Median house prices for NZ excl Auckland increased by 32.3% from May 2020 - REINZ stats May 2021

Wednesday, 16 June 2021

Median prices for residential property across New Zealand increased by 32.3% from $620,000 in May 2020 to $820,000 in May 2021, according to the latest data from the Real Estate Institute of New Zealand (REINZ).

Median prices for residential property across New Zealand increased by 32.3% from $620,000 in May 2020 to $820,000 in May 2021, according to the latest data from the Real Estate Institute of New Zealand (REINZ), source of the most complete and accurate real estate data in New Zealand. The median house price for New Zealand excluding Auckland increased by 28.0% from $530,000 in May last year to $678,500 in May 2021.

Wendy Alexander, Acting Chief Executive at REINZ says: “Whilst we haven’t seen as many record median prices in May as we’ve seen in the past few months, there is no denying that New Zealand’s residential property market is still holding strong. Median prices haven’t significantly eased yet as many had hoped would be the case, and things are certainly not getting any more affordable for first time buyers.

This is underpinned by some very strong results in the REINZ House Price Index (HPI), which reached a new high and represented the highest annual percentage increase in the New Zealand HPI that we’ve seen since records began,” continues Alexander. “Looking at the overall picture, we’re still seeing that the lack of total housing supply is continuing to push up house prices. In May, there were less than 15,000 properties available for sale across the entire country. This is the second lowest level of total inventory we’ve seen since we began collecting records, and properties are still selling relatively quickly for this time of year which is when we usually start to see things slow down a bit,” she points out.

“While some of the regions are starting to show signs of prices easing, which will be welcome news for locals who are looking to buy, it’s hard to know whether this is a direct result of the 23 March announcements or just the usual winter slow down. This is particularly true given that the Auckland market is still forging ahead, with another record median price seen in May" she says.

Regions with the largest increase in annual sales volumes during May were:

- Tasman: +112.9% (from 31 to 66 – 35 more houses)

- West Coast: +93.8% (from 32 to 62 – 30 more houses)

- Canterbury: +87.8% (from 596 to 1,119 – 523 more houses)

- Waikato: +87.6% (from 387 to 726 – 339 more houses)

- Bay of Plenty: +75.0% (from 260 to 455 – 195 more houses)

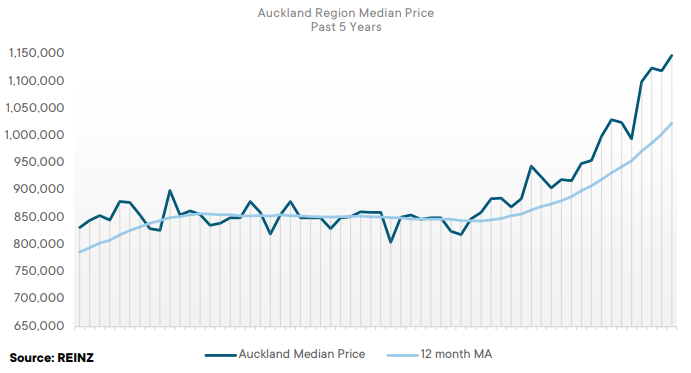

Regional Analysis - Auckland

“The Auckland region reached a record median of $1,148,000 in May 2021, up 26.9% annually. Auckland City, North Shore City, Manukau City, Rodney District and Waitakere City all now have median prices in excess of $1 million, with Papakura District and Waitakere City reaching record median prices in May 2021. Attendance at open homes has reduced slightly as the cooler weather sets in. First home buyers have remained active, particularly with developments and new builds.

Investor activity has eased slightly as a response to the government restrictions and more of a wait-and-see approach is being taken. There are early signs of developer activity increasing as they look for space for new builds. This is particularly important as new builds look to be exempt from the tax changes. Inventory continues to be an issue in the Auckland region, down -14.6% annually. Properties sold for $1 million or more increased from 38.4% of the market in May 2020 to 61.8% of the market in May 2021, highest percentage of sales in this price bracket for Auckland on record.” (REINZ)

The trend in median price has trended strongly upwards over the past year, with the sales volume trend also surging upwards. The days to sell median has improved over the past year. The House Price Index for Auckland has had the second worst performance over the past three months leading to a ‘middle-of-the-road’ performance over the past 12 months.

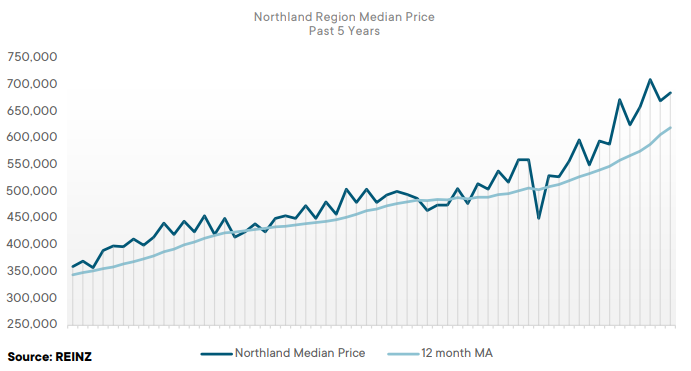

Regional Analysis - Northland

“Median house prices in the Northland region increased 29.2% year-on-year from $530,000 in May 2020 to $685,000 in May 2021. Sales volumes have eased from April 2021 as investors take more of a wait and see approach after the government changes, and first home buyers are struggling to secure a property for a reasonable price. Stock levels continue to be an issue, particularly in the mid-range, with new listings down -16.1% annually and overall inventory down -41.3% year-on-year.

This is the lowest level of inventory seen in the Northland region since records began and this will be contributing to the decline in sales volumes compared to April. Auctions continue to be a popular method of sale in the Northland region, with 21.3% of properties sold under the hammer. The REINZ House Price Index for Northland increased 24.7% to a new record level of 3,817.” (REINZ)

The trend in median price continues the steady upwards incline it has been on for the past year and a half and sales volume is higher than it has been for several years. The days to sell median has improved strongly over the past 9 months. The House Price Index was the fourth strongest performer over the past month, but third worst performer over 12 months.

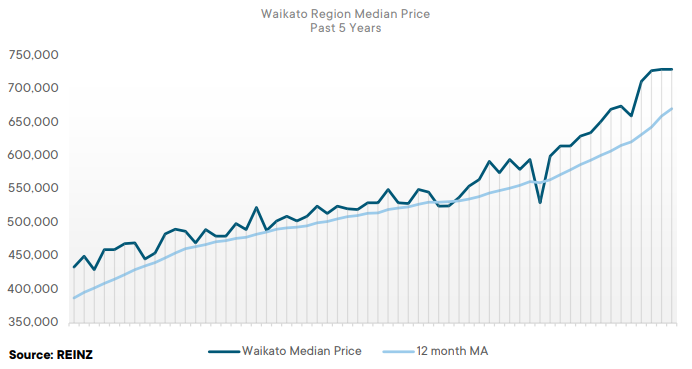

Regional Analysis - Waikato

“A record equal median house price of $730,000 was reached in the Waikato Region in May, up 21.7% year-on-year from $600,000 in May 2020. Investors have taken a step back in May as they take a wait and see approach to the new government restrictions. First home buyers have remained active in the market and made the most of the decrease in investor activity, although affordability remains an issue for this group. However, the low levels of stock have meant that there is still competition for most properties, particularly in the $500,000 - $600,000 range.

Auction continues to be a popular method of sale, with 24.4% of all properties sold in May sold by auction. Demand continues to outweigh stock for the region, with inventory down -36.4% year-on-year. Low levels of supply are expected to continue through the winter months, with the expectation that they will lift again later in the year. It is encouraging for first home buyers to see early signs of Investors easing back which, combined with the historically low interest rates may provide the best opportunity for them to secure their home and have their accommodation budget going toward their own home rather than rent. If we see a lift in listing supply over the coming months then this situation may even improve but that remains to be seen.” (REINZ)

The median price trend has had a steady upwards trend over the past 18 months, with sales volume increasing strongly over the past 12 months. The days to sell median has been improving over the last 9 months. The House Price Index was the strongest performer of all regions over the past 1 and 3 months, and the fifth strongest performer over the past 12 months.

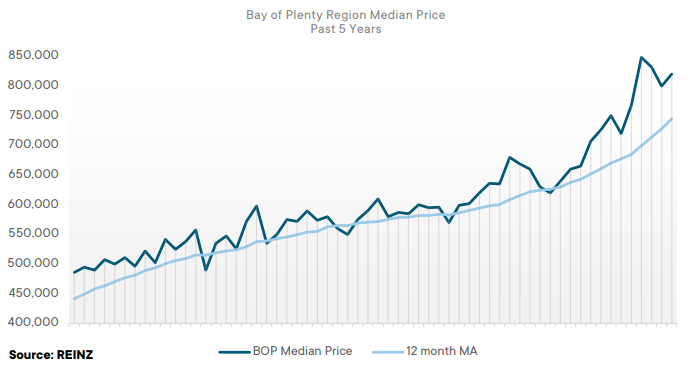

Regional Analysis - Bay of Plenty

“The Bay of Plenty region saw median house prices increase 32.3% year-on-year in May to $820,000. Whakatane District reached a new record median house price of $685,000 in May 2021, up 39.5% annually. The REINZ House Price Index for the Bay of Plenty region also reached a record level in May, up 30.1% annually to 3,914. Investor activity in the region has remained rather steady over the last few months, indicating that the newly imposed government restrictions are not yet having the intended effect.

New listings for the region are down -11.7% annually, contributing to the -46.9% drop in available inventory and increasing the competition for available properties. Sales of million dollar plus properties have increased significantly, up from 8.6% in May last year to 29.9% this May, showing the underlying strength in the market.” (REINZ)

The trend in median price has been increasing for several years, strongly so over the past year. The sales volume trend has increased over the past couple of months. The days to sell median has improved over the past 6 months. The House Price Index has been a 'middle-of-the-road' performer over the past 12 months.

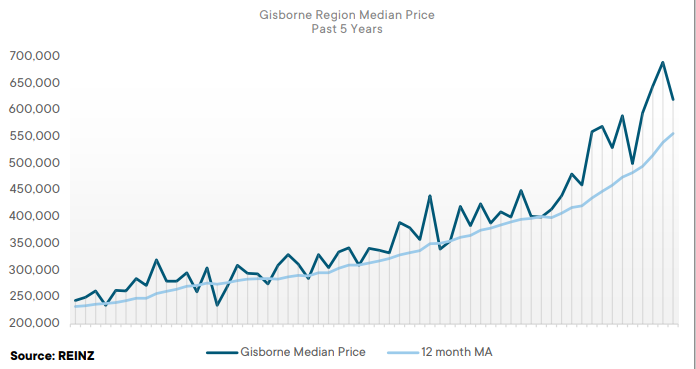

Regional Analysis - Gisborne

“Median house prices in the Gisborne region increased 49.4% year-on-year in May 2021 to $620,000, down -10.1% from $690,000 in April 2021. The REINZ House Price Index for Gisborne/Hawke’s Bay was up 35.6% annually to 4,276, down -0.4% from its peak. Listings for the region increased 56.4% year-on-year in May 2021, contributing to a 15.0% increase in overall inventory for Gisborne, the only region in the country with an annual increase.

Pressure is starting to ease on the available stock levels as the government restrictions have encouraged investors to take a step back and analyse their position a bit more, particularly in the mid-price ranges. Gisborne again saw the highest levels of auctions across the country, with 50.9% of all properties selling by auction in May 2021, up from 45.5% in April 2021.” (REINZ)

The median price trend has been increasing very strongly over the past few years and particularly so over the past year. The sales volume trend is steady to increasing. The days to sell median trend looks steady to easing. The House Price Index for Gisborne/Hawke's Bay has had the third worst movement over the past month but is still the third best performing region over the past 12 months.

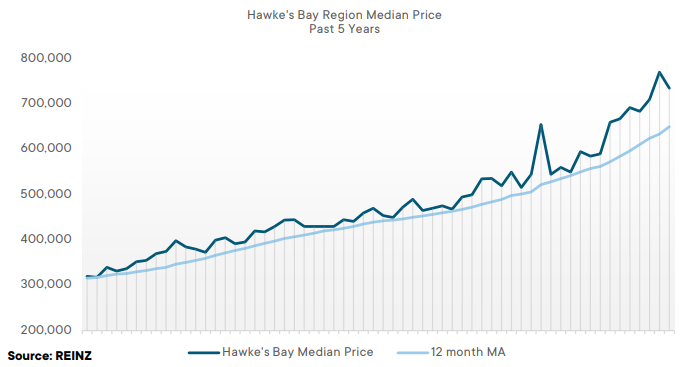

Regional Analysis - Hawke's Bay

“The Hawke’s Bay region saw median house prices increase 34.9% year-on-year to $735,000 in May 2021, but ease slightly from April’s $770,500. The government’s recently imposed restrictions have discouraged some investors, with enquiries from this group of buyers down from previous months.

First home buyers are still finding some difficulty with accessing finance, particularly if they do not have the 20% deposit. The REINZ House Price Index for Gisborne/Hawke’s Bay was up 35.6% annually to 4,276, down -0.4% from its peak. As winter sets in, activity levels for the Hawke’s Bay region are expected to continue to ease over the next few months, particularly if we don’t see more inventory come onto the market.” (REINZ)

The median price trend continues to rise strongly, with the sales volume trend improving recently. The days to sell median trend looks steady to improving. The House Price Index for Gisborne/Hawke's Bay has had the third worst movement over the past month but is still the third best performing region over the past 12 months.

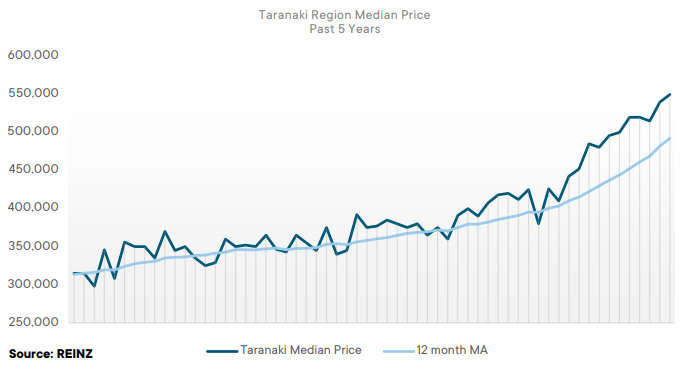

Regional Analysis - Taranaki

“The Taranaki region reached a new record median house price of $550,000 in May 2021, up 29.1% year-on-year from $426,000 in May 2020, driven by particularly strong price growth in the South Taranaki District which saw a new record median price of $405,000. Available stock levels continue to put pressure on the Taranaki market, as inventory is down -23.5% annually to 297 properties available to prospective purchasers. The recent government changes seem to have had little impact on investor activity to date.

First home buyers have started to pull back slightly, as they wait for the market to stabilise. Access to finance continues to be a barrier for first home buyers as banks appear to still be tightening their lending criteria. The REINZ House Price Index for Taranaki reached a record level in May 2021 of 4,239, up 33.5% annually.” (REINZ)

The median price trend continues the strong upwards trajectory it has been on for the past year. The trend in sales volume has increased over the past year. The days to sell median continues the improving trend it has had for the past few years. The House Price Index was the second best performer over 3 months and the fourth strongest performer over 12 months.

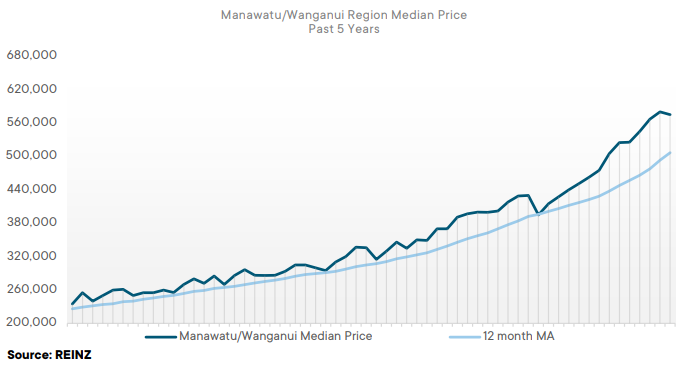

Regional Analysis - Manawatu/Whanganui

“Median house prices in the Manawatu/Whanganui region increased 38.6% year-on-year from $415,000 in May 2020 to $575,000 in May 2021. This is the first time since June 2020 that the region did not hit a new record high median house price. Properties are still selling quickly in the Manawatu/Whanganui region, with median days to sell at 26 days – the lowest for a May month on record.

The REINZ House Price Index for the region increased 52.1% annually to a record 4,993, the largest annual increase across the country. The recent changes in legislation including the Healthy Homes Guarantee, the 10-year bright-line test and the reintroduction of 40% LVRs for investors, have had their intended effect of slowing investor activity in May, with some choosing to exit the market.” (REINZ)

The median price trend continues the strong upwards trajectory it has been on for the past three years, with the sales volume trend increasing over the past few months. The days to sell median trend looks steady to improving. The House Price Index had the third strongest performance of all regions over the past 3 months, and the strongest performance of all regions over the past 12 months.

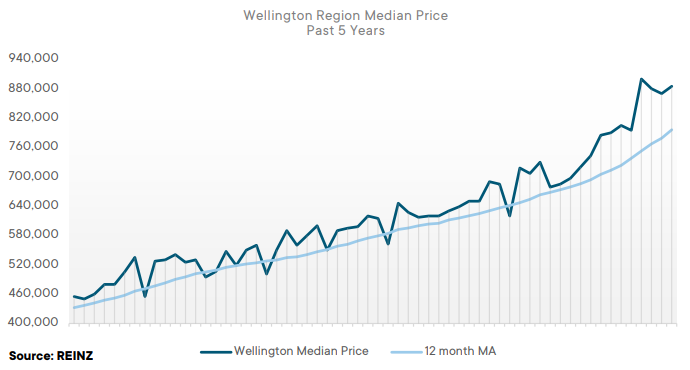

Regional Analysis - Wellington

“Median house prices in the Wellington region increased 30.3% year-on-year to $885,000 in May 2021. Lower Hutt City also reached a record median house price of $873,500, up 33.2% annually – Lower Hutt City has reached a new record median sale price in 10 out of the last 12 months. Properties sold for $1 million or more increased from 10.9% of the market in May 2020 to 36.8% of the market in 2021.

The REINZ HPI for Wellington reached a record level of 4,075, up 41.8% year-on-year, indicating the underlying value of the property in the region is still increasing. Listings were down -14.2% from April 2021, contributing to the -20.8% decrease in inventory for the region – leaving 746 properties available for prospective purchasers, or 5 weeks of stock. Investor activity has started to ease slightly, which may show some impact over the coming months in regard to sales volumes and inventory.” (REINZ)

The trend in the median price has been strongly increasing over the past three years, with the sales volume trend increasing over the past few months. The days to sell median trend has been steady over the past 12 months. The House Price Index has had the second strongest performance over the past 12 months.

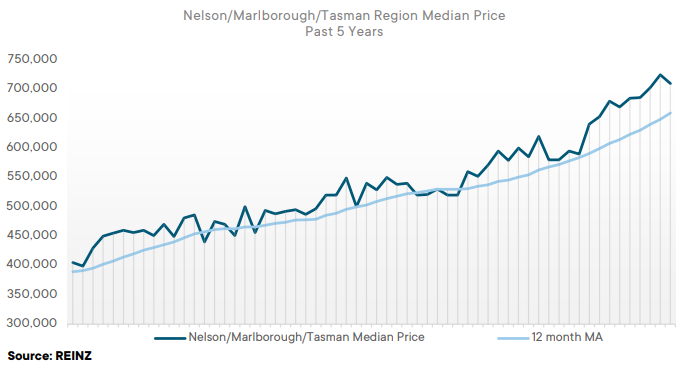

Regional Analysis - Nelson/Marlborough

“The Nelson (+20.8%), Marlborough (+32.7%) and Tasman (+21.2%) regions all saw increases in median house prices year-on-year in May, with Tasman reaching a new record median of $850,000. The REINZ House Price Index for Nelson/Marlborough/Tasman/West Coast reached a new record level in May 2021 of 3,182, up 28.8% annually.

Attendance at open homes eased slightly, however, interest from out-of-town prospective purchasers has remained strong. A shortage of available stock in the region has continued to put upward pressure on prices and resulted in a number of multi-offers being placed on homes. Sales of million dollar plus properties increased from 5.3% in May 2020 of the market to 17.6% in May 2021. Activity is expected to remain steady over the winter months before picking up again in spring.” (REINZ)

The median price trend for the region has been climbing over the past two years, with the sales volume rising over the past few months. The days to sell median is steady to improving. The House Price Index for Nelson/Tasman/Marlborough/West Coast has had the second strongest performance over the past month leading to a 'middle-of-the-road' performance over the past 12 months.

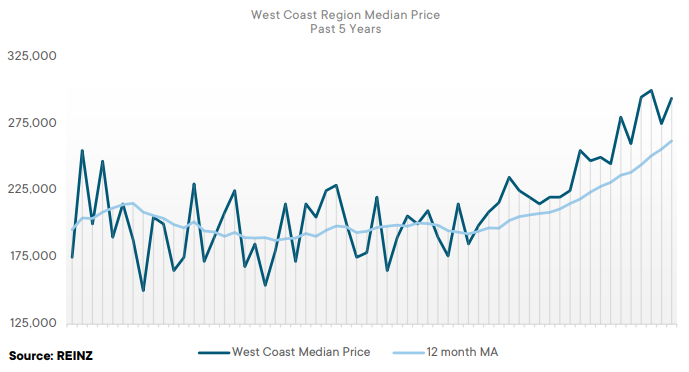

Regional Analysis - West Coast

“Median house prices in the West Coast region increased 33.6% year-on-year to $294,000 in May 2021. Sales volumes increased 31.9% month-on-month from 47 In April 2021 to 62 in May 2021 – the fourth highest level of sales for a May month since records began.

Overall inventory for the region decreased -44.4% year-on-year to a record low level of 169 properties. This pressure on available stock has contributed to the increasing prices for the region. Properties are selling fast with the median days to sell at 31 days, the lowest for a May month since 2005. Interest in the region and enquiry levels from prospective purchasers have remained strong with the government’s recent legislation changes not appearing to have much of an impact on the West Coast yet.” (REINZ)

The median price trend has been increasing strongly over the past year and a half. The sales volume trend has also increased rapidly over the past year. The days to sell median trend has been improving very strongly over the past 18 months. The House Price Index for Nelson/Tasman/Marlborough/West Coast has had the second strongest performance over the past month leading to a 'middle-of-the-road' performance over the past 12 months.

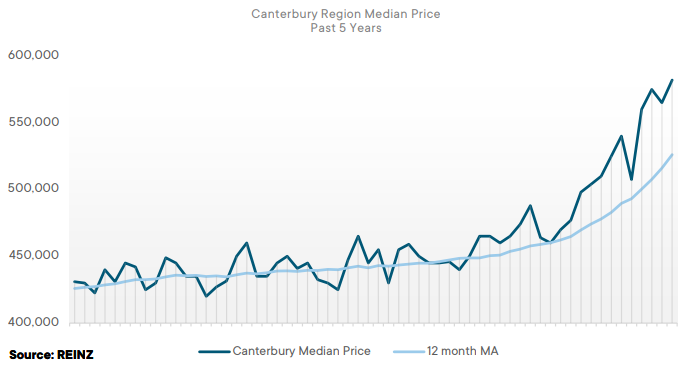

Regional Analysis - Canterbury

“Canterbury region saw a record median house price of $582,000 in May 2021, up 26.5% year-on-year. Mackenzie District ($705,000), Selwyn District ($677,500) and Waimate District ($385,000) all reached record median house prices in May and strong price results were seen in Christchurch City and the Hurunui District too. Houses are also selling at their fastest pace (28 days) for a May month in 5 years.

Investor activity has eased slightly as the government restrictions come into effect. First home buyer activity has remained rather steady, however finding a suitable property to purchase is proving difficult for some. Inventory for Canterbury reached an all time low in May, down -42.8% from May 2020, leaving just 1,603 properties available to purchase in the region. The REINZ HPI for Canterbury reached a record high of 3,222 in May, up 25.7% year-on-year, indicating the underlying value of the property in the region is still increasing.” (REINZ)

The median price trend continues to increase rapidly, with the sales volume trend also increasing rapidly over the past 12 months. The days to sell median trend is strongly improving. The House Price Index is the fifth best performer over the past month and 3 months.

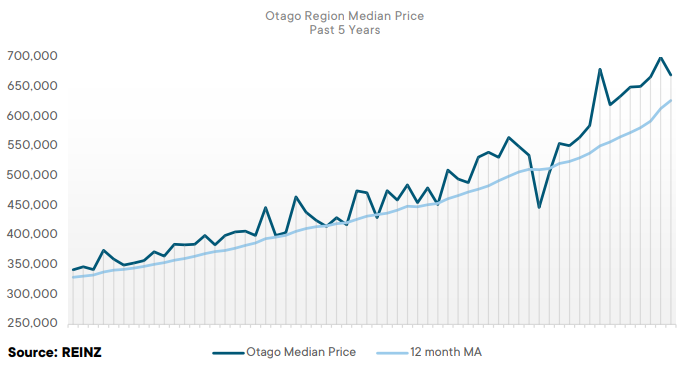

Regional Analysis - Otago

“Dunedin City reached a record median house price of $643,000 in May 2021, up 29.7% from the same time last year. Investor activity has eased as a result of the government’s changes to legislation, with some exiting the market and reducing the rental pool. First home buyers are still active, however, in lower numbers as the increasing house prices are making it harder to find something affordable. Supply for the district is tight which is continuing to put upward pressure on prices as many properties are going to multi-offer.” (REINZ)

“Buyer enquiry has remained strong for the region; however, it appears some are now taking a slightly more cautious approach after the government’s changes to investor related legislation. Listings are down -19.6% year-on-year and down -4.5% month-on-month, which is consistent with a winter easing for the region. International interest has increased with the opening of the Australian travel bubble and an increase in enquiries from across the ditch. Activity in the Otago region, and particularly the Queenstown-Lakes District lifts in the winter months, so it is expected that activity will be steady over the coming months.” (REINZ)

The median price trend has increased strongly over a long period of time. The sales volume trend has increased over the past 12 months. The days to sell median trend is steady. The House Price Index is the worst performing index over the past 3 months and the second worst performer over the past 12 months.

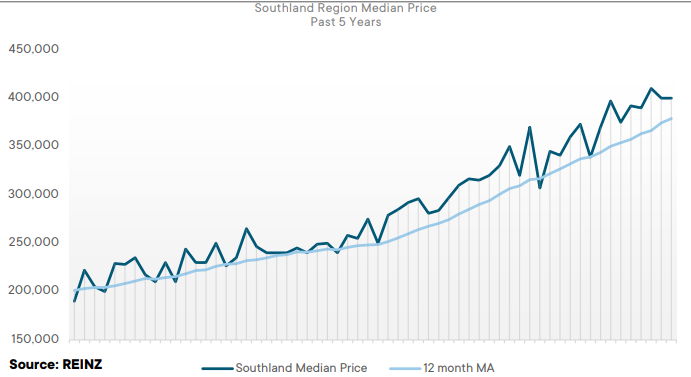

Regional Analysis - Southland

“The Southland region saw median house prices increase 15.9% year-on-year to $400,000 in May 2021. New listings for the region decreased -0.6% from the same time last year, with 179 properties coming to the market in May, bringing the overall inventory for Southland down -35.4% year-on-year. This leaves 272 properties available to prospective purchasers, or 8 weeks of available inventory.

Investor activity dropped in May with fewer enquiries from this demographic as a result of the recently imposed government legislative changes. First home buyer activity has also eased slightly as more individuals are taking a wait and see approach to see what will happen as a result of the government changes.” (REINZ)

The median price trend has been increasing strongly for many years, with the sales volume trend increasing over the past 12 months. The days to sell median trend has been steady to improving over the past 6 months. The House Price Index for Southland has had the worst return over the past month resulting in it being the worst performer over the past 12 months.

Browse

Topic

Related news

Read more

Find us

Find a Salesperson

From the top of the North through to the deep South, our salespeople are renowned for providing exceptional service because our clients deserve nothing less.

Find a Property Manager

Managing thousands of rental properties throughout provincial New Zealand, our award-winning team saves you time and money, so you can make the most of yours.

Find a branch

With a team of over 850 strong in more than 88 locations throughout provincial New Zealand, a friendly Property Brokers branch is likely to never be too far from where you are.