A 24.3% uplift on sales volumes compared to the same time last year - REINZ stats March 2021

Friday, 16 April 2021

Median prices for residential property across New Zealand increased by 24.3% from $665,000 in March 2020 to $826,300 in March 2021, a new record high for the country, according to the latest data from the Real Estate Institute of New Zealand (REINZ).

The number of residential properties sold in March across New Zealand increased by 31.2% when compared to the same time last year (from 7,408 to 9,721) – the highest for the month of March in 14 years and the highest annual percentage change in 3 months.

For New Zealand excluding Auckland, the number of properties sold increased by 21.2% when compared to the same time last year (from 4,825 to 5,849). In March, 12 out of 16 regions saw annual increases in sales volumes.

Wendy Alexander, Acting CEO at REINZ says: “March was another incredibly strong month from a price perspective with 12 regions and 32 districts across the country seeing record median prices. The national median also reached a new record, increasing by $46,300 since last month, showing just how much pressure has been placed on house prices and how we desperately need more supply to come to the market.”

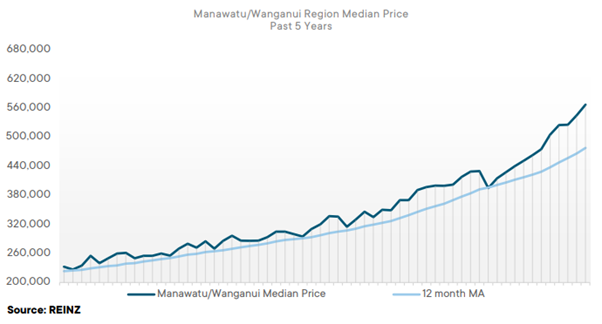

“The Manawatu/Whanganui region has now had 9 record median prices in a row, 10 of the last 12 months were record or equal record prices for the Waikato region, 7 of the last 8 months were records for the Canterbury region and the Auckland region has hit another record median price. These sorts of price rises are unsustainable and show just why New Zealand continues to top the league tables of most unaffordable nations in international studies.

Additionally, we’re seeing houses sell at their fastest pace in a March month ever and we’ve seen the highest percentage of auctions the country has ever seen since REINZ began keeping records showing just how quickly the market is moving,” she continues.

"Looking forward over the next couple of months, we would expect house prices to continue rising, but we hope this will beat a slower pace than we’ve seen over the last 6 to 12 months. Hopefully the re-implementation of the LVRs, changes in government policy and the move towards winter will slow the rate of growth down a little, but only time will tell what effect they will have,” points out Alexander.

Regions with the largest increase in annual sales volumes during March were:

- West Coast: +120.0% (from 35 to 77 – 42 more houses) – the highest for a March month in 17 years

- Waikato: +42.4% (from 682 to 971 – 289 more houses) – the highest for the month of March in 5 years

- Canterbury: +33.0% (from 1,027 to 1,366 – 339 more houses) – the highest for the month of March in 14 years

- Nelson: +28.2% (from 78 to 100 – 22 more houses) – the highest for the month of March in 3 years

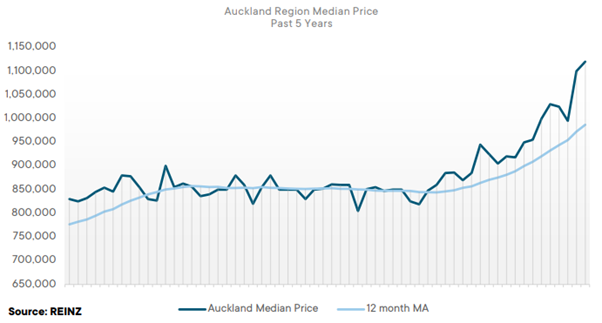

Regional Analysis - Auckland

“Median house prices in the Auckland region reached a record median price in March of $1,120,000, up 18.5% from the same time last year. The REINZ House Price Index further displays the increasing value of properties in the region, as it increased 22.7% from the same time last year to a new record of 3,749. Activity has remained strong for the majority of the month as investors moved to secure property prior to the new legislation and as first home buyers continue to secure property where they can. 3,872 properties were sold in the Auckland region during March, up 49.9% year-on-year resulting in the second highest level of sales on record. Although, since the announcement of the changes to the bright-line test and tax deductibility rules, investor interest levels have eased a bit.

Auctions remain a popular choice for vendors to find the market value of their home, with 52.4% of all sales being completed by auction, up from 38.4% at the same time last year.” (REINZ)

The current Days to Sell of 31 days is less than the 10-year average for March which is 33 days. There were11 weeks of inventory in March 2021 which is 5 weeks less than the same time last year.

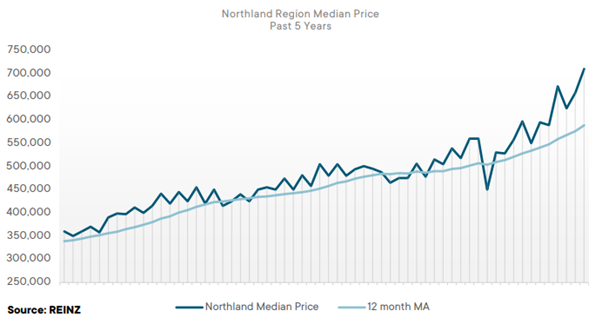

Regional Analysis - Northland

“The Northland region reached a record median house price in March 2021 of $710,000, up 26.8% year-on-year from $560,000 in March 2020. Demand has remained high for good properties in the region, especially with out-of-towners looking for something more affordable. However, properties sold for $1 million or more have increased to 17.0%, up from 5.6% in March 2020, further showing the increasing cost of property in the region. There has been a slight uplift in investor activity, particularly before the new legislation occurred in late March, at which point it has eased again.

Auction has become a popular method of sale in Northland as vendors look to make the most of a popular market with 27.7% of all sales in March sold by auction, up from 4.7% at the same time last year.” (REINZ)

The current Days to Sell of 35 days is much less than the 10-year average for March which is 55 days. There were 28 weeks of inventory in March 2021 which is 12 weeks less than the same time last year.

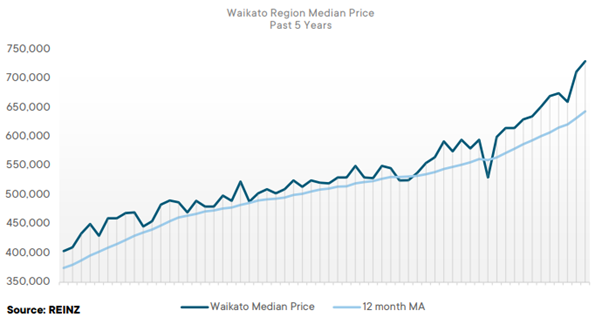

Regional Analysis - Waikato

“The Waikato region saw median house prices increase 22.7% annually from $595,000 in March 2020 to $730,000 in March 2021, a new record high for the second consecutive month. Open homes and auctions have been busy, with investors still looking for a good deal and seeing value in property, particularly in the early weeks of March. First home buyers have been active, hoping to get into the market, with a further increase in activity after the government announcement around the First Home Loan and Grant.

Competition has been high between the different buyer groups, as available inventory is down -27.7% year-on-year. The median number of days to sell a property is down to 24 days, a record equal low for the median number of days to sell a property for the region.” (REINZ)

The current Days to Sell of 24 days is much less than the 10-year average for March which is 36 days. There were 7 weeks of inventory in March 2021 which is 7 weeks less than the same time last year.

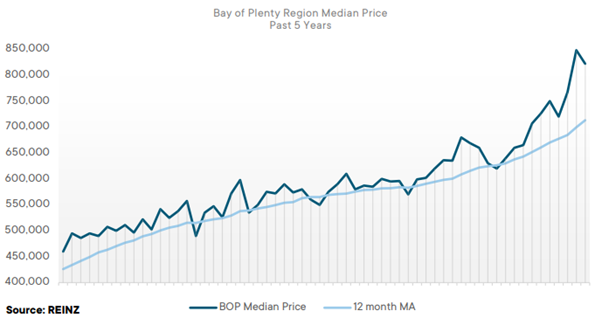

Regional Analysis - Bay of Plenty

“Median house prices in the Bay of Plenty increased 24.5% year-on-year to $822,000 in March 2021, up from $660,000 at the same time last year. Additionally, Rotorua District reached a new record median price of $650,000. Supply levels continue to be an issue for the region with a decrease of -7.8% in new listings from the same time last year, and a -32.9% decrease in available stock, leaving just 7 weeks of available inventory. Low levels of stock and high levels of demand have resulted in strong competition for good properties and therefore the median number of days to sell have dropped 4 days from the same time last year to 28 days, the lowest level for a March month on record.

Auctions continue to be a popular method of sale for the region, with 47.0% of all sales being completed by auction, up from 19.0% at the same time last year. However, access to finance is becoming harder for some buyers as banks continue to place conditions on buyers.” (REINZ)

The current Days to Sell of 28 days is much less than the 10-year average for March which is 43 days. There were 7 weeks of inventory in March 2021 which is 5 weeks less than the same time last year.

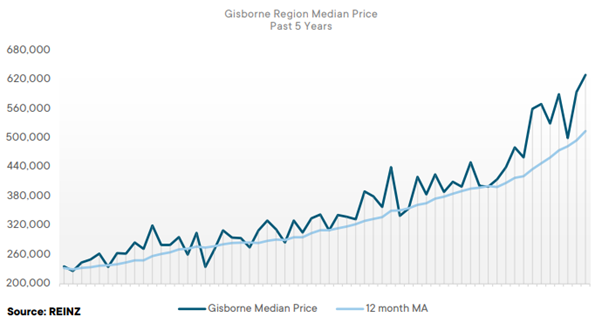

Regional Analysis - Gisborne

“Gisborne region reached a record median house price of $630,000 in March 2021, up 56.9% year-on-year from $401,618 in March 2020. Activity levels for the region have started to slow slightly, as purchasers start to take more of a wait and see approach. This month, the region experienced the lowest level of March sales since 2014 (7 years), with 41 properties sold, down from 45 at the same time last year. Lower sales volumes, paired with a 15.3% annual increase in new listings has resulted in an 8.5% increase in inventory for the Gisborne region and a slight easing in pressure.

The REINZ House Price Index for the Gisborne/Hawke’s Bay region increased 32.4% year-on-year to a record high of 4,220, showing that the underlying value of property in the region is still increasing. 2021. Activity levels are expected to be steady over the coming months before picking up again, later in the year.” (REINZ)

The current Days to Sell of 31 days is less than the 10-year average for March which is 38 days. There are 11 weeks of inventory in March 2021 which is 4 weeks more than the same time last year.

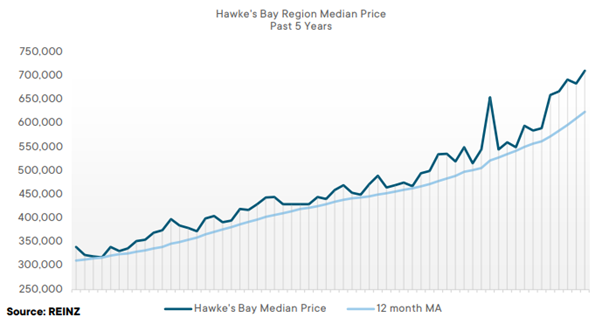

Regional Analysis - Hawke's Bay

“The Hawke’s Bay region reached a record median house price of $711,000 in March 2021, up from $545,000 at the same time last year, an increase of 30.5%. With decreases in new listings and total inventory, this has put increasing pressure on house prices in the region. Properties selling for $1 million or more increased to 17.3% of all sales in March, up from 4.2% in March 2020. The REINZ House Price Index for the Gisborne/Hawke’s Bay region increased 32.4% year-on-year to a record high of 4,220, showing that the underlying value of property in the region is still increasing.

Properties are selling quickly, with median days to sell down -2 days from 28 days in March 2020, to 26 days in March 2021 – this is the lowest number of days to sell for a March month since records began.” (REINZ)

The current Days to Sell of 26 days is less than the 10-year average for March which is 35 days. There were 10 weeks of inventory in March 2021 which is 2 weeks more than the same time last year.

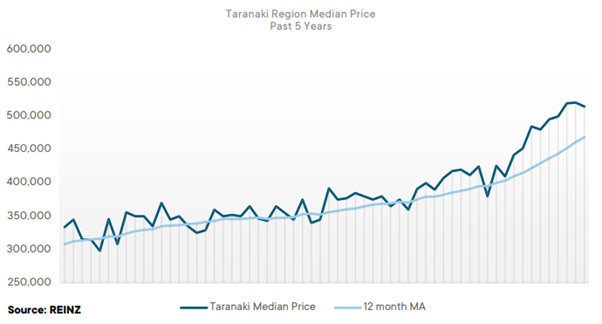

Regional Analysis - Taranaki

“Median house prices increased 21.2% annually in the Taranaki region, from $425,000 in March 2020 to $515,000 in March 2021. New Plymouth district reached a record median house price of $612,500, up 19.6% year-on-year and the fifth consecutive month of record highs for the district. Sales volumes for the Taranaki region were up 6.1% from the same time last year, but down -7.3% from last month.

A decrease in enquiries was noticed at the end of the month after the government’s latest housing policy was announced. The REINZ House Price Index for the region increased 27.4% year-on-year to a record level of 4,117.” (REINZ)

The current Days to Sell of 22 days is much less than the 10-year average for March which is 35 days. There were 9 weeks of inventory in March 2021 which is 8 weeks less than the same time last year.

Regional Analysis - Manawatu/Whanganui

“For the ninth consecutive month, the Manawatu/Whanganui region reached a record median house price, up 31.9% year-on-year from $430,000 in March 2020 to $567,000 in March 2021. Horowhenua ($575,000), Manawatu ($565,000), Rangitikei ($440,000) and Whanganui ($521,000) districts also all reached record median prices in March. The REINZ House price index for the region increased 31.7% from the same time last year, the largest annual increase for the region since records began. Open homes are continuing to draw good levels of turn out, especially with new listings. First home buyers continue to remain active in the market, but a shortage of available listings is making it difficult to get on the property ladder. Investor enquiries have started to slow towards the end of the month as they start to take more of a wait and see approach.

Available properties are selling quickly, as median days to sell are down to 20 days, the lowest number of days on record. Whanganui increased 29.4% annually, the largest annual increase the region has experienced since records began.” (REINZ)

The current Days to Sell of 20 days is much less than the 10-year average for March which is 35 days. There were 8 weeks of inventory in March 2021 which is 2 weeks less than the same time last year.

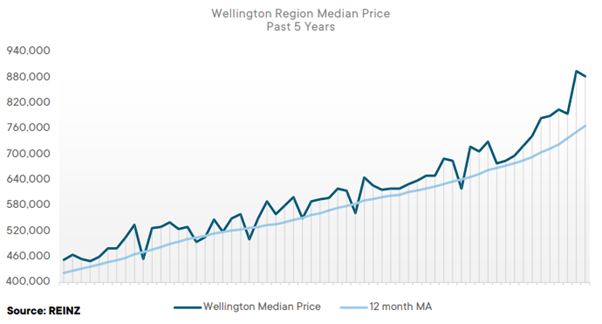

Regional Analysis - Wellington

“Median house prices in the Wellington region increased 24.9% year-on-year to $882,700 in March 2021, up from $707,000 at the same time last year. Kapiti Coast and Upper Hutt City both reached record median prices in March, up 35.4% and 33.9% year-on-year respectively. First home buyers and investors have remained relatively active in the market during March, with sales volumes for the region up 17.2% annually (911 properties sold during March 2021), resulting in the highest sales count in 48 months.

Inventory is down -11.3% year-on-year, leaving just 6 weeks of available stock for purchasers, the lowest number of weeks across New Zealand. The REINZ House Price Index for the region increased 31.2% from the same time last year, the largest annual percentage increase on record.” (REINZ)

The current Days to Sell of 28 days is less than the 10-year average for March of 29 days. There were 6 weeks of inventory in March 2021 which is 1 week less than the same time last year.

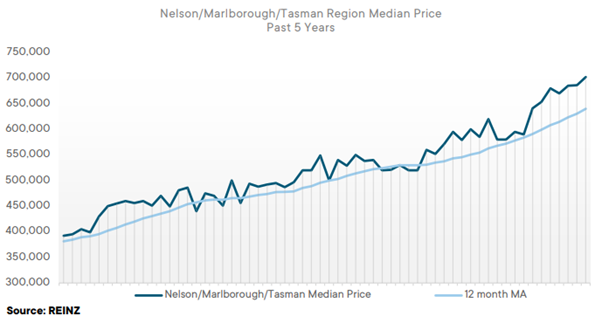

Regional Analysis - Nelson/Marlborough

“The Nelson/Marlborough/Tasman regions all saw an increase in median house prices in March, with Nelson increasing 13.7% annually to $682,000, Marlborough increasing 27.7% annually to a record median price of $664,000 and Tasman increasing 19.6% annually to record median price of $801,000. Open home attendance increased from February as more purchasers came to the market. A lot of buyers are coming in from out of town as the more affordable prices attract owner-occupiers to the region, looking for bigger properties. Many properties are selling under multi-offer as competition remains strong for good properties.

Properties are selling quickly, with Tasman experiencing the lowest number of days to sell a property (22 days) since August 2003 and Marlborough experiencing the lowest number of days to sell (22 days) since February 2004.” (REINZ)

The current Days to Sell of 24 days is much less than the 10-year average for March which is 39 days. There were 13 weeks of inventory in March 2021 which is 6 weeks less than the same time last year.

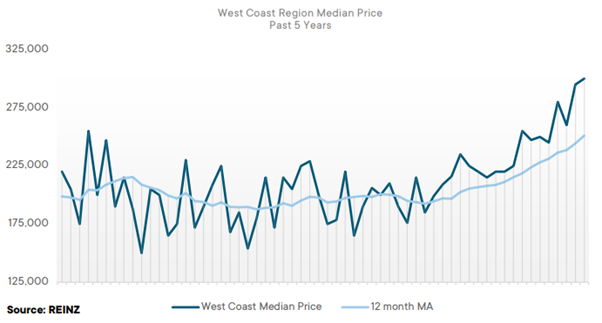

Regional Analysis - West Coast

“Median house prices reached a record median high of $300,000 in the West Coast in March 2021, up 36.4% from $220,000 in March 2020. Demand remained high for the region with 77 properties sold in March, up 120% from the same time last year (35 sales), resulting in the highest level of March sales since 2004. Levels of interest from out of town investors increased in March, particularly after the government announcement around changes to the bright line test and tax deductibility, as properties on the West Coast are more affordable and require low capital borrowing.

Properties are selling quickly as days to sell are down -8 days year-on-year to 33 days, the lowest for a March month since 2006. Popularity and house prices in the West Coast region are expected to continue increasing over the coming months as the region starts getting closer to approaching the price points of the surrounding regions” (REINZ)

The current Days to Sell of 33 days is much less than the 10-year average for March which is 61 days. There were 23 weeks of inventory in March 2021 which is 45 weeks less than the same time last year.

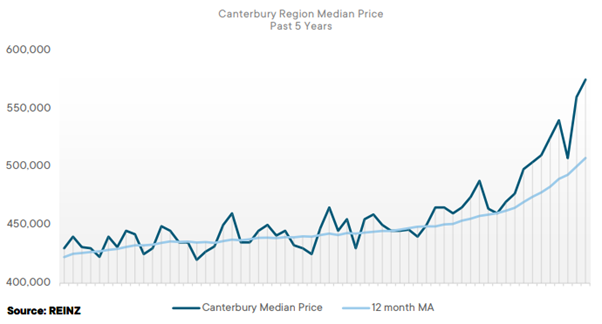

Regional Analysis - Canterbury

“The Canterbury region reached a record median price of $575,000 in March 2020, up 17.8% year-on-year from $488,000 in March 2021. Sales volumes for the region increased 33.0% annually to 1,366, up from 1,027 at the same time last year, the highest number of sales for a March month since 2004 (17 years). Inventory is down -20.0% year-on-year as new listings aren’t coming to the market fast enough to match the speed at which they are selling, putting further pressure on stock as supply is being outweighed by demand.

Properties are selling faster, with median days to sell down -5 days from the same time last year to just 24 days, the lowest median number of days to sell for a March month since 2005. The REINZ HPI for Canterbury also reached a new record level in March, up 20.3% annually to 3,120.” (REINZ)

The current Days to Sell of 24 days is less than the 10-year average for March which is 30 days. There were 9 weeks of inventory in March 2021 which is 7 weeks less than the same time last year.

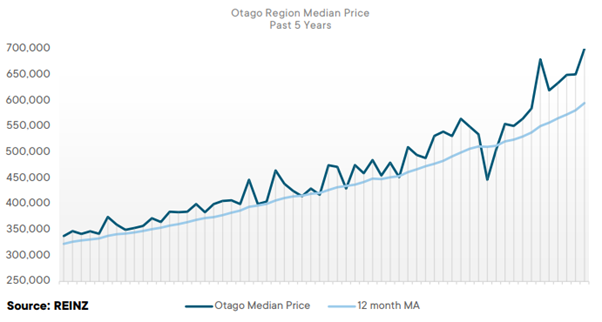

Regional Analysis - Otago

“Queenstown-Lakes District ($1,185,000) reached a record median price in March. 27.3% of all properties in the Otago region sold for $1 million or more in March 2021, up from 13.5% in March 2020, showing the ongoing increases experienced in the region. Buyer enquiry started easing towards the end of March after the government announcement. The Queenstown-Lakes District sales volume has remained steady with 115 properties sold in March, up 76.9% from the same time last year (65 properties sold).” (REINZ)

“Dunedin City reached a record median house price in March of $650,000, up 21.5% year-on-year, from $535,000in March 2020. Vendor expectations are high as a result of prices achieved over recent months; however, this is likely to diminish as the new investor/housing regulations begin. Demand continues to outweigh supply, particularly as listings slow towards the winter months, although this may improve as investor activity appears to be easing slightly. The fear of missing out is still a factor for a number of potential purchasers, wanting to secure a property before any further changes or price increases. Activity is expected to remain strong over the coming months, provided there is enough supply to service demand.” (REINZ)

The current Days to Sell of 28 days is less than the 10-year average for March which is 31 days. There were 16 weeks of inventory in March 2021 which is 4 weeks more than the same time last year.

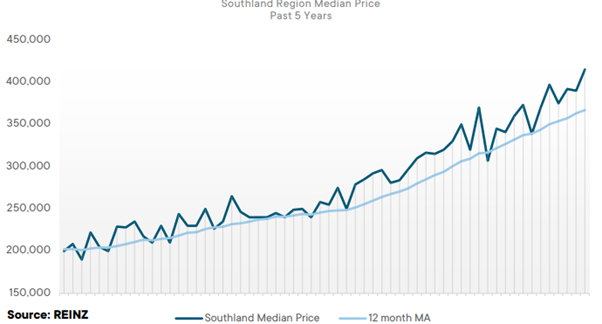

Regional Analysis - Southland

“A record median house price of $415,000 was reached in the Southland region in March 2021, up 12.2% from the same time last year. The REINZ HPI for Southland increased 20.5% year-on-year to a record level of 4,124 in March 2021, showing the ongoing increase in the underlying value of property in the region. Sales volumes increased 21.2% annually from 179 in March 2020 to 217 in March 2021, showing the ongoing popularity of the Southland region.

Purchasers are acting quickly when they find a property they want to secure, as days to sell are down - 6 days year-on-year to a median of 21 days, the lowest for a March month since 2007 (14 years). Activity is expected to remain steady in the Southland region over the coming months, although investor interest may ease slightly with the reintroduction of LVRs and the new bright line and tax deductibility changes announced in late March.” (REINZ)

The current Days to Sell of 21 days is much less than the 10-year average for March which is 32 days. There were 9 weeks of inventory in March 2021 which is 8 weeks less than the same time last year.

Browse

Topic

Related news

Read more

Find us

Find a Salesperson

From the top of the North through to the deep South, our salespeople are renowned for providing exceptional service because our clients deserve nothing less.

Find a Property Manager

Managing thousands of rental properties throughout provincial New Zealand, our award-winning team saves you time and money, so you can make the most of yours.

Find a branch

With a team of over 850 strong in more than 88 locations throughout provincial New Zealand, a friendly Property Brokers branch is likely to never be too far from where you are.