Tax break for Landlords, or common sense?

Wednesday, 10 April 2024

By continuing, you agree to our terms of use and privacy policy

Instructions on how to reset your password will be sent to the email below.

Your password reset link has been sent. Please check your inbox and follow the instructions provided.

We're taking hundreds of properties to auction at gala events across Property Brokers country in February 2026! Explore properties in your area below.

Wednesday, 10 April 2024

However, many media commentators report this as a tax break for well-off property investors at a time of austerity as many public sector departments face huge cuts.

In March 2021, the then-Labour Government dropped a tax bombshell for property investors in a range of measures to try and take the heat out of the housing market. A landlord’s ability to offset interest payments against income was to be phased out, resulting in property investors being hit with significant tax bills. In many cases, some investors would have to find between $50 to $100 a week extra per property to offset the losses they would incur. Slashing the OCR and pumping billions of dollars into the economy through the COVID lockdown stimulated the property market. We witnessed a surge in property prices, resulting in thousands of first-home buyers being priced out of the market.

The decision blindsided everyone as there was no warning regarding what the Government intended to do. It was not a popular decision, especially when the then Finance Minister claimed that thousands of property speculators were taking advantage of a tax loophole.

Firstly, this was not a tax loophole. If you are a property investor, you are running a business, and any business can offset interest payments against income. Secondly, the use of the term ‘speculators’ was misleading. There is a significant difference between a speculator, who is looking to make a quick profit through speculating that the market will increase over a brief period, compared to an investor who makes up most of the residential rental market. Investors are in it for the long haul. The overwhelming majority of which are Mum and Dad investors who have no more than two properties to help them prepare for retirement. To label everyone who owned a residential rental property as a speculator was inaccurate, misleading and unfair.

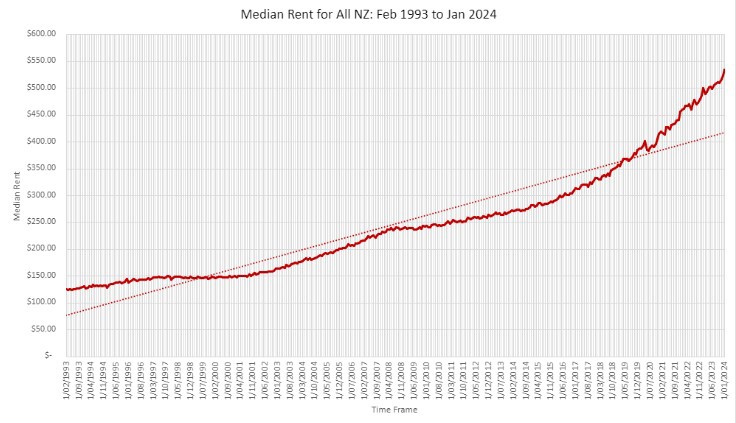

Rents increase significantly under Labour

Decisions such as the removal of interest deductibility result in upward pressure on rents. There are also other reasons why rents increase, however, if a business is to incur increased costs, what typically happens in any business is that those costs are passed onto the consumer. Rents have risen at a far faster rate since Labour came to power towards the end of 2017. In the six years from October 2023 to October 2017, rents increased by $180 or 45%. From October 2017 to October 2011, rents increased by $90 per week or 29%1. Many argue that the previous Government had an anti-landlord agenda and decisions such as this had unforeseen consequences.

If a government is to target landlords, it needs to ensure that it has the ability and the capacity to replenish and maintain the housing stock. There is a significant deficit around rental properties and strong immigration is only going to add fuel to the fire. The Government needs private landlords as part of a multi-faceted approach to resolving our housing crisis and our new coalition Government is simply removing draconian rules that benefited nobody. All that happened was landlords passed on increased costs to tenants which resulted in more subsidies being paid to tenants. What has compounded the issue is rising inflation resulting in banks increasing their interest rates and other costs increasing such as insurance and rates.

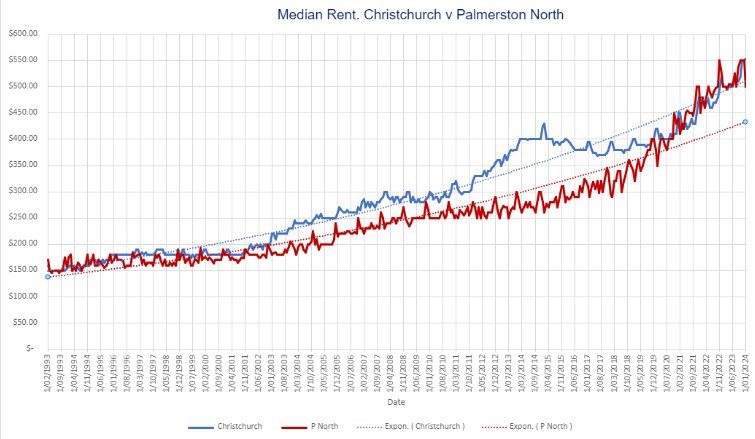

One region that has demonstrated that rent prices can be controlled through supply and demand is Canterbury, and particularly Christchurch. Post-earthquake in 2011, the then Earthquake Minister, Gerry Brownlee forced the Christchurch City Council to release land for development that had been scheduled to be released over 30 years. From August 2014 to April 2021, rents in Christchurch increased by only 0.37%. To give you an indication as to what this looks like, in back in February 2011, the median rent in Christchurch was $315 per week. In Palmerston North where our Head Office is based, it was $248 per week. In December 2023, the median rent for both these locations was $550.

Taking this tax burden off landlords will help slow down the increase of rents which is also being impacted by a strong net gain in immigration and a chronic lack of supply. This change by our new administration is about creating a fairer tax system that benefits all.

David Faulkner

Property Management General Manager, Property Brokers

Want to know more about Property Brokers' superior property management service? Check out our FREE guide here!

From the top of the North through to the deep South, our salespeople are renowned for providing exceptional service because our clients deserve nothing less.

Managing thousands of rental properties throughout provincial New Zealand, our award-winning team saves you time and money, so you can make the most of yours.

With a team of over 850 strong in more than 88 locations throughout provincial New Zealand, a friendly Property Brokers branch is likely to never be too far from where you are.