Optimism returns to New Zealand's property market - REINZ stats September 2024

Tuesday, 15 October 2024

September shows additional signs of stability as spring began and confidence increased among both vendors and buyers.

According to REINZ Chief Executive Jen Baird, while the market remains subdued, there is a noticeable rise in positivity and confidence that things will continue to improve as we approach the end of the year. Despite lingering challenges such as the cost of living, many believe that the downward trend of interest rates will lead to a gradual recovery as we move into 2025.

“After the Reserve Bank reduced the OCR rate by 50 basis points to 4.75%, the market is expected to see more activity from those who are ready to buy, reinforcing the optimism in the market, and this will likely be reflected in the coming months’ property reports, ” adds Baird.

The national median price decreased 2.3% year-on-year, from $799,000 to $781,000, and increased 2.1% month-on-month from $765,000. For New Zealand, excluding Auckland, the median price decreased slightly by 0.7% year-on-year (only $5,000), from $700,000 to $695,000. The median price increased by 2.2% compared to August 2024, up from $680,000.

“The signs across the country are largely of stability with slight decreases year-on-year, and the median price increase of 2.1% compared to August a slight improvement. Even though we are seeing another year-on-year decrease, this is in line with what we expect this time of year so the market is doing what we would expect, another sign of stability,” said Baird.

In the past year, eight of the sixteen regions experienced a median price increase. Gisborne had the highest increase at 10.1% to $605,500, followed by the West Coast at 9.9% to $390,000. Additionally, median prices increased in twelve regions month-on-month, with significant changes in Southland (14.1% to $487,000) and Marlborough (9.7% to $680,000).

The total number of properties sold nationally decreased by 1.1% compared to September 2023, down from 5,881 to 5,816. Compared to August 2024, sales counts decreased by 3.3%, from 6,015 to 5,816.

However, sales in New Zealand, excluding Auckland, increased by 4.5% year-on-year. Seven regions saw sales rise year-on-year in September 2024. The most significant increases were in Hawke’s Bay (+26.3%) and Gisborne (+22.6%). Five regions saw an increase month-on-month.

In the regions, twelve of the fifteen have seen a rise in new listings compared to September 2023, with the most notable increases recorded in Gisborne (+50.0%), Wellington (+36.1%) and Otago (+34.1%). New Zealand, excluding Auckland, there was a 20.4% increase in listings year-on-year.

New Zealand’s national inventory level rose 27.4% year-on-year and 1.5% month-on-month, reaching 30,028. Excluding Auckland, inventory increased by 27.8% year-on-year and 1.8% month-on-month, totaling 18,772. Baird notes that the continuous rise in inventory and listings gives buyers ample choice and time to find suitable properties.

“Local salespeople around the country have noted an increase in buyers attending open homes, more so than the usual spring lift we see each year. With some regions now seeing an uplift in sales (7 out of 16 regions), buyer engagement is improving, with listings receiving more enquiries. These trends could lead to a more robust market in the coming months, particularly if expected improvements in market activity and reductions in interest rates eventuate,” added Baird.

In September, there were 737 auctions nationally (12.7% of all sales), down from 911 (15.5%) in September 2023. Auckland had 398 auctions (21.2% of sales), compared to 579 (27.4%) a year ago.

The national median days to sell increased by nine days to 49, and excluding Auckland, it rose to 50 days. Notably, the West Coast saw a significant decrease in median days to sell, dropping by 28 days to 31.

The HPI for New Zealand stood at 3,600, a 0.4% decrease year-on-year and an increase of 1.0% month-on-month. The average annual growth in the New Zealand HPI over the past five years has been 4.9% per annum, and it is currently 15.8% below the market peak reached in 2021. Southland remains the top-ranked region in September, with a 3.7% increase year-on-year.

Regional highlights:

- Hawke’s Bay had the largest sales increase year-on-year, up 26.3% from 175 to 221.

- Twelve regions saw an increase in new listings year-on-year, with notable increases in Gisborne (+50%), Wellington (+36.1%) and Otago (+34.1%).

- Eight of the sixteen regions had a median price increase year-on-year. Gisborne leading the way with a 10.1% increase (from $550,000 to $605,500).

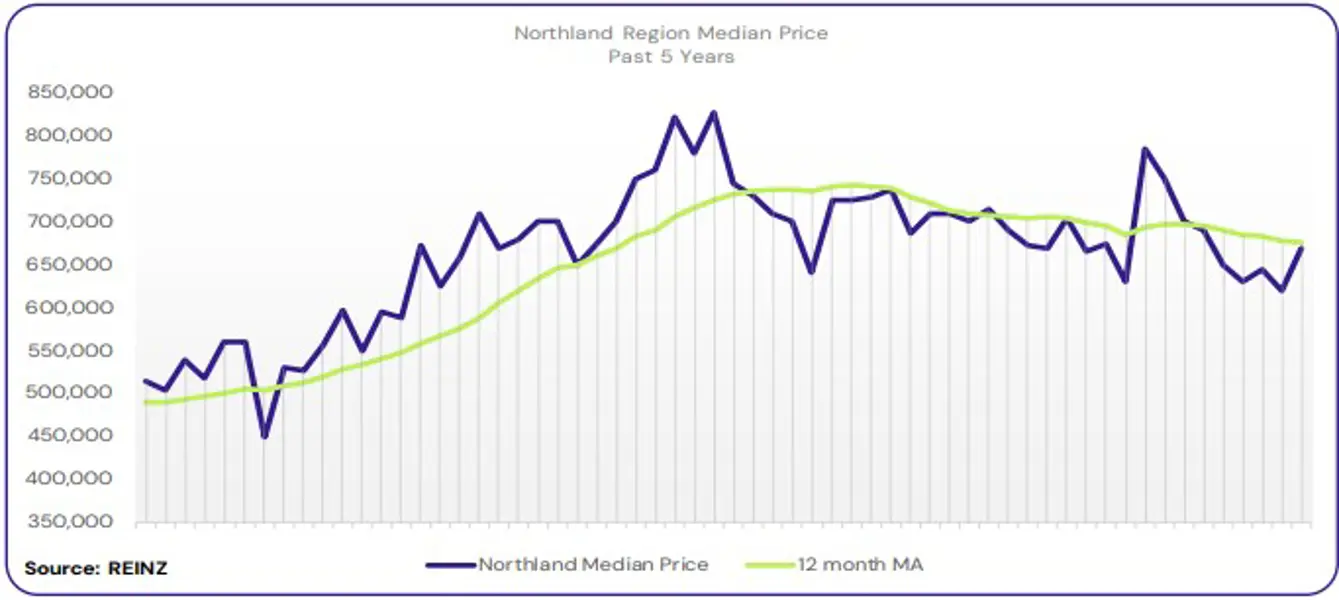

Regional Analysis - Northland

The median price for Northland decreased 5.0% year-on-year to $670,000.

“The most active buyer groups were owner-occupiers, first home buyers, and families looking to upsize.

Vendor expectations were realistic, with most listing their properties closer to market value. Attendance at open homes increased over September. However, well-priced new listings get the most attention. Activity in the auction room for Whangarei increased with more bidders, more sales under the hammer and more attendees.

Increased confidence among buyers and vendors, increased sales, and strong listing numbers influenced market sentiment. However, some buyers are concerned about overpaying. Local agents predict a slow recovery over the coming months. They suggest that confidence will continue to grow if prices stay steady, and so will the number of buyers who want to make an offer.” (REINZ).

The current median Days to Sell of 71 days is much more than the 10-year average for September which is 52 days. There were 40 weeks of inventory in September 2024 which is 2 weeks less than the same time last year.

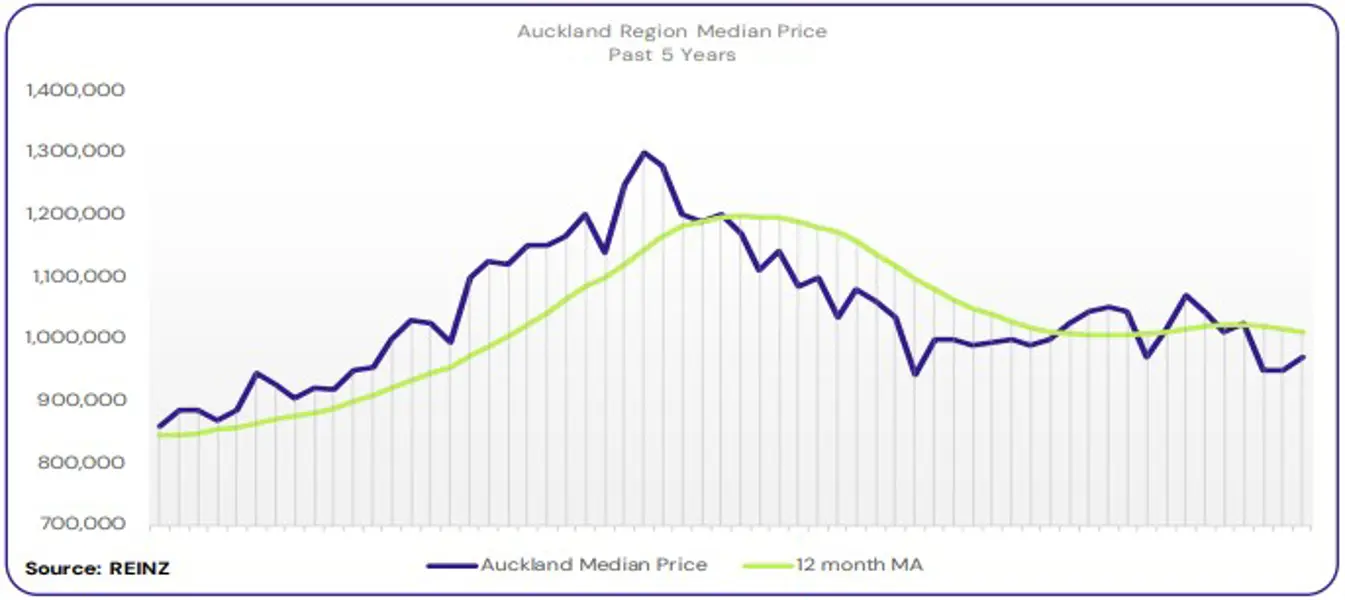

Regional Analysis - Auckland

The median price for Auckland decreased 5.4% year-on-year to $970,000.

“Owner-occupiers, first home buyers and investors were the active buyer groups across the region, with a decline in developers noticed in South Auckland.

Most vendors knew current market price expectations, while others took longer to understand and accept their property’s worth. Attendance at open homes was good for newer listings that were presented well. Auction activity varied, with some areas reporting low conversions under the hammer.

Market sentiment has shifted into a positive place, contributing to confidence for first-home buyers and investors. Local agents are cautiously predicting steady improvement in market activity as interest rates decline further.” (REINZ).

The current median Days to Sell of 48 days is more than the 10-year average for September which is 38 days. There were 30 weeks of inventory in September 2024 which is 7 weeks more than the same time last year.

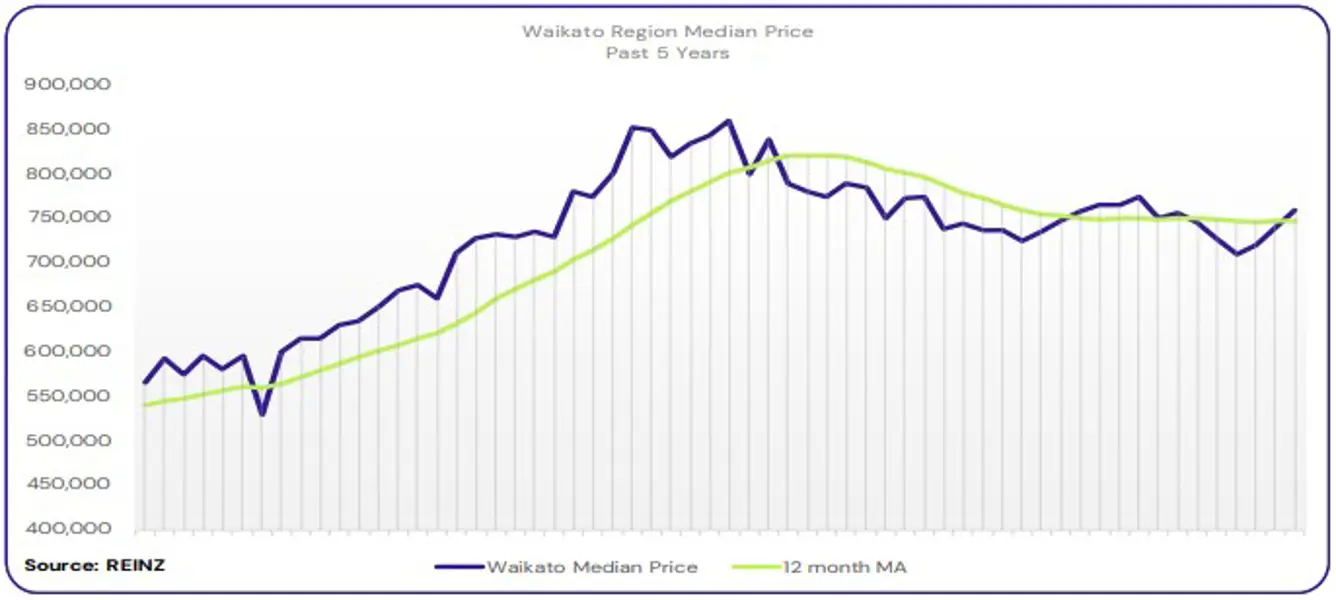

Regional Analysis - Waikato

Waikato’s median price increased 1.6% year-on-year to $760,000.

“Owner-occupiers, first home buyers, downsizers and investors were the most active buyer groups across the region.

Most vendors were realistic about their market expectations, but the OCR and interest rates influenced others to think they would achieve higher prices. Attendance at open homes varied. Some open homes showed many groups through, but no sales were made, while others opted for private viewings.

Attendance and bidding increased at auctions, and more auction listings hit the market. Post-auction activity increased if the property didn’t sell under the hammer. Increased buyer confidence, more ‘good news’ media, and increased buyer activity and enquiry influenced market sentiment. Local salespeople are cautiously optimistic that buyer activity could increase as 2024 ends, although they are concerned the replacement of stock will not meet the level of sales.” (REINZ).

The current median Days to Sell of 55 days is much more than the 10-year average for September which is 38 days. There were 26 weeks of inventory in September 2024 which is 3 weeks more than the same time last year.

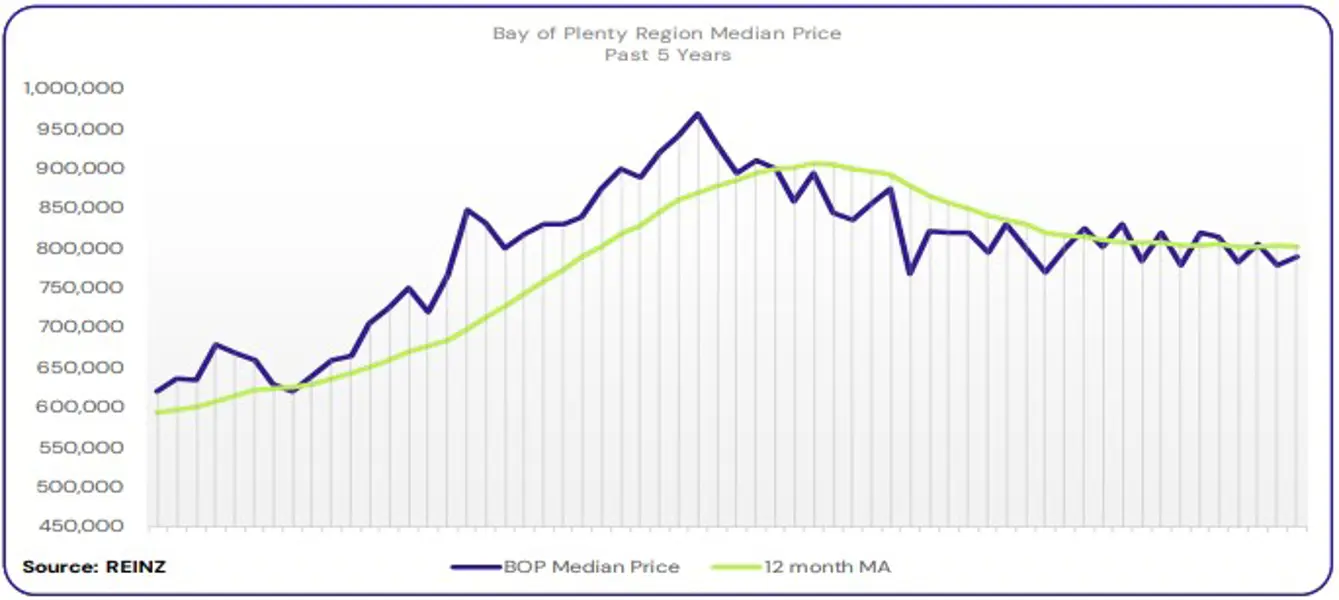

Regional Analysis - Bay of Plenty

The median price for Bay of Plenty decreased 1.3% year-on-year to $790,000.

“Owner-occupiers and first home buyers were the most active buyer groups, with early enquiry from investors and retirees in Tauranga.

Most vendor expectations were realistic and willing to meet market expectations. Others were still a bit optimistic and hoped for higher prices. Attendance at open homes improved, as those attending were well-researched buyers ready to transact as interest rates declined and the weather improved.

Auction activity varied across the region. Most auctions saw increased attendance and buyers more willing to make an offer. Post-auction activity was strong, too. Market sentiment was influenced by factors such as buyers assuming they would lose out to other buyers, vendors shifting to false market impressions, declining interest rates, and increased buyer activity.

Local agents predict a further steady market, as securing new listings is challenging, and they suggest appraising properties correctly and in line with current market conditions is critical.” (REINZ).

The current median Days to Sell of 50 days is more than the 10-year average for September which is 43 days. There were 24 weeks of inventory in September 2024 which is 2 weeks more than the same time last year.

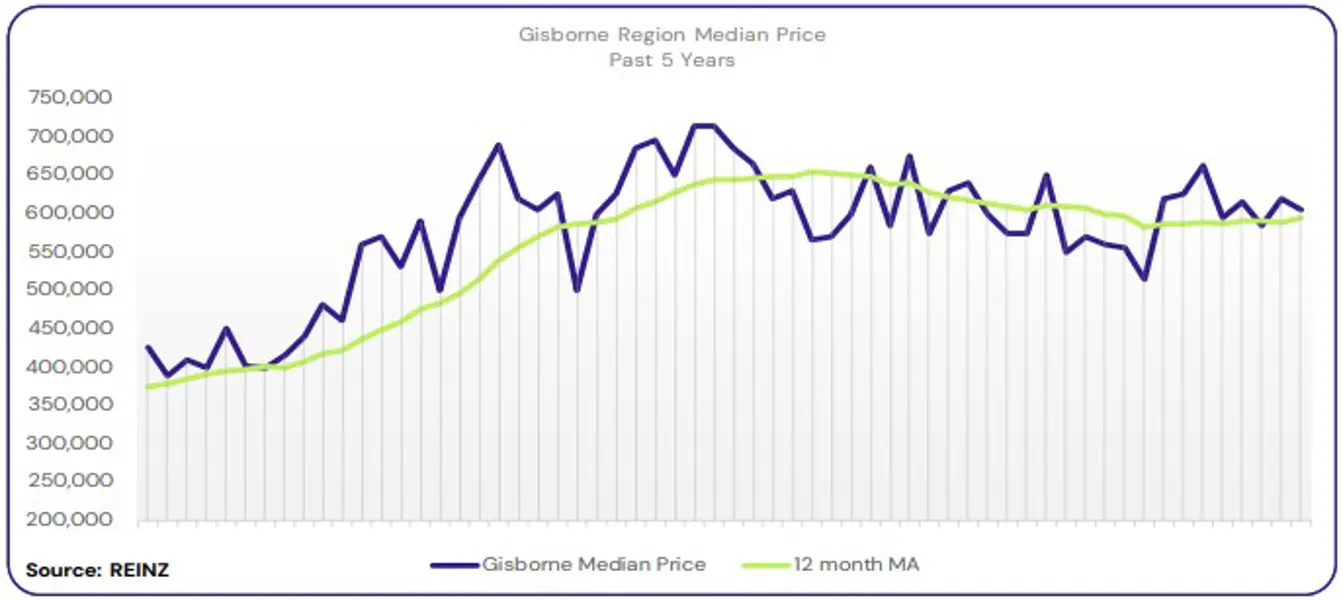

Regional Analysis - Gisborne

Gisborne’s median price increased 10.1% year-on-year to $605,500.

“The most active buyer groups were owner-occupiers, first home buyers and investors. There was still a decreased buyer pool for properties over $1 million.

Vendor expectations were realistic as they understood more about the current market, and as a result, there have been more sales. Attendance at open homes varied across the region – some weekends are busy while others don’t get a group through. Local salespeople suggest buyers still hope to see further signs of economic recovery.

Auction room attendance levels had increased, although sales rates under the hammer seemed to fluctuate. The increasing positivity and confidence, especially from first-home buyers and investors, influenced market sentiment. Local Gisborne agents predict further sales and new listings increases as we end 2024 and begin 2025.” (REINZ).

The current median Days to Sell of 48 days is much more than the 10-year average for September which is 35 days. There are 15 weeks of inventory in September 2024 which is 7 weeks more than last year.

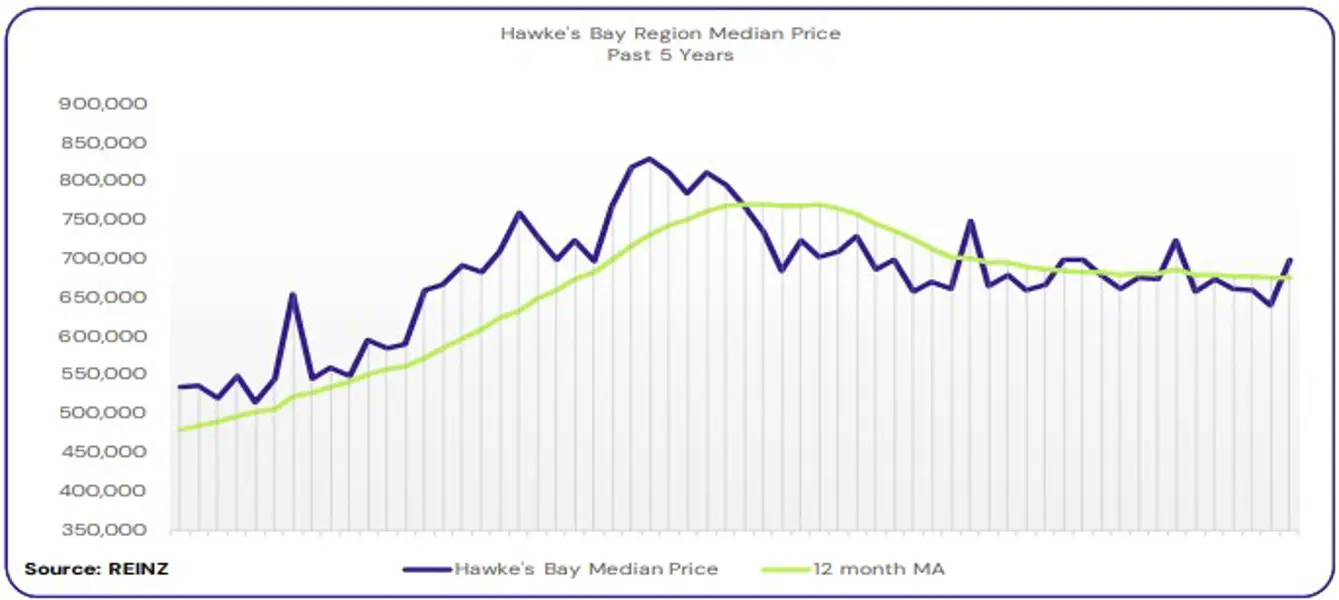

Regional Analysis - Hawke's Bay

Hawkes Bay’s median price was the same as in September 2023 at $700,000.

“Owner-occupiers and first home buyers were the most active buyer groups.

Most vendor expectations regarding the asking price were realistic. However, others require market evidence for their home before they agree. Attendance at open homes increased compared to August, and attendance at auction rooms also increased.

Local agents are cautiously optimistic that as interest rates continue to fall, there will be further increases in optimism and confidence market sentiment.” (REINZ).

The current median Days to Sell of 47 days is more than the 10-year average for September which is 37 days. There were 18 weeks of inventory in September 2024 which is 2 weeks more than the same time last year.

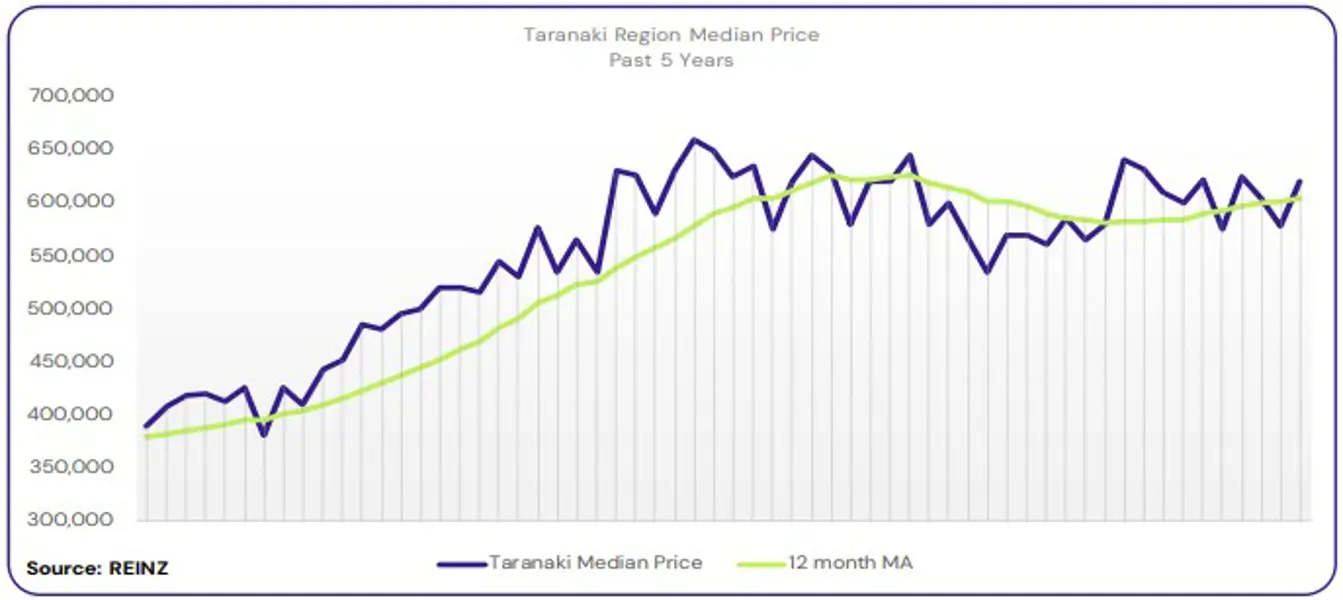

Regional Analysis - Taranaki

Taranaki’s median price increased 5.9% year-on-year to $619,750.

“Owner-occupiers continued to be the most active buyer group across Taranaki, with a noticeable increase in investment buyers.

Some vendors had realistic price expectations, and therefore, they were willing to meet the current market value. Attendance at open homes throughout the month were well attended, with some local agents reporting many new buyers.

The reduction of interest rates has seen more buyers enter the market, positively shifting market sentiment. Local agents are optimistic and confident that sales volumes will increase over the next quarter, as they already see noticeable increases in offers and sales.” (REINZ).

The current median Days to Sell of 42 days is more than the 10-year average for September which is 37 days. There were 24 weeks of inventory in September 2024 which is 4 weeks more than the same time last year.

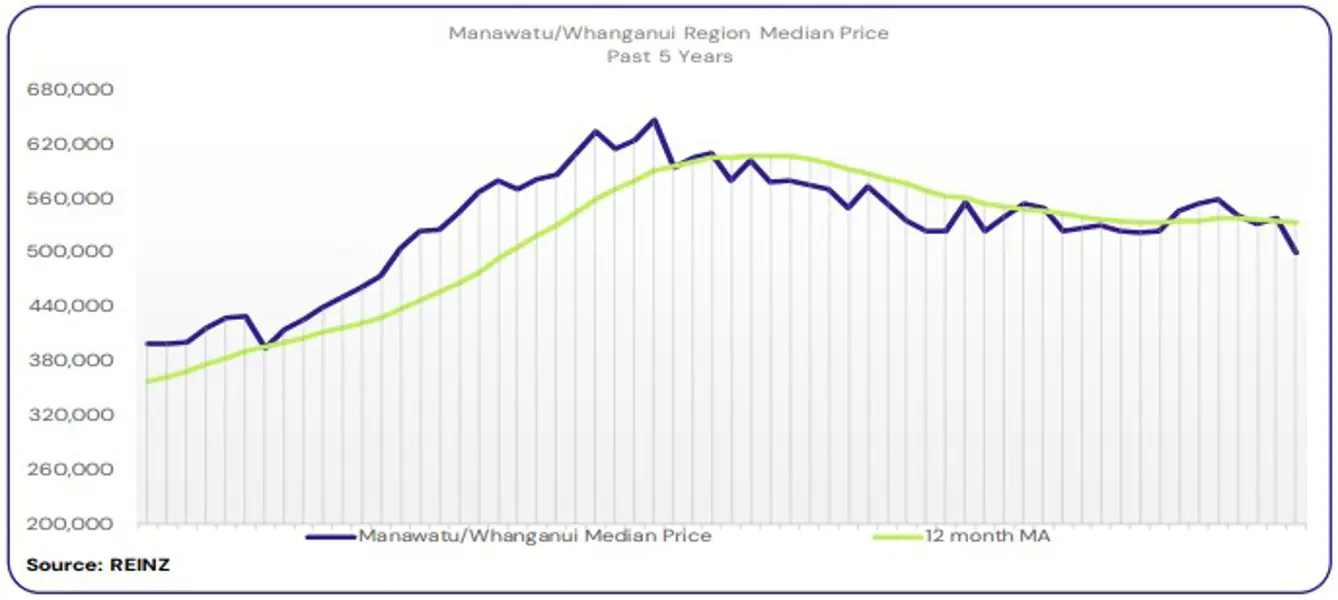

Regional Analysis - Manawatu/Whanganui

The median price for Manawatu/Whanganui decreased 4.8% year-on-year to $500,000.

“First home buyers were the most active buyer group across the region, with an increased interest in the residential investment market. There was a decline in overseas buyer interest.

Vendors who had accepted advice on the property value achieved quicker sales than those who considered a higher property value. Attendance at open homes increased for newer listings, which were priced correctly. However, auction room attendance and buyer activity in the auction room declined.

Market sentiment has shifted to show a more positive environment, influenced by the arrival of spring, shifting confidence and bank lending criteria. Local salespeople predict this will remain a favourable market as we head into spring and summer.” (REINZ).

The current median Days to Sell of 53 days is more than the 10-year average for September which is 37 days. There were 27 weeks of inventory in September 2024 which is 8 weeks more than the same time last year.

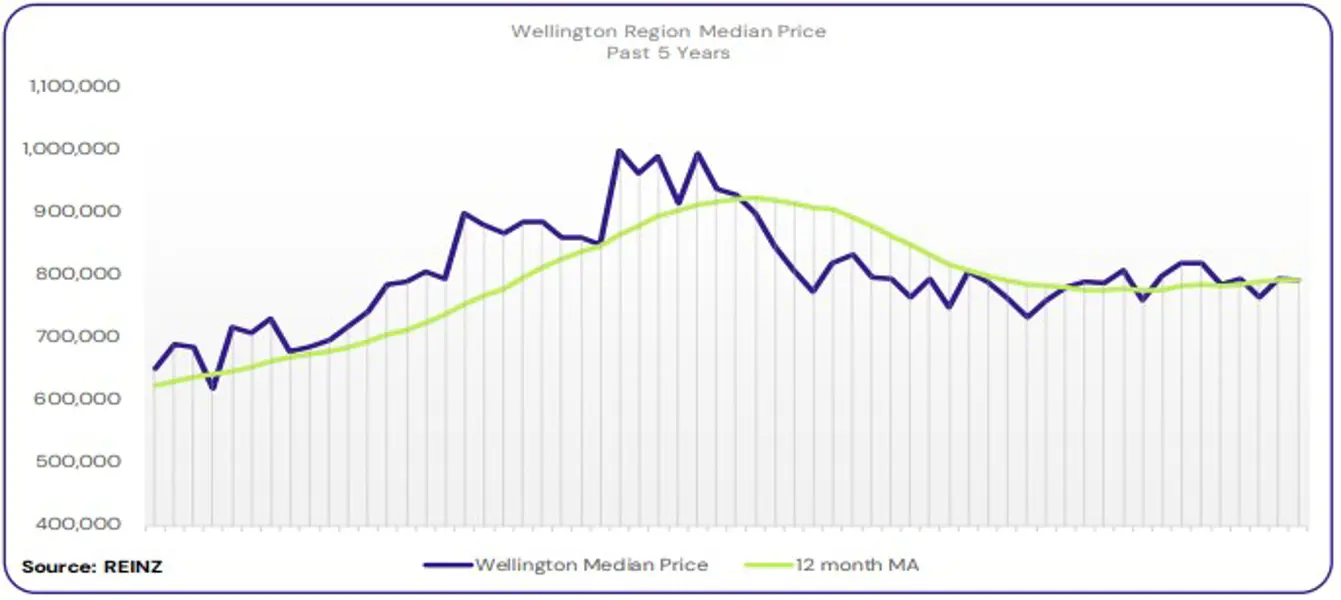

Regional Analysis - Wellington

Wellington’s median price increased 1.6% year-on-year to $792,500.

“The most active buyer group was first home buyers, with a slight increase in investor enquiries.

Most vendor expectations were realistic and willing to meet current market levels. Attendance at open homes varied, with some properties seeing multiple groups while others saw none.

Auction levels are low across the region – vendors opting for deadline sales or tenders. Market sentiment was influenced by factors such as the media’s production of positive market stories, increased council rales, and investors selling investment properties. Local agents are cautiously optimistic that there will be an increase in listings in the coming months, hopefully meaning more buyers. With the media increasing positive market stories, local agents suggest this might drive more offers from stagnant buyers.” (REINZ).

The current median Days to Sell of 51 days is much more than the 10-year average for September of 36 days. There were 15 weeks of inventory in September 2024 which is 5 weeks more than the same time last year.

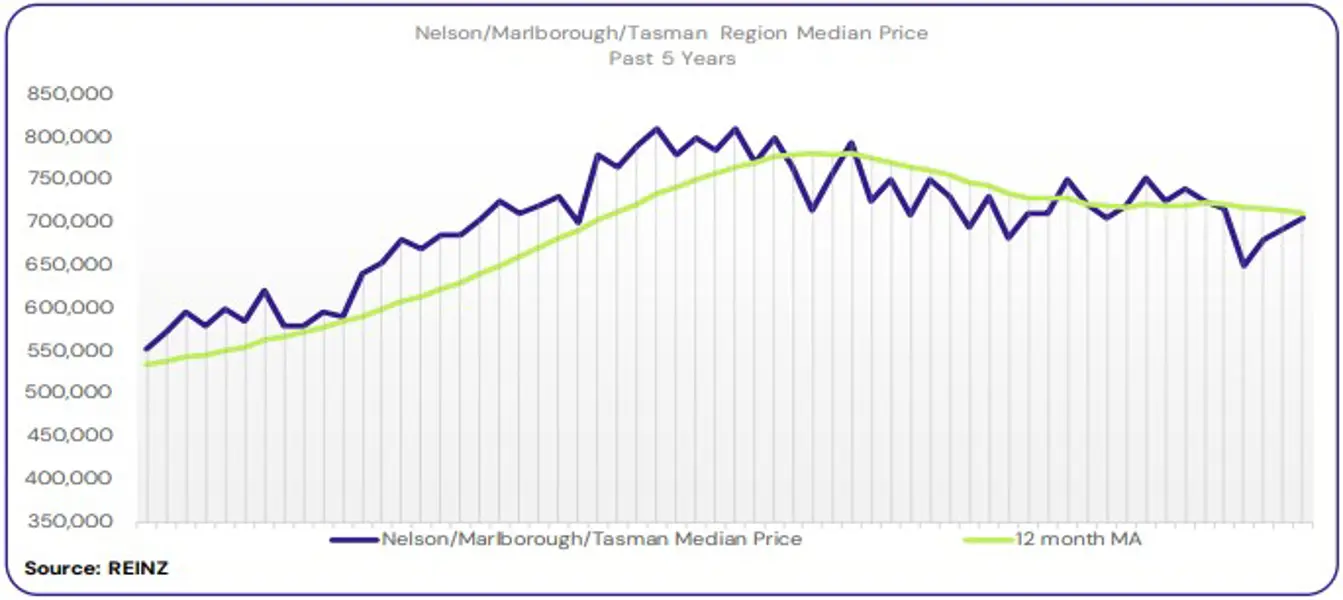

Regional Analysis - Nelson/Tasman/Marlborough

The median price for Nelson decreased 1.5% year-on-year to $670,000. The median price for Marlborough decreased 8.1% year-on-year to $680,000. The median price for Tasman decreased 1.9% year-on-year to $795,000.

“Owner-occupiers and out-of-town buyers were the most active buyer groups for September, with Blenheim salespeople noting a slight decline in first-home buyers.

Most vendors were aware of increasing positive sentiment among buyers and found it hard to relate to prices staying static; with this comes an increase in rejected offers from vendors. Attendance at open homes varied; some were well-attended, while others have been steady.

Auction room activity was slow. Auctions were passed in, and there was little to no bidding and low attendance. Increased positivity and optimism, declining interest rates, job security, economic sentiment, change in seasons and vendor hesitancy influenced market sentiment. Local agents cautiously predict the market will remain static for the rest of 2024.” (REINZ).

The current median Days to Sell of 55 days is much more than the 10-year average for September which is 37 days. There were 26 weeks of inventory in September 2024 which is 1 week more than the same time last year.

Regional Analysis - West Coast

West Coast’s median price increased 9.9% to $390,000.

“All buyer types were active across the West Coast in September. However, there have been fewer of them.

Most vendors have been realistic regarding asking prices and listing their properties at appraisal values. Attendance at open homes attracted steady interest.

Market sentiment remained constant for the region, with buyers expecting vendors to negotiate. However, stock levels declined slightly. Local agents expect market levels to remain steady, with mining jobs coming to the market, which keeps demand levels for rentals and residential properties increasing.” (REINZ).

The current median Days to Sell of 31 days is much less than the 10-year average for September which is 85 days. There were 38 weeks of inventory in September 2024 which is 3 weeks less than the same time last year.

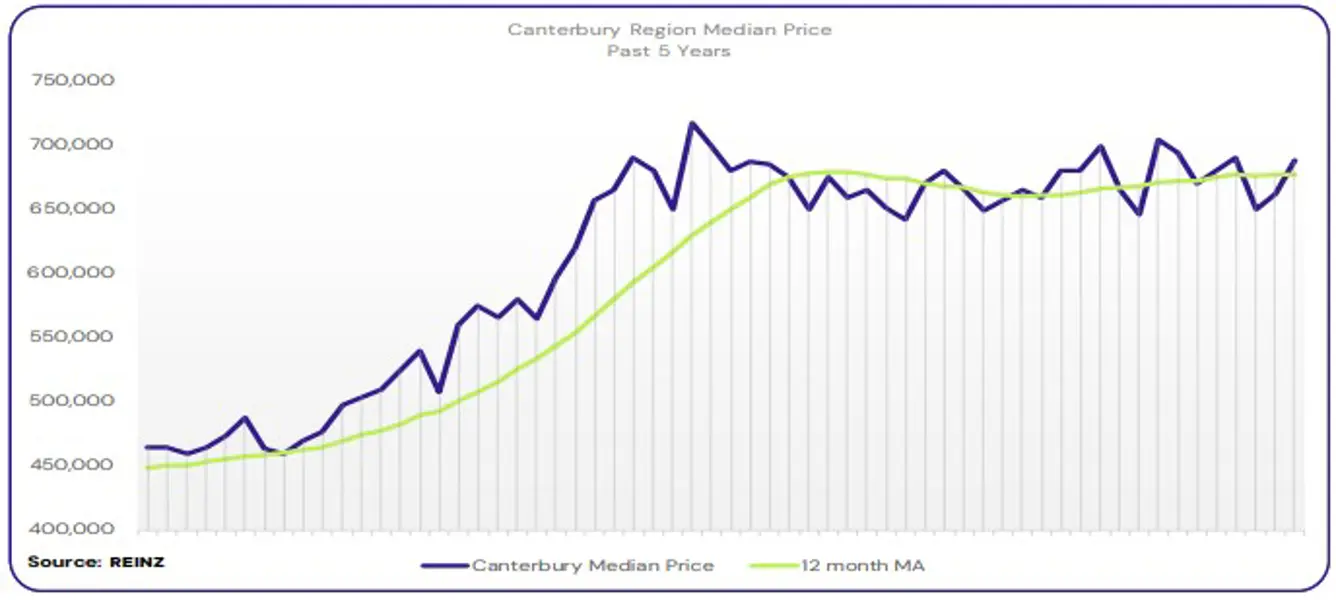

Regional Analysis - Canterbury

The median price for Canterbury increased 1.2% to $688,000.

“Owner-occupiers and first-home buyers were the most active buyer groups. There was a slight decline in investors and offshore buyers.

Most vendors were engaged and informed on current market expectations, while others saw the decline in interest rates as a sign that prices may increase. Attendance at open homes varied; some saw increased numbers, while others saw little to no activity—notably, fewer people at older listings.

Auction activity also varied. Some saw significant activity in clearance rates and active bidders, while others chose different sales methods. Declining interest rates, job security and increasing positivity among vendors and buyers influenced market sentiment. Local salespeople are cautiously optimistic that the market will improve in early 2025, especially if interest rates continue to decline.” (REINZ).

The current median Days to Sell of 41 days is more than the 10-year average for September which is 35 days. There were 17 weeks of inventory in September 2024 which is 3 weeks more than the same time last year.

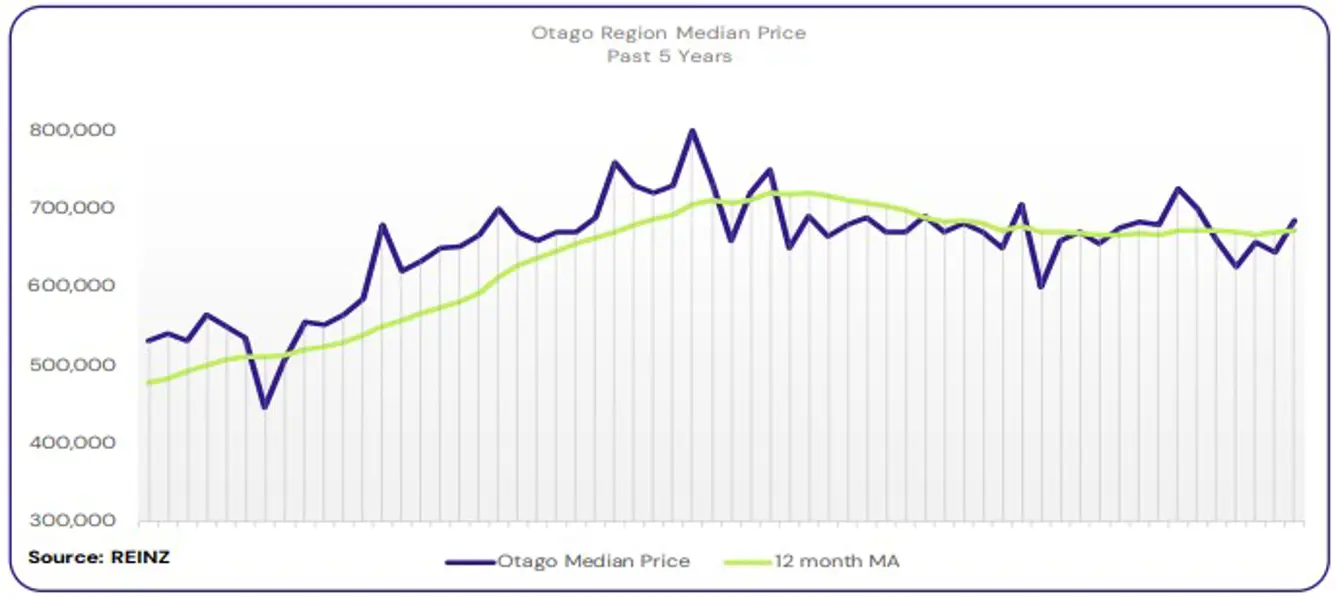

Regional Analysis - Otago

Dunedin City - “Dunedin’s median price increased by 4.3% year-on-year to $605,000.

The most active buyer groups were those at the top end of the market and first home buyers. Investors are noticeably quiet.

Some vendors are enthusiastic about their property’s value, which increases the days to sell. Attendance at open homes received good numbers, especially for newer listings, but gradually faded within a week if the property had been on the market for multiple weeks.

The auction room activity was steady—if a property didn’t sell under the hammer, it was sold very soon after the auction. Local agents feel that market sentiment for the region has remained unchanged over the past months. The decline in interest rates and steady prices creates a sense of confidence in the market.”

Queenstown Lakes

“Owner-occupiers and first home buyers continue to be the most active buyer groups, with an increased enquiry from investors as interest rates fall.

Most vendor expectations were above the current market. As signs of the market improvement show, vendors are gaining more confidence. Attendance at open homes increased as active buyers were the largest buyer group.

The auction room’s confidence levels were low, with buyers’ caution levels high. Market sentiment was influenced by the cost of living, inflation, interest rates, securing finance, and low confidence. Local agents suggest that the local market will remain slow and steady until 2025.” (REINZ).

The current median Days to Sell of 54 days is much more than the 10-year average for September which is 37 days. There were 21 weeks of inventory in September 2024 which is 6 weeks more than the same time last year.

Regional Analysis - Southland

The median price for Southland increased by 8.2% to $487,000.

“The most active buyer groups were first-home buyers and owner-occupiers, with early interest from investors.

Most vendors were well-informed and met the market, resulting in good outcomes. Attendance at open homes increased with the announcement of decreased interest rates and the arrival of spring. Auction room activity was also seen as improving, which increased the number of auction campaigns running.

Market sentiment was influenced by an increased sense of positivity, higher stock levels, lower interest rates and increased buyer demand.

Local salespeople predict that over the coming months, there will be an increased sense of positivity around market activity as we move out of the winter period and interest rates continue to fall. Other agents must manage buyers effectively by getting pre-approval and learning to manage expectations.” (REINZ).

The current median Days to Sell of 40 days is more than the 10-year average for September which is 32 days. There were 23 weeks of inventory in September 2024 which is 6 weeks more than the same time last year.

Browse

Topic

Related news

Read more

Find us

Find a Salesperson

From the top of the North through to the deep South, our salespeople are renowned for providing exceptional service because our clients deserve nothing less.

Find a Property Manager

Managing thousands of rental properties throughout provincial New Zealand, our award-winning team saves you time and money, so you can make the most of yours.

Find a branch

With a team of over 850 strong in more than 88 locations throughout provincial New Zealand, a friendly Property Brokers branch is likely to never be too far from where you are.