Property market slows further; positive outlook for able buyers

Monday, 16 May 2022

April shows a further slowdown in sales activity, more moderate price growth and, as properties stay on the market for longer, it appears favourable to buyers backed by equity.

Median prices for residential property across New Zealand increased 7.9% annually, from $825,000 in March 2021 to$890,000 in March 2022.

Jen Baird, Chief Executive of REINZ, says: “We’re now in the phase of the property cycle where demand has weakened, sale counts are down but prices remain high. We’re seeing a slowdown in activity, there is more stock staying on the market for longer, and while annual price growth is more moderate, the month-on-month trend shows a fall in median prices.

“April residential property sales decreased annually by 35.2% across New Zealand, a story reflected across all regions. Looking at the underlying reasons for the continued decrease in sales count, the seasonally adjusted figures provide some insight. Last year sales volumes were underperforming due to supply challenges, and post-October 2021 when we began to see an influx of stock, it became a market underperforming due to demand challenges.

“Falling attendance at open homes and auction rooms, and a decrease in buyer enquiries were reported across New Zealand. Exacerbated by a spate of public holidays through April. Affordability, uncertainty and changing financial conditions remain primary concerns. Tighter lending criteria, LVRs, and increasing interest rates coupled with inflation continue to create challenges for some buyers — particularly first home buyers and investors.

“Those who are backed by equity and secure in a job market with a low unemployment rate, will continue to see opportunity in the market as more stock increases choice, and prices ease. Owner-occupiers are the most present and active in the market, so while we see a softening in the mid to low price range, interest is solid in the mid to high bracket.

“Increases to the OCR, most recently by 0.5% in April, have further impacted affordability, and with the cost to own increasing, property may seem less attractive. With a forecast peak of over 3.0%, some potential buyers may hold off purchasing in a market where interest rates are likely to rise. For those who purchased property over recent years, these increases were largely expected and factored into banks’ requirement for borrowers to be able to service mortgage increases — providing a buffer for most. The challenge will be for those re-fixing their mortgage,” Baird observes.

All regions saw an annual decrease in the number of sales; those with the greatest annual percentage decrease were:

• Marlborough: decreased 53.6% annually from 84 to 39

• Auckland: decreased 41.3% annually from 2,682 to 1,573

• Hawke’s Bay: decreased 39.2% annually from 209 to 127

• West Coast: decreased 38.3% annually from 47 to 29

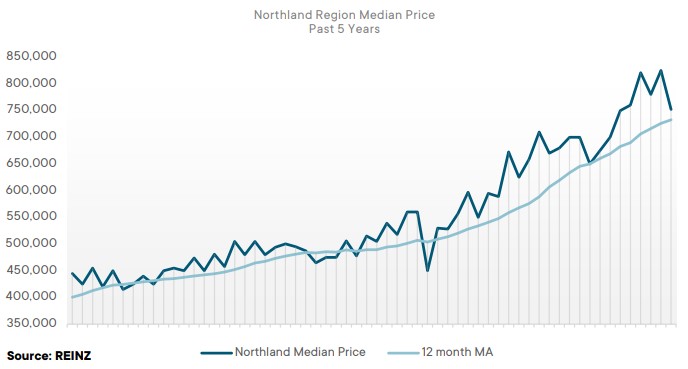

Regional Analysis - Northland

“Northland’s median house price continues to rise steadily — increasing 12.2% year-on-year to $752,000 this April. Owner occupiers were the main source of buyer interest. Numbers at open homes reduced and properties spent a longer time on the market. Northland’s sales count decreased by 36.9% when compared to April 2021, partly due to buyers having difficulty in securing finance and acting with caution. Vendors are starting to recognise the shift in market sentiment and have been adjusting their price expectations during negotiations.

“An increase of stock to the market has offered buyers more choice — they can now take their time to ensurethey are making the right purchase decision. Agents say that the market may take a while to adjust as vendors,reassess price and buyers become more confident that they can finance their purchase.” (REINZ)

The current Days to Sell of 40 days is less than the 10-year average for April which is 50 days. There were 26 weeksof inventory in April 2022 which is 13 weeks more than the same time last year.

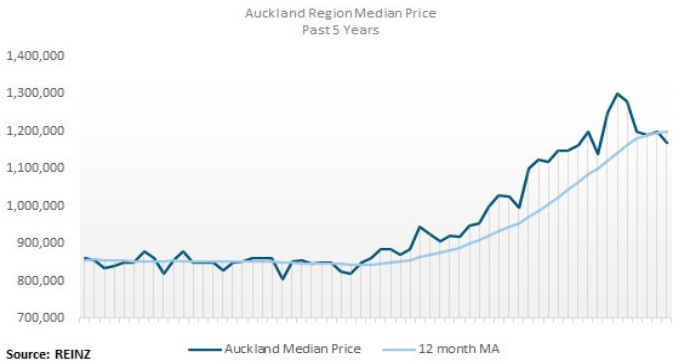

Regional Analysis - Auckland

“April showed the market continuing to slow in Auckland with the super city’s median price up just 4.5% year-on-year to $1,170,000. A feeling of uncertainty is evident around further rises in interest rates, decreases to house prices, and the number of Kiwis choosing to leave the country. According to agents, first home buyers have become more active in the market with banks allowing a 10% deposit for new homes. Investors, on the other hand, are wary of interest rates and have taken a step back from the market.

“Auckland’s sales count decreased by 41.3%, partly due to the tightened lending criteria impacting many buyers — buyers and vendors are becoming frustrated with the lending criteria’s impact on their ability to transact. Real estate professionals are having open and honest conversations to ensure vendors understand comparable sales at the time of listing and take buyer price feedback into account when setting reserves and/or considering offers.” (REINZ)

The current Days to Sell of 40 days is more than the 10-year average for April which is 34 days. There were 23weeks of inventory in April 2022 which is 14 weeks more than the same time last year.

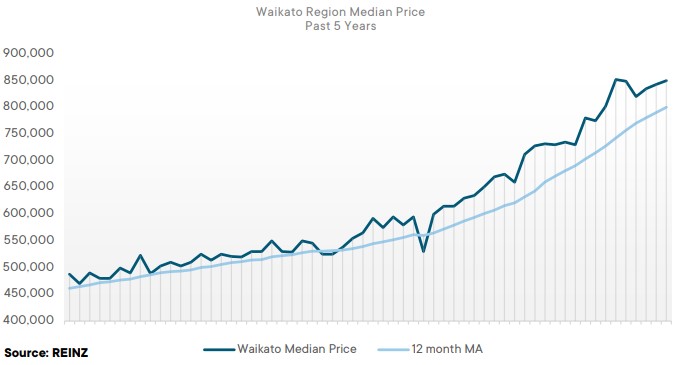

Regional Analysis - Waikato

“Waikato’s median house price increased 16.2% year-on-year to $850,000. The Waikato District reached a record high of $1,065,000. Owner-occupiers were the most active buyer group, and first home buyers started to show renewed interest. Investors are still watching from the sidelines in the hope of price reductions. The general feeling amongst buyers is a fear of overpaying along with concern of rising interest rates, access to funds, and greater difficulties with selling an existing home.

“Many vendors are now understanding that buyers have more choice, and that they must adjust their expectations accordingly. Their focus is on achieving a result rather than on an exceptional price. Stock levels increased 109.8% in April, and sales counts decreased by 35.5%. According to agents, newly advertised listings had good attendance at open homes.” (REINZ)

The current Days to Sell of 38 days is more than the 10-year average for April which is 37 days. There were 19weeks of inventory in April 2022 which is 14 weeks more than the same time last year.

Regional Analysis - Bay of Plenty

“Bay of Plenty’s median house price increased 11.6% from April 2021 to $892,777. Inventory levels saw a significant increase in April of 116.5% year-on-year. Listings also had a 21.8% increase. With more choices on the market, buyers are taking their time, and many are taking a ‘wait and see’ approach. Vendors are realising there has been a shift in market activity levels. Banks are busy and taking longer to approve finance. According to agents, the most significant impact on the market was the OCR increase on 13 April, and concern of further interest rate and living cost increases.” (REINZ)

The current Days to Sell of 41 days is less than the 10-year average for April which is 42 days. There were 20 weeksof inventory in April 2022 which is 13 weeks more than the same time last year.

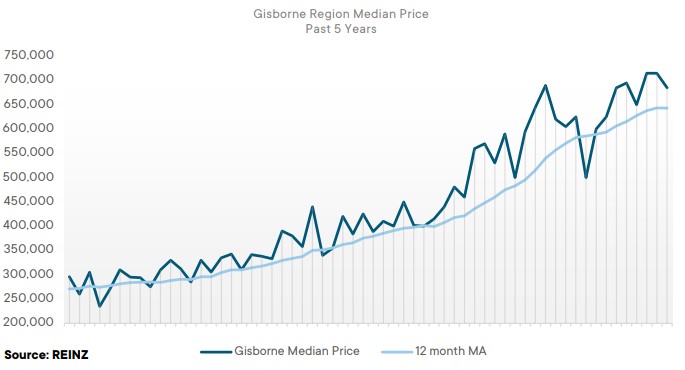

Regional Analysis - Gisborne

“In April 2022, Gisborne had a 0.7% decrease year-on-year in its median house price to $685,000. An increase in stock and listings on the market has granted buyers with more choice. First home buyers and investors are still impacted by the changes to the CCCFA introduced in December 2021. This has also seen attendance at open homesdecline and fewer properties selling by auction when compared to this time last year. Agents in the area expect stock levels to increase further with more ‘subject to sale’ transactions over the coming months. When corrective changes to the CCCFA are implemented in June, agents hope buyer confidence will return.”(REINZ)

The current Days to Sell of 42 days is more than the 10-year average for April which is 37 days. There are 18 weeks of inventory in April 2022 which is 8 weeks more than last year.

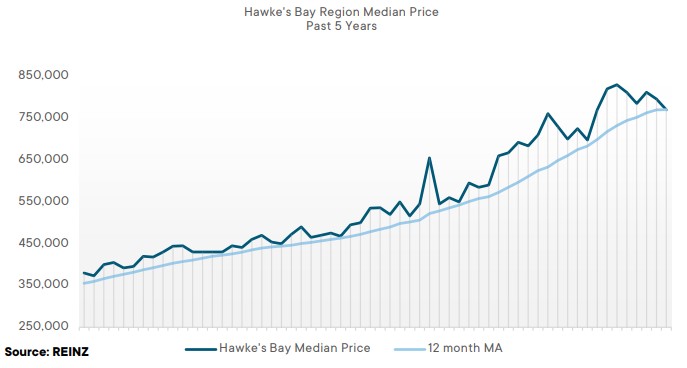

Regional Analysis - Hawke's Bay

“Price growth in Hawke’s Bay has eased. In April, the median house price was $770,000 — just a 1.2% increase year-on-year. Napier City reached a record median price of $900,000. Securing finance remains a challenge for buyers and has resulted in smaller numbers at open homes. With fewer buyers in the market, sales countsdecreased by 39.2%. According to agents in the area, the most significant impact on the market in April was the rise in interest rates and uncertainty around lending conditions. Buyers are deciding whether they are willing or able to pay the current prices, and vendors are concerned that they may not achieve the prices they hadoriginally hoped for.” (REINZ)

The current Days to Sell of 46 days is more than the 10-year average for April which is 39 days. There were 21weeks of inventory in April 2022 which is 14 weeks more than the same time last year.

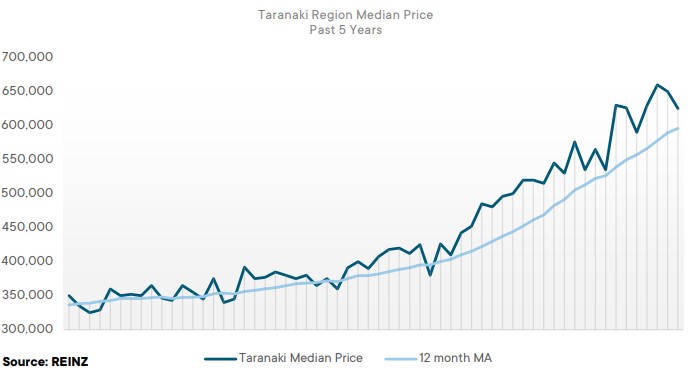

Regional Analysis - Taranaki

“Taranaki’s median house price was $625,000 in April 2022 — a 14.7% increase year-on-year. The number of first home buyers in the market have declined due to a lack of stock in their price range and rising interest rates. Subsequently, attendance at open homes and numbers at auctions also decreased. Sales counts fell by 22.9%and properties spent an additional ten days on the market when compared to April 2021. Buyers reluctant to transact due to rising interest rates and a fear of overpaying, and vendors hesitant to negotiate is combining to see the Taranaki market slow.” (REINZ)

The current Days to Sell of 32 days is less than the 10-year average for April which is 38 days. There were 14 weeksof inventory in April 2022 which is 7 weeks more than the same time last year.

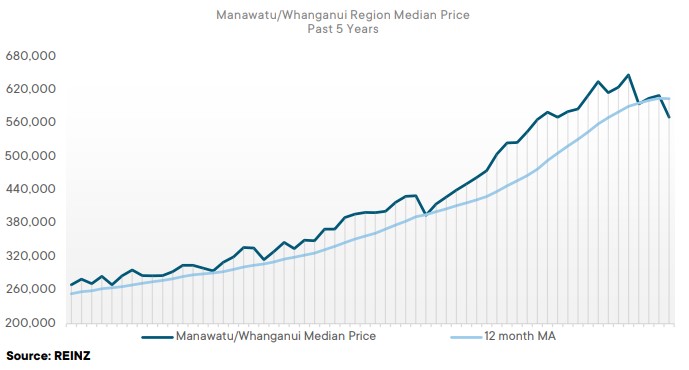

Regional Analysis - Manawatu/Whanganui

“Manawatu/Whanganui saw its median price decrease by 1.6% year-on-year to $571,000. As with most regions, owner-occupiers were the most active buyer segment in April. Many vendors are struggling to accept that the market has changed and that they may need to adjust their price expectations accordingly. Changes to the CCCFA, rising interest rates and the re-introduction of LVRs have contributed significantly to the pace of the market.In result, sales counts decreased by 31.2% and properties spent an additional 14 days on the market when compared to April 2021.” (REINZ)

The current Days to Sell of 39 days is less than the 10-year average for April which is 36 days. There were 23 weeksof inventory in April 2022 which is 18 weeks more than the same time last year.

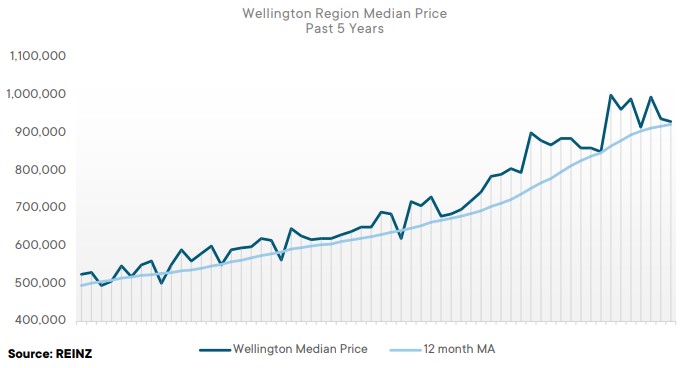

Regional Analysis - Wellington

“The median price in Wellington increased by 7.1% when compared to April last year, reaching $930,000. Stock levels increased significantly — up 157.4%, yet new listings decreased by 1.4%. Buyers have been granted more choice so can be more particular with their purchase decision. Consequently, properties are spending longeron the market — up 18 days when compared to this time last year, and six days up from March. However, April tends to be a quiet time for the capital due to the public holidays — adding further to the slowing of the market.” (REINZ)

The current Days to Sell of 48 days is much more than the 10-year average for April of 34 days. There were 21weeks of inventory in April 2022 which is 16 weeks more than the same time last year.

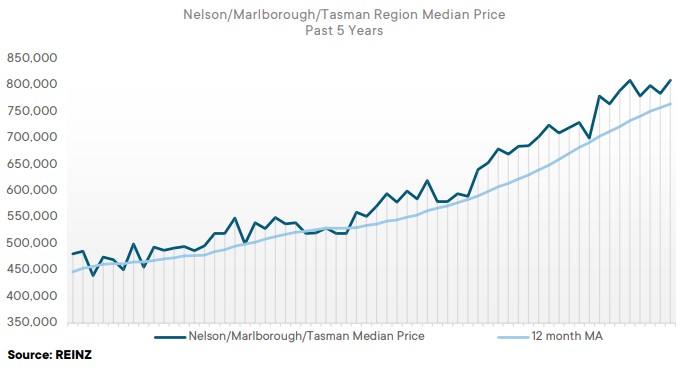

Regional Analysis - Nelson/Marlborough

“The Nelson/Marlborough/Tasman regions all saw an increase in their median house prices this April — up 8.8%, 13.7% and 16.1% to $800,000, $764,000 and $900,000 respectively. This was a record high for Marlborough. In all three regions, owner-occupiers were the dominant buyer group. Agents in Marlborough recorded good numbers at open homes but attendance at auctions was limited. All three regions are experiencing a market of supply outweighing demand and a decline in sales counts. For Marlborough, the seasonal impact on the market is the harvesting period. Each year, this tends to see large numbers of locals focused on work rather than active in the property market. According to Marlborough agents, when the harvest period ends, market activity is expected toincrease.

“An increase of stock to the market is offering more choice to buyers who are becoming more selective.However, properties sold two days faster than this time last year. Vendors are increasingly aware of meeting themarket now that sentiment has changed.” (REINZ)

The current Days to Sell of 37 days is more than the 10-year average for April which is 33 days. There were 15weeks of inventory in April 2022 which is 8 weeks more than the same time last year.

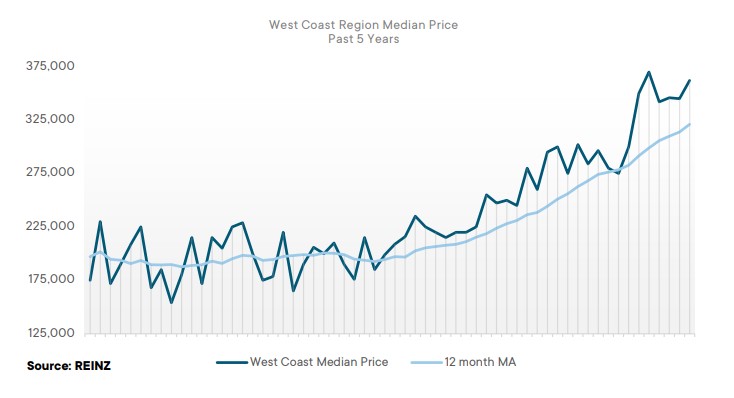

Regional Analysis - West Coast

“Prices are rising steadily in the West Coast. April 2022 saw its median house price increase by 31.6% to $362,000. The most active buyer group is owner-occupiers and younger families who have moved here to settle. Investor interest is still evident in the region as demand for rentals remains strong. First home buyer presence is scarce due to limited employment opportunities. Hokitika recorded some good value sales, with a median price of $475,000 — up 9.2% from April 2021. Greymouth and Westport showed signs of a subdued market coming off from its summer peak.” (REINZ)

The current Days to Sell of 27 days is much less than the 10-year average for April which is 76 days. There were28 weeks of inventory in April 2022 which is 18 weeks more than the same time last year.

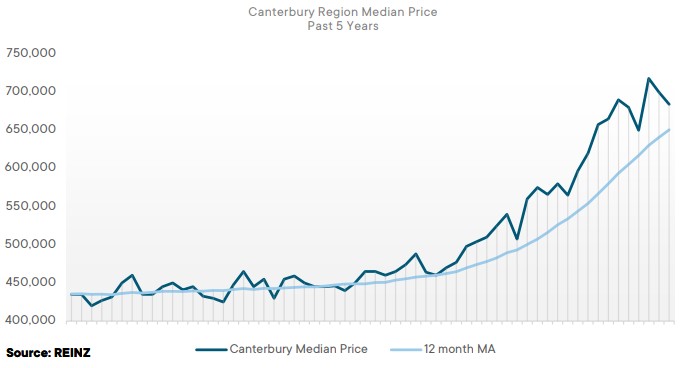

Regional Analysis - Canterbury

“Prices in Canterbury hold strong. Canterbury had a 20.8% increase in its median house price year-on-year to $684,000. Owner-occupiers were the most dominant buyer segment and the rising interest rates saw the numbers of first home buyers decline. Attendees at open homes were light, partly due to the school and public holidays which see many people travel. Vendor expectations were optimistic in holding up value and agents record that many are now meeting the market. Sales counts fell 32.1%. Agents in Canterbury say activity for propertiesin the mid-to-lower price range are softening, but higher-end properties remain competitive with good results.

“A shift in market sentiment has seen buyers become more selective. Lending restrictions, rising interest rates, and shortage of labour and materials are having a major impact on all parts of the transaction.” (REINZ)

The current Days to Sell of 31 days is less than the 10-year average for April which is 32 days. There were 13 weeksof inventory in April 2022 which is 7 weeks more than the same time last year.

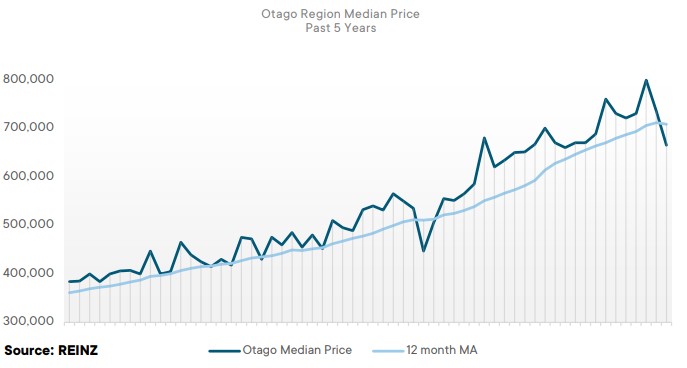

Regional Analysis - Otago

Dunedin City - "Dunedin’s median sale price remained steady at $640,000 — an easing of price growth. Owner occupiers remain the most dominant buyer pool as investors and first home buyers take a step back from the market due to tax legislation, tightened lending criteria and rising interest rates. According to agents in Dunedin, some vendors still have high expectations for sale prices and are needing regular communication with agents to understand the change in market sentiment. April’s public holidays and school holidays disrupted an already slowing market which saw a lower level of attendance at both open homes and auction rooms." (REINZ)

Queenstown Lakes - "In Queenstown, sales counts decreased by 10.9%. According to agents in the area, fear of missing out (FOMO) has been replaced with a fear of overpaying (FOOP). With fewer buyers in the market, there is less competition, not as much urgency and vendors have become more realistic in their expectations. Auctions continue to receive satisfactory results for vendors and the clearance rate in the area is generally higher than the national average." (REINZ)

The current Days to Sell of 43 days is more than the 10-year average for April which is 34 days. There were 18weeks of inventory in April 2022 which is 8 weeks more than the same time last year.

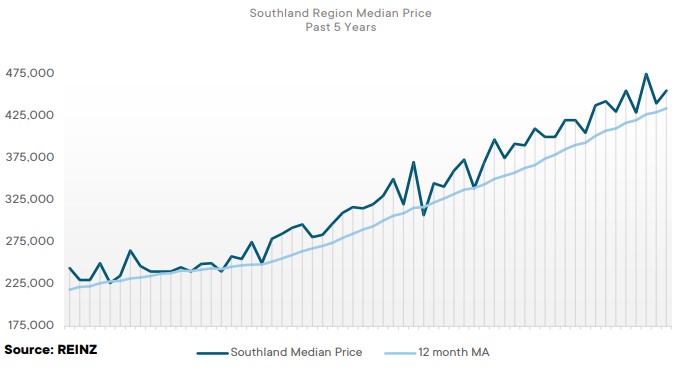

Regional Analysis - Southland

“Southland’s median house price increased 13.8% year-on-year to $455,000. The Southland District reached a record median of $630,000. In April, Southland saw its main buyer activity from owner-occupiers and some from out of town. Banks tightening lending criteria, tax legislation and fear of the market falling contributed to a decline in sales by 19.7%. Like most regions, Southland’s stock levels are now at a point where supply is outweighing demand, with some agents signalling the arrival of a buyer’s market.” (REINZ)

The current Days to Sell of 38 days is more than the 10-year average for April which is 36 days. There were 20weeks of inventory in April 2022 which is 14 weeks more than the same time last year.

Browse

Topic

Related news

Find us

Find a Salesperson

From the top of the North through to the deep South, our salespeople are renowned for providing exceptional service because our clients deserve nothing less.

Find a Property Manager

Managing thousands of rental properties throughout provincial New Zealand, our award-winning team saves you time and money, so you can make the most of yours.

Find a branch

With a team of over 850 strong in more than 88 locations throughout provincial New Zealand, a friendly Property Brokers branch is likely to never be too far from where you are.