First take on the New Tax Laws

Thursday, 15 April 2021

By continuing, you agree to our terms of use and privacy policy

Instructions on how to reset your password will be sent to the email below.

Your password reset link has been sent. Please check your inbox and follow the instructions provided.

Your property could unlock a year of financial freedom.

Thursday, 15 April 2021

The changes are broad and cover an extensive range of critical areas. Such as freeing up the RMA and making it easier to build new properties. The government has targeted existing landlords and investors by removing the ability to offset the mortgage interest against your income.

These new policies, specifically the ability to offset the interest, have hit a particular nerve within the industry. We are scrambling to understand the implications of these changes fully. Offsetting interest is not a loophole; as the government has suggested, it is common practice across all industries. Investing in property is no different – and fundamentally, it is running a business where the client is the tenant. As with many of the Residential Tenancies Act amendments, the unintended but noticeable side effect will be higher rents. We have already seen rents, on average, increase by 23.75% over the last four years due to all the changes.

The government has correctly identified that one of the key drivers behind house prices' growth is the lack of new builds. And the often-laborious task of obtaining consent to develop or free up land. And that is critical in slowing down inflation, as it is a simple matter of supply and demand. Create more supply; prices will come down.

Introducing new laws (as seen in April) will not fix the problem; it will likely create more. You only need to look to our neighbours over in Australia to see that stamp duty, capital gains and other mechanisms have done nothing to curb growth. With no consultation within the sector or industry bodies, and despite the IRD warning against this move, the government have proceeded.

As we all get our heads around these changes, it is essential to read extensively to capture all perspectives. Long term investors such as Graeme Fowler, Ashley Church or Tony Alexander, to name but a few, often have good pragmatic views and can articulate the implications, both positive and negative, in simple terms.

Based on the information that we have right now; these are our top takeaways regarding the new tax laws;

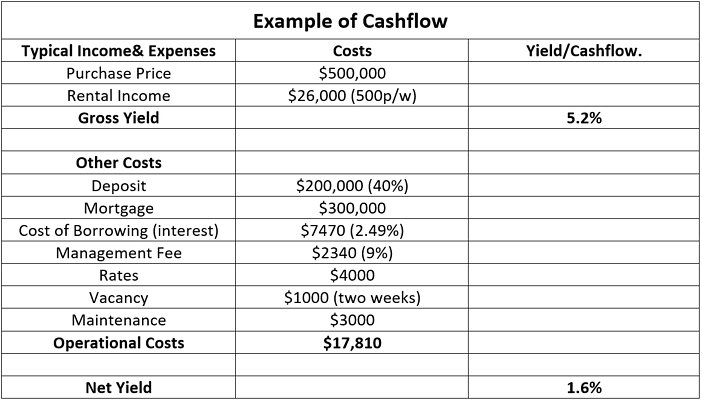

Disclaimer: The above table is an example of a basic purchase and costs associated with an investment property. These may change depending on the property.

Despite these changes, you might be surprised – it can still stack up, and you can wind up with a small amount of cash flow. Across provincial New Zealand, we see in excess of 20% gains in the capital growth of properties, and over ten years (new Brightline test), you only need to look at the history of the property sector in New Zealand. You can be confident that the value will increase.

To read our overview of the key changes, read our bright line test blog by following this link; https://blog.propertybrokers.co.nz/bright-line-test

We’ll save you time and money, so you can make the most of yours.

Reducing your risks and maximising your returns, all starts with an experienced Property Management team. Everything our Property Brokers Rental Property Management division does contribute to our commitment to provide long term trouble-free tenancies for landlords and a great home for Property Brokers' tenants and their families.

For more information or to request a free, no-obligation rental appraisal, please contact us today.

From the top of the North through to the deep South, our salespeople are renowned for providing exceptional service because our clients deserve nothing less.

Managing thousands of rental properties throughout provincial New Zealand, our award-winning team saves you time and money, so you can make the most of yours.

With a team of over 850 strong in more than 88 locations throughout provincial New Zealand, a friendly Property Brokers branch is likely to never be too far from where you are.