Property market closes on a high after a strong year - REINZ stats December 2021

Wednesday, 19 January 2022

Despite the restraints the market is operating under, this is a stronger than average October month. We’re seeing the continuation of what is a firm market, despite the pandemic (REINZ).

Median prices for residential property across New Zealand increased annually by 21.5%, from $745,000 in December 2020 to $905,000 in December 2021. Though year-on-year growth continues, this was a 1.6% decrease compared to November 2021.

Jen Baird, Chief Executive of REINZ, says: “December was a solid close to a strong year for the New Zealand property market. House prices were considerably higher than December 2020, demand and sales activity remained firm, and there was a welcome increase in new listings through November and into December.

“Across New Zealand, there was an annual increase of 21.5% in the median price, reaching $905,000 — down 1.6% compared to November 2021. New Zealand excluding Auckland saw a yearly increase of 20.6% to $760,000 — a 1.3% decrease compared to the month prior. When we consider the seasonally adjusted median prices, which assesses a month’s performance outside of predictable seasonal patterns, December price movements were as expected.

“However, we are noting signs of deceleration in annual price growth compared to previous months. While the market remains confident, the impact of rising interest rates, tighter lending criteria and changes to investor taxation restrictions are starting to shift dynamics.

October is the beneficiary of increased listings in the month prior. It is expected that sales activity across New Zealand will continue to rise in the coming months, as restrictions ease further, travel limitations lift and those who previously held back listing their property do so. The demand is certainly there,” Baird observes.

“Over 2022, the impact of these changes and anticipation of further interest rate increases are likely to play out in the market, leading to a gradual slowdown in the pace of price growth,” Baird observes.

Seven regions achieved record medians and there was one equal record in December:

- Northland: increased 13.0% annually from $672,500 to $760,000 — a new record median high

- Bay of Plenty: increased 27.8% annually from $720,000 to $920,000 - a new record median high

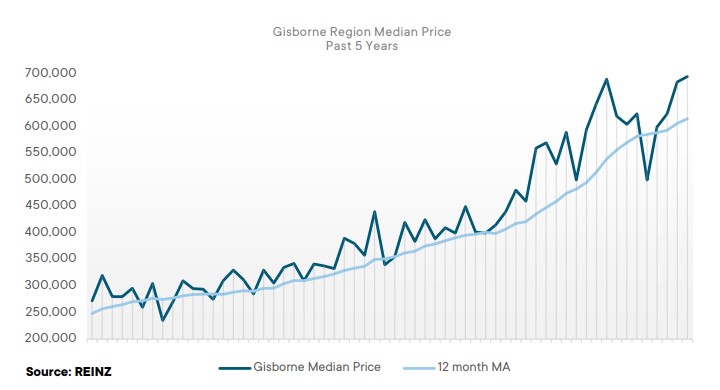

- Gisborne: increased 17.8% annually from $590,000 to $695,000 - a new record median high

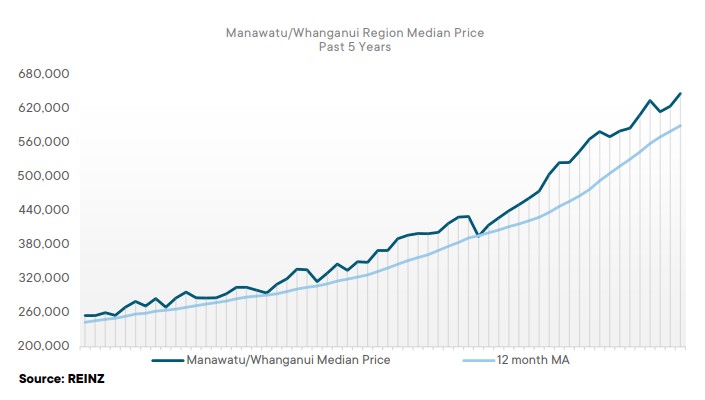

- Manawatu/Whanganui: increased 23.2% annually from $525,000 to $647,000 - a new record median high

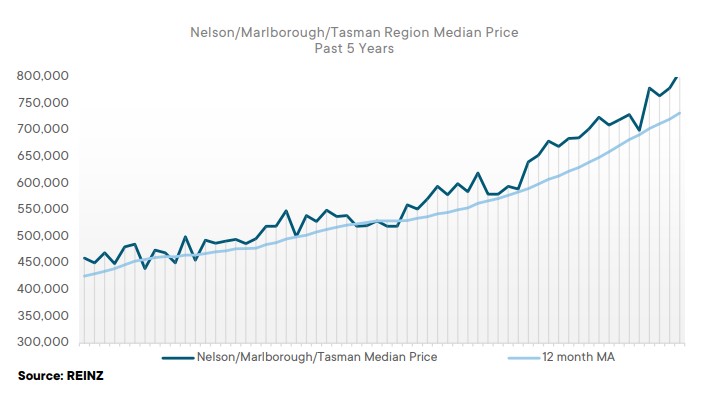

- Tasman: increased 25.2% annually from $735,000 to $920,000 - a new record median high

- Nelson: increased 23.0% annually from $675,000 to $830,000 - a new record median high

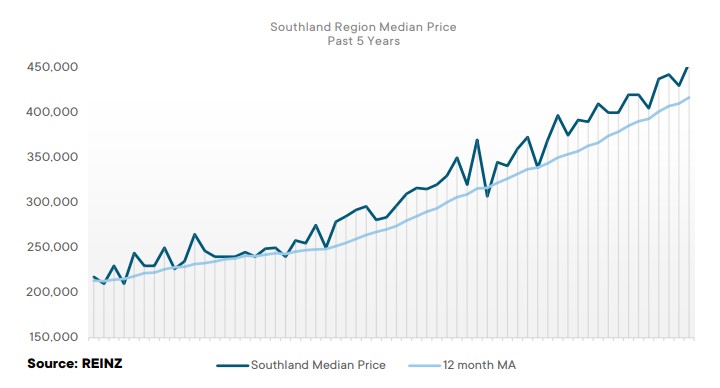

- Southland: increased 21.3% annually from $375,000 to $455,000 - a new record median high

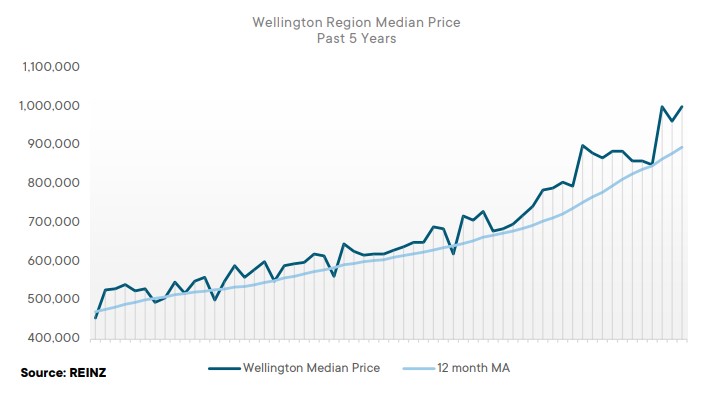

- Wellington: increased 24.2% annually from $805,035 to $1,000,000 - an equal record median to that previously reached in October 2021

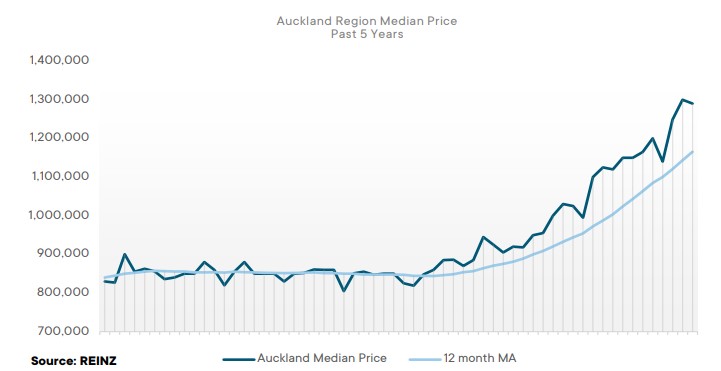

Regional Analysis - Auckland

“Auckland saw its median house price increase by 25.9% year-on-year, reaching $1,290,000. In December, the market softened, partly due to the Christmas break and the fact that many buyers are still getting their heads around the tightening of lending criteria. As house prices continue to rise, along with restrictions in lending criteria, the number of first home buyers declined — however, it is evident that these credit changes are impacting all buyers across the board to a certain extent. Compared to this time last year, there are fewer investors in the market due to interest rates, higher prices at auctions and uncertainty about further legislation.

“Listing numbers increased by 12.6%, but, as usual in December, some vendors are choosing to hold off until after the Christmas break. Vendors still have high price expectations, but unlike in November, some of these expectations are not being met as there is less buyer competition in certain areas. Sale by auction was significant in December — 48.9% of sales in Auckland happening by way of auction. This high number of auction listings versus other methods of sale is a further challenge for first home buyers whose lending criteria may not enable them to buy at auction.” (REINZ)

The current Days to Sell of 29 days is less than the 10-year average for December which is 32 days. There were 14 weeks of inventory in December 2021 which is 5 weeks more than the same time last year.

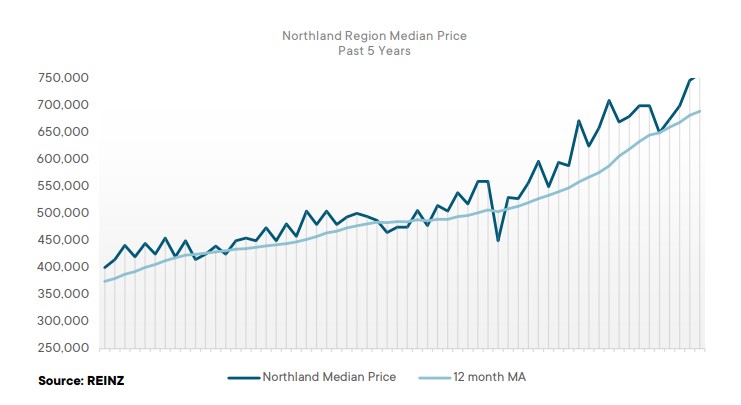

Regional Analysis - Northland

“The Northland region saw a record median house price of $745,000 in November 2021, up 26.5% from the same time last year. Two districts in Northland also reached record medians: Far North District ($817,500) and Kaipara District ($905,000). Despite stock levels decreasing 18.9%, Northland was one of four regions in New Zealand that had over 10 weeks of inventory (18 weeks inventory). Properties are selling quickly in Northland, with the region experiencing its lowest November median days to sell since 2005 (35 days).

“Direct buyer enquiry is beginning to slow, but interest remains high, and this is expected to accelerate once Auckland’s borders open. Auctions have proven a popular method of sale in the region, with 21.7% of sales by auction up from 13.1% in November 2020. Anecdotally, more negotiation has been required on the auction floor with vendors adjusting reserves. Whilst there have been some noteworthy sales, some are noticing a decline in buyers, with preapprovals becoming more difficult as banks exercise caution. Northland had its lowest November sales count since 2014 with 203 properties sold.” (REINZ)The current Days to Sell of 35 days is much less than the 10-year average for November which is 45 days. There were 18 weeks of inventory in November 2021 which is 6 weeks less than the same time last year.

The current Days to Sell of 33 days is much less than the 10-year average for December which is 46 days. There were 15 weeks of inventory in December 2021 which is 2 weeks less than the same time last year.

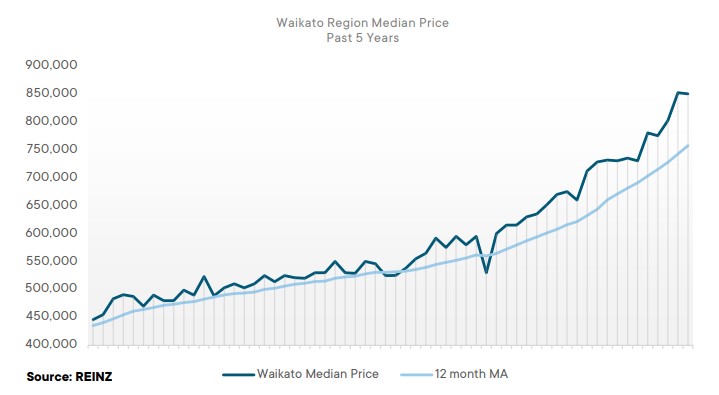

Regional Analysis - Waikato

“The Waikato region reached a new median price of $850,000 — up 25.9% year-on-year. Four districts in Waikato reached record medians: Hauraki District ($695,000), Matamata-Piako District ($760,000), South Waikato District ($535,000), and Waipa District ($890,000). The borders opening has allowed more people to travel and view properties, and it was easier to complete settlements than in previous months.

“The market remained active in December, with a rise in listings and appraisals. Anecdotally, some vendors chose to list their high-end property in the hope that Aucklanders in the market over summer would purchase. Finance is a central obstacle for buyers, and this has impacted the number of deals in December. It is expected that the Waikato market will see an uplift in sales in January and February as people continue to move about the country freely.” (REINZ)

The current Days to Sell of 27 days is less than the 10-year average for December which is 35 days. There were 11 weeks of inventory in December 2021 which is 4 weeks more than the same time last year.

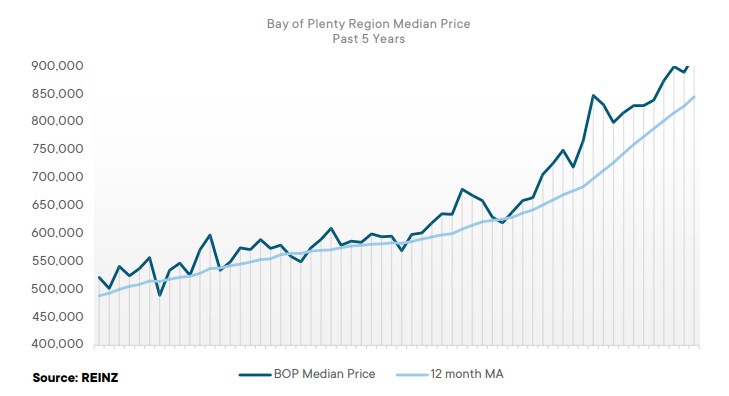

Regional Analysis - Bay of Plenty

“The Bay of Plenty region saw a 27.8% increase in its median house price reaching $920,000 — a new record high. The Rotorua District also reached a new record high of $700,000. It felt like the market in December slowed down earlier than usual. Attendance at open homes dropped noticeably in mid-November rather than mid-December, which saw activity in the market ease — in some cases due to existing finance agreements being pulled altogether. As a result, properties are spending longer on the market, with the days to sell up from 27 days in December 2020 to 30 days in December 2021. However, this increase in days to sell is relatively minimal and indications are that the market remains strong notwithstanding the uplift in median days to sell. The number of new listings increased in the Bay of Plenty, and inventory levels are slowly replenishing after the COVID-19 lockdowns of 2021.” (REINZ)

The current Days to Sell of 30 days is less than the 10-year average for December which is 39 days. There were 10 weeks of inventory in December 2021 which is 5 weeks more than the same time last year.

Regional Analysis - Gisborne

“Gisborne reached a record high median house price of $695,000 — a 17.8% increase from December 2020. Listings were down notably in December, with a 34.9% decrease year-on-year, showing that many sellers are waiting to list in the new year when more people are around. The median number of days properties are spending on the market increased by five, largely due to lending criteria changes taking effect — a contributing factor to the decline in buyer numbers compared to previous months. Days to sell may increase further due to the new finance criteria which will begin to affect the price sellers receive if they find themselves under pressure and unable to hold out for a premium price.” (REINZ)

The current Days to Sell of 33 days is more than the 10-year average for December which is 32 days. There are 7 weeks of inventory in December 2021 which is 2 weeks less than the same time last year.

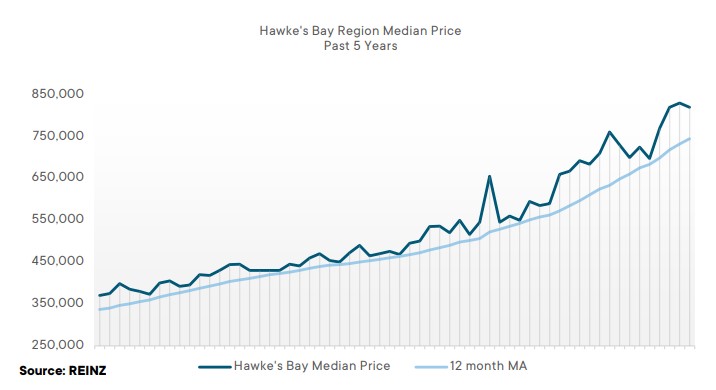

Regional Analysis - Hawke's Bay

“The Hawke’s Bay region reached a median price of $820,000 — a 22.8% increase annually. Two districts reached record median prices in Hawke’s Bay: Central Hawke’s Bay District ($675,000 and Napier City ($848,000). Like many other regions across the country, Hawke’s Bay saw a decrease in its number of first home buyers and investors due to the new tax legislation and fiscal tightening. These factors also impacted the median days to sell which increased by five from December last year. Despite the market slowing down nearer to Christmas, Hawke’s Bay saw an increase in its listings, and inventory rose significantly by 107.4% when compared to this time last year. Despite a decrease of 17.3% in sales count, it has been noted that higher-value property is selling well, but mid priced property enquiry appears low.” (REINZ)

The current Days to Sell of 29 days is less than the 10-year average for December which is 33 days. There were 9 weeks of inventory in December 2021 which is 4 weeks more than the same time last year.

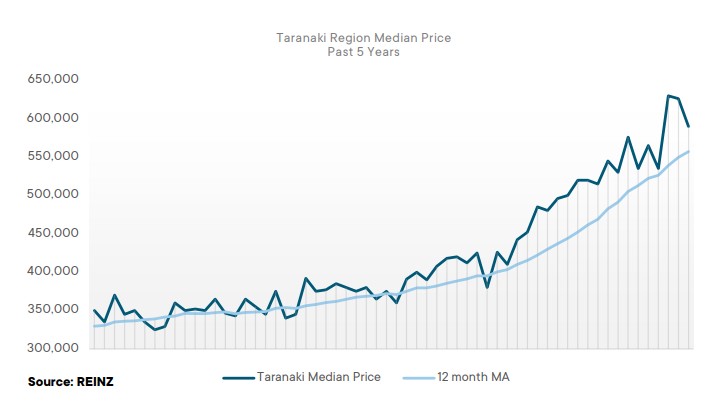

Regional Analysis - Taranaki

In December 2021, Taranaki had an 18.0% increase in its median house price reaching $590,000. The South Taranaki District reached a record median high of $450,000. Many first home buyers have put their property plans on hold due to a shortage of stock combined with rising interest rates, rising prices, loan to-value ratios and the new lending criteria — a similar story for investors. As a result, properties are spending longer on the market, with the median days to sell up by eight days.

“Listings were also down in December, and the shortage of stock along with new build costs has enabled vendors to ask for higher prices. In the coming months, buyer demand is expected to increase with a low level of stock as summer comes to an end.” (REINZ)

The current Days to Sell of 28 days is less than the 10-year average for December which is 32 days. There were 7 weeks of inventory in December 2021 which is 2 weeks less than the same time last year.

Regional Analysis - Manawatu/Whanganui

“The Manawatu/Whanganui region reached a new record median house price of $647,000 — a 23.2% increase from December 2020. Three districts also reached record medians: Horowhenua District ($680,000), Palmerston North City ($750,000), and Whanganui District ($585,000). The market in Manawatu/Whanganui is in a state of change with an uplift in listings but a decrease in the number of buyers. Whilst this is the norm for the holiday period, the rising interest rates, loan-to value ratios and banks tightening lending criteria are definitely impacting the number of buyers. Vendors are asking for slightly less and adjusting their expectations to meet the market. It is expected that normal market activity will return in February.” (REINZ)

The current Days to Sell of 26 days is less than the 10-year average for December which is 32 days. There were 10 weeks of inventory in December 2021 which is 5 weeks more than the same time last year.

Regional Analysis - Wellington

“The Wellington region had an equal high in its median house price in December 2021 of $1,000,000, increasing by 24.2% annually. Wellington City had a record median house price of $1,161,000. Anecdotally, the Auckland and Waikato borders opening resulted in more inquiries from the north, suggesting some people want to relocate and change their lifestyle. Inventory has increased significantly from December 2020 — up 206.6%. However, listings remained relatively stagnant, with only a 2.6% increase in new listings. Due to new lending criteria, properties are spending longer on the market, and certain properties aren’t selling at tender or deadline dates. If lending criteria stays as is, it is expected that properties will continue to sit on the market.” (REINZ)

The current Days to Sell of 31 days is more than the 10-year average for December of 29 days. There were 9 weeks of inventory in December 2021 which is 5 weeks more than the same time last year.

Regional Analysis - Nelson/Marlborough

“Median house prices in the Nelson, Marlborough and Tasman region increased annually by 23.0%, 22.6% and 25.2% respectively. Tasman reached a record median of $920,000, and Nelson reached a record median of $830,000. December saw sales activity ease; the Tasman and Nelson regions saw a decrease in sales counts of 30.7% and 7.5%, respectively, compared to December 2020. Marlborough was the only region in New Zealand that saw a year-on-year increase in its sales count (+5.1%).

“Numbers of first home buyers have declined, with the latest lending criteria impacting many. Borders opening throughout the country enabled further sales activity, and some properties were purchased via virtual viewings. Demand in the regions remains strong as they continue to be seen as an attractive investment and there are good work prospects for those wanting a lifestyle change. January and February may give us more of an insight into whether this demand outweighs supply.” (REINZ)

The current Days to Sell of 27 days is less than the 10-year average for December which is 30 days. There were 8 weeks of inventory in December 2021 which is 2 weeks more than the same time last year.

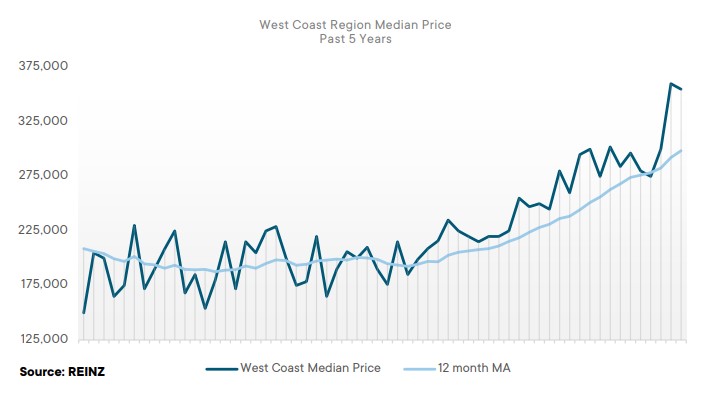

Regional Analysis - West Coast

“The West Coast saw its median house price reach $355,000 in December 2021 — a 26.8% increase annually. Two districts in the West Coast saw record median prices: Grey District ($355,000) and Westland District ($505,000). The West Coast is considered one of the most affordable regions to buy a property and an attractive region for investors due to its investment returns. Despite the low level of stock in the region, buyer demand has continued, and properties sold fast in December — down 11 days from 43 in December 2020 to 32 in December in 2021. The West Coast also experienced its highest sales count since July 2021.” (REINZ)

The current Days to Sell of 32 days is much less than the 10-year average for December which is 78 days. There were 16 weeks of inventory in December 2021 which is 1 week less than the same time last year.

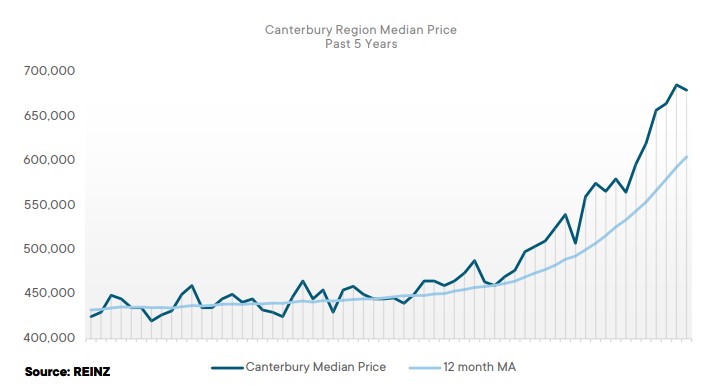

Regional Analysis - Canterbury

“Canterbury saw its median house price increase by 25.9% in December 2021, reaching $680,000. The Timaru District reached a record median house price of $474,000. Owner-occupiers and first home buyers were active in the market in December, with a notable number of people moving from other regions looking for new opportunities in work and lifestyle.

“Auctions remained a popular method of sale with 42.6% of sales by auction — some had auctions running right up until the week of Christmas There was strong participation at auctions and property enquiries, which indicates people want to ‘get on with it’ despite challenges in the months prior.

“Although securing finance is difficult, the entry level price in the Canterbury area is still achievable for first home buyers. Investor numbers are also steady — some investor-developers are looking for opportunities to renovate and develop property. Investor interest is also strong for dwellings rented by students. With the market tracking steadily, many remain positive and confident for the next few months and expect an increase in listings and buyers coming from outside the Canterbury market as well as locally.” (REINZ)

The current Days to Sell of 27 days is less than the 10-year average for December which is 30 days. There were 7 weeks of inventory in December 2021 which is 1 week less than the same time last year.

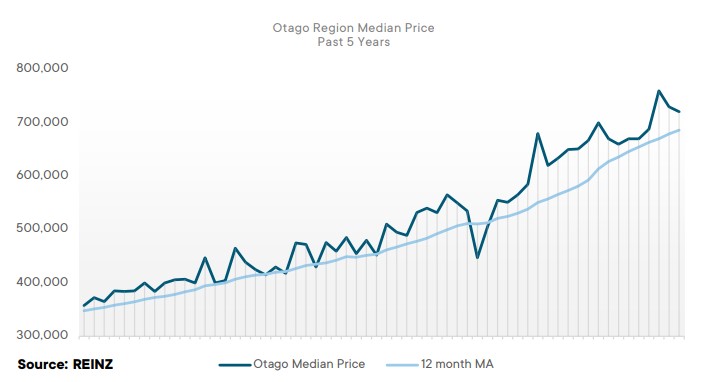

Regional Analysis - Otago

Dunedin City - “Median house prices in Dunedin increased 10.2% annually, reaching $650,000. Buyers were spread across a lot more properties and houses are spending longer on the market with days to sell up nine from 21 in December 2020 to 30 in December 2021. The top end of the market continues to perform strongly with many buyers waiting for premium properties who are in strong financial positions and ready to offer. In the coming months, we expect a further lift in the numbers of properties coming onto the market as sellers press to secure a buyer before interest rates rise again.” (REINZ)

Queenstown Lakes -“The Queenstown-Lakes District saw median house prices increase 24.3% year-on-year reaching $1,325,115. The Wanaka Ward also saw its median house price reach $1,330,000 — a 46.6% increase from December 2020. Upward house prices are making it difficult for first home buyers to enter the market. However, land sales to first home buyers through the Hanley’s Farm Division have been strong. The upper end of the market has seen activity and enquiry remain steady, but the sales count declined by 9.6% across the board. As summer comes to an end, the national tourist market will begin to dissipate, but — with the Queenstown-Lakes District remaining an attractive option to out of town buyers — many remain hopeful that upward momentum will continue throughout summer.” (REINZ)

The current Days to Sell of 29 days is less than the 10-year average for November which is 30 days. There were 10 weeks of inventory in November 2021 which is 1 week less than the same time last year.

Regional Analysis - Southland

“Southland saw a 21.3% increase in its median house price, reaching $455,000 — a new record high. In December 2021, Southland saw an uplift in listings, but sales were down by 23.0% due to the holiday period. The most prevalent buyers in the market were owner-occupiers. New lending criteria impacted the numbers of first home buyers, and new regulations affected investor numbers. It is expected that listings will continue to increase in the region over the summer months with media influencing sellers to sell now or soon.” (REINZ)

The current Days to Sell of 22 days is less than the 10-year average for December which is 31 days. There were 8 weeks of inventory in December 2021 which is the same as the same time last year.

Browse

Topic

Related news

Find us

Find a Salesperson

From the top of the North through to the deep South, our salespeople are renowned for providing exceptional service because our clients deserve nothing less.

Find a Property Manager

Managing thousands of rental properties throughout provincial New Zealand, our award-winning team saves you time and money, so you can make the most of yours.

Find a branch

With a team of over 850 strong in more than 88 locations throughout provincial New Zealand, a friendly Property Brokers branch is likely to never be too far from where you are.