Median house prices for NZ excl Auckland increased by 33.5% from April 2020 - REINZ stas April 2021

Thursday, 13 May 2021

The number of residential properties sold in April across New Zealand was the highest number of properties sold in an April month for 5 years with 7,218 properties sold according to the latest data from the Real Estate Institute of New Zealand (REINZ).

Median prices for residential property across New Zealand increased by 19.1% from $680,000 in April 2020 to $810,000 in April 2021, albeit down from last month’s record. Additionally, 9 out of 16 regions reached record median prices and so did 21 districts – well down on 32 districts last month.

Median house prices for New Zealand excluding Auckland increased by 33.5% from $517,000 in April last year to $690,000, a new record high for New Zealand excluding Auckland.

Wendy Alexander, Acting Chief Executive at REINZ says: “As we predicted last month, the ongoing lack of supplycontinues to put upwards pressure on house prices. However, we have seen some regions start to show signs of prices easing and the rate of growth slowing down a little which will be welcome news to those looking to get on the property market. Additionally, it might be the first signs that the re-introduction of the LVRs is starting to have the desired effect.”

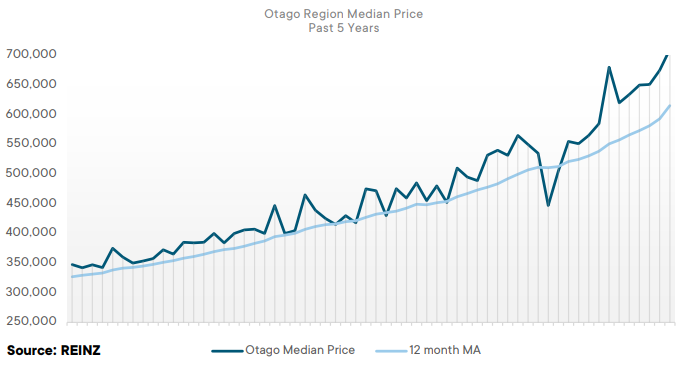

“However, we were still surprised by the strength of some of the rises in places such as Gisborne, Manawatu/Wanganui, Marlborough and Otago which have all seen annual price rises in excess of 45%. Furthermore, we were surprised that the Auckland region reached another record median price – the third in a row,” continues Alexander.

“Also of note was New Plymouth District ($620,000) which has had six record median prices in a row and TaurangaCity ($937,500) which has had four median price records in a row. Additionally, Manukau City ($1,070,000) Waipa District ($860,000), Gisborne District ($690,000) and Marlborough District ($672,000) have all had three median price records in a row and Queenstown Lakes District ($1,200,000) had its second consecutive month of a record median price.

“As we head further into the cooler months of the year and the second tranche of LVRs comes into effect, we would expect to see further stabilisation of the market in the coming months – as long as we see a solid level of new listings come to the market,” concludes Alexander.

Regions with the largest increase in annual sales volumes during April were:

- Waikato: 37.7% increase from $530,000 in April 2020 to $730,000 in April 2021.

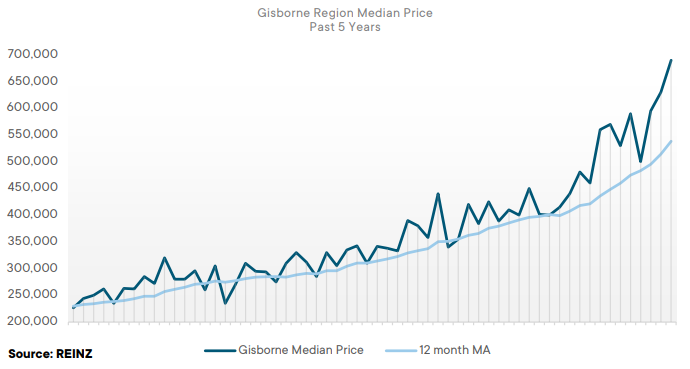

- Gisborne: 72.5% increase from $400,000 in April 2020 to $690,000 in April 2021.

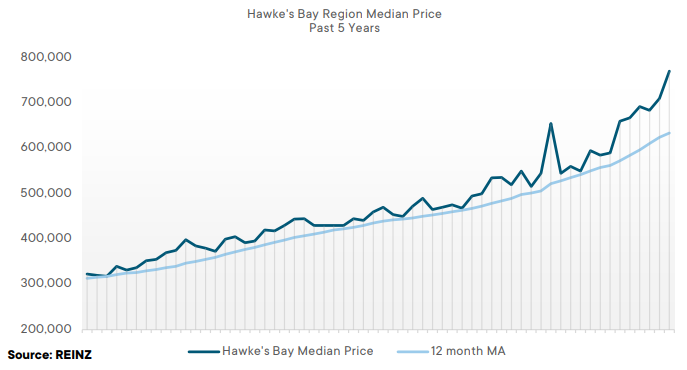

- Hawke’s Bay: 17.6% increase from $655,000 in April 2020 to $770,500 in April 2021.

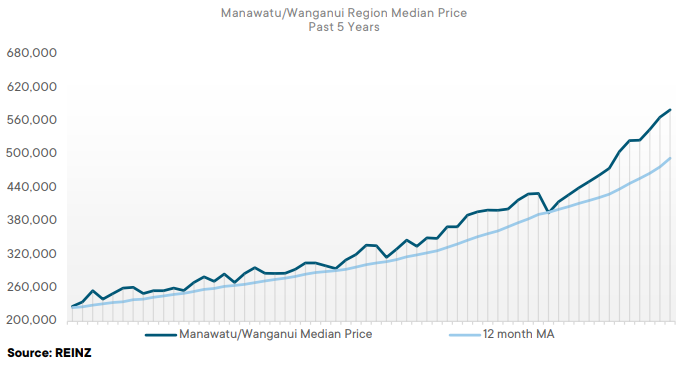

- Manawatu/Wanganui: 46.8% increase from $395,000 in April 2020 to $580,000 in April 2021.

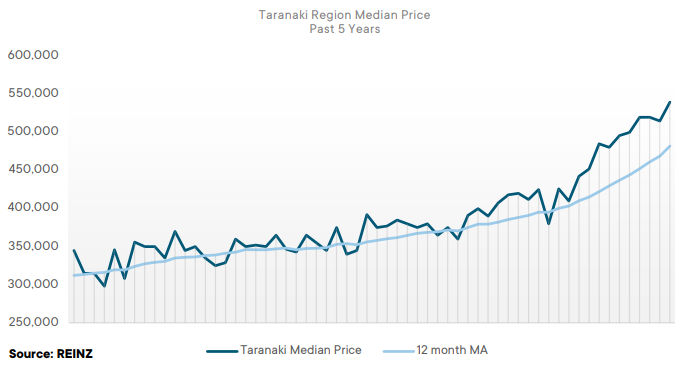

- Taranaki: 42.1% increase from $380,000 in April 2020 to $540,000 in April 2021.

- Nelson: with a 15.1% increase from $645,500 in April 2020 to $743,000 in April 2021.

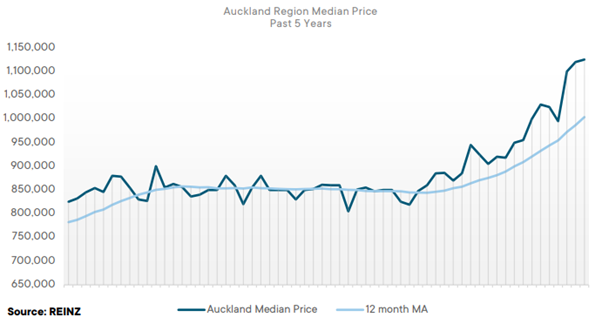

Regional Analysis - Auckland

“Median house prices in Auckland reached a new record in April 2021 of $1,125,000, up 21.6% year-on-year and the third consecutive month of record prices. Sales volumes eased from the high levels we saw in March, down 34.7% month-on-month from 3,970 in March to 2,591 in April 2021. The decreased number of sales in April looks to be a result of investors slowing down, particularly as there was a strong presence in March as purchasers rushed to beat the new Government restrictions. First home buyers are still active in the market and looking to take advantage of the decreased number of attendees at open homes and auctions.

However, properties are still selling quickly, with days to sell down to 31 – the lowest level of April days to sell for the region since records began. Auctions accounted for 48.1% of all properties sold in April, the highest for an April month since records began. April saw a noticeable increase in developers looking for land for new builds” (REINZ)

The current Days to Sell of 31 days is less than the 10-year average for April which is 34 days. There were 9 weeks of inventory in April 2021 which is 9 weeks less than the same time last year.

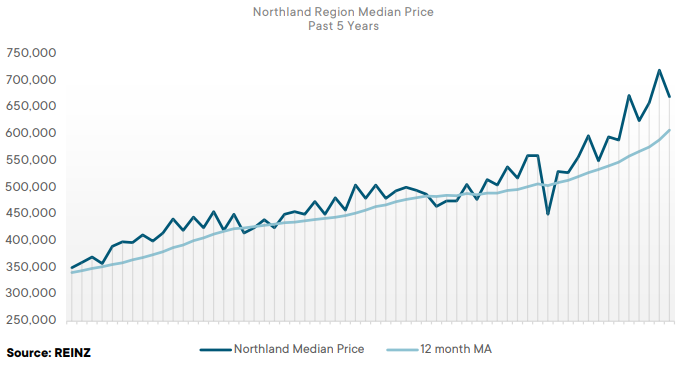

Regional Analysis - Northland

“Median prices in the Northland region eased slightly in April 2021 to $670,000, from the record high of $720,000 in March 2021. Sales volumes also eased from last month, down 20.1% month-on-month from 259 in March 2021 to 207 in April 2021. Investors have taken a pause and slowed in their enquiries as a result of the recent government announcements. First home buyers are still active but are finding it difficult to secure a property at an appropriate price point.

Good properties coming to the market are getting a lot of attention and selling quickly with days to sell at the lowest level for an April month since 2005 (37 days)." (REINZ)

The current Days to Sell of 37 days is much less than the 10-year average for April which is 52 days. There were13 weeks of inventory in April 2021 which is 28 weeks less than the same time last year.

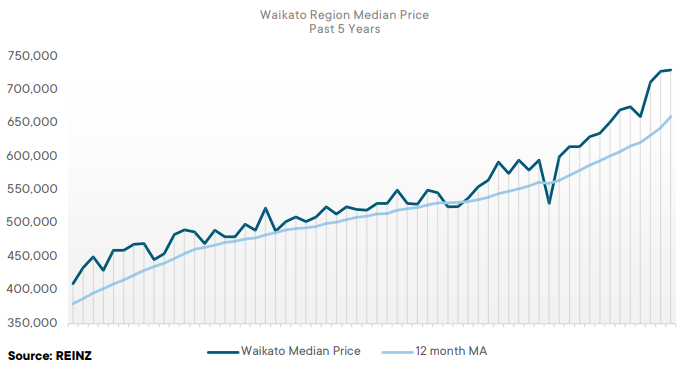

Regional Analysis - Waikato

“The Waikato region reached a record median house price of $730,000 in April 2021, up 37.7% year-on-year and the third consecutive month of record prices. The continuing upward trend of median prices is starting to have an impact on first home buyers, who are becoming increasingly priced out of the market. However, enquiry levels are still high and properties are selling at the fastest rate for an April month since 2005. High sales volumes combined with low levels of new listings coming to the market have resulted in the Waikato region experiencing a fall in inventory, down -32.8% annually, with just 5 weeks of property available to prospective purchasers.

Auctions have continued to be a popular method of sale in April, with 27.1% of all properties being sold by auction, up slightly from 24.5% in March 2021.” (REINZ)

The current Days to Sell of 28 days is much less than the 10-year average for April which is 39 days. There were 5 weeks of inventory in April 2021 which is 12 weeks less than the same time last year.

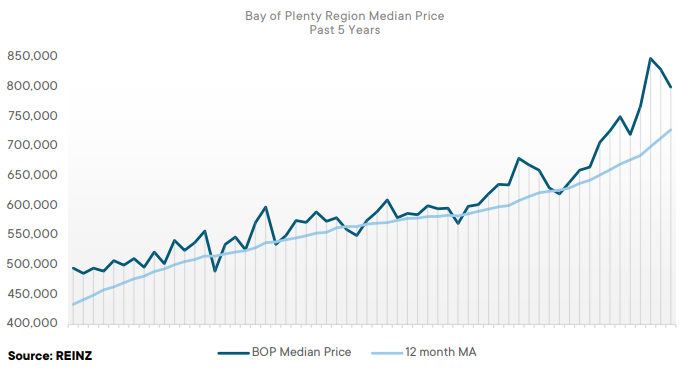

Regional Analysis - Bay of Plenty

“Median house prices in the Bay of Plenty region increased 27.0% annually to $800,000 in April 2021, up from $630,000 in April 2020. Tauranga City reached a record median price in April of $937,500, up 34.8% annually and up 3.3% from March 2021 – the fourth record median price in a row. Listings are still tight for the region, down -16.1% from March, leaving some vendors with FONFA – the Fear Of Not Finding Anything, meaning they are reluctant to sell until they find somewhere to move.

Investor activity has not slowed too much in April, with professional investors still eager to secure good properties; however, mum and dad investors are rethinking their purchases and have eased off slightly. Access to finance continues to be an issue, particularly for first home buyers as the processing of requests is slow and the market is still moving at a quick pace with days to sell at just 30 days.” (REINZ)

The current Days to Sell of 30 days is much less than the 10-year average for April which is 44 days. There were 7 weeks of inventory in April 2021 which is 9 weeks less than the same time last year.

Regional Analysis - Gisborne

“Median house prices reached a record high in April 2021 for the Gisborne region of $690,000, up 72.5% annually from $400,000 in April 2020 and the third consecutive month of record prices for the region. Activity levels have started to ease slightly for the region in April with the number of properties sold down -13.5% from March 2021, from 52 to 45 – this is the lowest level of April sales since 2014 (excluding April 2020, the Alert Level 4 lockdown period). This slight decrease in activity has begun to ease pressure and helped increase overall inventory by 9.3%, with 101 properties available to prospective purchasers.

The REINZ House Price Index for Gisborne/Hawke’s Bay increased 37.0% year-on-year to a record high level of 4,301 – the highest annual increase across the country.” (REINZ)

The current Days to Sell of 35 days is less than the 10-year average for April which is 38 days. There are 10 weeks of inventory in April 2021 which is 5 weeks less than the same time last year.

Regional Analysis - Hawke's Bay

“The Hawke’s Bay region reached a record median house price in April 2021 of $770,500, up 17.6% year-on-year and up 8.5% from March 2021. This represents a $60,500 increase since March in the median price. Activity levels have remained strong, with good levels of attendance at open homes and private viewings, however, purchasers are still rushing to secure property with days to sell the lowest for an April month since records began. School holidays always tend to have an impact on sales volumes too, as potential purchasers shift their focus temporarily.

The REINZ House Price Index for Gisborne/Hawke’s Bay increased 37.0% year-on-year to a record high level of 4,301 – the highest annual increase across the country, displaying the underlying value of property has continued to grow. Overall, the Hawke’s Bay region has begun to steady over the last three months, and this is expected to continue into the winter months.” (REINZ)

The current Days to Sell of 29 days is much less than the 10-year average for April which is 39 days. There were 7 weeks of inventory in April 2021 which is 3 weeks less than the same time last year.

Regional Analysis - Taranaki

“Median house prices in the Taranaki region reached a record $540,000 in April 2021, a 42.1% increase from $380,000 in April 2020. New Plymouth District has also reached a record median price in April of $620,000, the sixth record median in a row. Sales volumes have eased slightly from March, down -11.8% as some investors begin to take a step back due to new legislation. Some professional investors are still active in the market, and first home buyers have taken a pause to see if the latest lending criteria has an impact on house prices before they take the plunge. Vendor expectations are still high due to the low levels of stock available and therefore, decreased levels of competition.

Overall inventory is down -16.5% annually, with 324 properties available to prospective purchasers. The REINZ House Price Index for Taranaki also reached a record level of 4,139 in April 2021, up 32.9% year-on-year.” (REINZ)

The current Days to Sell of 22 days is much less than the 10-year average for April which is 40 days. There were 7 weeks of inventory in April 2021 which is 11 weeks less than the same time last year.

Regional Analysis - Manawatu/Whanganui

“Median house prices increased 46.8% year-on-year in Manawatu/Whanganui to a record $580,000 in April 2021, up from $395,000 at the same time last year. Sales volumes eased slightly in April, down -22.2% annually, however this is likely due to the lack of available properties. Inventory for the region was down -22.7% year-on-year to 488 properties, or 5 weeks of stock available to prospective purchasers. There has been a slight reduction in the number of investors active in the market, as they adjust to the new LVRs and changes to tax regulations.

Attendance at open homes has remained fairly consistent in April, and first home buyers have taken the opportunity to secure a property while investors re-analyse. There has been a slight increase in available listings, which will hopefully continue over the coming months and help ease pressure on stock and prices.” (REINZ)

The current Days to Sell of 25 days is much less than the 10-year average for April which is 38 days. There were 5 weeks of inventory in April 2021 which is 5 weeks less than the same time last year.

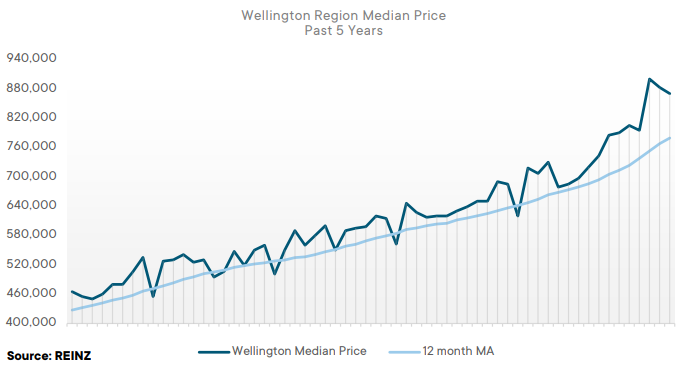

Regional Analysis - Wellington

“Median house prices in Wellington increased 19.2% year-on-year to $870,000, up from $730,000 in April 2020. Kapiti Coast ($930,000), Lower Hutt City ($860,000) and South Wairarapa ($850,000) all reached record median house prices in April. Lower Hutt has had a record median house price for 9 out of the last 12 months, showing just how popular the area has been with purchasers. First home buyers are still active in the market and keen to secure their place in the market, with many moving out further to the outer suburbs and many heading to Levin.

Investors have started to sell some of their stock, leaving many prospective tenants looking for new homes. Inventory for the region has decreased -8.5% annually, leaving 830 properties available for prospective purchasers, or 5 weeks – one of the lowest levels across the country. The REINZ House Price Index for Wellington increased 34.2% year-on-year to a record high 4,046.” (REINZ)

The current Days to Sell of 30 days is less than the 10-year average for April of 33 days. There were 5 weeks of inventory in April 2021 which is 4 weeks less than the same time last year.

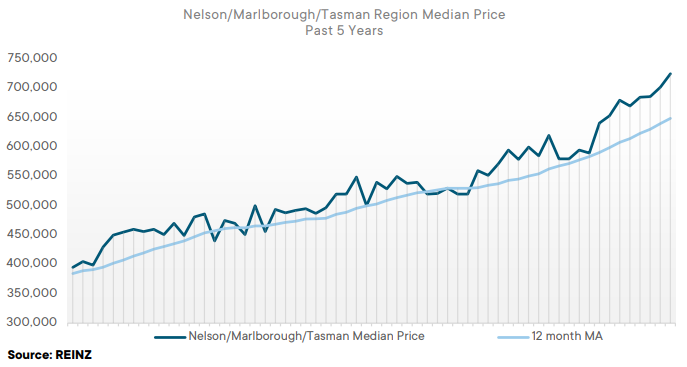

Regional Analysis - Nelson/Marlborough

“The Nelson ($743,000) and Marlborough ($672,000) regions reached record median house prices in April, up 15.1% and 46.1% year-on-year, respectively – this is the third consecutive month that Marlborough has reached a record median price. The Tasman region saw median sales prices increase 16.9% to $767,500, down -4.2% from a record $801,000 in March 2021. Marlborough was the only region nationally that saw an increase in sales count from March 2021, up 10.7%. Many properties are going to multi-offer as demand has continued to outweigh supply.

Vendor expectations have been high as a result of busy open homes and an arrival of out-of-town purchasers driving competition. It is expected that the market will remain steady over the coming months, as the shortage of stock will maintain demand.” (REINZ)

The current Days to Sell of 28 days is less than the 10-year average for April which is 34 days. There were 10 weeks of inventory in April 2021 which is 11 weeks less than the same time last year.

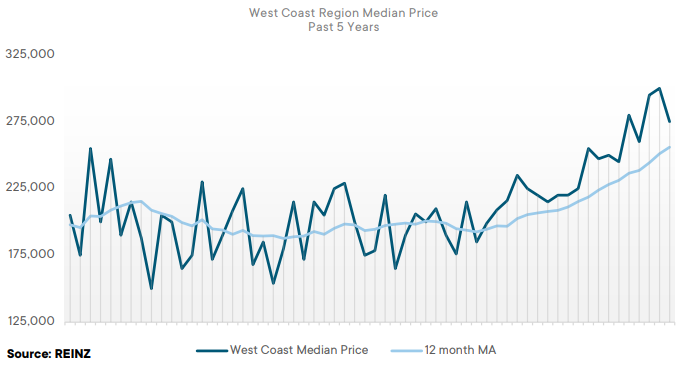

Regional Analysis - West Coast

“Median house prices in the West Coast region increased 27.9% from $215,000 in April 2020, to $275,000 in April 2021, and down -8.3% from the record high $300,000 set in March 2021. Demand for properties in the region continues to grow as enquiries are being fielded from cross the country. 46 properties were sold during April 2021, the highest number sold during an April month since 2006. Investor activity has remained solid in the West Coast region and hasn’t slowed as a result of the government announcement, like it has in other parts of the country.

Overall inventory for the region has decreased -37.4% in April to 189 properties, from 301 at the same time last year – leaving 10 weeks of available stock for prospective purchasers.” (REINZ)

The current Days to Sell of 33 days is much less than the 10-year average for April which is 79 days. There were 10 weeks of inventory in April 2021 which is 86 weeks less than the same time last year.

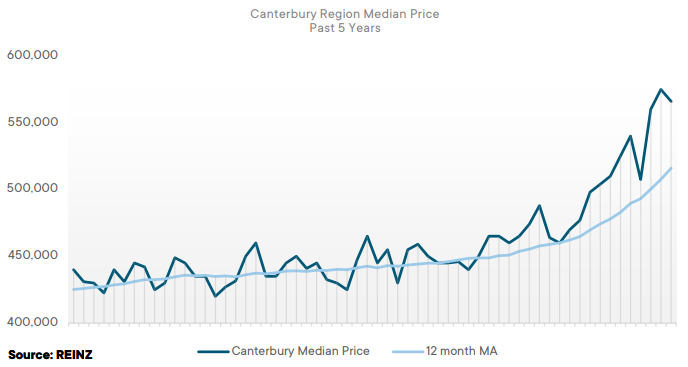

Regional Analysis - Canterbury

“The Canterbury region saw median house prices increase 22.0% year-on-year to $566,000 up from $464,000 at the same time last year. The number of properties sold during April decreased from March, down -23.6% to 1,076 properties sold (from 1,409) – however, this is the highest number of properties sold for an April month since 2007. First home buyers are still active in the market, although at a lower level than previous months as they take more of a wait and see approach to the government announcement and whether this will make any difference for them.

Interest from out-of-town investors also seems to have eased in April, as the LVRs have been reinstated and the new government changes have taken effect. Looking forward, we expect the normal winter slow down over the coming months, before picking up again in Spring.” (REINZ)

The current Days to Sell of 27 days is less than the 10-year average for April which is 32 days. There were 6 weeks of inventory in April 2021 which is 12 weeks less than the same time last year.

Regional Analysis - Otago

“The Queenstown-Lakes district reached a new record median house price of $1,200,000 in April 2021, up 41.2% from $850,000 in April 2020. The lack of stock is continuing to put pressure on house prices. Listings for the Otago region are also down in April, and buyer enquiry is down, following the government announcements and partially as a result of very restrictive lending plus the regular seasonal slow-down that comes with winter. Buyer enquiries from Australia have increased slightly since the opening of the Trans-Tasman bubble has made the option of a move or holiday house in Queenstown more viable.” (REINZ)

“Dunedin City reached a record median house price in April 2021 of $621,120, up 25.5% year-on-year from $495,000 at the same time last year. The number of properties sold in April decreased -37.6% from March 2021 as investors have started to pull back from the market after the government announcements. First home buyers have remained active in the market, now making up a larger portion of active buyers as they try to take advantage of the investor slow-down. Access to finance has continued to be an issue for those with lower levels of equity, resulting in more cash buyers at the upper end of the scale. The next few months will be telling as to the depth of the impact from the government changes.” (REINZ)

The current Days to Sell of 32 days is less than the 10-year average for April which is 35 days. There were 10 weeks of inventory in April 2021 which is 4 weeks less than the same time last year.

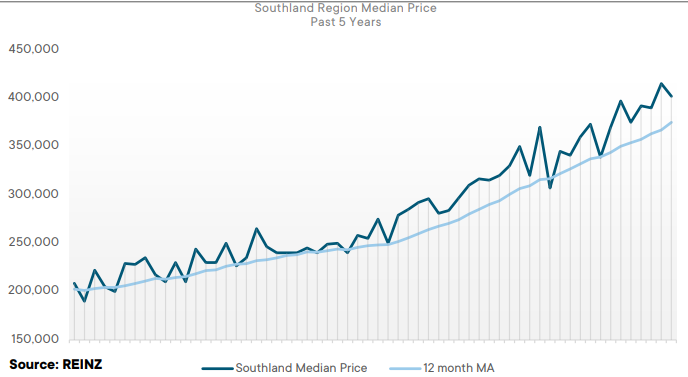

Regional Analysis - Southland

“Median house prices in Southland increased 30.9% year-on-year to $402,000 in April 2021, up from $307,000 at the same time last year. The number of properties sold in the Southland region decreased -40.2% from March 2021 as first home buyers and investors stepped back slightly after the government announcement in late-March, to take a wait and see approach about how this may impact them. The FOMO that was previously driving a lot of sales appears to have become less of a factor for purchasers. Southland experienced the lowest number of properties sold since May 2020.

The REINZ House Price Index for Southland increased 19.6% annually to a record 4,156, showing that the underlying value of properties in the region is still increasing. Moving forward, we expect the Southland market to stabilise further.” (REINZ)

The current Days to Sell of 22 days is much less than the 10-year average for April which is 36 days. There were 6 weeks of inventory in April 2021 which is 10 weeks less than the same time last year.

Browse

Topic

Related news

Read more

Find us

Find a Salesperson

From the top of the North through to the deep South, our salespeople are renowned for providing exceptional service because our clients deserve nothing less.

Find a Property Manager

Managing thousands of rental properties throughout provincial New Zealand, our award-winning team saves you time and money, so you can make the most of yours.

Find a branch

With a team of over 850 strong in more than 88 locations throughout provincial New Zealand, a friendly Property Brokers branch is likely to never be too far from where you are.