Market Momentum Builds as Sales Rise and Days to Sell Drop - REINZ stats September 2025

Tuesday, 14 October 2025

Market Momentum Builds as Sales Rise and Days to Sell Drop

New data released today by the Real Estate Institute of New Zealand (REINZ) show that sales counts increased nationwide, while national median prices eased slightly compared to September 2024.

Increased sales were recorded across the country during the month. National sales were up 3.1% year-on-year to 6,346 sales, and New Zealand, excluding Auckland, saw a rise of 7.5%, to 4,421. Eleven regions recorded increased sales year-on-year, with the most notable percentage increases recorded in the West Coast (up 56.0% to 39 sales), Marlborough (up 37.1% to 85 sales), and Nelson (up 32.0% to 66 sales).

Month-on-month data reveals a slight uptick in activity at the national level. However, when adjusting for seasonal patterns, we see a subtle slowdown in overall momentum, resulting in a 2.5% decline in sales nationally. The national median days to sell declined by six days year-on-year, reaching 43 days. This was the same for New Zealand, excluding Auckland. The largest decrease in median days to sell was recorded in Nelson, down 19 days from 51 to 32. The highest year-on-year increase in median days to sell was on the West Coast, rising from 31 to 76 days.

“This month’s higher sales counts contributed to a six-day reduction in the national median days to sell. Some regions bucked this trend; the West Coast and Marlborough saw longer selling times, potentially reflecting the completion of sales for properties that had been on the market for an extended period,” says REINZ Chief Executive Lizzy Ryley. New Zealand’s median price decreased by 1.5% year-onyear, to $770,000. Excluding Auckland, the median price decreased by $5,000 (-0.7%) year-on-year to $690,000.

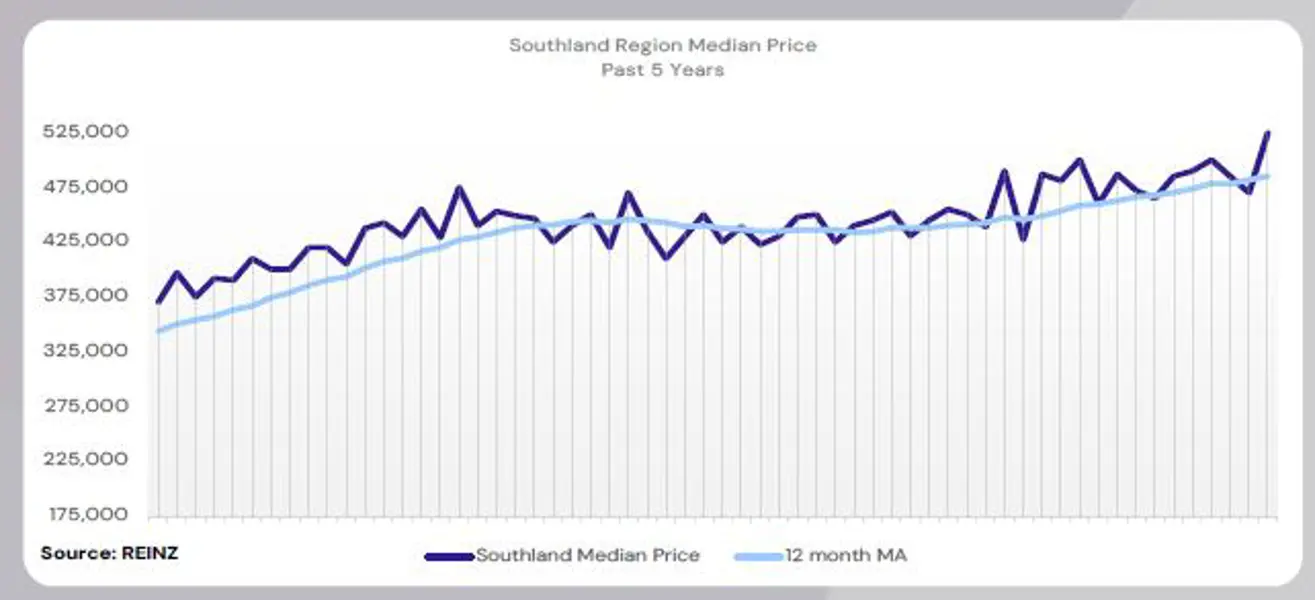

Ten out of the sixteen regions reported an increase in median prices year-on-year. Auckland’s median price increased by 0.8% year-on-year, to $978,000. Two regions hit record-high median prices: the West Coast, up 14.6% year-on-year to $447,000, and Southland, up 7.8% year-on-year to reach $525,000.

“This is the first time since January of this year that there has been any record regional median price, and the first time in over three years that two or more regions had record median prices,” says Ryley. “This shows renewed confidence in parts of the property market, where local conditions and sustained demand are driving price growth despite a national-level balance.” There was an increase in new listings recorded around the country, with New Zealand up 1.3% year-on-year to 9,394. New Zealand, excluding Auckland, also recorded an increase, up 1.7% year-on-year to 6,068. Inventory levels reached 30,721 properties on the market across New Zealand, representing a 2.3% year-on-year increase.

“Some local salespeople are reporting a noticeable lift in activity across the market, with first-home buyers and owner-occupiers still the most active participants,” says Ryley. “With the recent OCR drop of 50 basis points likely to influence further interest rate reductions, combined with the usual spring rush, salespeople are cautiously optimistic that activity will strengthen further through spring and into summer."

September’s auction sales reached 889 nationally, which was 14.0% of all sales. For New Zealand, excluding Auckland, there were 435 auction sales, which were 9.8% of all sales. Auction sales in Auckland have increased both year-on-year and month-on-month, with 454 sales, representing 23.6% of all sales.

The House Price Index (HPI) for New Zealand is at 3,606, indicating a year-on-year increase of 0.2% and a month-on-month increase of 0.8%. Over the past five years, New Zealand’s average annual growth rate in the HPI has been 2.8%. (REINZ)

Regional highlights:

- The West Coast saw the largest increase in sales year-on-year, up 56.0% to 39 sales, up from 25. The largest year-on-year decrease in sales was observed in Hawke’s Bay, down 22.1% from 222 to 173 sales in September.

- Ten regions saw a year-on-year increase in median prices. The West Coast led the way with a 14.6% increase, from $390,000 to $447,000 – a record high for the region.

- Taranaki saw the largest decline in median price year-on-year, down 9.1% from $612,000 to $556,500.

- Ten regions reported an increase in listings compared to last year. The top two percentage increases were: West Coast, up 57.1% to 77 listings, and Southland, up 9.4% to 209 listings.

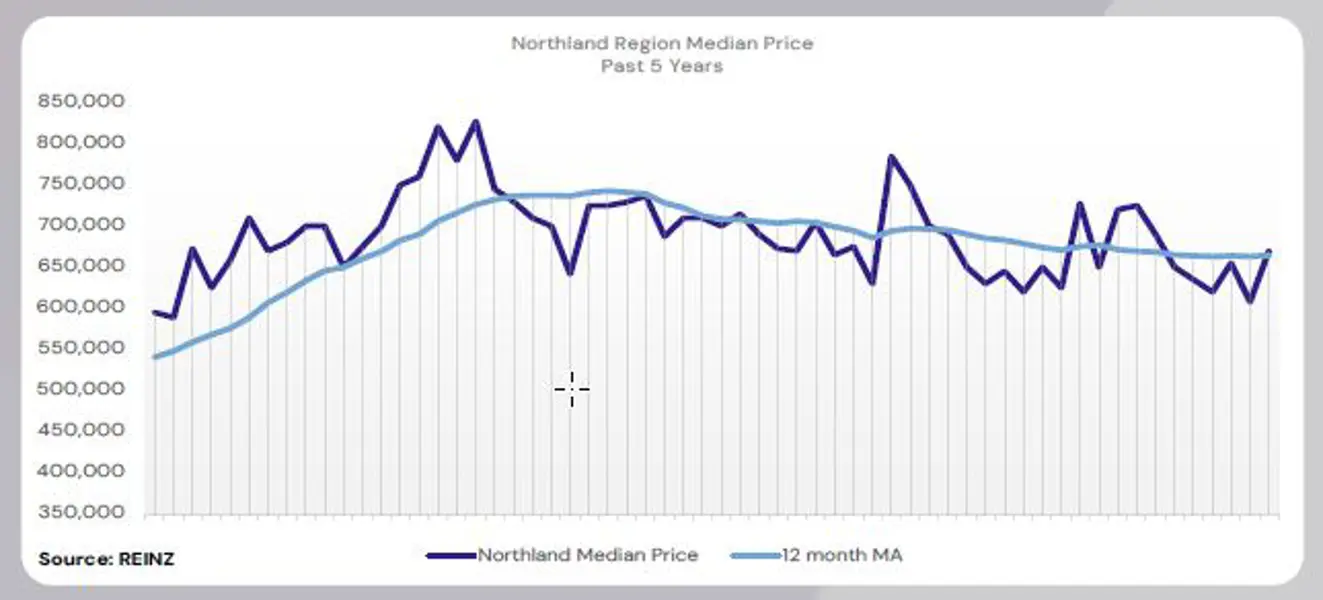

Regional Analysis - Northland

The median price for Northland increased by 3.1% year-on-year to $670,000

“Investors and owner-occupiers were the most active buyer groups, with a slight decrease in first home buyer enquiries reported across the region. Most vendors met market expectations regarding pricing their properties, recognising that to sell, they need to meet demand. Attendance at open homes varied across Northland, with some properties seeing high numbers, only to drop significantly the following weekend. The auction rooms saw a good level of active bidders on most properties.

Factors such as increased confidence, easing rental rates, and a shift towards a balanced market all influenced market sentiment. Local salespeople predict that the next few months will continue to be steady, with the warmer weather improving positivity among buyers and sellers.” (REINZ)

The current median Days to Sell of 58 days is more than the 10-year average for September which is 54 days. There were 38 weeks of inventory in September 2025 which is 6 weeks less than the same time last year.

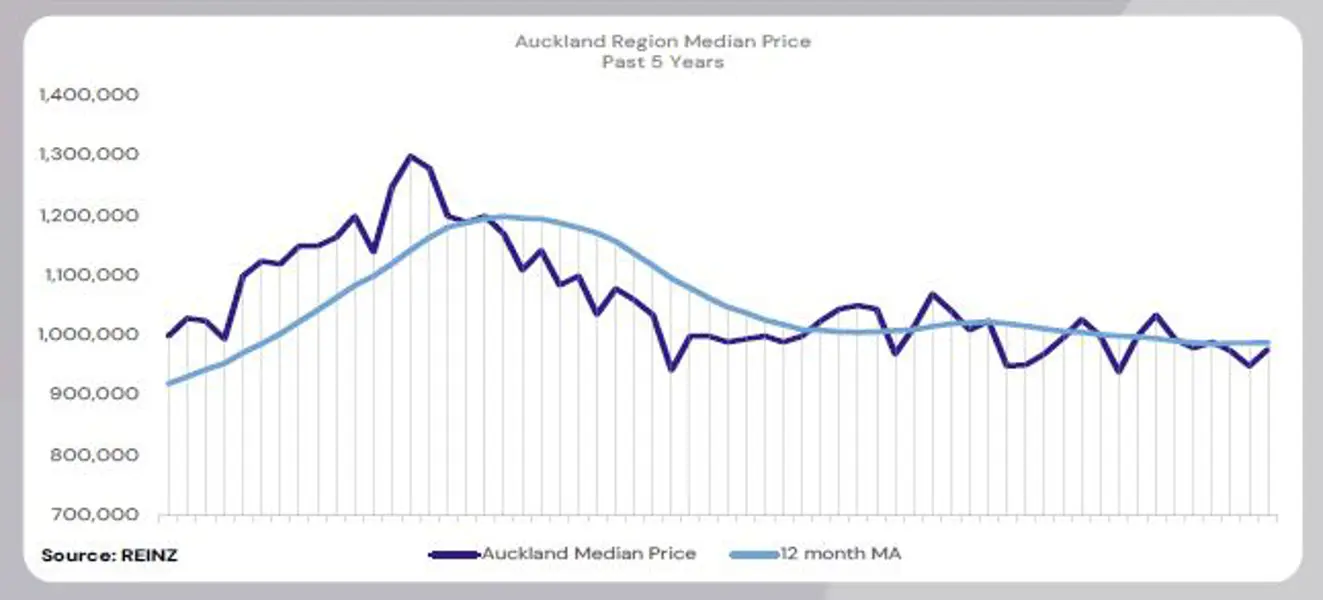

Regional Analysis - Auckland

The median price for Auckland increased by 0.8% year-on-year to $978,000

“The most active buyer groups were first home buyers, investors and owner-occupiers. Vendor expectations around asking prices are increasingly aligning with what buyers are willing to pay, reflecting a growing acceptance of current market values.

Attendance at open homes was generally good, especially for new listings. However, new builds saw a decline in attendees. Auction room attendance and clearance rates improved over the month. Factors such as increased stock availability, lower interest rates, rising positivity and optimism, and seasonal changes influenced market sentiment and activity. Local salespeople are cautiously optimistic that confidence amongst all buyers will increase in the coming months, which might lead to increased sales.” (REINZ)

The current median Days to Sell of 43 days is more than the 10-year average for September which is 40 days. There were 31 weeks of inventory in September 2025 which is 2 weeks more than the same time last year.

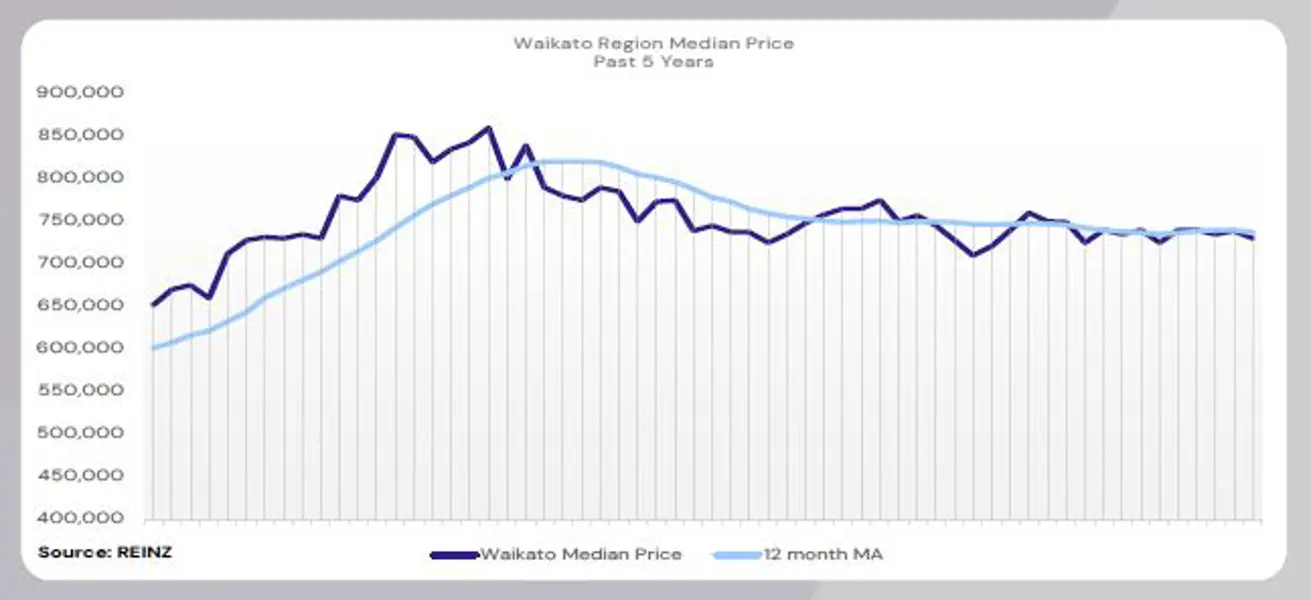

Regional Analysis - Waikato

Waikato’s median price decreased by 3.9% year-onyear to $730,000

“All buyer groups were active in Waikato. Some vendors were realistic regarding the asking price, while others, especially those with older listings, held firm on their original price expectations, and were reluctant to reduce it. Attendance at open homes varied, with some listings seeing higher numbers than others, while some opted for private viewings. Auction room activity improved over the month, with an increased number of properties marketed by auction and more attendees.

Factors such as increased confidence among buyers and sellers, anticipation of a busy spring, and more achievable financing conditions for those in a position to purchase influenced market sentiment. Local salespeople predict that the next few months will likely continue to improve in terms of activity and sales, but it is dependent on the levels of stock coming to market.” (REINZ)

The current median Days to Sell of 44 days is more than the 10-year average for September which is 40 days. There were 22 weeks of inventory in September 2025 which is 8 weeks less than the same time last year.

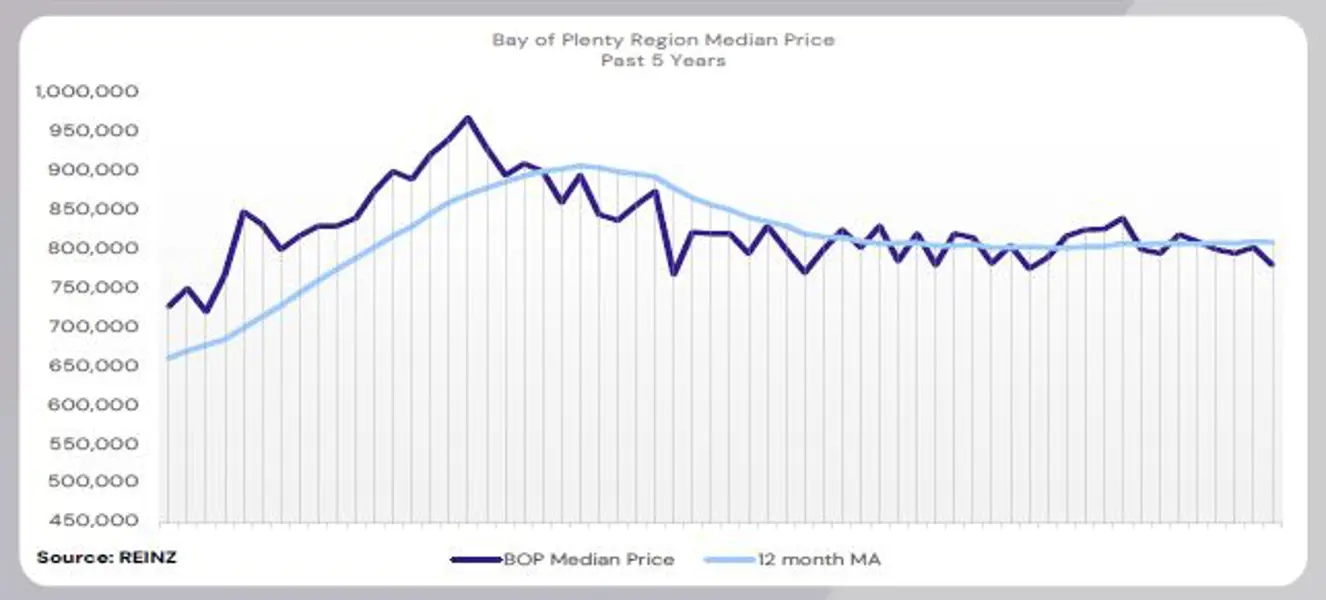

Regional Analysis - Bay of Plenty

The median price for the Bay of Plenty decreased by 1.3% year-on-year to $780,000

“Investors and first home buyers were the most active buyer groups across the region. Some vendors were realistic regarding their asking prices; they listened to advice and understood current market conditions. Attendance at open homes was good for the first couple of weeks for new listings, tapering off later in the campaigns. Auction activity lifted, with an increase in the number of attendees, active bidders, and clearance rates, and more properties expected to sell under the hammer in the coming months.

Market sentiment was influenced by the move into spring and the lowering of interest rates, and some buyers sought a bargain. Local salespeople predict that the next few months will track consistently and that there might be more listings to come to the market.” (REINZ)

The current median Days to Sell of 44 days is the same as the 10-year average for September which is 44 days. There were 25 weeks of inventory in September 2025 which is 2 weeks less than the same time last year.

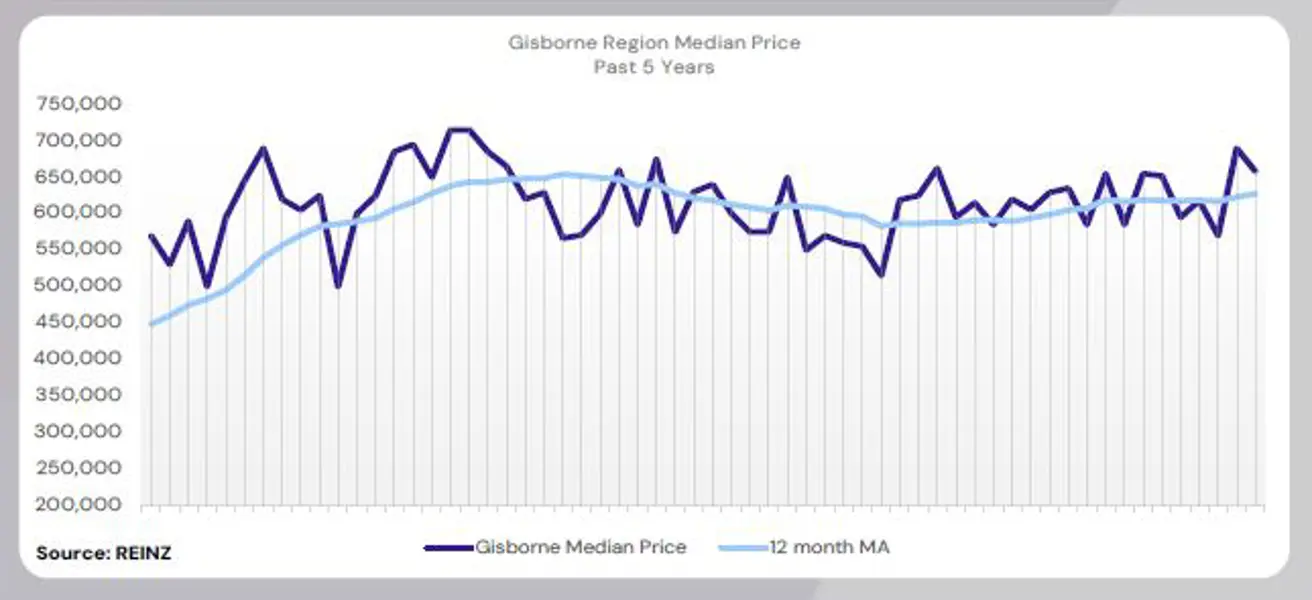

Regional Analysis - Gisborne

Gisborne’s median price increased by 8.7% year-on-year to $658,000

“Owner-occupiers and first home buyers were the most active buyer groups. Reports indicate fewer investor enquiries. Most vendors were realistic regarding their asking prices and met market expectations, as competition increased and new properties come on the market. Attendance at open homes increased steadily over the last few months, as more buyers start to look as the weather warms.

Factors such as declining interest rates, increased positivity, a shift towards a more balanced market, and the transition from winter to spring influenced market sentiment. Local salespeople predict that the next few months will bring more listings, which is usual for spring, and more sales leading up to Christmas.” (REINZ)

The current median Days to Sell of 48 days is much more than the 10-year average for September which is 37 days. There are 17 weeks of inventory in September 2025 which is 5 weeks more than last year.

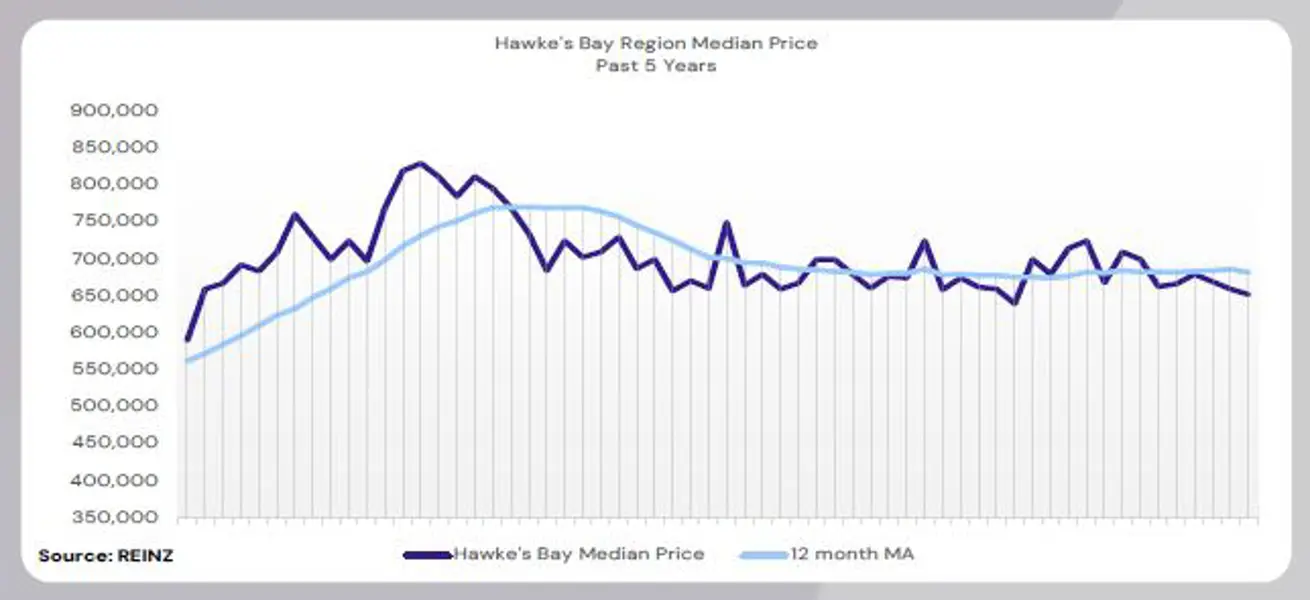

Regional Analysis - Hawke's Bay

Hawke’s Bay’s median price decreased by 6.8% year-on-year to $652,500

“The most active buyer groups in the Hawke’s Bay region were first-home buyers and owner-occupiers looking to downsize. Most vendor expectations were realistic in terms of asking price, with some hoping for higher prices. Attendance at open homes was good, increasing compared to other months. Market sentiment was influenced by declining interest rates, the arrival of spring, and stock levels.

Local salespeople suggest that the local property market will only continue to improve in the coming months.” (REINZ)

The current median Days to Sell of 43 days is more than the 10-year average for September which is 38 days. There were 17 weeks of inventory in September 2025 which is 6 weeks less than the same time last year.

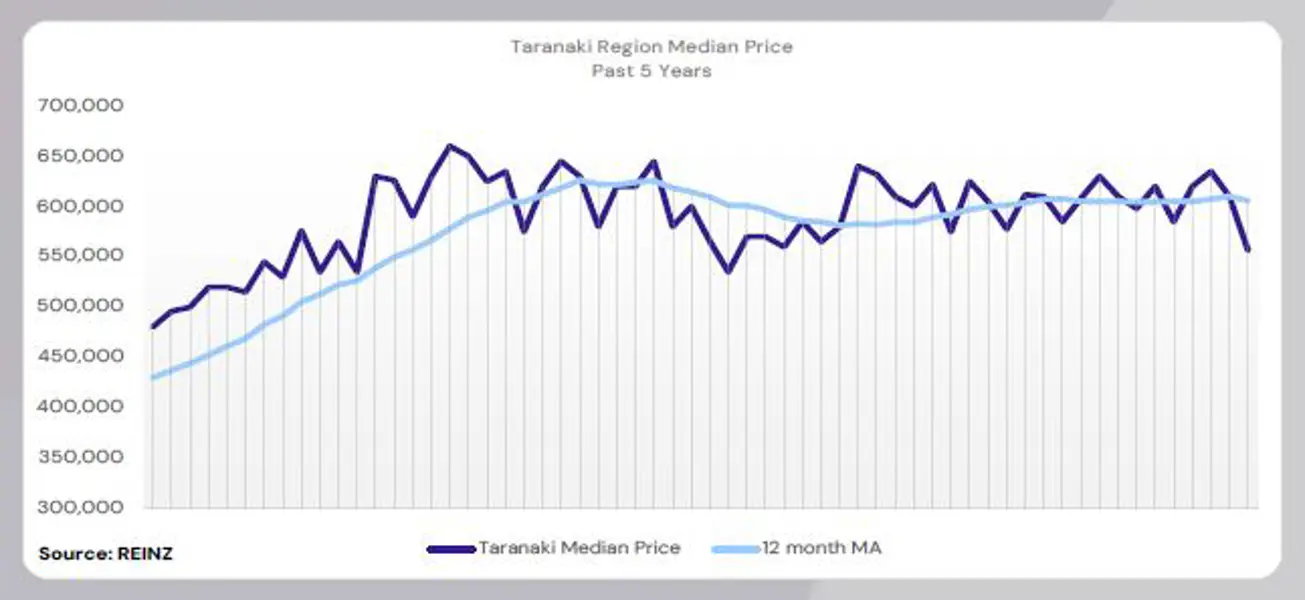

Regional Analysis - Taranaki

Taranaki’s median price decreased by 9.1% year-on-year to $556,500

“Owner-occupiers with properties to sell continue to be the most active buyer group in Taranaki. Local salespeople comment that after a slow start to September, a flurry of activity was recorded later in the month, with no signs of that slowing down. Most vendors set realistic price expectations, as prices across the region held relatively steady throughout 2025. Open homes continued to be well-attended, as there’s an excellent range of homes for buyers to view. Sales appear to be gradually improving and have increased compared to September 2024.

Market sentiment was influenced by the local market being a buyer’s market, with high listings and buyers making offers early in the campaign. However, sales of residential development land took longer than anticipated. Local salespeople predict that the next few months will bring more buyers to the market, leading up to summer, and talk of further interest rate reduction should add further momentum.” (REINZ)

The current median Days to Sell of 45 days is more than the 10-year average for September which is 37 days. There were 21 weeks of inventory in September 2025 which is 1 week less than the same time last year.

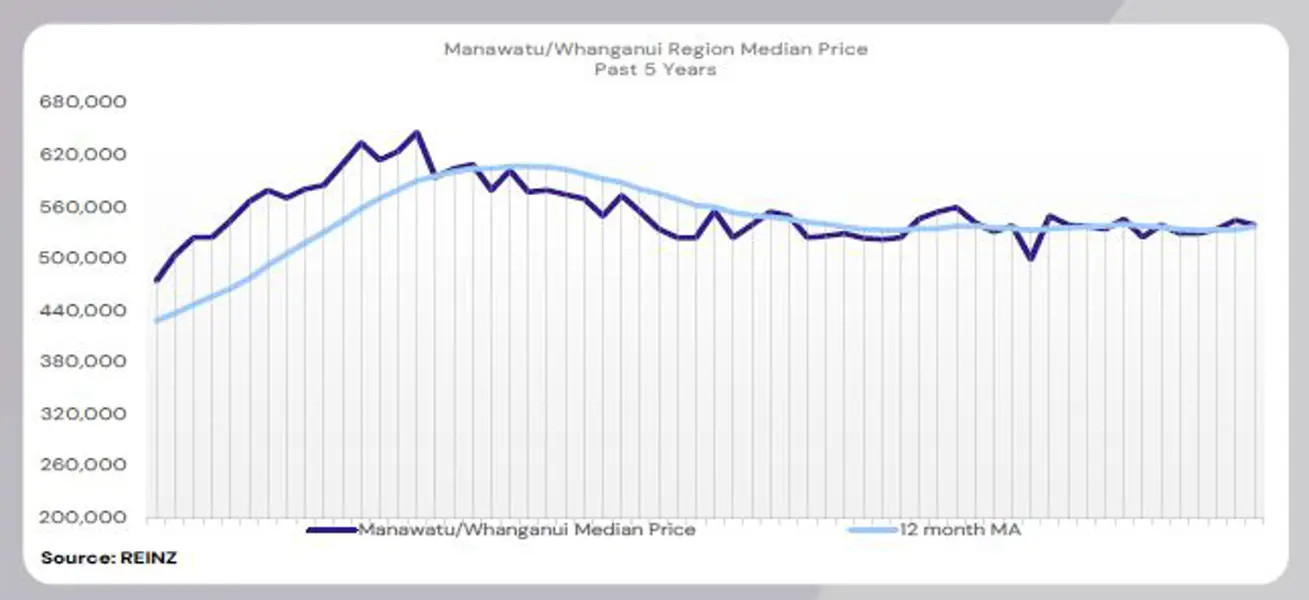

Regional Analysis - Manawatu/Whanganui

The median price for Manawatu/Whanganui increased by 8.0% year-on-year to $540,000

“Owner-occupiers and first home buyers were the most active groups, with a few investors also looking for bargains. However, local salespeople state that investor enquiries were still few and far between. Some vendors’ expectations regarding the asking price were above market value, which meant their property stayed on the market while other listings around them sold. Attendance at open homes was good for newer listings and for those considered well-priced. Older listings continue to sit on the market unless vendors make price adjustments.

Auction rooms saw little in attendance and little competitive bidding. More sales were secured after the auction, rather than under the hammer. Market sentiment remained largely unchanged compared to the previous months. Lowered interest rates brought more confidence, but job security and cost-of-living pressures were major concerns for buyers. Local salespeople cautiously predict that there could be a lift in market activity (sales, listings) in the coming months.” (REINZ)

The current median Days to Sell of 38 days is more than the 10-year average for September which is 37 days. There were 22 weeks of inventory in September 2025 which is 4 weeks less than the same time last year.

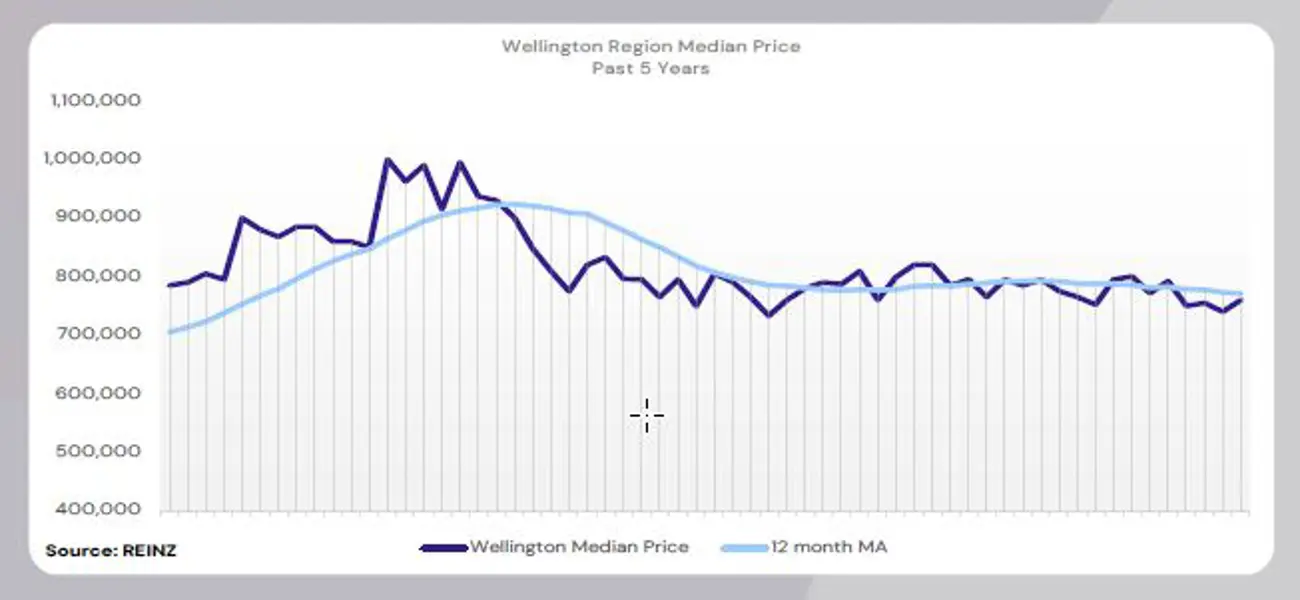

Regional Analysis - Wellington

Wellington’s median price decreased by 3.2% year-on-year to $760,000

“First home buyers were the most active buyer group, with reports of fewer investors present. Some vendors were starting to push for higher prices due to the time of year, which made their expectations unrealistic. Attendance at open homes has been strong for newly listed properties but tends to decline after the initial viewings.

Market sentiment is being shaped by the growing number of townhouse developments and the rising volume of property listings, many of which are not attracting the anticipated interest. Local salespeople remain hopeful that stock levels will decrease, but the primary challenge for buyers continues to be cash flow constraints. This dynamic is expected to influence market activity in the coming months.” (REINZ)

The current median Days to Sell of 49 days is much more than the 10-year average for September of 38 days. There were 16 weeks of inventory in September 2025 which is 2 weeks more than the same time last year.

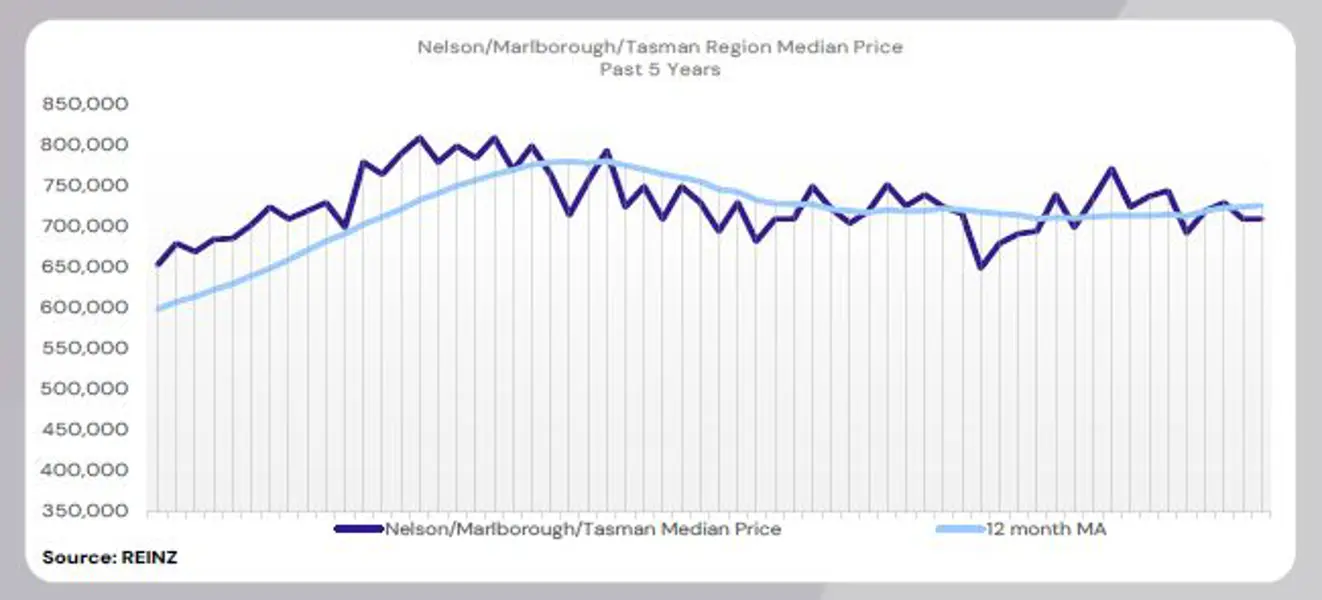

Regional Analysis - Nelson/Tasman/Marlborough

The median price for Nelson increased by 9.1% year-on-year to $720,000. The median price for Marlborough decreased by 4.4% year-on-year to $650,000. The median price for Tasman increased by 4.0% year-on-year to $780,000

“First home buyers were the most active buyer group, with an increased number of investor enquiries reported in Blenheim. Most vendors maintained realistic expectations regarding asking prices and demonstrated a clear awareness of the competitive landscape. Access to readily available market information helped vendors align their pricing strategies. Attendance at open homes varied across the region, with weather being the biggest influence.

Market sentiment was influenced by increased positivity, reduced interest rates, higher stock levels, the perception of a buyer’s market, concerns about job security, and ongoing cost-of-living pressures. Local salespeople are cautiously optimistic that the change of seasons is likely to increase activity in both sales and rentals. However, for the region, the upcoming months coincide with a popular period for seasonal work and holidays, which is expected to cause a slight slowdown.” (REINZ)

The current median Days to Sell of 43 days is more than the 10-year average for September which is 38 days. There were 21 weeks of inventory in September 2025 which is 6 weeks less than the same time last year.

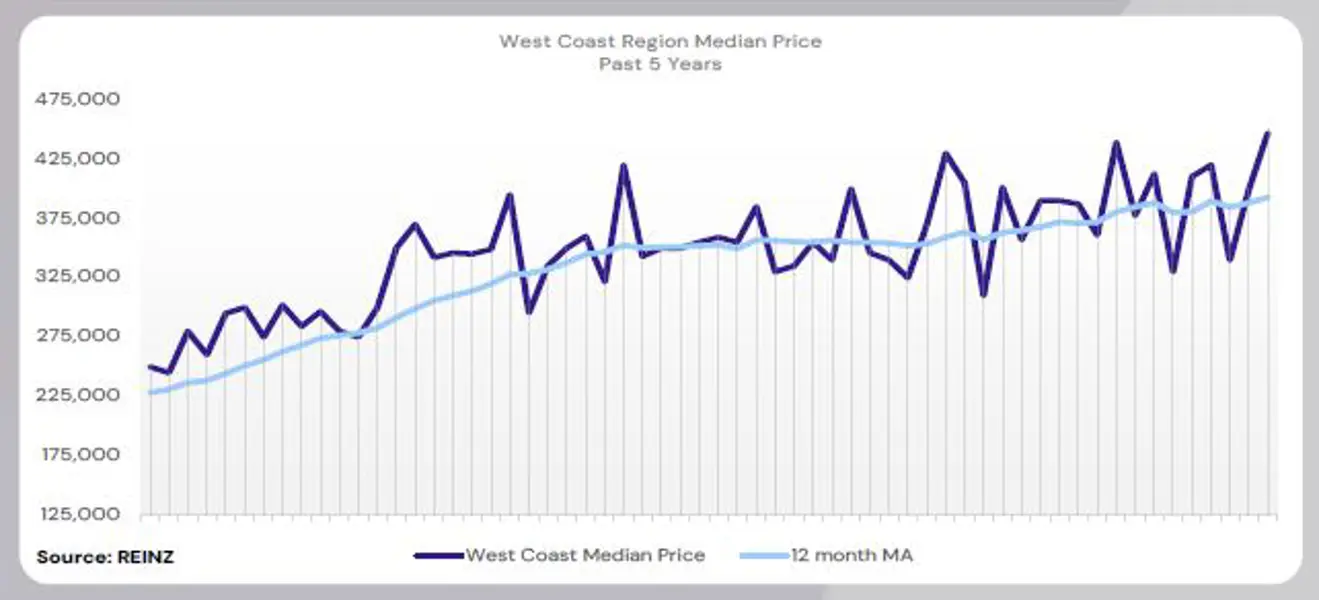

Regional Analysis - West Coast

West Coast’s median price increased by 14.6% year-on-year to $477,000 – a record high for the region

“Owner-occupiers looking to upgrade from their previous property were the most active buyer group. Local salespeople reported a decline across all buyer groups, due to cost-of living pressures and the fear of overpaying. Most vendors met market expectations regarding property prices. Attendance at open homes varied depending on the property, with a general downward trend. Local salespeople described the market as flat, with an abundance of choice and buyers searching for bargains.

The perception of a flat market, the presence of older stock, and challenges faced by buyers who were unable to secure insurance, which in turn impacted lending, all influenced market sentiment. Local salespeople suggested that the market might improve slightly in the coming months, as new jobs in the mining sector were expected to become available, providing buyers with the confidence needed to proceed with a purchase.” (REINZ)

The current median Days to Sell of 76 days is more than the 10-year average for September which is 71 days. There were 44 weeks of inventory in September 2025 which is 5 weeks more than the same time last year.

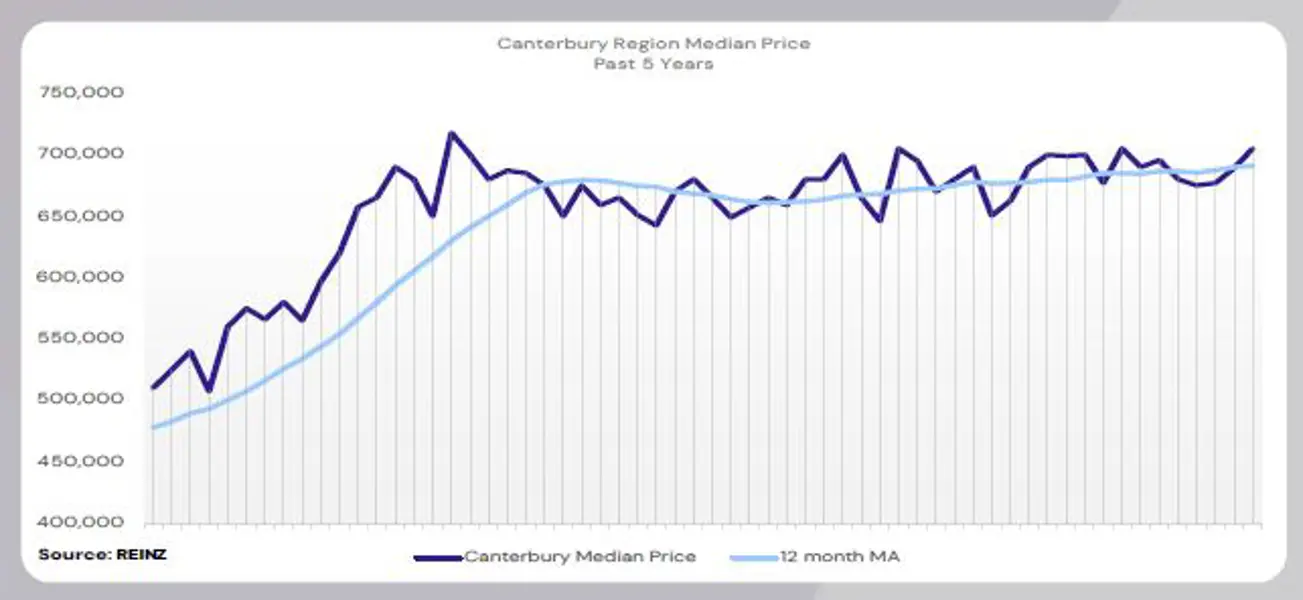

Regional Analysis - Canterbury

The median price for Canterbury increased by 2.2% year-on-year to $705,000

“Owner-occupiers and first home buyers were the most active buyer groups across the region, with local agents reporting fewer enquiries from investors and overseas buyers. Most vendors met market expectations regarding the asking price and were motivated by what has been reported about the market. However, vendors of higher-end properties had to lower prices to meet buyer demand. Attendance at open homes was steady, although the school holidays towards the end of September saw lower attendee numbers.

Auction rooms were relatively busy, with a few people in attendance per property. If the property was not sold under the hammer, negotiations took place shortly after. Local salespeople suggest that auction campaigns will build well over the next few months. Factors like increased optimism and positivity, lack of buyer urgency due to the number of properties available, and motivated vendors influenced market sentiment. Local salespeople cautiously predict that towards the end of the year, there may be a “spring rush” that might bring a sales surge; however, this depends on listing numbers and if the numbers will continue to rise.” (REINZ)

The current median Days to Sell of 40 days is more than the 10-year average for September which is 36 days. There were 14 weeks of inventory in September 2025 which is 2 weeks less than the same time last year.

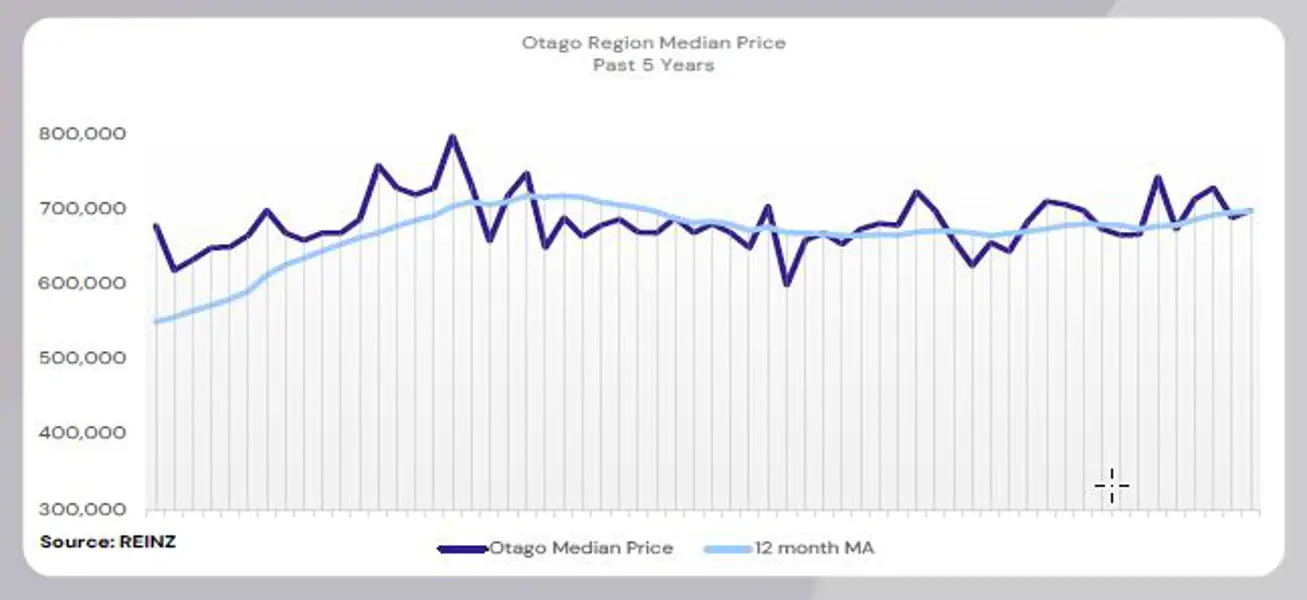

Regional Analysis - Otago

“Dunedin’s median price increased by 2.0% year-on-year to $615,000

All buyer types were active across the region, with increased investor activity as well. Vendor expectations were realistic regarding asking price, as the market is relatively steady. Attendance at open homes was high for new listings, but interest declined after the second weekend. Good results were recorded in the auction room, and if not sold under the hammer, it was post-auction.

Market sentiment remained largely unchanged from previous months, with steady conditions prevailing. The prospect of lower interest rates was particularly encouraging for first-home buyers. Local salespeople predict that over the spring period and moving to summer, there will be an increase in listings and buyer activity, which may mean prices are likely to stay steady through to Christmas.” (REINZ)

Queenstown Lakes

“First home buyers were the most active, although investors were cautiously optimistic about the local market, and enquiries increased. Most vendor expectations, in terms of asking price, were ahead of the market. Spring brought an increase in listings, and the majority of open homes saw a rise in attendance. As interest rates continue to decline, buyer enquiries have increased.

Auction room attendance and clearance rates were reasonable, although they came with challenges. However, if it didn’t sell under the hammer, it was likely to sell within a few days following the auction. Factors like increased market confidence, increased job opportunities, and cautious optimism include market sentiment, although there wasn’t much of a bit shift. Over the next few months, local salespeople cautiously predict an increase in enquiries and more sales. They state that the local market has certainly turned a corner from a sluggish winter period. If interest rates drop further, that might lead to more activity.” (REINZ)

The current median Days to Sell of 48 days is more than the 10-year average for September which is 38 days. There were 18 weeks of inventory in September 2025 which is the same as the same time last year.

Regional Analysis - Southland

The median price for Southland increased by 7.8% year-on-year to $525,000 – a record high for the region

“The most active buyer group in Southland was first-home buyers. There were reports of a decline in investor enquiries, as they were waiting for further rate cuts. Most vendors met market expectations regarding price due to limited stock, which resulted in strong buyer activity – a trend also observed in attendance at open homes. Auction room activity was a little patchy, but well-presented properties received high interest, as did small development properties with subdivision potential.

Factors such as stock shortages, stable prices, reduced rates, and strong buyer demand influenced market sentiment. Local salespeople are cautiously optimistic that there will be more positivity as we move into spring and summer.” (REINZ)

The current median Days to Sell of 35 days is more than the 10-year average for September which is 32 days. There were 15 weeks of inventory in September 2025 which is 4 weeks less than the same time last year.

Browse

Topic

Related news

Find us

Find a Salesperson

From the top of the North through to the deep South, our salespeople are renowned for providing exceptional service because our clients deserve nothing less.

Find a Property Manager

Managing thousands of rental properties throughout provincial New Zealand, our award-winning team saves you time and money, so you can make the most of yours.

Find a branch

With a team of over 850 strong in more than 88 locations throughout provincial New Zealand, a friendly Property Brokers branch is likely to never be too far from where you are.