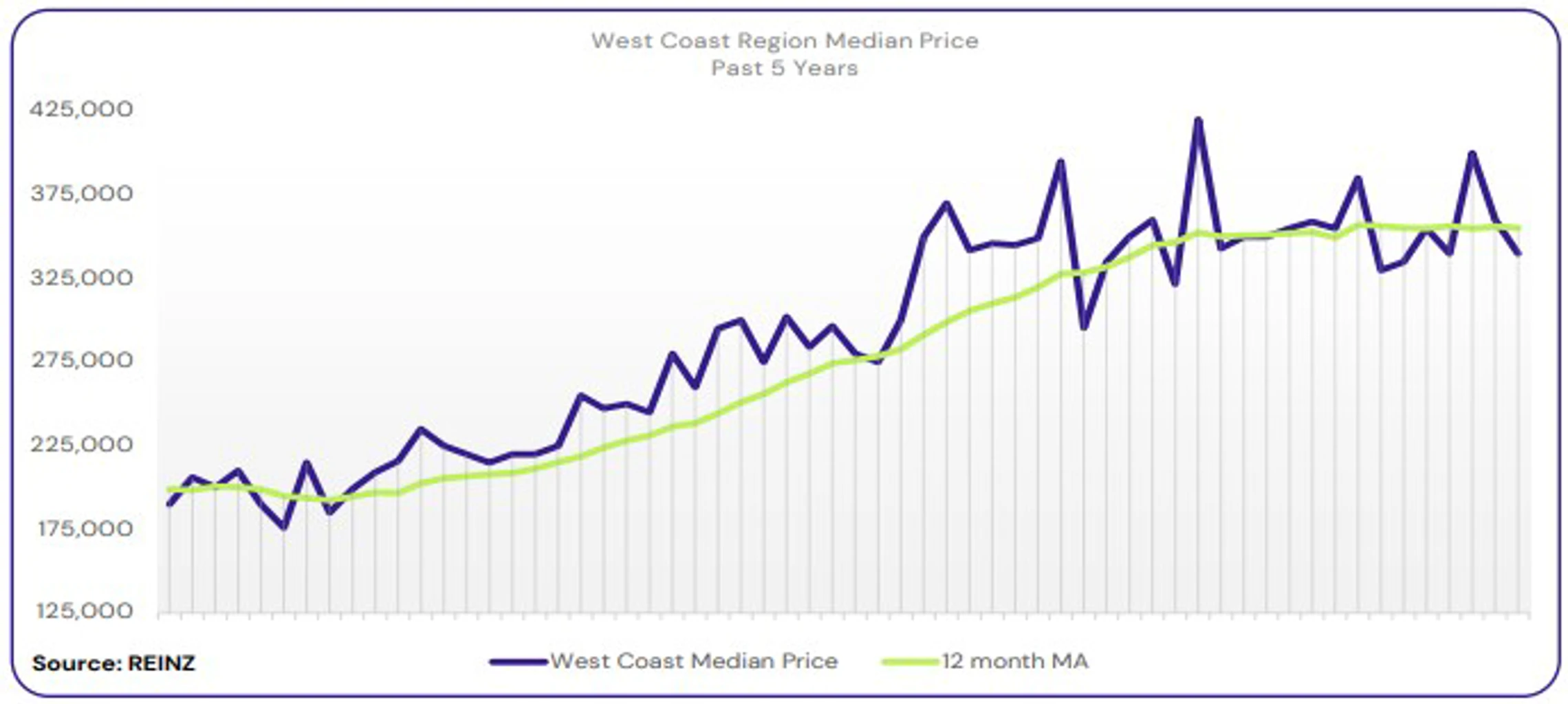

Regional Analysis - West Coast

In the West Coast, median prices decreased by 2.9% year-on-year to $340,000.

“In January, first-home buyers were the most active buyer group on the West Coast. Vendors are modifying their expectations to reflect market appraisals. Local agents report that the number of open homes on the market has been stable in recent months. Sales counts dropped somewhat around Christmas but have subsequently returned to typical levels.

Market sentiments have remained high; but interest rates and the cost of living influenced the January market, making buyers more likely to negotiate the asking price. Lower priced properties remain popular amongst first-home buyers. Local agents believe that the market will remain stable over the next few months and are hopeful for more activity as the year continues.” (REINZ)

The current median Days to Sell of 41 days is much less than the 10-year average for January which is 58 days. There were 36 weeks of inventory in January 2024 which is 10 weeks less than the same time last year.

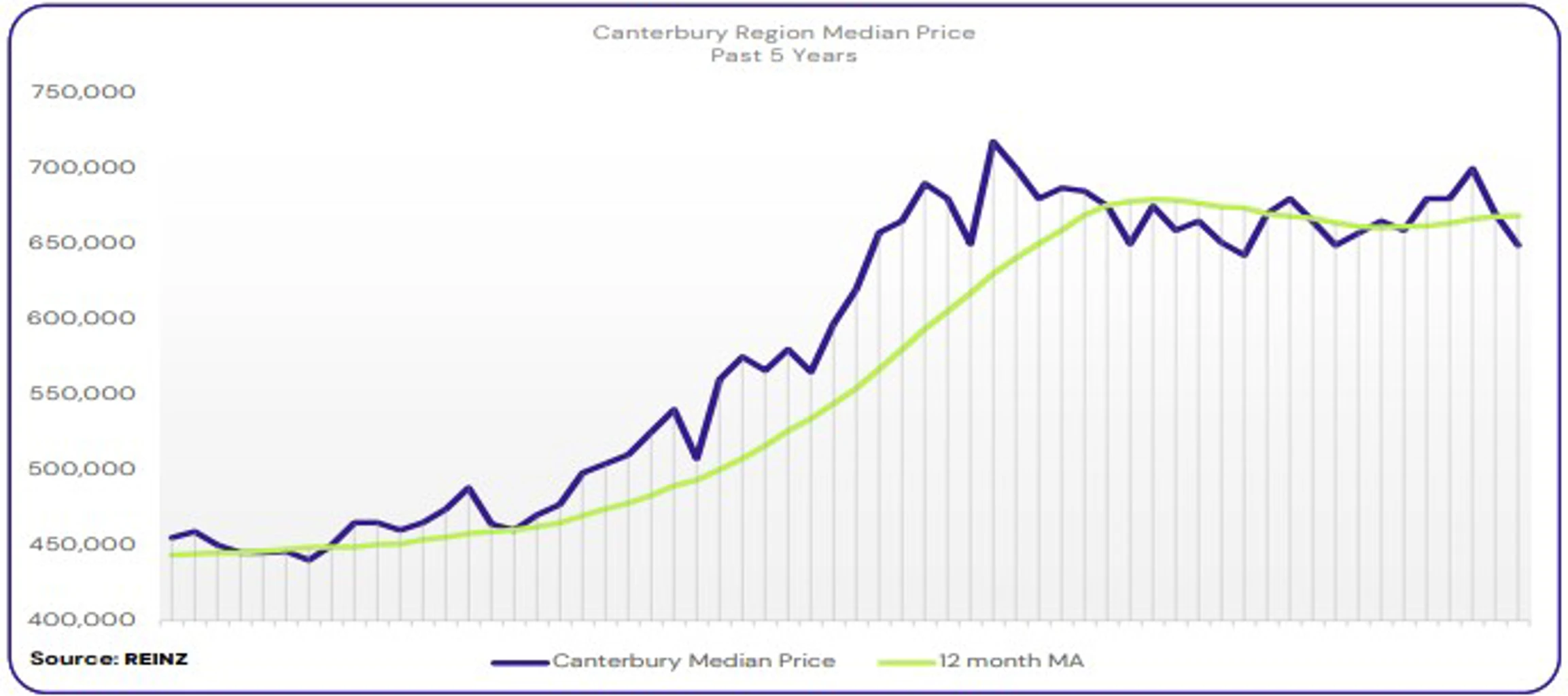

Regional Analysis - Canterbury

Canterbury’s median price increased by 1.0% year-on-year to $649,000.

“Owner-occupiers continue to be the most active buyers in Ashburton and Christchurch. There was also a surge in activity from first-home buyers in Timaru and Christchurch. Most vendors continue to adjust their asking prices based on market conditions but are hoping for better prices.

Open home attendance varied across the region, from fair to good, depending on the property. Auction rooms in Christchurch continue to be well-attended. Sales counts were good across the region. The new government, interest rates, inflation, and summer have all had a substantial impact on the market. Overall, agents are seeing more favourable market sentiments and anticipate increased business as listing numbers rise and the economy stabilises.” (REINZ)

The current median Days to Sell of 45 days is more than the 10-year average for January which is 43 days. There were 15 weeks of inventory in January 2024 which is 5 weeks less than the same time last year.

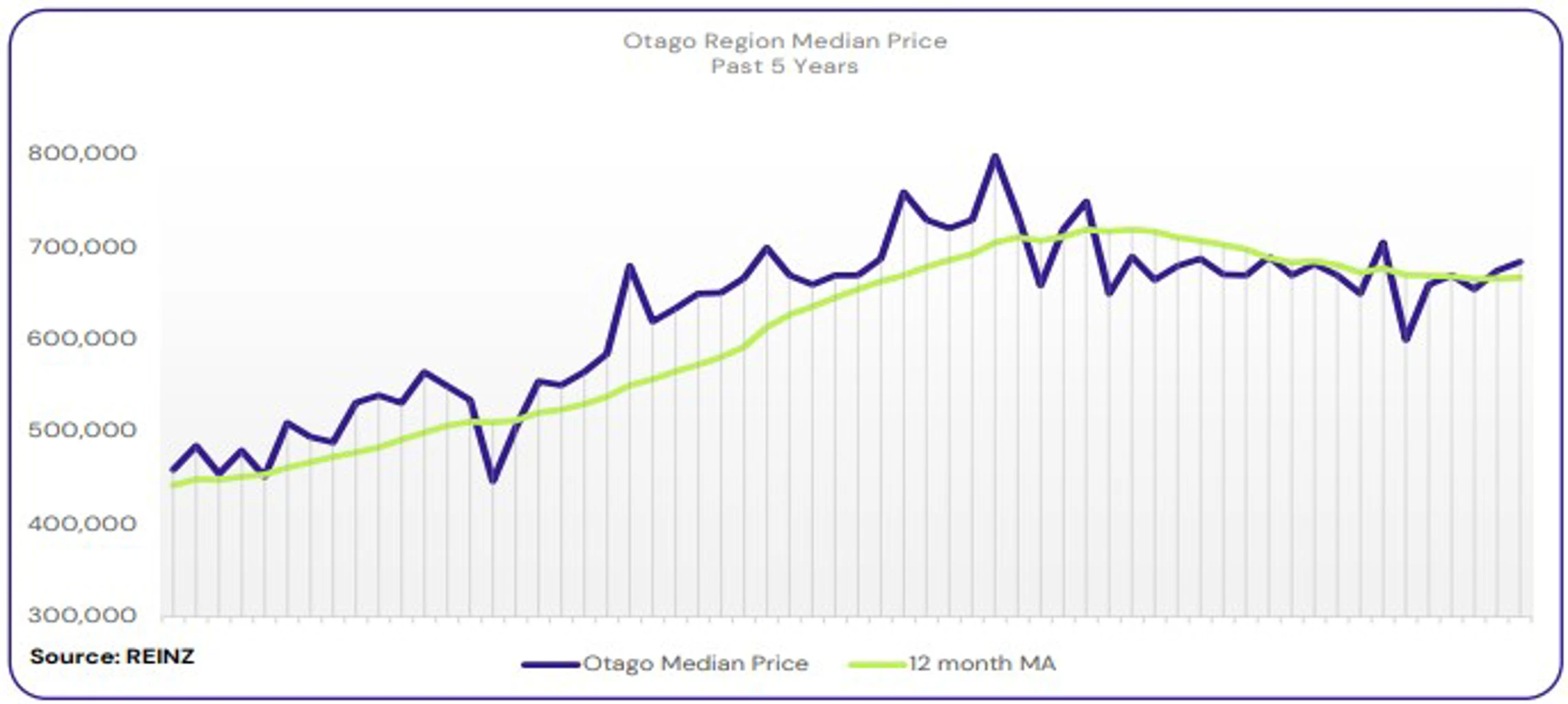

Regional Analysis - Otago

Dunedin City - “Dunedin’s median price increased by 11.7% year-on-year to $575,000.

First-home buyers and owner-occupiers remained the most active buyer groups. More have begun to raise their price expectations, anticipating that the market will improve over time. Open home attendance for new listings remains high.

Auction rooms also saw some action. Interest rates and the cost of living continue to have the greatest impact on the market. Local agents are reporting a strong market at the moment, with an increase in both volume and the number of purchasers expected as we move into autumn.” (REINZ)

Queenstown Lakes

“Local agents indicate a rise in activity from all buyer groups; nevertheless, owner-occupiers and first-home buyers remained the most active groups. Vendors continue to be bullish and solid in their price expectations. In January, open homes and auction rooms were very active.

The market was most significantly influenced by factors such as the new government, modifications to the bright-line test, and interest rate fluctuations. Market attitude is now positive; nonetheless, local agents have seen that buyers and sellers continue to monitor market activity.” (REINZ)

The current median Days to Sell of 53 days is more than the 10-year average for January which is 45 days. There were 14 weeks of inventory in January 2024 which is 8 weeks less than the same time last year.

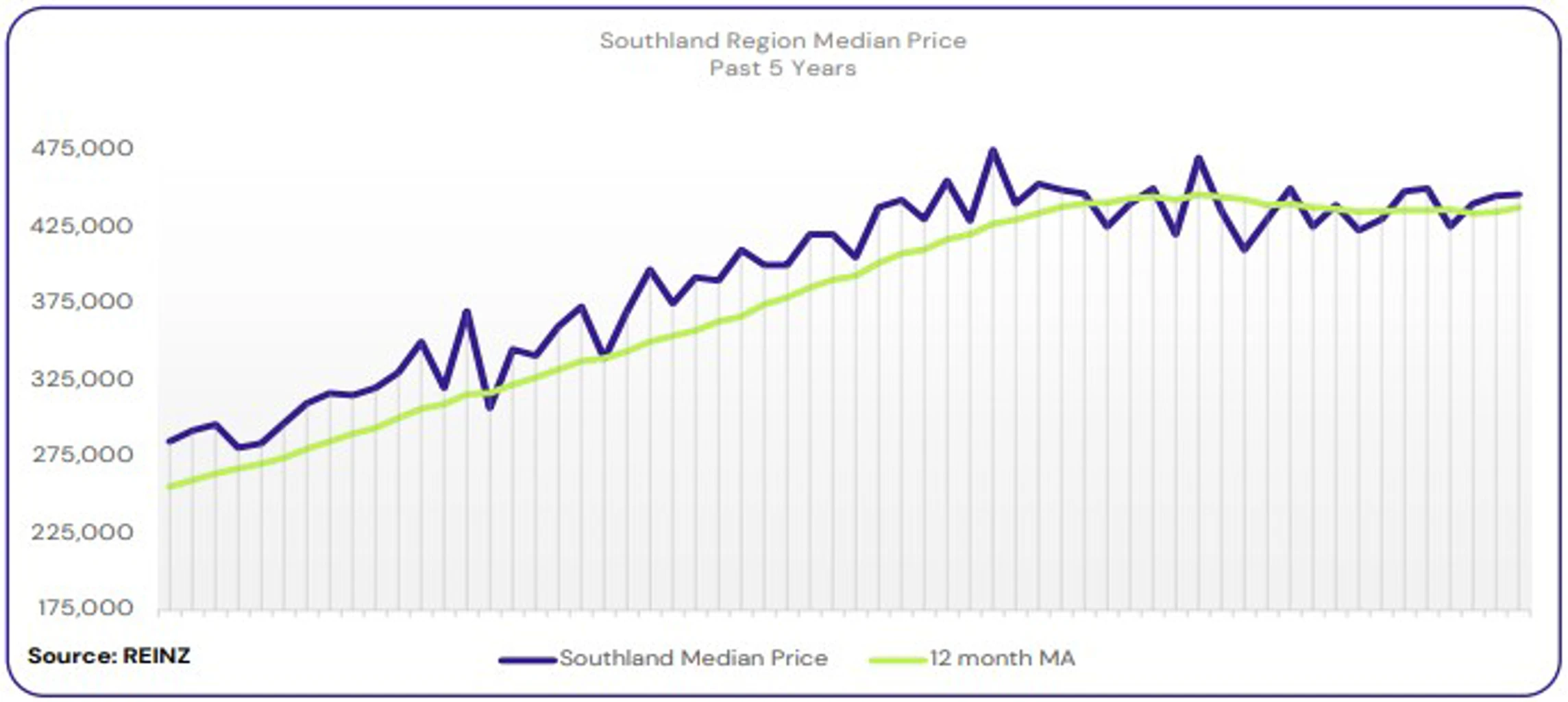

Regional Analysis - Southland

The median price in Southland increased by 8.8% year-on-year to $446,000.

“Local agents in Southland are seeing increased activity from all buyer groups. However, they are still cautious and hunting for better pricing. Some vendors maintain their original price expectations while waiting for the market to improve in their favour.

Open homes and auction rooms are experiencing increasing activity, with some localities reporting high attendance. The cost of living and a mismatch between vendor and buyer expectations have made market sentiments in Southland uncertain. However, local salespeople are cautiously optimistic that the market will improve later in the year.” (REINZ)

The current median Days to Sell of 41 days is the same as the 10-year average for January which is 41 days. There were 17 weeks of inventory in January 2024 which is the same as the same time last year.

Browse

Topic

Related news

Find us

Find a Salesperson

From the top of the North through to the deep South, our salespeople are renowned for providing exceptional service because our clients deserve nothing less.

Find a Property Manager

Managing thousands of rental properties throughout provincial New Zealand, our award-winning team saves you time and money, so you can make the most of yours.

Find a branch

With a team of over 850 strong in more than 88 locations throughout provincial New Zealand, a friendly Property Brokers branch is likely to never be too far from where you are.