Regional Rental Review: Grey District

Friday, 14 November 2025

By continuing, you agree to our terms of use and privacy policy

Instructions on how to reset your password will be sent to the email below.

Your password reset link has been sent. Please check your inbox and follow the instructions provided.

Want your property SOLD? There is no better opportunity this summer! Our Bid Day Out auction is geared to get you more!

Friday, 14 November 2025

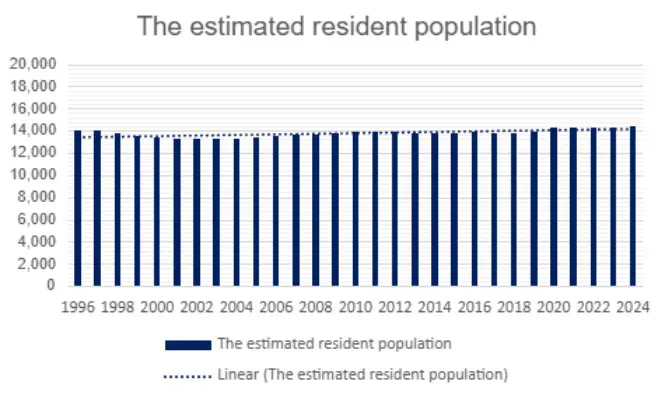

Nestled on the West Coast of New Zealand’s South Island, the Grey District is a region steeped in history and natural beauty. Historically, its economy was driven by coal mining and gold extraction, industries that shaped the character of towns like Greymouth. Today, while mining still plays a role, the district has diversified into tourism, forestry, and agriculture, leveraging its rugged landscapes and proximity to the Tasman Sea. With a population of around 14,400, Grey District remains a small but resilient community, offering affordable housing and strong rental returns compared to many other regions.

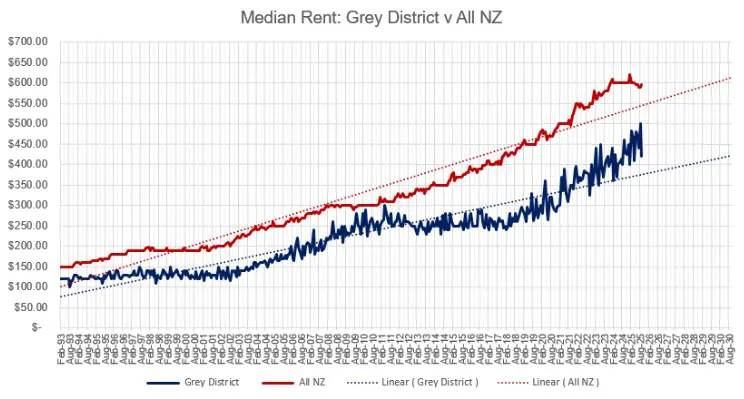

As of September 2025, the median weekly rent in Grey District is $420, marking a steady increase over the past two years. This growth reflects a tightening rental market, driven by limited housing supply and consistent demand from both locals and newcomers attracted by lifestyle and affordability.

Key Figures (As of September 2025):

• Median Rent: $420 per week

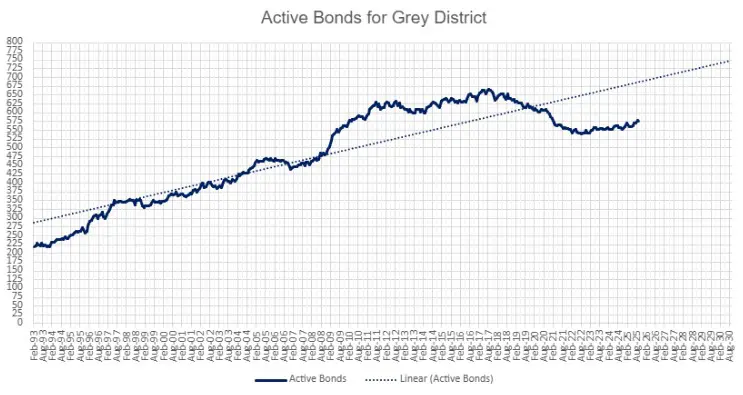

• Active Bonds (proxy for rental stock): 576

• Median Sales Price: $515,000

The West Coast, including Grey District, continues to rank among the best regions in New Zealand for rental yields. Shrewd investors can obtain yields of up to 7% and are seeing returns that significantly outperform major urban centres like Auckland or Wellington, where yields often hover around 3–4%.

Rents have continued to grow unlike many locations in New Zealand which have seen rents reduce.

Rental stock stays relatively tight. Active bonds indicate a modest pool of properties, and new supply is constrained by slower construction activity compared to larger regions. Demand is supported by stable population trends and a growing interest in lifestyle relocations. While Grey District’s population growth is modest, it has remained steady over decades, avoiding the volatility seen in some rural areas.

2024, reflecting slow but consistent growth. This stability underpins rental demand and reduces vacancy risk for landlords. Over the last 12 months, ending September 2025, there is an average of 15.5 bonds lodged every month whilst 14.5 bonds are being closed.

• High Yields: Grey District offers some of the strongest returns in the country.

• Affordable Entry Point: Median property values remain low compared to national averages.

• Lifestyle Factor: Coastal living, natural attractions, and a slower pace of life attract tenants and buyers alike.

Want to know more about Property Brokers' superior property management service? Check out our FREE guide here!

Read more

From the top of the North through to the deep South, our salespeople are renowned for providing exceptional service because our clients deserve nothing less.

Managing thousands of rental properties throughout provincial New Zealand, our award-winning team saves you time and money, so you can make the most of yours.

With a team of over 850 strong in more than 88 locations throughout provincial New Zealand, a friendly Property Brokers branch is likely to never be too far from where you are.