Median residential property prices hold whole growth rate eases - REINZ stats January 2022

Wednesday, 16 February 2022

While January figures usually reflect the holiday slow down, the data suggest compounding factors are influencing a decrease in sales activity and easing of price growth nationwide.

Median prices for residential property across New Zealand increased 20.5%, from $730,300 in January 2021 to $880,000 in January 2022. While median prices were down 2.2% compared to December ($900,000), REINZ’s seasonally adjusted figures indicate prices held up slightly better than we would usually expect when moving from December to January, showing a 1.4% increase.

Jen Baird, Chief Executive of REINZ, says: “In January, we expect to see activity in the residential property market slow and prices ease due to the summer holidays. The number of residential property sales decreased 28.6% in January 2022 compared to January 2021. When compared to December, the sales count was down 48.2%, which is to be expected as we move from December into January. However, in seasonally adjusted terms, this is still a 5.3% decrease, which shows that this January sales volumes are weaker than is usually expect for January.

“Most regions report the move to the Red traffic light setting has had less of an impact on activity, and out of town enquiry has been restored. However, feedback from agents across the country suggests a decrease in the number of first home buyers and investors in the market, noting quieter auction rooms and open homes.

“Many point to access to finance, exacerbated by changes introduced in December to the Credit Contracts and Consumer Finance Act (CCCFA) — currently under review, as having a major impact. This is a sentiment echoed in a survey conducted at the end of January by economist Tony Alexander in collaboration with REINZ, which noted that the predominant concern for buyers is no longer availability of stock but rather financing.

“While hard evidence is lacking in terms of the impact of the CCCFA, data from Centrix, a New Zealand credit reporting agency, found the percentage of home loan applications that were approved dropped from 39% in October to 30% after December. The longer-term impact will be seen in the numbers of buyers in the market in coming months.

“Looking forward, we would expect sales volumes to increase as we head into February and March. However, this does depend on reasonable levels of new listings.

In January, two regions achieved record medians and one saw a record equal:

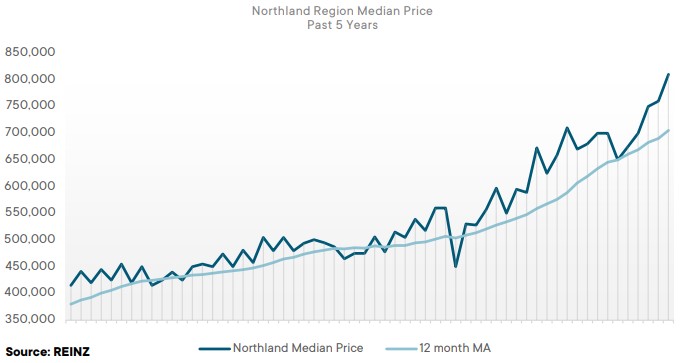

- Northland: increased 29.6% annually from $625,000 to $810,000 — a new record median high

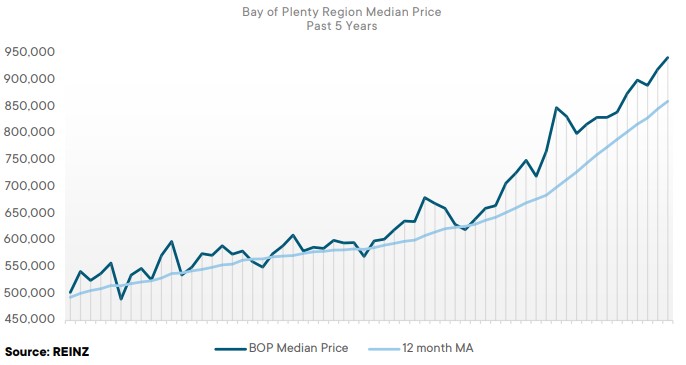

- Bay of Plenty: increased 22.8% annually from $767,000 to $942,000 — a new record median high

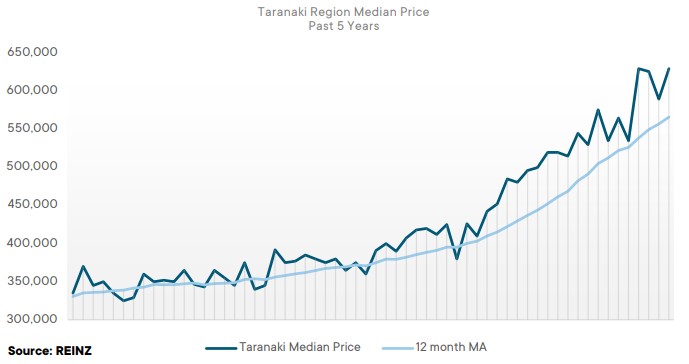

- Taranaki: increased 21.2% annually from $520,000 to $630,000 — an equal record median to that previously reached in October 2021

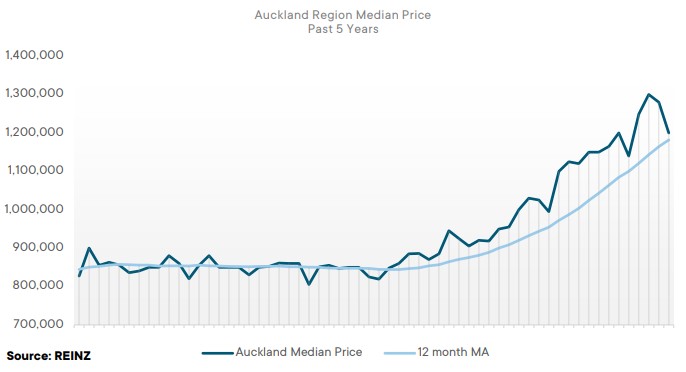

Regional Analysis - Auckland

“The median house price in Auckland increased 20.6% to $1,200,000 up from $995,000 in January 2021. Two districts in Auckland reached record median prices: Franklin District ($1,050,000) and Rodney District ($1,350,000). Agents noted a decrease in the number of first home buyers and investors in the market in January, largely due to tighter lending guidelines. This, along with the Red COVID-19 traffic light setting, has caused uncertainty and frustration amongst many buyers.

“Levels of inventory in Auckland were quite a lot higher than this time last year (+23.4%) and new listings were down 12.8% — some people are waiting to see what will happen with international borders opening. Vendor price expectations remain high, but agents are recommending their vendors be aware that market expectations and the narrative around the property market is changing. The market is expected to track steadily, but as international borders open, some people may choose to travel rather than purchase property.” (REINZ)

The current Days to Sell of 34 days is less than the 10-year average for January which is 40 days. There were 16 weeks of inventory in January 2022 which is 6 weeks more than the same time last year.

Regional Analysis - Northland

“The Northland market remained strong in January 2022, with the median house price increasing 29.6% year-on-year — reaching a record $810,000. Two districts in Northland also reached record medians: Kaipara District ($1,000,000) and Whangarei District ($810,000). Despite price growth, activity in the region slowed down in January, and agents recorded less urgency with many first home buyers and investors. Whilst the sales count was down 36.6% compared to a year ago, listings increased slightly as more vendors decided to sell, creating further choice for buyers.

“The recent changes to the CCCFA have been a well-discussed influence over buyer confidence — particularly first home buyers. The buyer pool is still strong, yet lending requirements have slowed the sales process down. With demand growing and stock numbers increasing, some argue that a transition to a buyer’s market may be ahead.” (REINZ)

The current Days to Sell of 41 days is much less than the 10-year average for January which is 53 days. There were 16 weeks of inventory in January 2022 which is 1 week more than the same time last year.

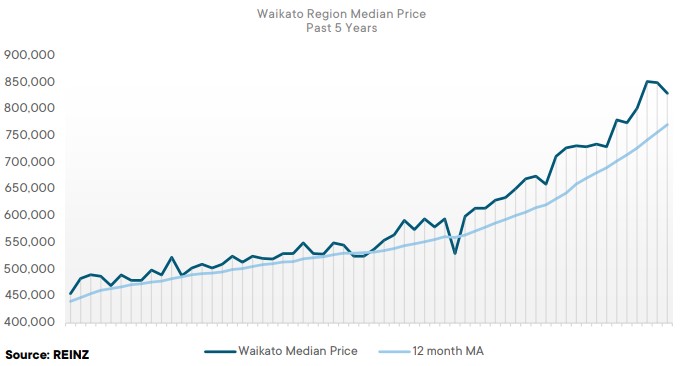

Regional Analysis - Waikato

“Median prices in the Waikato increased by 25.8% compared to January last year, with a median of $830,000. Two districts in the Waikato reached record median prices: Matamata-Piako District ($920,000) and Taupo District ($845,000).

“The nationwide move to the Red setting of the COVID-19 Protection Framework, along with stricter lending requirements and rising of interest rates has meant that whilst vendor expectations remain high, buyers are more cautious. In particular, first home buyer numbers have dwindled, likely due to changes to the CCCFA impacting lending. That said, investor numbers have increased as out-of-town buyers enter the market looking for a holiday home or a property they can rent short-term before making a permanent move. Inventory levels in Waikato increased by 46.7% year-on-year, and listings increased slightly by 9.9% — it's likely we will see more listings on the market in the next couple of months.” (REINZ)

The current Days to Sell of 38 days is less than the 10-year average for January which is 46 days. There were 13 weeks of inventory in January 2022 which is 5 weeks more than the same time last year.

Regional Analysis - Bay of Plenty

“The Bay of Plenty region reached a record high median price of $942,000 — a 22.8% increase year-on-year. Two districts in the Bay of Plenty also reached record high medians: Opotiki District ($666,000) and Whakatane District ($878,000).

“The most prevalent buyers in the region are owner-occupiers, as securing finance is less of an issue for this buyer segment. Agents reported an influx of out-of-town buyers, but the expected impact of Auckland’s borders opening on the Bay of Plenty market did not eventuate.

“More listings are on the market as people decided to move over the holiday period. Stock levels increased 56.8% year-on-year and more people are buying subject to sale and subsequently, more vendors are accepting conditional contracts.” (REINZ)

The current Days to Sell of 43 days is less than the 10-year average for January which is 53 days. There were 12 weeks of inventory in January 2022 which is 5 weeks more than the same time last year.

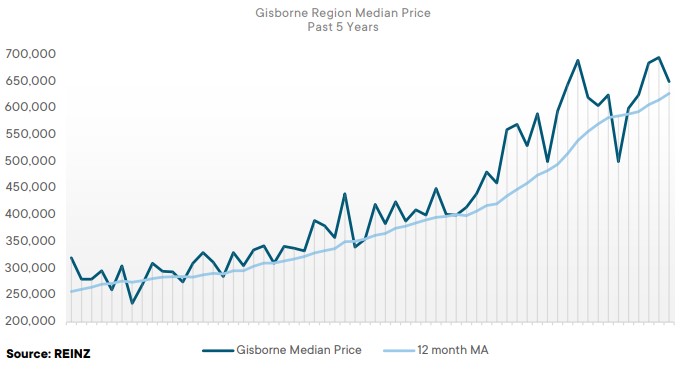

Regional Analysis - Gisborne

“Median house prices in Gisborne increased 30.0% year-on-year to $650,000. Agents initially saw hesitation in the market as New Zealand entered the Red traffic light setting, but this feeling has since passed. Listings increased only slightly as people waited until after the holidays to make their decisions.

“A change in the mid to lower property price range selling at auction is evident due to lending restrictions impacting first home buyers. Gisborne saw only 4.5% (1 property) sold by auction in January this year in comparison to 33.3% (9 properties) in January 2021. Many expect the market to level out and the days spent on the market to increase across all price ranges in the following months.” (REINZ)

The current Days to Sell of 38 days is less than the 10-year average for January which is 44 days. There are 7 weeks of inventory in January 2022 which is the same as the same time last year.

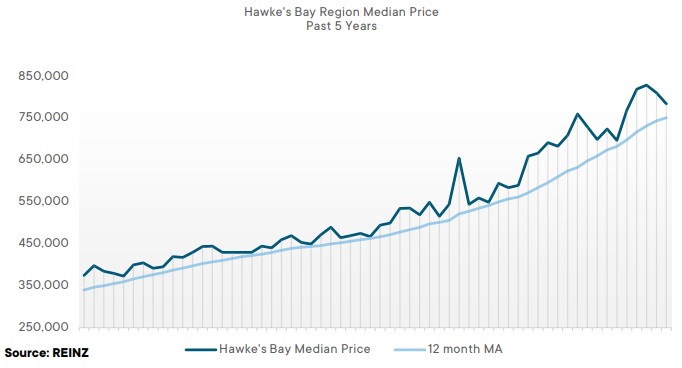

Regional Analysis - Hawke's Bay

“The median price in Hawke’s Bay was $785,000 in January 2022 — a 13.4% increase from January 2021. Napier City reached a record median price of $870,000. Hawke’s Bay was one of the only regions to see an increase in sales count (2.5%) in January this year.

“Since the move to the Red setting of the COVID-19 Protection Framework, there has been less buyer activity but more listings — this is unusual for a January month where we would expect to see the inverse. Properties are spending longer on the market, with the median days to sell increasing by 14 days — from 28 days in January 2021 to 42 days in January 2022. Agents describe the January market as tight with more contracts failing on finance, fewer buyers and growing concern over COVID-19.” (REINZ)

The current Days to Sell of 42 days is less than the 10-year average for January which is 44 days. There were 11 weeks of inventory in January 2022 which is 5 weeks more than the same time last year.

Regional Analysis - Taranaki

“Taranaki had an equal high in its median house price of $630,000 — a 21.2% increase year-on-year. The South Taranaki District reached a record median price high of $515,000. Anecdotally, some people used the Christmas period to prepare their properties for the market. However, listings fell 9.8% in January, suggesting that some of these properties may be listed in the following months.

“The market in Taranaki is steady, but stricter lending criteria have directly impacted first home buyers. As a result, owner-occupiers have been the most prevalent buyer segment in the market. Enquiry from buyers out of town has been strong, particularly from larger cities such as Auckland.” (REINZ)

The current Days to Sell of 30 days is less than the 10-year average for January which is 44 days. There were 8 weeks of inventory in January 2022 which is 3 weeks more than the same time last year.

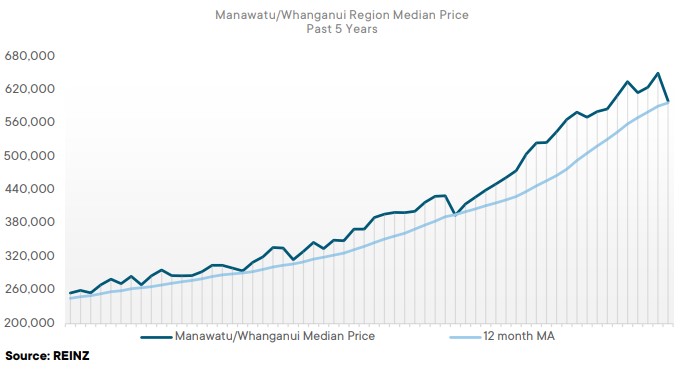

Regional Analysis - Manawatu/Whanganui

“In January this year, Manawatu/Whanganui’s median house price was $600,000 — an increase of 14.2% yearon year. The Ruapehu District reached a record median house price of $480,000.Buyers are frustrated with the challenge in getting finance created by loan-to-value ratios, tighter lending criteria and the COVID-19 Red traffic light setting, indicating a time of change. However, there is a silver lining for buyers — listings increased slightly in January, bringing greater choice to the market. The level of inventory saw a 121.3% rise year-on-year — over twice as much inventory as we had one year ago.” (REINZ)

The current Days to Sell of 41 days is much less than the 10-year average for January which is 44 days. There were 12 weeks of inventory in January 2022 which is 8 weeks more than the same time last year.

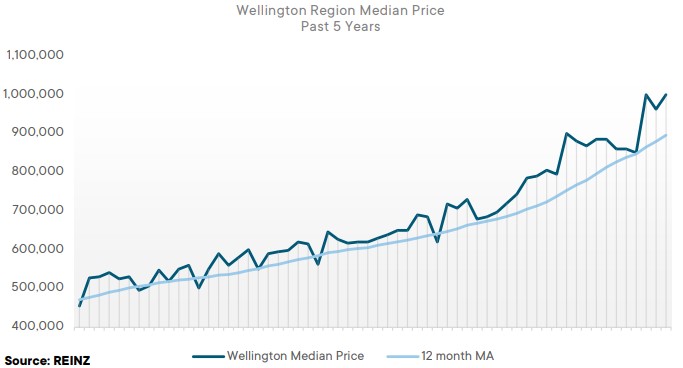

Regional Analysis - Wellington

“Median house prices in Wellington increased by 14.6% to $911,000 in January 2022 — up from $795,000 in January 2021. Unlike many other regions in the country, Wellington saw an increase in its sales count — up 9.0% compared to January last year. Levels of inventory and listings also saw increases — up 111.6% and 19.3%, respectively. Days to sell increased by 11 days from 38 days in January 2021 to 49 days in January 2022 — agents have suggested that this could be down to stricter lending criteria impacting buyers. In result, properties are attracting fewer offers, and numbers at open homes have declined.” (REINZ)

The current Days to Sell of 49 days is more than the 10-year average for January of 44 days. There were 14 weeks of inventory in January 2022 which is 7 weeks more than the same time last year.

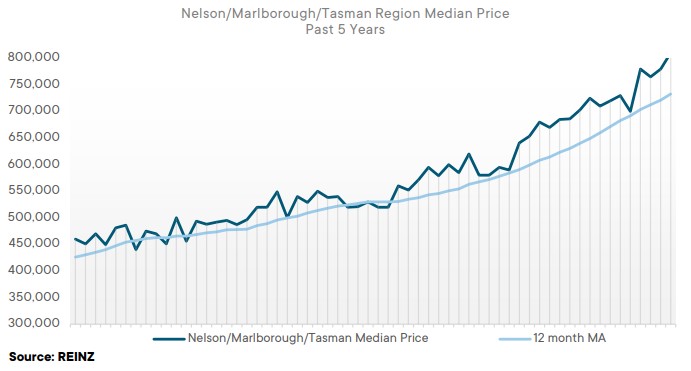

Regional Analysis - Nelson/Marlborough

“The Nelson/Marlborough/Tasman region saw median prices increase by 7.4%, 27.4% and 23.6% respectively in January 2022 to $765,000, $700,600 and $915,000. Both Nelson and Tasman saw their sales count drop in January compared to the same time last year, whereas Marlborough’s sales count increased by 7.7%. Despite this, agents in Marlborough noted many sales not being completed due to the changes to the CCCFA and an increase in conditional contracts where sales are subject to the buyer selling their property or subject to them getting finance.

“In Nelson, out of town buyers were active in the market, both to invest and relocate. The Nelson and Tasman region remains an attractive location due to its ever-increasing opportunities for investment, recreation, and employment, which has made it an ideal region for those looking for a lifestyle change. Vendors are becoming more confident to go to market. With more stock to choose from, the region has maintained its competitive pricing due to continuing strong demand resulting in multi-offers.” (REINZ)

The current Days to Sell of 37 days is less than the 10-year average for January which is 40 days. There were9 weeks of inventory in January 2022 which is 1 week more than the same time last year.

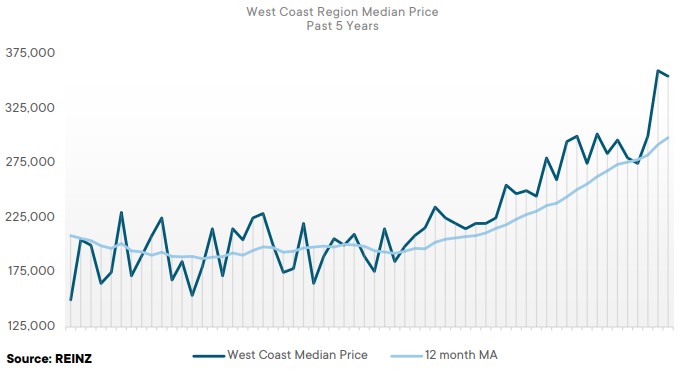

Regional Analysis - West Coast

“The West Coast saw its median house price increase by 32.7% in January 2022 to $345,000, up from $260,000 in January last year. The West Coast started the year high in confidence but low on stock with a 23.0% decrease in its inventory year-on-year. Buyer enquiry remained strong, with good visitor numbers to the region. A good level of sales activity is expected heading into Autumn. Whilst the sales count in January was down by a considerable 55.4%, strong media interest in the growing popularity of the northern West Coast should help the market to continue tracking steadily.” (REINZ)

The current Days to Sell of 28 days is much less than the 10-year average for January which is 61 days. There were 15 weeks of inventory in January 2022 which is 6 weeks less than the same time last year.

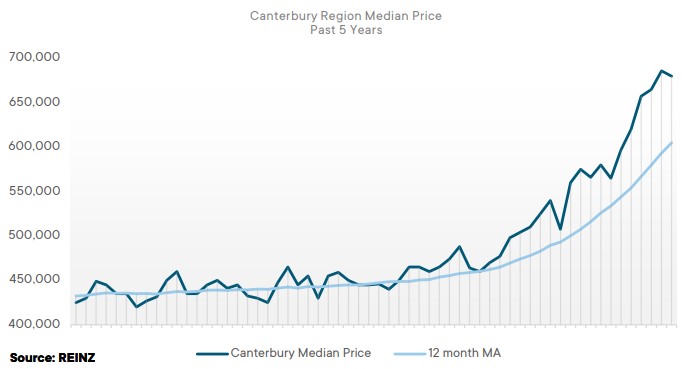

Regional Analysis - Canterbury

“Canterbury saw its median house price increase by 25.9% in December 2021, reaching $680,000. The Timaru District reached a record median house price of $474,000. Owner-occupiers and first home buyers were active in the market in December, with a notable number of people moving from other regions looking for new opportunities in work and lifestyle.“Auctions remained a popular method of sale with 42.6% of sales by auction — some had auctions running right up until the week of Christmas There was strong participation at auctions and property enquiries, which indicates people want to ‘get on with it’ despite challenges in the months prior.“Although securing finance is difficult, the entry level price in the Canterbury area is still achievable for first home buyers. Investor numbers are also steady — some investor-developers are looking for opportunities to renovate and develop property. Investor interest is also strong for dwellings rented by students. With the market tracking steadily, many remain positive and confident for the next few months and expect an increase in listings and buyers coming from outside the Canterbury market as well as locally.” (REINZ)

The current Days to Sell of 27 days is less than the 10-year average for December which is 30 days. There were 7 weeks of inventory in December 2021 which is 1 week less than the same time last year.

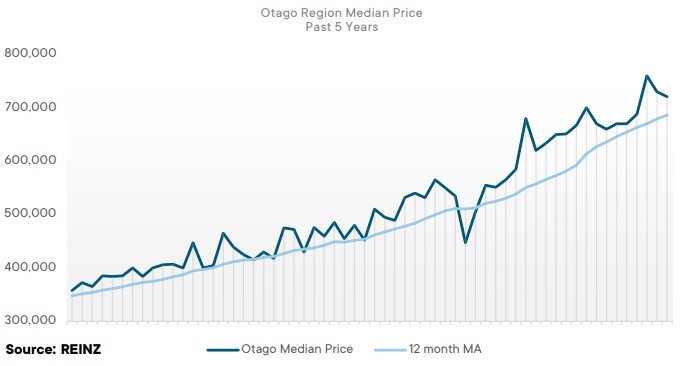

Regional Analysis - Otago

Dunedin City - “Dunedin City saw its median price hit $670,000 in January 2022 — an 8.1% increase year-on-year. Like many other regions across New Zealand, buyer sentiment is beginning to shift in Dunedin. Stricter lending criteria, rising interest rates and new investor tax policies are now having an impact and some people are unprepared and/or unable to pay current prices. Properties spent an additional 18 days on the market from 30 days in January 2021 to 48 days in January this year but, the extra choice available has meant people are taking longer to make buying decisions. The coming months will be the real indicator of the impacts of all these factors.” (REINZ)

Queenstown Lakes - “The Queenstown Lakes District saw a 21.1% increase in its median house price reaching $1,302,000 in January 2022. The Wanaka Ward saw an increase in its median house price of 49.5% — up from $920,000 in January 2021 to $1,375,000 in January this year.

“With domestic borders open, out-of-town enquiry has continued to occur. Still, a level of caution remains in the market due to Omicron and the Red COVID-19 Protection Framework setting. In tandem with tighter lending restrictions, the median price has continued to make it difficult for first home buyers to enter the market. The Queenstown-Lakes District saw a 37.0% decrease in its sales count compared to January 2021.”(REINZ)

The current Days to Sell of 46 days is more than the 10-year average for January which is 43 days. There were 12 weeks of inventory in January 2022 which is 4 weeks more than the same time last year.

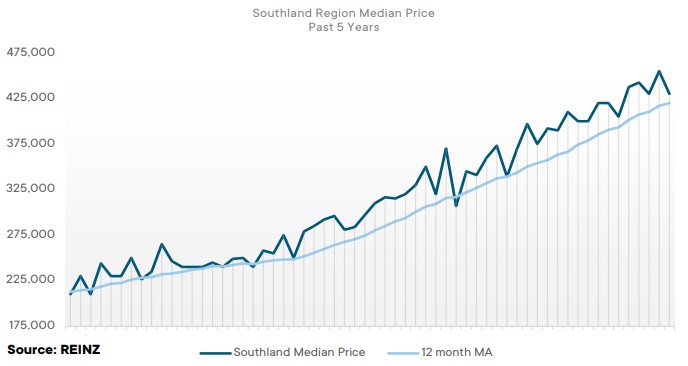

Regional Analysis - Southland

The Southland region saw its median house price increase by 9.7% annually in January 2022 to $430,000, up from $392,000 in January 2021. Southland saw the number of investors and first home buyers decline this January, likely due to new tax legislation and changes to lending criteria.

“Vendors are starting to see the hesitancy in buyers caused by these factors and the likelihood of further increases to interest rates over the course of 2022. While Southland’s inventory increased year-on-year, listings declined by 3.4% — but this is not unusual considering the holiday period.” (REINZ)

The current Days to Sell of 32 days is less than the 10-year average for January which is 41 days. There were 10 weeks of inventory in January 2022 which is 2 weeks more than the same time last year.

Browse

Topic

Related news

Find us

Find a Salesperson

From the top of the North through to the deep South, our salespeople are renowned for providing exceptional service because our clients deserve nothing less.

Find a Property Manager

Managing thousands of rental properties throughout provincial New Zealand, our award-winning team saves you time and money, so you can make the most of yours.

Find a branch

With a team of over 850 strong in more than 88 locations throughout provincial New Zealand, a friendly Property Brokers branch is likely to never be too far from where you are.