More positivity, slow and steady this month - REINZ stats October 2023

Thursday, 16 November 2023

More sales activity, more listings coming to market, lower days to sell and a sense of more confidence overall (year-on-year).

In November 2023, the Real Estate Institute of New Zealand (REINZ) reports a positive trend in the country's property market. Sales activity and listings have increased, with a sense of growing confidence year-on-year.

The market is described as moving slowly but steadily, following the post-election period. While there is a slight month-on-month decrease in the number of properties sold, there is an 8.0% increase compared to October 2022.

Median sale prices vary across regions, but the national median remains unchanged at $795,000. Days to sell have decreased year-on-year, indicating a quicker market pace. The total number of properties available for sale has decreased year-on-year but increased month-on-month.

New listings show a notable increase, suggesting renewed confidence among vendors.

Despite the positive trends, caution is advised, considering factors like interest rates, cost of living, and post-election market impacts. The House Price Index (HPI) reflects a 2.5% decline year-on-year, emphasizing a slow recovery from the peak in 2021.

Regional highlights

- Four of the sixteen regions had positive year-on-year median price movements, the largest being Canterbury with +3.2%.

- Tasman had the largest regional median price change, increasing 5.8% month-on-month.

- Northland had the biggest decrease in days to sell, reducing 23 days compared to September 2023, and the largest number of properties sold, increasing by 36.1% year-on-year.

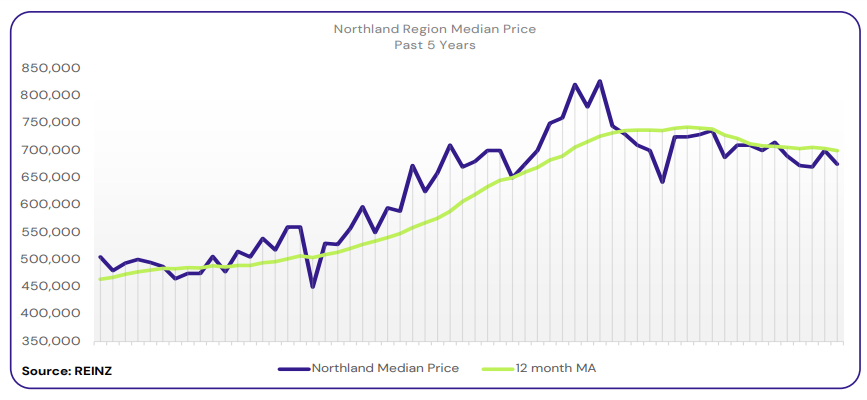

Regional Analysis - Northland

“Owner-occupiers continued to be the most active buyers across the region. Whangarei also saw continued activity from first-home buyers and a noticeable increase in activity from investors.

Most vendors are more attuned to market conditions and have set their price expectations accordingly. In Whangarei, open homes and auction rooms saw an increase in activity. Local agents report that the result of the election has played a role in current market conditions. They have also said that there is an increase in market confidence and are expecting an increase in market activity in the coming months.” (REINZ)

The current median Days to Sell of 55 days is more than the 10-year average for October which is 47 days. There were 37 weeks of inventory in October 2023 which is 4 weeks more than the same time last year.

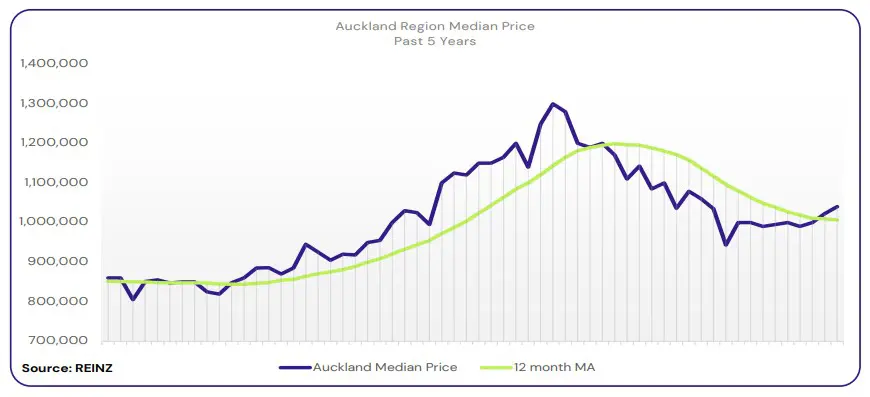

Regional Analysis - Auckland

Auckland’s median prices decreased by 3.6% year-on-year to $1,040,000.

“First-home buyers were the most active buyer group across most of Auckland, with some activity from owner-occupiers and investors as well. In the Rodney district, all buyer groups remained quiet, taking on a wait-and-see attitude.

Most vendors are working with the current market, but some are still holding fast to their original prices. Most of the region saw an increase in activity at open-homes and auctions. Factors such as interest rates, the weather and anticipation of the new government’s policies are affecting the market.

Most agents report more positive feelings towards the real estate market following the end of the election and are cautiously optimistic that we will see more activity as we move into summer.” (REINZ)

The current median Days to Sell of 36 days is the same as the 10-year average for October which is 36 days. There were 24 weeks of inventory in October 2023 which is 4 weeks less than the same time last year.

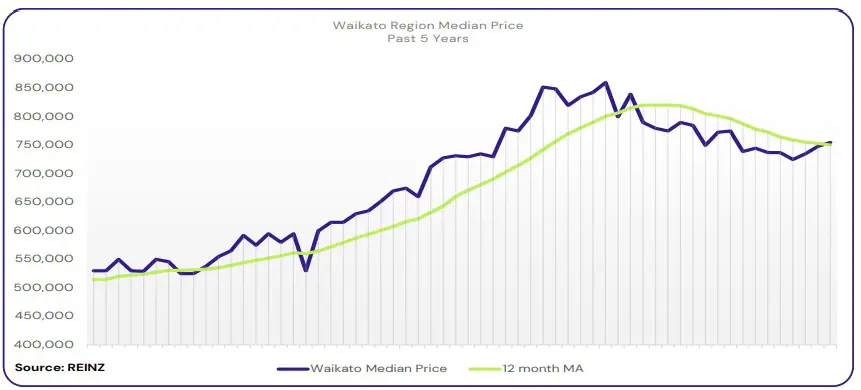

Regional Analysis - Waikato

In Waikato median prices decreased by 4.4% year-on-year to $755,000.

“Owner occupiers were the most active buyer group across Thames-Coromandel and Taupo. Thames-Coromandel also received interest from buyers looking to purchase a holiday home. Taupo and Hamilton saw fair activity from first-home buyers and investors have also been making more enquiries in Hamilton.

Most vendors across the region have been adjusting their prices to meet the market, but they are hopeful of prices improving in the near future. Some vendors continue to hold on to their initial price expectations.

Across the region, open homes and auction rooms saw more activity following the conclusion of the election and improving weather. Factors such as the current economic environment, interest rates and the election result have had an impact on the market.

Local agents report an increase in market activity and are expecting a return in market confidence.” (REINZ)

The current median Days to Sell of 41 days is more than the 10-year average for October which is 36 days. There were 26 weeks of inventory in October 2023 which is 5 weeks less than the same time last year

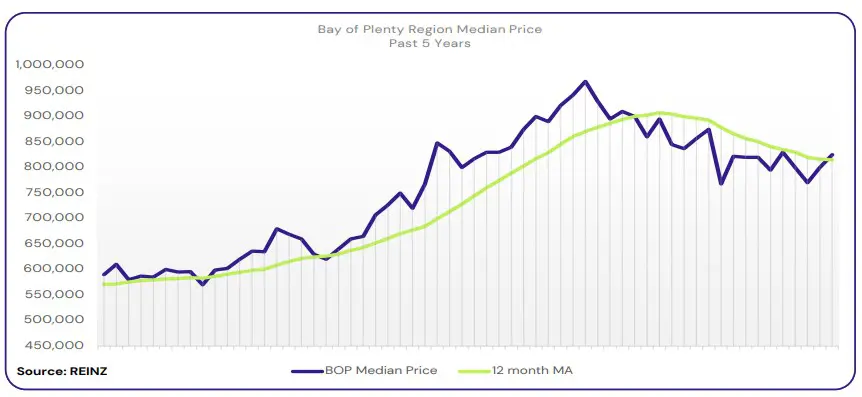

Regional Analysis - Bay of Plenty

Bay of Plenty’s median prices decreased by 5.3% year-on-year to $800,000.

“First-home buyers and owner-occupiers were the most active group across the region. There was more activity in the high-end sector in Tauranga this month.

Most vendors are adjusting their price expectations to meet the market, but some Tauranga vendors are still holding on for more favourable conditions.

Attendance in open homes and auctions was mixed in Rotorua but picked up in Tauranga this month.

Local agents report that there is more energy in the market. Anticipation of the election and economic conditions have impacted the market; however, agents believe they might see more activity soon.” (REINZ)

The current median Days to Sell of 56 days is much more than the 10-year average for September which is 44 days. There were 22 weeks of inventory in September 2023 which is 3 weeks less than the same time last year.

Regional Analysis - Gisborne

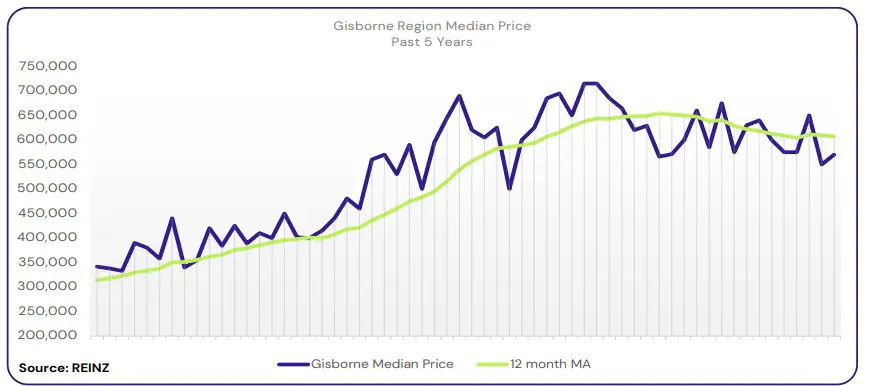

Gisborne’s median prices decreased by 5.0% year-on-year to $570,000.

“The region saw investors tentatively returning to the market following the election. Local agents report a decrease in the buying power of first-home buyers, likely due to an increase in interest rates.

Some vendors are adjusting their expectations and are working to meet the market, while others are hoping for better opportunities. Open homes saw some activity while auction rooms performed very well.

Sales counts were on the low side; however, local agents expect this to change now that the election has concluded. The weather continues to have a significant impact on market activity, alongside factors such as inflation and rising interest rates. Local agents believe that the region will see more activity in the coming months as the weather improves.” (REINZ)

The current median Days to Sell of 52 days is much more than the 10-year average for October which is 37 days. There are 10 weeks of inventory in October 2023 which is 2 weeks less than last year.

Regional Analysis - Hawke's Bay

Median prices in Hawke’s Bay decreased by 4.1% year-on-year to $700,000.

“First-home buyers were the most active buyer group in the region once again. More vendors have been setting their price expectations to match the current market. The region saw a rise in activity at open homes and auction rooms. However, local agents have noted that the demand for property is currently higher than the supply.

Factors such as interest rates and costs are showing their effect on the property market. Local agents report a continued decrease in listing numbers. Agents remain cautious yet hopeful that there will be an upswing in market activity now that the elections are over, and a new government moves in. (REINZ)

The current median Days to Sell of 39 days is more than the 10-year average for October which is 36 days. There were 17 weeks of inventory in October 2023 which is 3 weeks less than the same time last year.

Regional Analysis - Taranaki

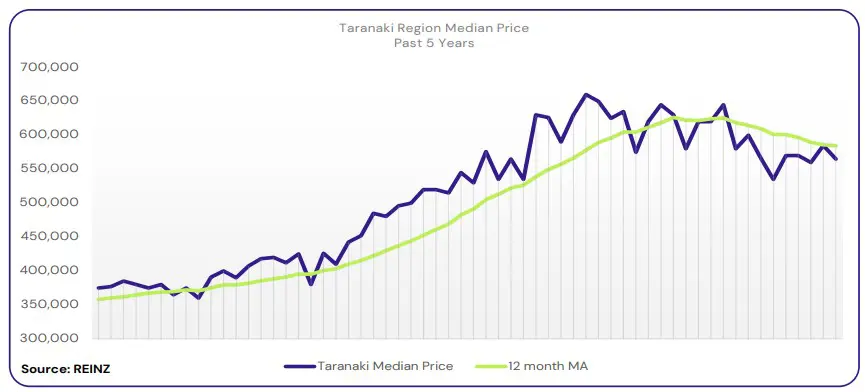

In Taranaki, median prices decreased by 2.6% year-on-year to $565,000.

“Owner-occupiers continue to be the most active buyers in Taranaki. Most vendors are setting realistic price expectations and are ready to meet the market. Open homes saw an increase in attendance compared to last month.

Local agents report that sales counts have been low, and most buyers are in no hurry to purchase a property.

Factors such as the result of the election and interest rates have had a significant impact on the market. Overall, it continues to be a buyer’s market in Taranaki. With the conclusion of the election and summer months coming up, agents expect to see a significant jump in activity in the next few months.” (REINZ)

The current median Days to Sell of 43 days is much more than the 10-year average for October which is 32 days. There were 20 weeks of inventory in October 2023 which is 1 week less than the same time last year.

Regional Analysis - Manawatu/Whanganui

Manawatu’s/Whanganui’s median prices decreased by 5.1% year-on-year to $521,750.

“Owner occupiers were the most active buyer group in the region once again in October, with some activity from first home buyers as well. Some vendors are adjusting their prices to the market, but others are sticking to their original prices.

New property listings and properties where the price has been adjusted showed good attendance at open homes. Auction rooms have also seen a small yet steady increase in activity.

Local agents report a low level of market activity which may be due to the result of the election and the market transitioning from a buyers’ market to a more balanced one. Other factors include rising interest rates, difficulty for buyers to secure approval for finance and the current economic climate. Agents believe the market will remain the same as we enter the Christmas/New Year period.” (REINZ)

The current median Days to Sell of 40 days is much more than the 10-year average for October which is 34 days. There were 19 weeks of inventory in October 2023 which is 7 weeks less than the same time last year.

Regional Analysis - Wellington

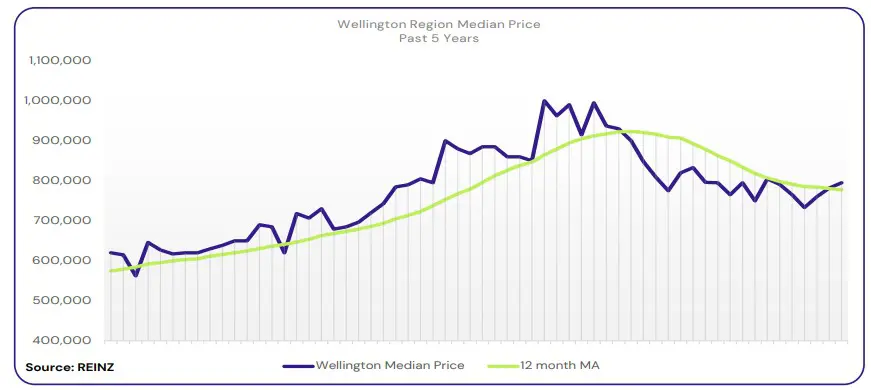

In Wellington, median prices decreased by 4.6% year-on-year to $795,000.

“First-home buyers continue to be the most active buyer group in the region, with some activity coming from investors as well. Vendors continue to listen to the market and are setting their price expectations accordingly. Open homes saw an increase in activity.

Factors such as interest rates and current economic conditions continue to influence the market, but the results of the election had the most significant impact. Local agents believe the market will begin to stabilise and are hopeful the new year will bring more listings and sales.” (REINZ)

The current median Days to Sell of 37 days is more than the 10-year average for October of 32 days. There were 11 weeks of inventory in October 2023 which is 5 weeks less than the same time last year.

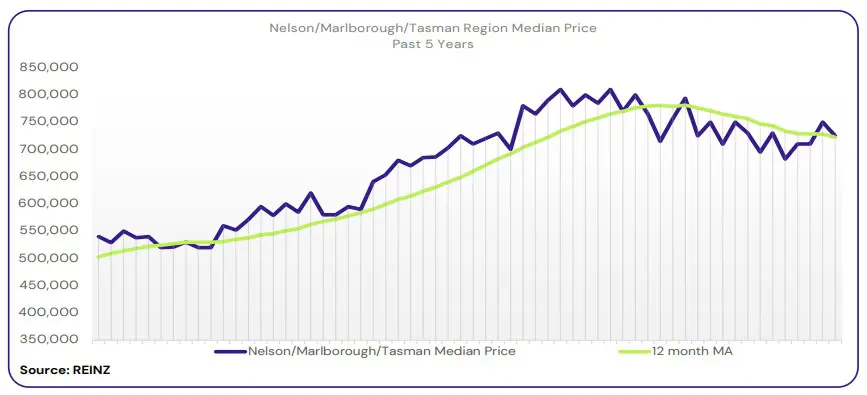

Regional Analysis - Nelson/Marlborough

Median prices in Nelson decreased by 13.3% year-on-year to $670,500. Marlborough’s median prices decreased by 16.8% year-on-year to $650,000. In Tasman median prices increased by 2.0% year-on-year to $857,000.

“There was an increase in activity from all buyer groups, with owner-occupiers being the most active in Marlborough. Marlborough also saw first-home buyers and investors returning to the market.

Vendors continue to set their price expectations according to the market, though they are optimistic that the market will become more favourable in the future. In Nelson, open homes saw some activity, depending on the property. In Marlborough, open homes saw a decrease in activity. Auction rooms saw a decline in activity across the region.

Local agents report a relatively slow market overall. Despite this, market confidence is returning, and agents are expecting an increase in activity in the coming months.” (REINZ)

The current median Days to Sell of 52 days is much more than the 10-year average for October which is 35 days. There were 20 weeks of inventory in October 2023 which is the same as the same time last year.

Regional Analysis - West Coast

The median prices for the West Coast increased by 2.6% year-on-year to $330,000.

“Owner-occupiers were the most active buyers’ group in the region. Most vendors are aware of the current market conditions and are more open to adjusting their price expectations. Open home attendance was low across the region.

Factors such as rising interest rates are contributing to the recent market activity. Most buyer and seller groups have adopted a wait-and-see attitude. Local agents are cautiously optimistic the market will see an increase in activity with the end of the election.” (REINZ)

The current median Days to Sell of 48 days is much less than the 10-year average for October which is 72 days. There were 42 weeks of inventory in October 2023 which is 8 weeks more than the same time last year.

Regional Analysis - Canterbury

Median prices in Canterbury increased by 3.2% year-on-year to $680,000.

“Like the previous month, there was a mix of active buyer groups in the region, with owner occupiers being the most active across the region and first home buyers showing activity in Timaru and Christchurch.

There was a mix of vendor expectations, with some meeting the market while others held on for better opportunities.

Open homes and auction rooms saw some good attendance in Timaru and Christchurch. Sales counts were stable in Timaru and Ashburton.

Agents observed that the market sentiment was positive across the region. Ashburton agents reported low yet steady activity, and in Christchurch, buyers showed more engagement. Factors such as interest rates, the economy, election results and international events have impacted the market. Some agents are expecting market activity to pick in the next two months and others are expecting a strong start later in 2024.” (REINZ)

The current median Days to Sell of 33 days is more than the 10-year average for October which is 32 days. There were 14 weeks of inventory in October 2023 which is 5 weeks less than the same time last year.

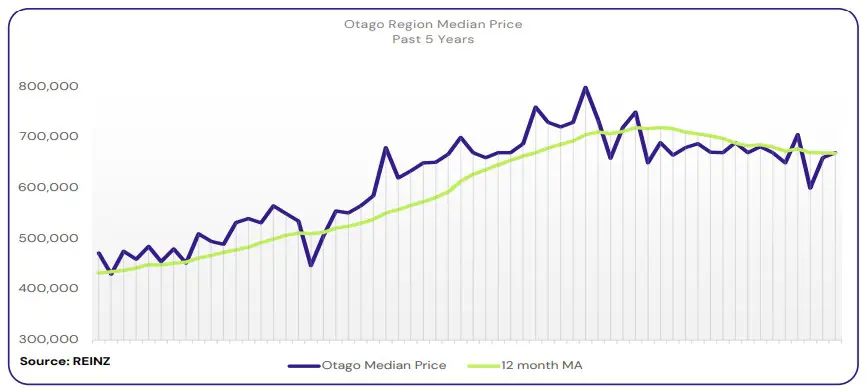

Regional Analysis - Otago

Dunedin City - “First-home buyers were the most active buyer group in the region once again in October.

Vendors’ price expectations have gone up slightly compared to previous months. Open homes and auction rooms have seen good attendance levels.

Factors such as the result of the election, cost of living and interest rates are playing a significant role in the current market. Local agents report the market is doing well postelection and predict we will see increased activity and more listings in the lead-up to Christmas.” (REINZ)

Queenstown Lakes - “October still saw first-home buyers and owner-occupiers as the most active buyer group in the region.

Local agents report that most vendors are staying firm with their asking price, while buyers remain cautious about their spending. Open homes were well attended in October. Auction rooms were well attended with most properties having bidders.

Factors such as interest rates, cost of living and the current economic situation continue to affect the market, however local agents expect a gradual improvement in the market in the coming months. Local agents also report that there continues to be strong interest from out-of-towners.” (REINZ)

The current median Days to Sell of 39 days is more than the 10-year average for October which is 34 days. There were 19 weeks of inventory in October 2023 which is the same as the same time last year.

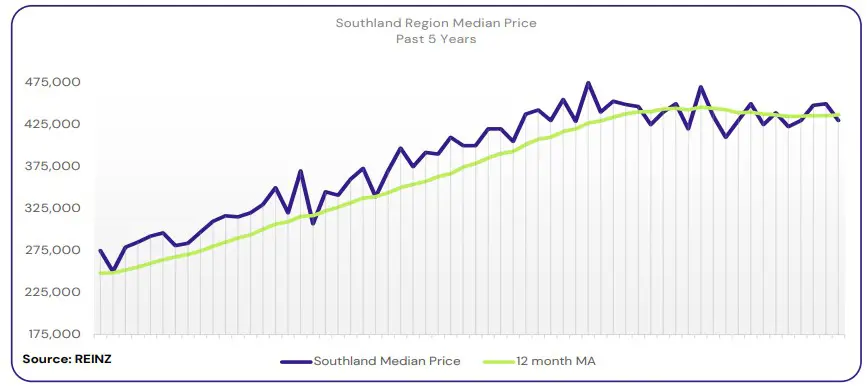

Regional Analysis - Southland

In Southland median prices increased by 2.4% year-on-year to $430,000.

“Local agents are reporting that all buyer groups, including vendors, adopted a wait-and-see attitude in October. However, agents also expect the situation to improve in time.

Open-home attendance has been sporadic, with some homes showing good attendance and some low attendance, depending on the type of property, the price and how long it has been on the market. Sales counts remained steady.

Agents report the market is currently in a state of flux, with interest rates, and anticipation of the new government’s policy changes having the largest impact. Local agents believe the current market state will remain the same until after Christmas, at which point they are hopeful of a steady and progressive improvement.” (REINZ)

The current median Days to Sell of 46 days is much more than the 10-year average for October which is 31 days. There were 17 weeks of inventory in October 2023 which is the same as the same time last year.

Browse

Topic

Related news

Find us

Find a Salesperson

From the top of the North through to the deep South, our salespeople are renowned for providing exceptional service because our clients deserve nothing less.

Find a Property Manager

Managing thousands of rental properties throughout provincial New Zealand, our award-winning team saves you time and money, so you can make the most of yours.

Find a branch

With a team of over 850 strong in more than 88 locations throughout provincial New Zealand, a friendly Property Brokers branch is likely to never be too far from where you are.