Stable inventory and increased interest from first-time buyers create buyer opportunities - REINZ stats April 2023

Thursday, 11 May 2023

Holidays add to market slow-down, but green shoots begin to emerge

The Real Estate Institute of New Zealand's (REINZ) April 2023 figures show that the economic climate has put further pressure on the country's real estate market. The April median price decreased 10.9% year-on-year to $780,000, and sales counts have eased annually, with inventory levels stabilizing. However, the West Coast and Otago regions saw an annual increase in median price, and two districts reached record median prices.

The total number of properties for sale across New Zealand increased 5.9% year-on-year, but new listings decreased by 18.9% year-on-year. Despite this, salespeople are reporting "glimpses of green shoots" in the market as first home buyers show more interest after the Reserve Bank announced the easing of LVR restrictions.

Regional highlights

- Whilst prices continue to ease annually in most regions, West Coast and Otago saw increases in median sale price to $379,000 and $680,000 respectively.

- Auckland had a 15.0% decrease in the median sale price for April year-on-year and dropped under the $1m price point to $995,000.

- Six regions had a decrease in the median days to sell.

- West Coast had the highest increase in median days to sell month-on-month (42 days) and the largest year-on -year increase (46 days).

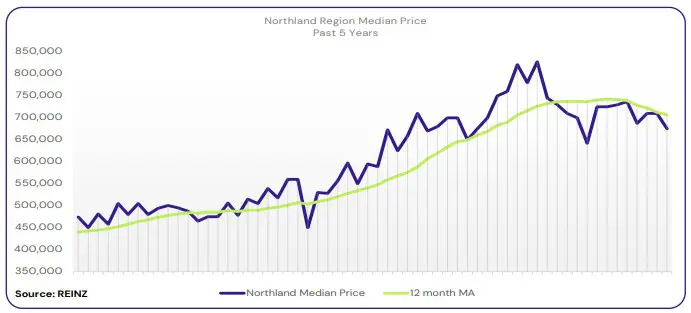

Regional Analysis - Northland

The median price in Northland decreased 9.4% year-on-year to $675,000.

“Vendors are adjusting their price expectations faster than in previous months. April saw good open home attendance at new listings, but numbers were quick to drop off after the first weekend of the open home.

“Sales counts were down 24.7% annually. Salespeople believe this is down to a combination of buyers taking longer to commit to a contract, price uncertainty, and talk of the economy and election year. There is also uncertainty about which way interest rates will go in the months to come.” (REINZ)

The current Days to Sell of 73 days is much more than the 10-year average for April which is 52 days. There were 40 weeks of inventory in April 2023 which is 14 weeks more than the same time last year.

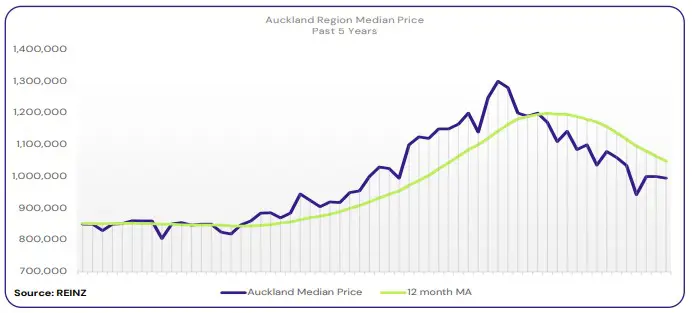

Regional Analysis - Auckland

Auckland’s median price has again slipped under the $1 million price point with its median now at $995,000 — a 15.0% decrease year-on-year.

“In Rodney and Auckland Central, owner occupiers were most active. There were fewer first home buyers in the market this month and local salespeople believe this may be due to Australia’s immigration changes for Kiwis, seeing many of them pursue another life afield.

“Many vendors are still hopeful for the best price, but those who need to sell are meeting the market with their expectations. Buyers still hold a fear of overpaying and continuous changes to interest rates. There is uncertainty and fear around the economy and the barrier of securing finance. As a result, sales counts continue to ease — down 23.0% year-on-year.” (REINZ)

The current Days to Sell of 43 days is more than the 10-year average for April which is 35 days. There were 33 weeks of inventory in April 2023 which is 10 weeks more than the same time last year.

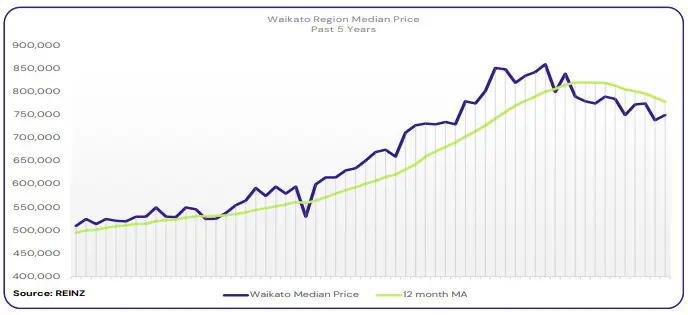

Regional Analysis - Waikato

Median prices in Waikato decreased 12.8% year-on-year to $750,000.

“Owner occupiers were the most active buyer pool throughout Thames and Taupo, with first home buyers close behind. In Hamilton, salespeople report a lack of investors and developers.

“In Thames, open home attendance was poor, largely due to inaccessibility to the region from road closures caused by Cyclone Gabrielle. Taupo saw an increase in visitors to the region due to public and school holidays, which resulted in good openhome attendance.

“The Waikato market has been largely impacted by finance and the ability for buyers to secure it, higher interest rates as some people can no longer afford repayments, conditional sales which are slowing the market and adding to the length of time properties are taking to sell, and the upcoming election.

However, despite that, salespeople say there are signs of an improving market and that an election year generally creates a pause in the market and activity tends to pick up following the election — regardless of the outcome.” (REINZ)

The current Days to Sell of 55 days is much more than the 10-year average for April which is 39 days. There were 26 weeks of inventory in April 2023 which is 7 weeks more than the same time last year.

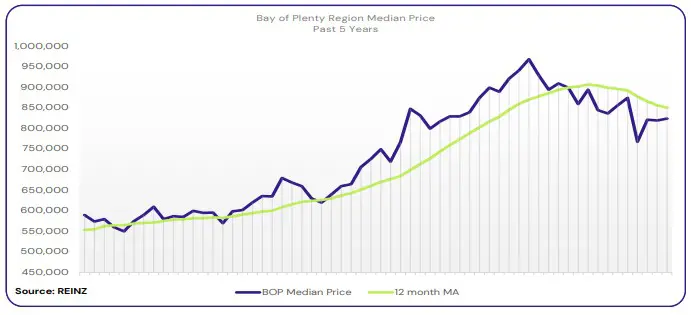

Regional Analysis - Bay of Plenty

Bay of Plenty’s median price was down 7.9% year-on-year in April to $824,500.

“First home buyers and owner occupiers were active in Rotorua and Tauranga, but investors remain quiet. Tauranga salespeople report high-end enquiry having slowed.

“Vendors are accepting market conditions and the amount of time properties are spending on the market is giving them solid evidence as to why they need to make sensible decisions when offers are presented.

“Rising interest rates, difficulty securing finance, a lower level of new listings, and uncertainty around both local and global economic conditions are having an impact on the Bay of Plenty’s market. Sales counts continue to ease year-on-year (-10.1%) and properties are spending an additional 15 days on the market than they were this time a year ago.” (REINZ)

The current Days to Sell of 56 days is much more than the 10-year average for April which is 42 days. There were 25 weeks of inventory in April 2023 which is 5 weeks more than the same time last year.

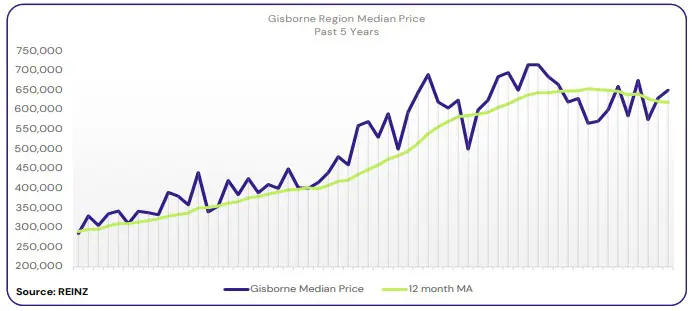

Regional Analysis - Gisborne

Gisborne’s median price decreased 5.1% annually to $650,000.

“Unlike most regions in April, Gisborne saw an increase in its sales counts — up 10.0% year-on-year. However, the sample size was relatively small from 30 properties sold in April 2022 to 33 properties sold in April this year.

“Auctions remain a popular method of sale for the region with 28.1% of sales by auction. Rising interest rates, fear of overpaying, and the cost of living are contributing to a slower market pace throughout the region — the median days to sell was up 8 days year-on-year.” (REINZ)

The current Days to Sell of 49 days is much more than the 10-year average for April which is 38 days. There are 12 weeks of inventory in April 2023 which is 6 weeks less than last year.

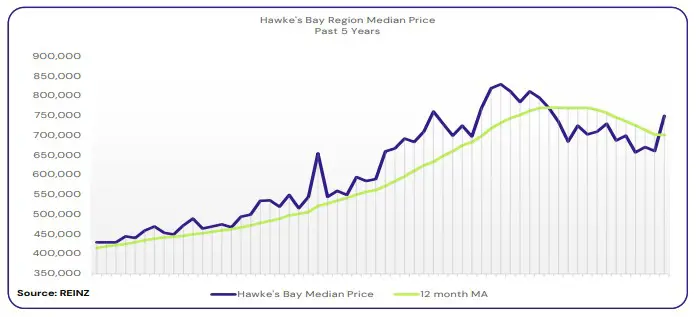

Regional Analysis - Hawke's Bay

Hawke’s Bay saw a 2.6% decrease in median price in April to $750,000.

“First home buyers were a popular buyer group throughout the month, as well as those looking to upsize or downsize. “Vendors are more realistic about their price expectations and investors started to show some interest again. Hawke’s Bay also had an increase in its sales count — up 14.0% year-on-year.” (REINZ)

The current Days to Sell of 50 days is much more than the 10-year average for April which is 38 days. There were 18 weeks of inventory in April 2023 which is 3 weeks less than the same time last year.

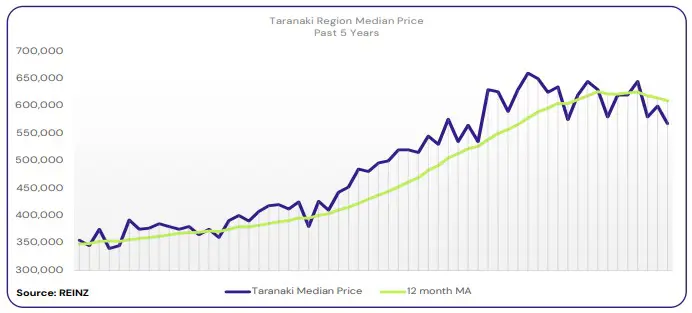

Regional Analysis - Taranaki

The median price in Taranaki was down 9.1% year-on-year to $568,000.

“Local salespeople say it was a noticeably quiet month for buyer activity across the board. This is largely due to lingering uncertainty, public holidays, and school holidays.

“Most vendors are realistic about their asking price and are aware that the days on the market have increased significantly recently. In April, the median days to sell was up 14 days annually, from 32 days to 46 days.

“Financial pressures including forecast rising interest rates and the increased cost of living are having the most significant impact on Taranaki’s housing market currently. Taranaki salespeople say that many buyers and vendors are holding off their property plans currently.” (REINZ)

The current Days to Sell of 46 days is more than the 10-year average for April which is 38 days. There were 22 weeks of inventory in April 2023 which is 8 weeks more than the same time last year.

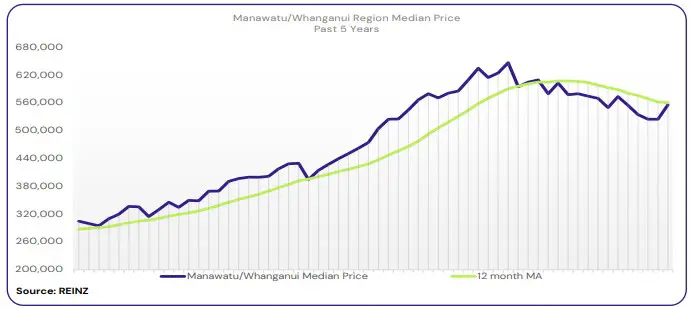

Regional Analysis - Manawatu/Whanganui

Manawatu/Whanganui’s median price decreased 4.1% year-on-year to $556,000.

“While owner occupiers remain active, first home buyers are struggling with the current loan-to-value ratios, rising interest rates, and house prices in general. Investors are sparse — there appears to be no incentive to purchase an investment property with continued rising interest rates and an absence of taxable support.

“Most vendors are meeting the market with their price expectations. New listings have attracted good open home attendance but there is a lack of urgency within buyers to make any purchasing decisions.” (REINZ)

The current Days to Sell of 43 days is more than the 10-year average for April which is 36 days. There were 21 weeks of inventory in April 2023 which is 2 weeks less than the same time last year.

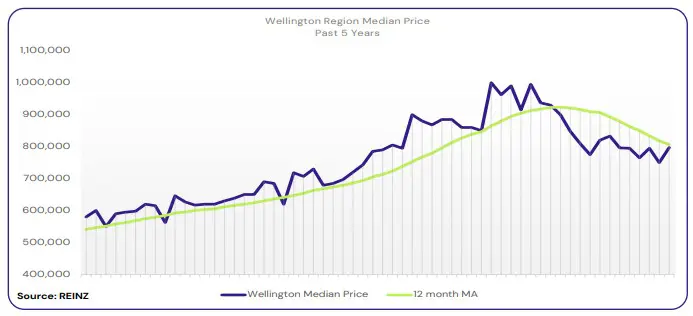

Regional Analysis - Wellington

The median price in the capital was down 14.3% year-on-year to $797,000.

“Owner occupiers remain the most dominant buyer pool — backed by equity, securing finance is less of a barrier.

“Sales counts continue to ease across the region — down 12.7% year-on-year as rising interest rates, cost of living, and the ability to secure finance are continuous challenges. New listings have seen a decrease, and subsequently, stock levels, which have decreased 25.0% year-on-year.” (REINZ)

The current Days to Sell of 52 days is much more than the 10-year average for April of 36 days. There were 17 weeks of inventory in April 2023 which is 4 weeks less than the same time last year.

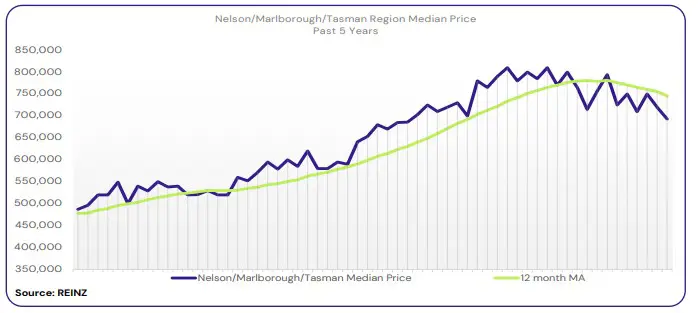

Regional Analysis - Nelson/Marlborough

The median price in Nelson, Tasman and Marlborough was down 9.4%, 13.3% and 19.2% to $693,000, $780,000 and $617,500 respectively.

“Owner occupiers were a popular buyer group, and in Nelson, first home buyers are showing more confidence — particularly with the recent changes to lending restrictions announced by the Reserve Bank.

“Marlborough salespeople say the market has slowed and the number of ‘subject to sale’ have increased significantly. However, sales counts did increase by 11.6% year-on-year. In Nelson, sales counts decreased by 30.1%, largely due to a lack of urgency within buyers and a fear of overpaying.” (REINZ)

The current Days to Sell of 56 days is much more than the 10-year average for April which is 35 days. There were 25 weeks of inventory in April 2023 which is 12 weeks more than the same time last year.

Regional Analysis - West Coast

The West Coast bucked the national trend with an 8.6% increase in its median price year-on-year to a new median price of $379,000. The Grey District reached a record median price of $398,000.

“Salespeople in the area say although market activity was subdued, this was not a concern nor uncommon given the public holidays throughout April. There were fewer contracts written, but steady enquiry with underlying confidence remaining in the market. Properties are still taking a lengthier time to sell than they were a year ago, with the median days to sell up 46 days annually.” (REINZ)

The current Days to Sell of 69 days is less than the 10-year average for April which is 76 days. There were 42 weeks of inventory in April 2023 which is 14 weeks more than the same time last year.

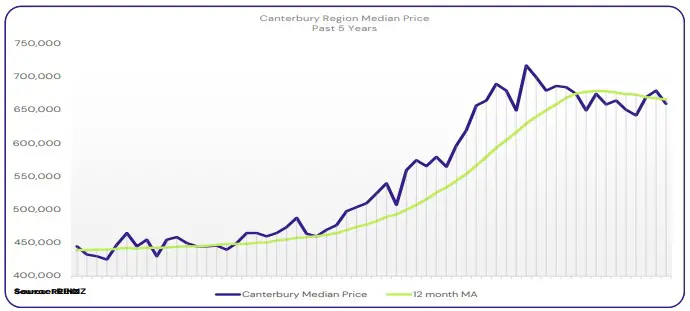

Regional Analysis - Canterbury

The median price in Canterbury decreased marginally by 2.9% year-on-year to $660,000 this April. The Ashburton District reached a record median price of $615,000.

“Local salespeople in Ashburton and Christchurch report owner occupiers as the most dominant buyer pool in the market, whereas in Timaru they have eased back, and first home buyers have taken a step forward.

“Open home attendance was satisfactory and homes in good locations have attracted great interest — more so than at the beginning of the year. Rising interest rates are still a concern of many, but Christchurch salespeople say they feel the market has adjusted and buyers are still making decisions.

“News of the Reserve Bank easing loan-to-value restrictions has been welcome news and there was good attendance in the auction rooms — 15.5% of sales in April were by auction.” (REINZ)

The current Days to Sell of 37 days is more than the 10-year average for April which is 33 days. There were 19 weeks of inventory in April 2023 which is 6 weeks more than the same time last year.

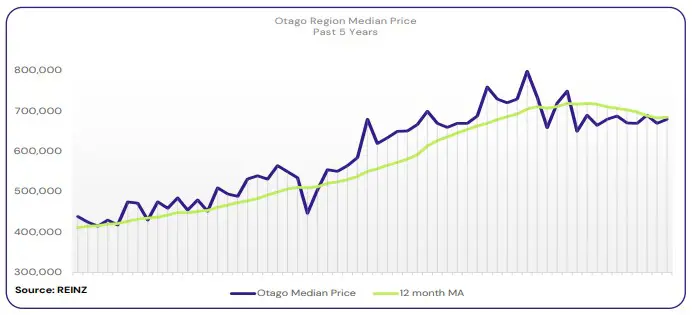

Regional Analysis - Otago

Dunedin City: Dunedin saw its median price decrease 9.7% annually to $570,000 in April this year.

“Local salespeople report first home buyers are more active in the market and vendors are more realistic with price expectations.

“Open home attendance was satisfactory, with first home buyers now joined by owner occupiers wanting to downsize.

“For the first time in a while, sales counts increased marginally by 1.6% when compared to April 2022.” (REINZ)

Queenstown Lakes: The median price in the Queenstown Lakes District had a 15.5% increase year-on-year to $1,120,000 in April 2023.

“Owner occupiers are the most active buyer pool — those who are cashed up are in the best position to buy.

“Open homes were quiet over April, although this is expected due to public holidays like Easter and ANZAC day. Despite this, buyer interest in the region remains constant, especially from the North Island due to the desirability of Queenstown and its lifestyle offerings. Local salespeople say that tourism in the region is booming, the building sector is busy, and this bodes well for good momentum going into the winter months.” (REINZ)

The current Days to Sell of 51 days is much more than the 10-year average for April which is 35 days. There were 18 weeks of inventory in April 2023 which is the same as the same time last year.

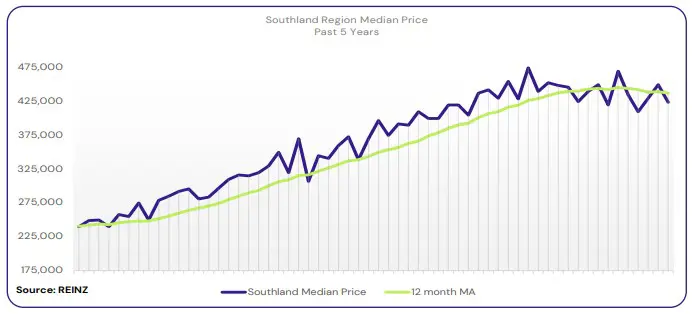

Regional Analysis - Southland

The median price in Southland had a 6.4% decrease when compared to this time last year, with a new median price of $424,000 for April 2023.

“Local salespeople say buyers have been slow to act due to rising interest rates and people’s ability to secure finance. To add, buyers still very much have a fear of overpaying.

“Sales counts in the region were down 6.5% year-on-year, and properties are still spending a longer amount of time on the market than they were last April — up 12 days annually.” (REINZ)

The current Days to Sell of 50 days is much more than the 10-year average for April which is 36 days. There were 21 weeks of inventory in April 2023 which is 1 week more than the same time last year.

Browse

Topic

Related news

Find us

Find a Salesperson

From the top of the North through to the deep South, our salespeople are renowned for providing exceptional service because our clients deserve nothing less.

Find a Property Manager

Managing thousands of rental properties throughout provincial New Zealand, our award-winning team saves you time and money, so you can make the most of yours.

Find a branch

With a team of over 850 strong in more than 88 locations throughout provincial New Zealand, a friendly Property Brokers branch is likely to never be too far from where you are.