A 14.6% uplift on sales voluemes comparted to the same time last year - REINZ Stats February 2021

Monday, 15 March 2021

The number of residential properties sold in February across New Zealand increased by 14.6% when compared to the same time last year (from 6,951 to 7,964) – the highest for the month of February in 14 years, according to the latest data from the Real Estate Institute of New Zealand (REINZ).

Median prices for residential property across New Zealand increased by 22.8% from $635,000 in February 2020 to$780,000 in February 2021 a new record high for the country. Additionally, 12 out of 16 regions reached recordmedian prices and so did 37 Districts.

Median house prices for New Zealand excluding Auckland increased by 19.1% from $550,000 in February last year to $655,000.

Bindi Norwell, Chief Executive at REINZ says:“February was certainly an extraordinary month, with a new record median price for the country and 12 regions and 37 districts all reaching new or equal records. Wellington, Manukau and Waitakere Cities now all have median prices of $1,000,000 or more, meaning that 7 districts across the country now have reached or exceeded the million dollar threshold.”

“It’s likely that February’s housing data will make very difficult reading for the thousands of renters and first home buyers who are one day hoping to be able to purchase a property. Hopefully the re-introduction of the LVRs will start to slow down the rate at which prices have been rising, and that the market will stabilise in due course.

“Now more than ever, we need our political parties to work together and to work closely with key industry players in order to start addressing the unaffordability issues and to address the housing shortages the country faces,” continues Norwell.

Regions with the largest increase in annual sales volumes during February were:

- West Coast: +58.0% (from 50 to 79 – 29 more houses) – the highest it’s been since March 2004 (203 months) and the highest for the month of February ever

- Taranaki: +31.4% (from 153 to 201 – 48 more houses) – the highest for the month of February in 4 years

- Northland: +22.5% (from 191 to 234 – 43 more houses) – the highest for the month of February in 4 years

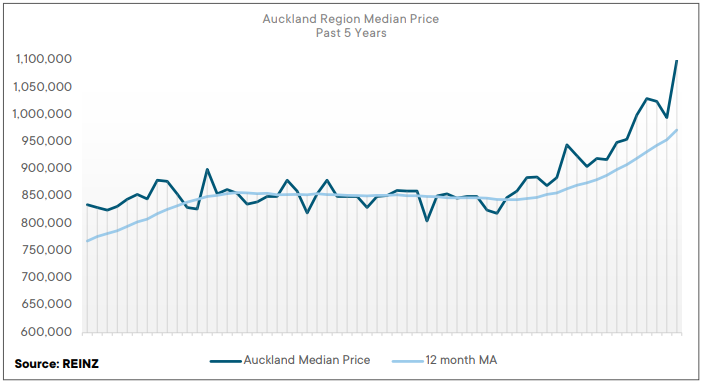

Regional Analysis - Auckland

“The Auckland region reached a new record median house price in February 2021 of $1,100,000, up 24.3% from the same time last year ($885,000). This price growth was underpinned with six of the seven districts experiencing record high median house prices and the lowest level of inventory for a February month for 6 years. Sales volumes for February were up 34.6% year-on-year to 2,775, the highest level of February sales for the region since 2007. Stock continues to be an issue and has made the market very competitive. Open homes have been busy, particularly in good school zones and in the central districts. There is a lot of interest in family homes and upper end apartments with many going to multi-offer and pre-auction offers. Auction also continues to be a popular method of sale, with 47.0% of all sales in February occurring by auction. Properties continue to sell quickly with the median number of days to sell down 5 days annually to 34 days, the lowest for a February month in 17 years. The REINZ House Price Index for Auckland also reached a record level in February of 3,662, up 20.7% annually.” (REINZ)

The current Days to Sell of 34 days is less than the 10-year average for February which is 40 days. There were 11 weeks of inventory in February 2021 which is 8 weeks less than the same time last year.

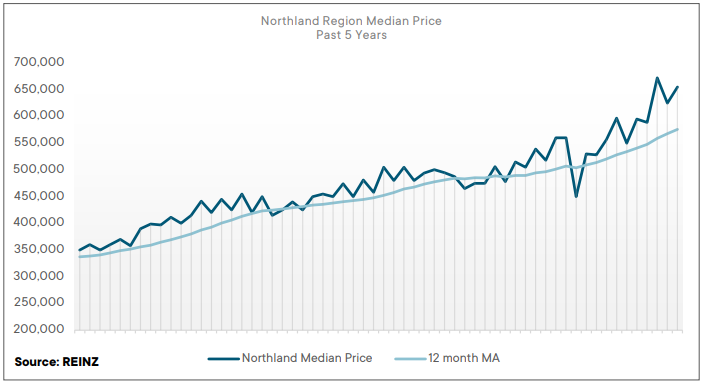

Regional Analysis - Northland

“Median house prices in Northland increased 17.0% year-on-year in February 2021 to $655,000, up from $560,000 at the same time last year. This was supported by strong median price increases in Kaipara District, which reached a record median price of $760,000, up 43.4% annually from $530,000 in February 2020. Sales volumes increased 22.5% year-on-year, further displaying the demand for properties in the region. Interest from out-of-town investors increased in February as purchasers hurried to secure properties prior to the reintroduction of LVRs, and returns for the region are good compared to Auckland and the Bay of Plenty. Banks are already slowing down the process on approvals and we would expect this combination of factors to show a levelling off of prices over the coming months.” (REINZ)

The current Days to Sell of 47 days is much less than the 10-year average for February which is 64 days. There were 19 weeks of inventory in February 2021 which is 34 weeks less than the same time last year.

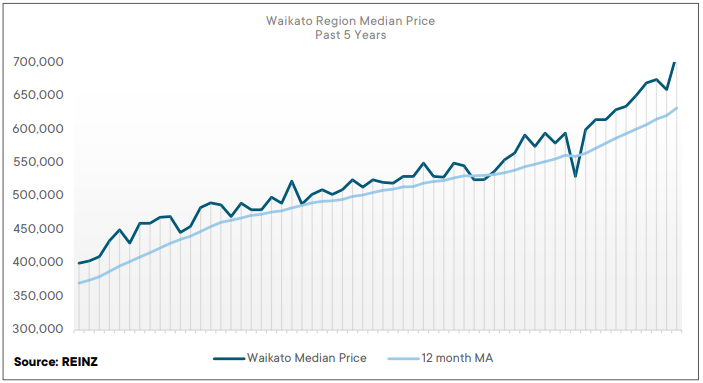

Regional Analysis - Waikato

“The Waikato region reached a record median price in February or $713,500, up 23.0% year-on-year, up from$580,000 in February 2020 with demand for properties continuing to exceed supply. Five of the ten districts within the Waikato region also reached record median house prices in February, including Hamilton City, Taupo District, Thames Coromandel District, Waikato District and Waipa District. Open homes continue to be busy and have been generating competition and a sense of urgency with buyers. Inventory is down -38.4% year-on-year to 935, which is also adding pressure on purchasers. Auctions have become a more popular method of sale, with 22.2% of all sales in February being sold by auction, up from 11.0% in February 2020. Properties continue to sell quickly, with median days to sell down 11 days from the same time last year to 27 days, the lowest number of days to sell for the region for a February month, since records began.” (REINZ)

The current Days to Sell of 27 days is much less than the 10-year average for February which is 47 days. There were 8 weeks of inventory in February 2021 which is 9 weeks less than the same time last year.

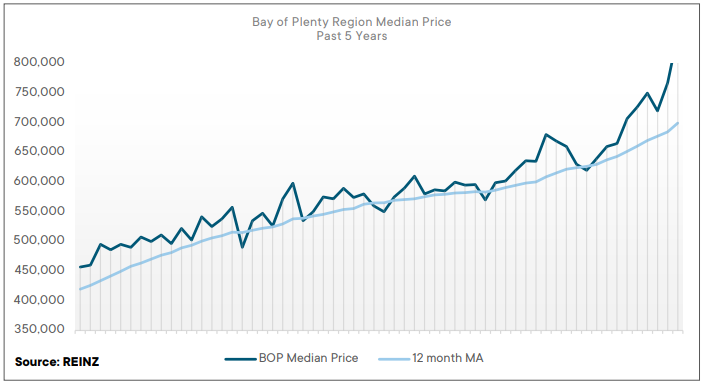

Regional Analysis - Bay of Plenty

“Median house prices in the Bay of Plenty region reached a record $848,250 in February 2021, up 26.8% year-on-year, from $669,000 in February 2020. Record median house prices were also reached in Rotorua District ($617,000), Tauranga City ($905,000) and Western Bay of Plenty District ($855,000). At $905,000, Tauranga City is now more expensive than Auckland’s Franklin District ($827,000) and Papakura District ($822,000). Demand for good properties has remained high and purchasers are quick to act on new listings with median days to sell down to 30 days, from 45 days in February 2020 – this is the lowest median days to sell for a February month on record. Auctions continue to be a popular method of sale, as 47.8% of all February sales were made by auction, up from 18.9% at the same time last year. Access to finance is still difficult, particularly for first time buyers or purchasers with low equity. Looking forward, we would expect prices to remain under pressure unless we can see an uplift in supply.” (REINZ)

The current Days to Sell of 30 days is much less than the 10-year average for February which is 56 days. There were 8 weeks of inventory in February 2021 which is 4 weeks less than the same time last year.

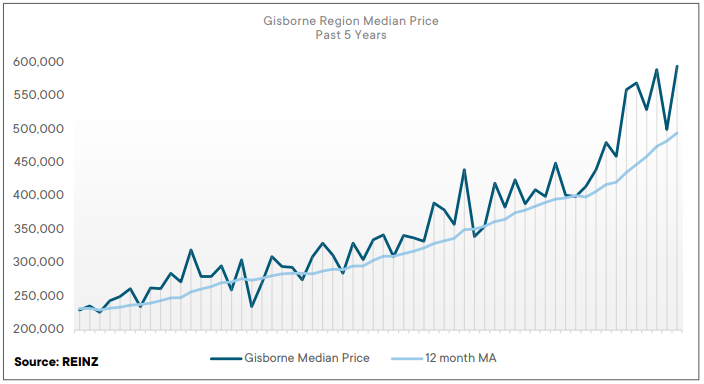

Regional Analysis - Gisborne

“Gisborne region reached a new record median house price in February 2021 of $595,000, up 32.2% year-on-year from $450,000 in February 2020. More than 70% of properties sold across the region are now in the $500,000-$999,999 bracket, up from less than 30% at the same time last year. The REINZ House Price Index for Gisborne/Hawke’s Bay also reached a record high in February of 4,110, up 30.1% from the same time last year, the largest growth of any region year-on-year. Investor activity seems to have slowed slightly this month, with changes to the RTA deterring some investors. Sales volumes are down -17.9% year-on-year, but up 137.0% from January 2021. Activity levels are expected to be steady over the coming months before picking up again, later in the year.” (REINZ)

The current Days to Sell of 37 days is much less than the 10-year average for February which is 48 days. There are 16 weeks of inventory in February 2021 which is 2 weeks less than the same time last year

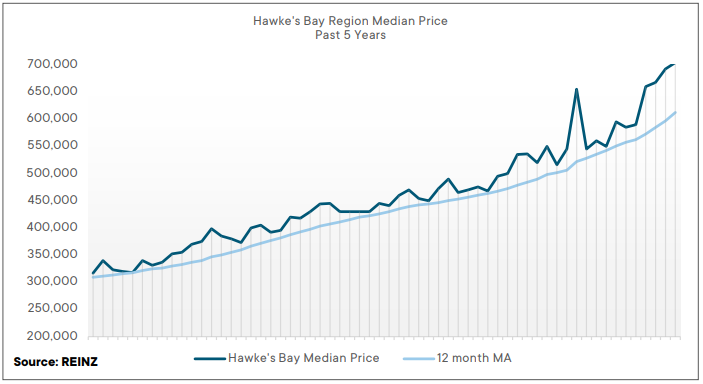

Regional Analysis - Hawke's Bay

“The Hawke’s Bay region reached a record median house price of $704,000 in February 2021, up 36.4% from $516,000 in February 2020 – the fourth consecutive month of record median prices and the largest annual percentage increase across the country. Hastings District also reached a record median house price in February of $772,300, up 51.4% from the same time last year. The REINZ House Price Index for Gisborne/Hawke’s Bay reached a record high in February of 4,110, up 30.1% from the same time last year, the largest growth of any region year-on-year. New listings are down -20.6% annually, which is contributing to the low levels of stock on the market and increased competition for available properties. Multi-offers are increasingly common place, reiterating the shortage of properties available to prospective purchasers.” (REINZ)

The current Days to Sell of 29 days is much less than the 10-year average for February which is 41 days. There were 8 weeks of inventory in February 2021 which is 2 weeks less than the same time last year.

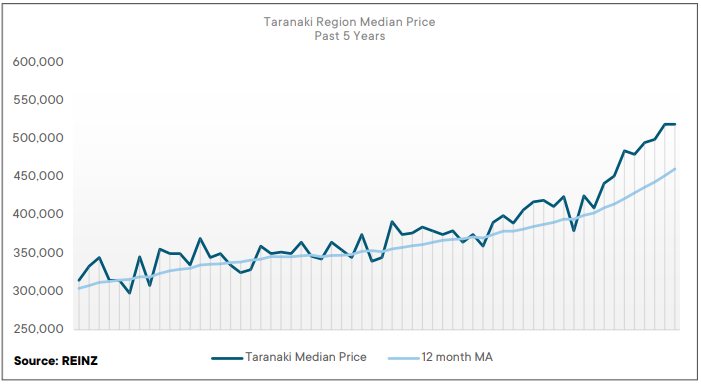

Regional Analysis - Taranaki

“Median house prices in Taranaki region increased 26.2% annually in February 2021 to $520,000, a record equal with January 2021. The number of properties sold in February increased 31.4% from the same time last year. There are plenty of purchasers in the market looking for quality properties, including investors and open homes have continued to be busy across the region. Listings for the region were up 0.5% annually, but high sales volumes and low listings have resulted in a -29.4% decrease in available stock for the region. This shortage of available properties has placed upward pressure on prices and meant that properties are selling quickly when they do reach the market. Median days to sell are at their lowest level for a February month since records began, at 21 days.” (REINZ)

The current Days to Sell of 21 days is much less than the 10-year average for February which is 44 days. There were 9 weeks of inventory in February 2021 which is 7 weeks less than the same time last year.

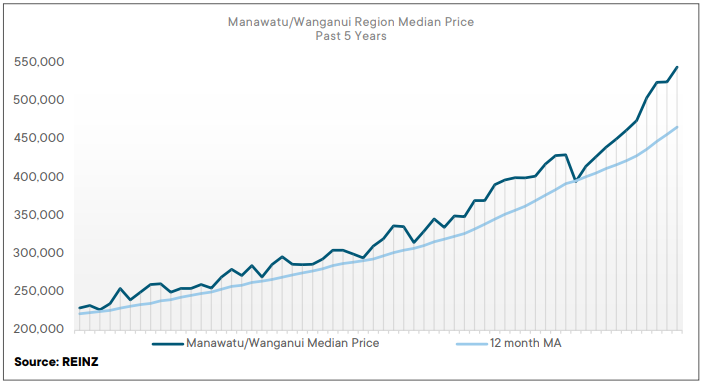

Regional Analysis - Manawatu/Whanganui

“The median house price in Manawatu/Wanganui reached a new record of $545,000 in February 2021, up 27.0% from February 2020. This is the eighth consecutive month that Manawatu/Wanganui has experienced a record high median house price. New listings are down -15.0% year-on-year which is contributing to the low levels of available stock. Inventory is down -40.3% annually, leaving 6 weeks of inventory available for potential purchasers, the lowest number of weeks across the country. There are a lot of active buyers in the market with more investors entering the market and first home buyers struggling to compete and secure a property. Open homes are attracting a large number of viewers and vendor expectations are increasing. Properties are selling quickly with median days to sell down to 24 days, the lowest for a February month since records began. The REINZ House Price Index for Manawatu/Wanganui increased 29.4% annually, the largest annual increase the region has experienced since records began.” (REINZ)

The current Days to Sell of 24 days is much less than the 10-year average for February which is 44 days. There were 6 weeks of inventory in February 2021 which is 3 weeks less than the same time last year.

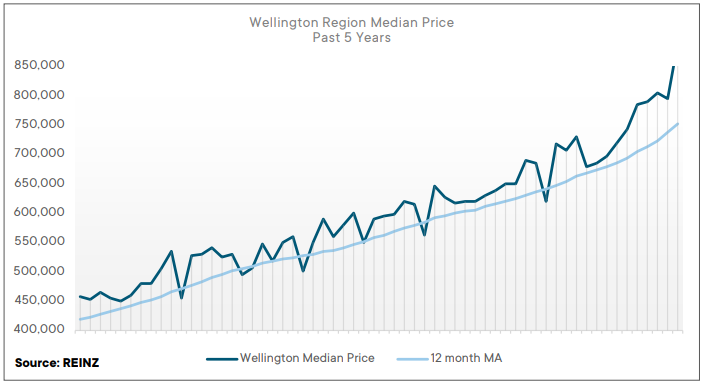

Regional Analysis - Wellington

“The Wellington region reached a record median house price of $890,000 in February 2021, up 24.0% year-on-year from $718,000 in February 2020. Lower Hutt City, Masterton District, Porirua City, South Wairarapa District and Wellington City all also reached record median prices. Inventory levels for the region are down -20.2% from the same time last year, leaving just 7 weeks of available stock for potential purchasers. These low levels of stock are generating high levels of competition between buyers and it continues to put upward pressure on house prices. Some investors are starting to sell their properties due to the new legislation on rental properties, and in some instances, we are seeing these be sold directly to the tenants. The REINZ House Price Index for Wellington region increased 29.2% year-on-year to 3,905, the largest annual increase that the region has experienced since records began.” (REINZ)

The current Days to Sell of 29 days is less than the 10-year average for February of 35 days. There were 7 weeks of inventory in February 2021 which is 5 weeks less than the same time last year.

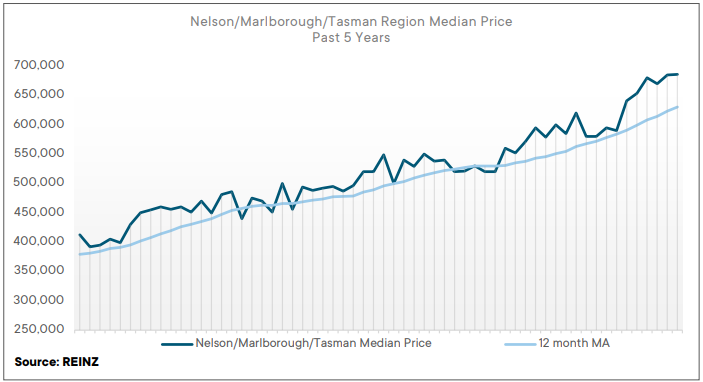

Regional Analysis - Nelson/Marlborough

“The Nelson/Marlborough/Tasman regions all saw an increase in median house prices in February, with Nelson increasing 23.5% annually to a record equal price of $710,000 (the same as January 2021 and the fourth consecutive month of record highs), Marlborough increasing 15.9% annually to a new record price of $615,500 and Tasman increasing 12.8% annually to $750,000. Open homes are busy across all three regions, with good levels of attendance due to limited available stock, which in turn is creating more competition between purchasers and putting further upward pressure on prices. Properties are selling quickly with the Tasman region experiencing its lowest number of days to sell in a February month (28 days) since 2003 and the Marlborough region experiencing its lowest number of days to sell in a February month (29 days) since 2007. Some investors are beginning to sell their properties, which will hopefully add to stock levels over the coming months.” (REINZ)

The current Days to Sell of 28 days is much less than the 10-year average for February which is 39 days. There were 11 weeks of inventory in February 2021 which is 7 weeks less than the same time last year.

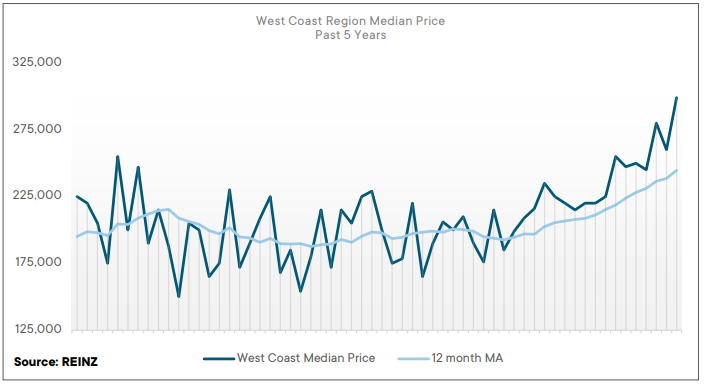

Regional Analysis - West Coast

“The West Coast region reached a record median house price of $299,000 in February 2021, up 32.9% year-on-year from $225,000 in February 2020 – the highest level of growth for the South Island. The West Coast continues to be a popular region for property purchasers, with median days to sell down to 43 days, the lowest for a February month in 15 years (since 2006). Grey District also reached a record median price in February of $285,000, up 23.9% annually. Buller District also saw a significant jump in median house price in February, up 60.6% year-on-year from $180,000 in February 2020 to $289,000 in February 2021. Sales count increased 58.0% year-on-year to 79, the highest sales count since March 2004 (203 months). A -14.9% decrease in new listings has contributed to the -46.4% decrease in inventory for the region, leaving it with the lowest level of available stock since records began. Activity levels are expected to remain steady over the coming months.” (REINZ)

The current Days to Sell of 43 days is much less than the 10-year average for February which is 90 days. There were 29 weeks of inventory in February 2021 which is 22 weeks less than the same time last year.

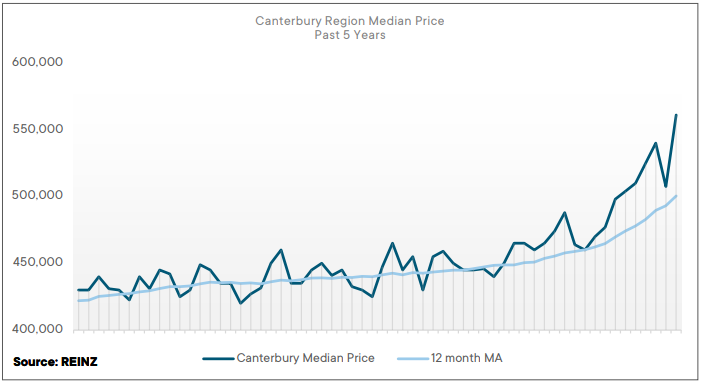

Regional Analysis - Canterbury

“Median house prices in the Canterbury region reached a new record of $561,000 in February 2021, up 18.4% annually from $474,000 in February 2020. In part, this is due to the percentage of properties over the $750,000 mark nearly doubling. Sales volumes increased 17.9% year-on-year to 1,151, the highest level of February sales in 14 years (since 2007). Auctions have become a more popular method of sale, with 26.8% of all properties selling by auction in February, up from 11.6% at the same time last year – this is the highest percentage of auctions Canterbury has seen since records began. The increase in sales by auction has resulted in more purchasers being cash ready and has helped with quicker sales. Median days to sell are down -9 days from the same time last year to 29 days. There has been an increase in out-of-town buyers as investors are looking to the regions for good rental options. The REINZ House Price Index for Canterbury increased 16.8% annually.” (REINZ)

The current Days to Sell of 29 days is less than the 10-year average for February which is 39 days. There were 9 weeks of inventory in February 2021 which is 9 weeks less than the same time last year.

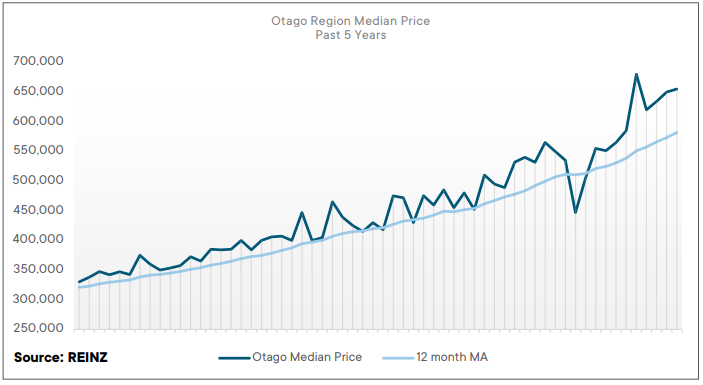

Regional Analysis - Otago

“Median prices in Queenstown Lakes have eased slightly from a year ago however volumes have increased considerably. The median price in Arrowtown in February 2021 reached a record high of $1,820,000, up from $930,000 a year ago. Sales by auction are proving popular with vendors with 17.1 % of all sales in the area being conducted by this auction compared to 11.7% a year ago. Activity is expected to remain steady over the coming months.” (REINZ)

“Dunedin reached a record median house price of $621,000 in February 2021, up 20.6% year-on-year from $515,000 in February 2020. The market is very busy with a lot of interest from first home buyers experiencing a fear of missing out and hoping to get on the ladder before prices increase much more. Investor interest is also still high due to low interest rates and purchasers securing properties before the reintroduction of LVRs. There has been an increase in out-of-town purchasers, both owner occupiers and investors, as they are looking to Dunedin for more affordable property with good returns. Stock levels are expected to increase over the coming months as new listings come to the market.” (REINZ)

The current Days to Sell of 30 days is less than the 10-year average for February which is 38 days. There were 13 weeks of inventory in February 2021 which is 7 weeks less than the same time last year.

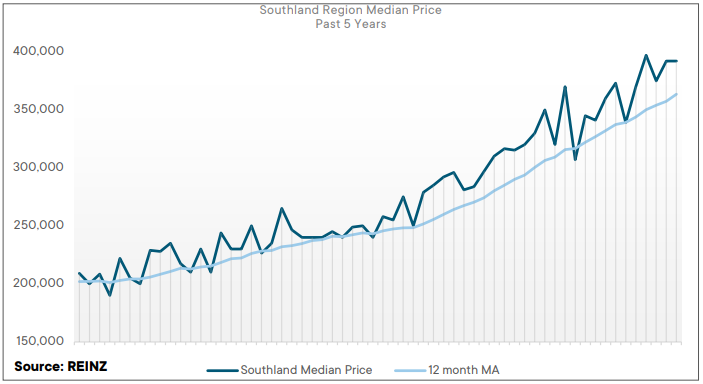

Regional Analysis - Southland

“Median house prices in Southland increased 22.5% annually in February from $320,000 in 2020 to $392,000 in 2021 and Gore District reached a record median house price of $379,000, up 64.8% year-on-year. Investor activity has remained strong in the region and contributed to the 15.3% increase in sales volumes for the month as the rush to beat the reintroduction of LVRs takes place. Properties are selling quickly with days to sell down 10 days from January to 23 days – the lowest days to sell for a February month for the region since 2007. Activity in the region is expected to remain steady with potentially lower levels of investor interest in the coming months as LVRs return. The REINZ House Price Index for Southland increased 15.9% annually.” (REINZ)

The current Days to Sell of 23 days is much less than the 10-year average for February which is 40 days. There were 10 weeks of inventory in February 2021 which is 10 weeks less than the same time last year.

Browse

Topic

Related news

Find us

Find a Salesperson

From the top of the North through to the deep South, our salespeople are renowned for providing exceptional service because our clients deserve nothing less.

Find a Property Manager

Managing thousands of rental properties throughout provincial New Zealand, our award-winning team saves you time and money, so you can make the most of yours.

Find a branch

With a team of over 850 strong in more than 88 locations throughout provincial New Zealand, a friendly Property Brokers branch is likely to never be too far from where you are.